We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Basic Account with my current bank

RebeccaO26

Posts: 18 Forumite

Hi,

I'm hoping someone can help me? Tonight I tried to open a second current account with my current bank, Nationwide, for my bills to be paid out of. I get paid every 4 weeks and I find it harder to keep track of my cash when the pay days start to fall out of sync with the beginning of the month. When I tried to open the account, they rejected my application and directed me to a basic account which I then applied for thinking it would make sense in order to help me with my budgeting and my application was approved.

Now I'm concerned that Nationwide might decide to close my preexisting current account into which my wages etc are all paid. Should I be concerned or am I just overthinking things? Ideally I'd be keen to keep both accounts open to help me with my budgeting.

Any advice would be greatly appreciated!

I'm hoping someone can help me? Tonight I tried to open a second current account with my current bank, Nationwide, for my bills to be paid out of. I get paid every 4 weeks and I find it harder to keep track of my cash when the pay days start to fall out of sync with the beginning of the month. When I tried to open the account, they rejected my application and directed me to a basic account which I then applied for thinking it would make sense in order to help me with my budgeting and my application was approved.

Now I'm concerned that Nationwide might decide to close my preexisting current account into which my wages etc are all paid. Should I be concerned or am I just overthinking things? Ideally I'd be keen to keep both accounts open to help me with my budgeting.

Any advice would be greatly appreciated!

0

Comments

-

The reason your application was rejected could be to do with the type of account it is. I know that with certain types of savings accounts you are only allowed 1 at whatever bank you have it with. I'm not sure if there are certain currant accounts that also work that way as I've never tried to have more then one. I know you can open another current account at a different bank.

Best thing to do is head over to Nationwide's website. Look at the terms and conditions of your 1st account and also the account you have just applied for. If you can't find the info you need or you are still worried I'd call them tomorrow to put your mind at ease.

1 -

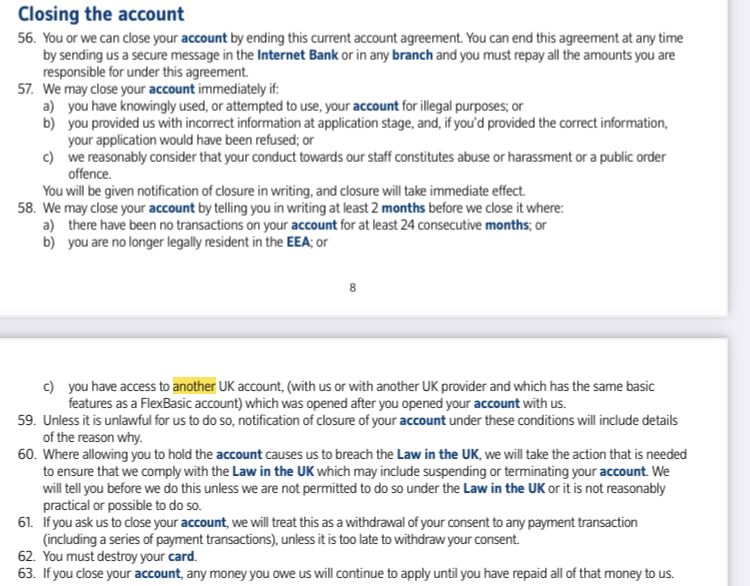

This is what the T&Cs say

0

0 -

Having a second current account with a different bank is generally a good idea, and would probably put your mind at rest. Starling Bank, Chase UK and Monzo don't carry out hard credit searches, so you would probably be able to open an account with one of these three quite quickly.0

-

Chase is no good if you need direct debits because they don't do them.Daliah said:Having a second current account with a different bank is generally a good idea, and would probably put your mind at rest. Starling Bank, Chase UK and Monzo don't carry out hard credit searches, so you would probably be able to open an account with one of these three quite quickly.1 -

Good point, I had forgotten they don'tEarthBoy said:

Chase is no good if you need direct debits because they don't do them.Daliah said:Having a second current account with a different bank is generally a good idea, and would probably put your mind at rest. Starling Bank, Chase UK and Monzo don't carry out hard credit searches, so you would probably be able to open an account with one of these three quite quickly.0 -

As they offered the basic account when you already had a different type of current account with them, I would not expect them to want to close the pre-existing one as long as you are conducting it sensibly. That is on the basis that the first account was not also a basic account but was, say, Flex or Flex Direct.RebeccaO26 said:Hi,

I'm hoping someone can help me? Tonight I tried to open a second current account with my current bank, Nationwide, for my bills to be paid out of. I get paid every 4 weeks and I find it harder to keep track of my cash when the pay days start to fall out of sync with the beginning of the month. When I tried to open the account, they rejected my application and directed me to a basic account which I then applied for thinking it would make sense in order to help me with my budgeting and my application was approved.

Now I'm concerned that Nationwide might decide to close my preexisting current account into which my wages etc are all paid. Should I be concerned or am I just overthinking things? Ideally I'd be keen to keep both accounts open to help me with my budgeting.

Any advice would be greatly appreciated!

However, what they might do is close the new basic account if you later opened another basic-type account with another bank.1 -

The position on multiple current accounts does vary - I've got 2 barclays current accounts, neither of which receives my salary. One is used for my weekly spending allowance, and the other is used solely to pay my university fees (which are paid as montly installments, interest free).

Neither has an overdraft facility.0 -

A quick look at the Nationwide website seems to indicate you can hold up to 4 current accounts with them (a combination of joint & sole). Do you have more than 4 current accounts? (Joint with someone else as well as your sole account) If not then they may have offered you a basic account due to your previous activity (you mention struggling to budget) and/or credit file data. Use the account to help you budget, don't overthink things and cross that bridge if it ever happens.I’m a Forum Ambassador and I support the Forum Team on the Budgeting & Bank Accounts, Credit Cards, Credit File & Ratings and Energy boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

If you can't be the best -

Just be better than you were yesterday.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards