We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

New Nationwide Switch - both new and existing?

Comments

-

Are you sure you'd get 3 incentives between you as I read it to be one per member?noh said:

You do not need to open a new account if you are an existing member with a Flex, Flex Plus or Flex Direct account. If you switch an account with two DDs into your existing account you should receive £125.Money_Grabber13579 said:

I think this highlights my dilemma.

If I understand you correctly, you are of the view that I would need to open a new account and switch into that to be eligible for the incentive i.e. an account which I opened years ago wouldn't be sufficient as all that does is make me an existing member. I agree that this seems to be the literal intrepretation.td_007 said:Money_Grabber13579 said:5. You’ll qualify for this offer if:To me, this suggests that if I have an existing current account with Nationwide (which I do), I can switch my M&S current account into that account and get £125.- you use our Internet Bank to switch a current account held with another provider to a FlexAccount, FlexPlus or FlexDirect current account you have with us, or

- you open a FlexAccount, FlexPlus or FlexDirect current account with us through our website, Internet Bank or Banking app and switch a current account held with another provider to that account.

However:10. You also won’t qualify for this offer if:Does this mean that I won't get the £125 if I do the above, because my "application to open" was started before the offer was available, which it obviously was, given I've held it for a long time? Do I then need to open a new current account and switch into that? If so, condition 5 doesn't make a lot of sense as both parts are effectively saying the same thing i.e. you open an account or you have opened an account from today onwards.- you started your application to open a FlexAccount, FlexPlus or FlexDirect current account with us or requested your switch before this offer was made available. This will apply even if that application or switch is completed after this offer is made available. If we withdraw this offer and make it available again in the future, this exclusion will still apply

Anyone have any thoughts on this?The way I read it is:If you have a NW current account (exisiting member) :- you will be eligible for £125 if you open a new account anytime from today onwards and switch-you will not be eligible if for example you had started the process of opening a NW current account yesterday. However, it does not stop you opening yet another account if NW permits (you can have upto total of 4 FlexAccount or/and FlexDirect accounts sole or joint) and this new account will be eligible.The same also applies to new members except that switch incentive is £100

However, this seems to be a counter view, in that an long term account should be sufficient to switch into, as it clearly wasn't opened with the idea of getting any incentive. I can therefore see the logic of this intrepretation.Yorkshire_Pud said:

They are referring to folks who are in the process of opening an account not those who opened an account such as yourself in the past. That’s because those folks were already wanting to be with Nationwide anyway with no mention of a bonus to attract them. So you should be fine, long as you got two DDs set up on the M&S account.Money_Grabber13579 said:5. You’ll qualify for this offer if:To me, this suggests that if I have an existing current account with Nationwide (which I do), I can switch my M&S current account into that account and get £125.- you use our Internet Bank to switch a current account held with another provider to a FlexAccount, FlexPlus or FlexDirect current account you have with us, or

- you open a FlexAccount, FlexPlus or FlexDirect current account with us through our website, Internet Bank or Banking app and switch a current account held with another provider to that account.

However:10. You also won’t qualify for this offer if:Does this mean that I won't get the £125 if I do the above, because my "application to open" was started before the offer was available, which it obviously was, given I've held it for a long time? Do I then need to open a new current account and switch into that? If so, condition 5 doesn't make a lot of sense as both parts are effectively saying the same thing i.e. you open an account or you have opened an account from today onwards.- you started your application to open a FlexAccount, FlexPlus or FlexDirect current account with us or requested your switch before this offer was made available. This will apply even if that application or switch is completed after this offer is made available. If we withdraw this offer and make it available again in the future, this exclusion will still apply

Anyone have any thoughts on this?

On the whole though, it seems like it will be safer to open a new current account and switch into that and then worry about getting rid of that account (perhaps merging with an existing Nationwide account, if that's possible) at a later date. I'm trying to reduce the number of current accounts that I have, but if I can pick up bonuses whilst doing that, even better!

Near the end of this page

https://www.nationwide.co.uk/current-accounts/switch/

There are a series of questions the answers to which determines your eligbility and amount of the switch incentive.

I have switched 3 accounts today into existing Flex accounts (mine my wifes and joint) and expect to receive £125 for each switch.

0 -

Unless you are searched by Transunion ( CallCredit ) who keep them on file for up to 24 months:colsten said:

yessnowqueen555 said:Will this work for those already with a flex account, transfer another eternal account and then have 2 flex accounts?

Most unlikely, unless you have lots of other hard searches, too. Hard searches fall off your credit files after 12 months, anywaysnowqueen555 said:

Will a credit check affect my ability to get a mortgage net year?

https://www.transunion.com/blog/credit-advice/how-long-do-closed-accounts-stay-on-credit-report

https://www.transunion.co.uk/consumer/credit-report-help?#faq8

Regards0 -

According to this yes you can switch a sole into a joint account.Ghostcrawler said:noh said:

No it doesn't make any difference which one you use if you both already have accounts.Ghostcrawler said:noh said:

You do not need to open a new account if you are an existing member with a Flex, Flex Plus or Flex Direct account. If you switch an account with two DDs into your existing account you should receive £125.Money_Grabber13579 said:

I think this highlights my dilemma.

If I understand you correctly, you are of the view that I would need to open a new account and switch into that to be eligible for the incentive i.e. an account which I opened years ago wouldn't be sufficient as all that does is make me an existing member. I agree that this seems to be the literal intrepretation.td_007 said:Money_Grabber13579 said:5. You’ll qualify for this offer if:To me, this suggests that if I have an existing current account with Nationwide (which I do), I can switch my M&S current account into that account and get £125.- you use our Internet Bank to switch a current account held with another provider to a FlexAccount, FlexPlus or FlexDirect current account you have with us, or

- you open a FlexAccount, FlexPlus or FlexDirect current account with us through our website, Internet Bank or Banking app and switch a current account held with another provider to that account.

However:10. You also won’t qualify for this offer if:Does this mean that I won't get the £125 if I do the above, because my "application to open" was started before the offer was available, which it obviously was, given I've held it for a long time? Do I then need to open a new current account and switch into that? If so, condition 5 doesn't make a lot of sense as both parts are effectively saying the same thing i.e. you open an account or you have opened an account from today onwards.- you started your application to open a FlexAccount, FlexPlus or FlexDirect current account with us or requested your switch before this offer was made available. This will apply even if that application or switch is completed after this offer is made available. If we withdraw this offer and make it available again in the future, this exclusion will still apply

Anyone have any thoughts on this?The way I read it is:If you have a NW current account (exisiting member) :- you will be eligible for £125 if you open a new account anytime from today onwards and switch-you will not be eligible if for example you had started the process of opening a NW current account yesterday. However, it does not stop you opening yet another account if NW permits (you can have upto total of 4 FlexAccount or/and FlexDirect accounts sole or joint) and this new account will be eligible.The same also applies to new members except that switch incentive is £100

However, this seems to be a counter view, in that an long term account should be sufficient to switch into, as it clearly wasn't opened with the idea of getting any incentive. I can therefore see the logic of this intrepretation.Yorkshire_Pud said:

They are referring to folks who are in the process of opening an account not those who opened an account such as yourself in the past. That’s because those folks were already wanting to be with Nationwide anyway with no mention of a bonus to attract them. So you should be fine, long as you got two DDs set up on the M&S account.Money_Grabber13579 said:5. You’ll qualify for this offer if:To me, this suggests that if I have an existing current account with Nationwide (which I do), I can switch my M&S current account into that account and get £125.- you use our Internet Bank to switch a current account held with another provider to a FlexAccount, FlexPlus or FlexDirect current account you have with us, or

- you open a FlexAccount, FlexPlus or FlexDirect current account with us through our website, Internet Bank or Banking app and switch a current account held with another provider to that account.

However:10. You also won’t qualify for this offer if:Does this mean that I won't get the £125 if I do the above, because my "application to open" was started before the offer was available, which it obviously was, given I've held it for a long time? Do I then need to open a new current account and switch into that? If so, condition 5 doesn't make a lot of sense as both parts are effectively saying the same thing i.e. you open an account or you have opened an account from today onwards.- you started your application to open a FlexAccount, FlexPlus or FlexDirect current account with us or requested your switch before this offer was made available. This will apply even if that application or switch is completed after this offer is made available. If we withdraw this offer and make it available again in the future, this exclusion will still apply

Anyone have any thoughts on this?

On the whole though, it seems like it will be safer to open a new current account and switch into that and then worry about getting rid of that account (perhaps merging with an existing Nationwide account, if that's possible) at a later date. I'm trying to reduce the number of current accounts that I have, but if I can pick up bonuses whilst doing that, even better!

Near the end of this page

https://www.nationwide.co.uk/current-accounts/switch/

There are a series of questions the answers to which determines your eligbility and amount of the switch incentive.

I have switched 3 accounts today into existing Flex accounts (mine my wifes and joint) and expect to receive £125 for each switch.

for joint does it matter from whose login account you switch into? because I also have a sole and wife also have a sole account and we want to get £125*3 if possible

We already each have sole account and a joint account with Nationwide. I did a switch to my sole account and a switch to the joint account using my login. Then my wife switched an account to her sole account using her log in.

Thanks, got another question on switching to joint account. Donor account also have to be a joint account or doesnt matter?

https://www.money.co.uk/current-accounts/how-to-switch-your-bank-account.htm

I requested a switch of a joint to a joint.1 -

Brilliant! Already got a Flexaccount so it will mean I can switch one of my donor accounts into it without having to open another one. Trying my best to reduce then number of accounts I have, would be good if I can get down to single digits.0

-

Will this work?

0

0 -

Have applied for 2 new direct debits but obviously will take a number of days before they get debited. Can I go ahead and apply for switch with Nationwide using a date perhaps 2-3 weeks ahead?1

-

Yes. That is what i have done with one of my switches. I selected 8th September for the switch completion date. The T+Cs state that the switch needs to be completed within 30 days of request to be eligible for the incentive payment.numbercruncher said:Have applied for 2 new direct debits but obviously will take a number of days before they get debited. Can I go ahead and apply for switch with Nationwide using a date perhaps 2-3 weeks ahead?0 -

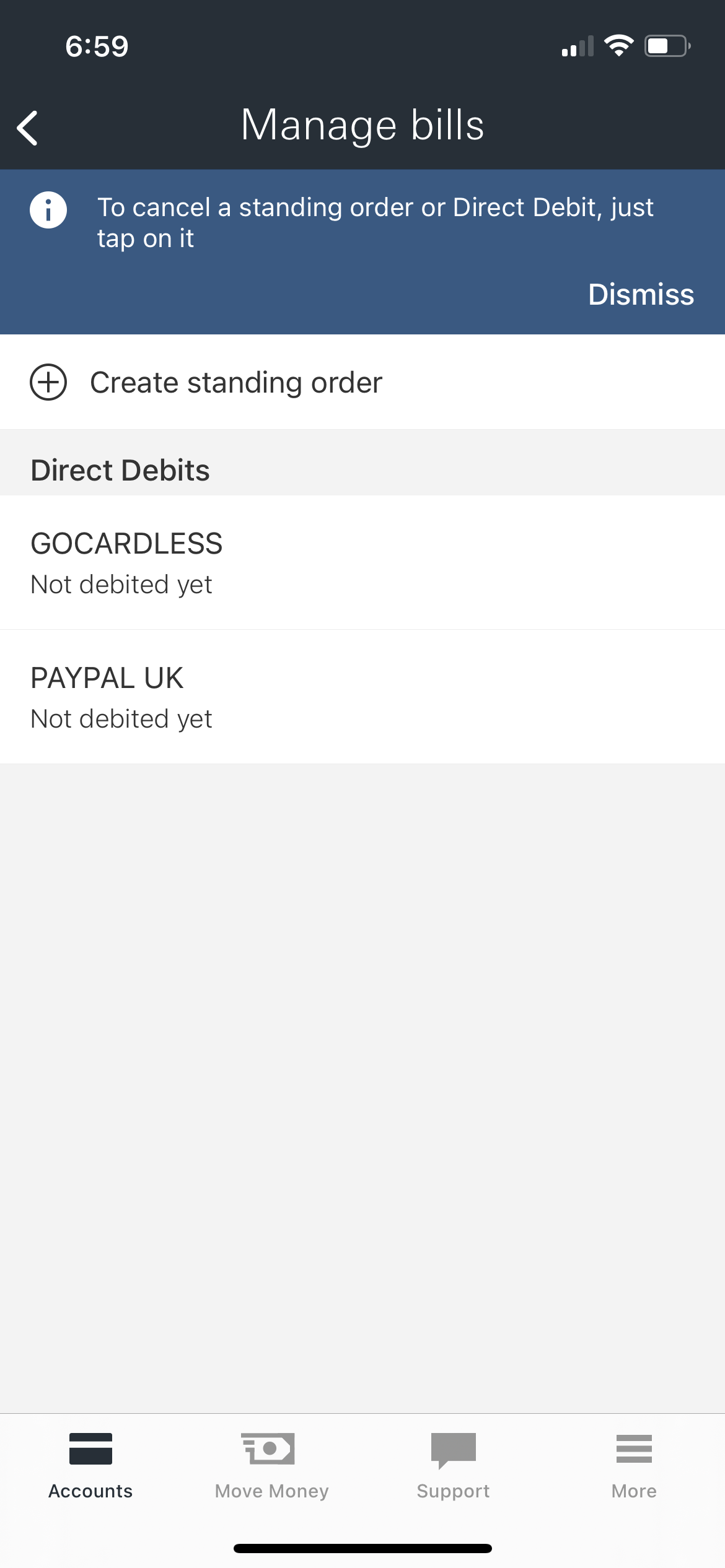

Can I please ask how long it took for the GoCardless DD to appear from setting it up? I'm using this as one of my DD's.DebtHurricane said:Will this work? This site has saved me a fortune :money: ...it's also cost me a fortune! :doh:

This site has saved me a fortune :money: ...it's also cost me a fortune! :doh:

© Tharweb 2006 0

0 -

I literally signed up for a charity direct debit yesterday around 10am, and it was visible this morning. But do the direct debits have to have already paid out before the switch? Or just be activeTharweb said:

Can I please ask how long it took for the GoCardless DD to appear from setting it up? I'm using this as one of my DD's.DebtHurricane said:Will this work? 0

0 -

DebtHurricane said:

I literally signed up for a charity direct debit yesterday around 10am, and it was visible this morning. But do the direct debits have to have already paid out before the switch? Or just be activeTharweb said:

Can I please ask how long it took for the GoCardless DD to appear from setting it up? I'm using this as one of my DD's.DebtHurricane said:Will this work?

No one knows for sure, it will be just a guess work. We will know once people start getting bonus and their story. But donating few pounds wont hurt as you will get the bonus of £125 and by letting your DD go through, you are absolutely sure that you will be paid.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards