We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Core and Satellite approach for a SIPP

Comments

-

If you plan to build a core and satellite investment approach then why would you use VTR rather than VLS (or other similar multi-asset fund).I was thinking of investing in satellites of sectors including Global Smaller Companies, Emerging Markets, Global Property, Global Technology, Infrastructure and Health. However, I'm unsure of whether these sectors offer further diversification with minimal duplication. The majority of my capital will be invested in the core holding and small percentages allocated to the satellites.If you are going to go to that level, you may as well drop the multi-asset fund and just go with preferred weightings into each area. Your multi-asset fund will already have a holding in many of these areas.I'm therefore also wondering what percentages would you allocate to different sectors of the satellite Funds/ Investment Trusts aswell as the core holding?It would depend on risk profile, timescale and how you intend to build the core and satellite approach along with the amount of money involved. Firstly, the fact you are considering this method would suggest you have a larger fund value (over £100k). Otherwise, it is largely pointless. What value you are looking at.

It would also depend on your knowledge and ability to understand research and analysis and keep it under continued review. It's not a lazy investor option.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.3 -

If you’re planning to retire in 2055 (34 years time), I would 100% ditch the Target Retirement Fund for a 100% equity fund. Either Vanguard FTSE Global All Cap or Vanguard LifeStrategy 100%.

Your existing Target Date Retirement Fund has approximately 20% allocated to bonds, this will reduce your investment returns over the long-term."If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)2 -

george4064 said:Your existing Target Date Retirement Fund has approximately 20% allocated to bonds, this will reduce your investment returns over the long-term.I agree with the sentiment, but 'will' is too strong unless you have a crystal ball or nominate how long 'long-term' is so we can follow up on the prediction. A couple of observations...I'm not a fan of experts, but Benjamin Graham the investing guru of the early 20th century advised people to hold between 25% and 75% as stocks, not 100%.We can look at the historic returns at the portfolio visualiser website: an 80% stocks, 20% treasury bonds portfolio under-performed a 100% stocks portfolio over the 35 years since 1986 by 0.19%/year in annual returns, but with much less risk, much less fall during crises, fewer bad and not so bad single year returns, and a better risk adjusted return.So, you'd have been wise to choose a 100% stock portfolio in 1986, and probably now. But you need nerves of steel to hang on during the financial meltdowns without capitulating and 'selling low' only to have to buy in higher on the way up, and nerves of steel to keep investing in stocks that are down on where they were 5 years ago while bonds are holding their value better. That's the difficult part with 100% stocks, or one of them. Your biggest hazard is staring back at you in the mirror because you can't stick to your plan. Any wrong moves by you during that 35 years when stocks finally outperformed stocks/bonds by 0.19%/year could have wiped out that 0.19%/year completely.And at the 34 year mark the stock/bond portfolio was still ahead of the 100% stocks. Have you got the ticker for it?

1 -

I would also caution the OP about tinkering, since risks only become really clear when markets fall and panic might set in.

JohnWinder’s info about the benefits of holding a small % of bonds is interesting. It makes some intuitive sense that if you hold say an 80/20 equity/bond split, you get the benefit of selling equities when they are high, rebuying them when they fall and ending up with a greater number of units. The easiest way to view this is Vanguard LifeStrategy but the theory doesn’t seem to hold up. Over the last ten years the difference between the funds is:

VLS40 outperforms VLS20 by 23.10%

VLS60 outperforms VLS40 by 25.70%

VLS80 outperforms VLS60 by 26.80%

VLS100 outperforms VLS80 by 27.70%.

Is the Graham thesis flawed? Is the bull market of the last 10 years unrepresentative? Or is it much more complex…?

3 -

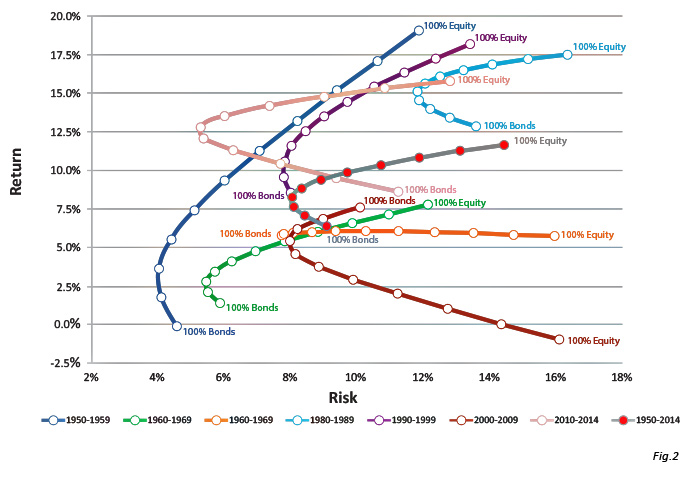

It's easiest to understand this by referring to an equities vs bonds efficient frontier curve:

It's really at the other end of the risk spectrum that you get a synergistic effect by diversifying (i.e. 80% bonds is both lower risk and higher return than 100% bonds). The same is not true at the high risk end, as the generally lower return from bonds over the long term outweighs the benefits from rebalancing. The power of rebalancing really comes into its own when holding uncorrelated assets with similar long term returns.2

It's really at the other end of the risk spectrum that you get a synergistic effect by diversifying (i.e. 80% bonds is both lower risk and higher return than 100% bonds). The same is not true at the high risk end, as the generally lower return from bonds over the long term outweighs the benefits from rebalancing. The power of rebalancing really comes into its own when holding uncorrelated assets with similar long term returns.2 -

You raise a good point. My example used annual rebalancing. It's hard to know what benefit or harm rebalancing WILL do over decades - hard, impossible. In an ever trending up market you keep selling winners to buy the also-ran; in a swinging market you can sell near the top and buy back near a bottom (if you rebalance at the right interval/% imbalance, or whatever). Good luck trying to know what to do.In the period I looked at in portfolio visualiser, with global stocks and 10 year Treasuries, rebalancing the stocks/bonds portfolio did not change the annual return by even one basis point/year, but it increased the risk measure slightly.0

-

Not promoting Gold in any way, but I am several years further on from the OP on the same journey so this is what my wife and I do:

S and P global tracker for the majority of our funds plus things I am interested in and had a good gut feeling about - Clean Energy fund (micro companies in an expanding sector) Pharma tracker (ethically felt the right thing to do and defensive - worked very well in 2000) Tec fund (I know S and P covers this but I have always held it and look at the returns! and it turns out to be defensive - who knew?)

This is hedged by:

1 years worth of cash in Premium Bonds. If I need cash quickly this is where it comes from.

4% in physical gold - not telling you where I live! This is the % I expect to take out year on year from my portfolio and would have sold gold before stocks if I needed money in 2020. As you can see from the graph above gold was probably the best counter balance to stocks as market movements were the exact opposite. Actually in the last crash in 2020 this 4% goes up to something like 6%, so it does its job as a hedge against market crashes and provides funds without having to sell stocks at a low point.

No bonds of any colour. Recent history shows bonds correlate with stocks so what is the point? All it will take is a jump in interest rates and bond values will plummet. Gilts are safe but at practically 0% interest may as well hold premium bonds and hope for a win.Edible geranium0 -

Not wishing to repudiate any of your ideas, but a couple of observations...bugbyte_2 said:

No bonds of any colour. Recent history shows bonds correlate with stocks so what is the point? All it will take is a jump in interest rates and bond values will plummet. Gilts are safe but at practically 0% interest may as well hold premium bonds and hope for a win.When I look at correlations on portfolio visualiser, I see the correlation between a broad stock fund and a broad bond fund over the last 3 years (you chose 3 years for recent history in your chart) was between minus 0.19 and plus .013. That's not much of a correlation - even the positive bit.So what's the point? Yes, there may be a jump in interest rates ahead, folk have been saying that for several years now, but a global bond fund returned 4.5%/year over the last year or so, which wasn't that shabby. But more to the point, if you haven't got the ticker for the volatility of stocks and gold, bonds are a good choice to help you stay the course.1 -

Interesting though that the real difference between the( presumably annual) return between 100% equities ( US ones anyway ) and the traditional 60:40 split is less than 1% pa .masonic said:It's easiest to understand this by referring to an equities vs bonds efficient frontier curve: It's really at the other end of the risk spectrum that you get a synergistic effect by diversifying (i.e. 80% bonds is both lower risk and higher return than 100% bonds). The same is not true at the high risk end, as the generally lower return from bonds over the long term outweighs the benefits from rebalancing. The power of rebalancing really comes into its own when holding uncorrelated assets with similar long term returns.

It's really at the other end of the risk spectrum that you get a synergistic effect by diversifying (i.e. 80% bonds is both lower risk and higher return than 100% bonds). The same is not true at the high risk end, as the generally lower return from bonds over the long term outweighs the benefits from rebalancing. The power of rebalancing really comes into its own when holding uncorrelated assets with similar long term returns.

For the average investor not a huge price to pay if it helps to avoid the worst of the market drops when they might panic and pull out.0 -

Albermarle said:

Interesting though that the real difference between the( presumably annual) return between 100% equities ( US ones anyway ) and the traditional 60:40 split is less than 1% pa .masonic said:It's easiest to understand this by referring to an equities vs bonds efficient frontier curve: It's really at the other end of the risk spectrum that you get a synergistic effect by diversifying (i.e. 80% bonds is both lower risk and higher return than 100% bonds). The same is not true at the high risk end, as the generally lower return from bonds over the long term outweighs the benefits from rebalancing. The power of rebalancing really comes into its own when holding uncorrelated assets with similar long term returns.True enough, but it ain't always so. As this article says, "The problem with the efficient frontier is that it is a moving target. If one looks at the frontier between bonds and equities over 10-year intervals, which is much more representative of the average investor’s time frame, the highest return for the lowest risk ranges from 100% bonds to 100% equity. That’s not very efficient." It demonstrates the point with this graph:

It's really at the other end of the risk spectrum that you get a synergistic effect by diversifying (i.e. 80% bonds is both lower risk and higher return than 100% bonds). The same is not true at the high risk end, as the generally lower return from bonds over the long term outweighs the benefits from rebalancing. The power of rebalancing really comes into its own when holding uncorrelated assets with similar long term returns.True enough, but it ain't always so. As this article says, "The problem with the efficient frontier is that it is a moving target. If one looks at the frontier between bonds and equities over 10-year intervals, which is much more representative of the average investor’s time frame, the highest return for the lowest risk ranges from 100% bonds to 100% equity. That’s not very efficient." It demonstrates the point with this graph:

4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards