We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Core and Satellite approach for a SIPP

Comments

-

Using BOE base rate as an example. Was at 6% in February 2000. By March 2009 had bottomed at 0.5%. Requires no commentary as to why (high quality) bond yields collapsed over that period.bugbyte_2 said:

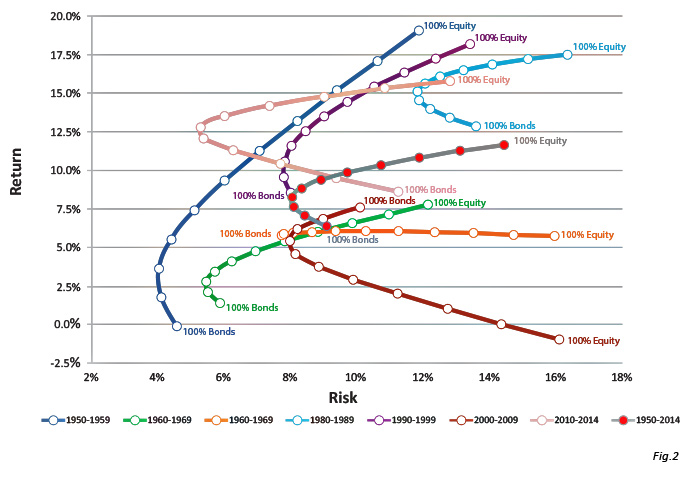

This is really interesting because there is one period - 2000 to 2009 - when common convention went out of the window and corporate bonds returned greater than stocks. The effect of this can be seen on a comparison of corporate bonds vs stocks vs gilts over the last 20 years (Baillie Gifford represents Corp. Bonds). Corporate bonds come out massive winners both in returns and volatility.aroominyork said:

The growth that Corp bonds had accumulated by 2010 was so great that world stocks have not managed to catch up, even after 11 years. However in aroominyork's chart 7 out of 8 times this didn't happen so it is very unusual and cannot be expected. In the other 7 out of 8 ten year periods normality resumed and stocks had the greatest increase.

As regards 'do bonds correlate with stocks' it really depends on definitions. Gilts don't correlate but it looks like corporate bonds do, as shown by the next two charts for the 2008 and 2020 crashes when corporate bonds dipped at the same time as stocks. Gilts or cash would therefore be your hedge option unless you found another asset class to do this job.

The start of the bond bull market can be traced back to October 1976 when BOE base rate was 15%. 45 years on there's no where further for it to go. Question is now when rates may start to rise again. With all eyes on the Fed as their policies have a major influence globally. 2023 is being penciled in for an upward movement in rates.0 -

What's the yield to maturity on the bonds? Running income yield which is distributed could be high. The offset is that in buying the bonds you are baking in a guaranteed capital loss. As the purchase cost of £100 of nominal stock is far above par value.bugbyte_2 said:

This bit I don't get. Take a fund I used to hold, Baillie Gifford Strategic Bond. Current distribution yield is 3.2% with costs of about 0.8% on an average platform, inflation running at 1.8%? so 3.2 - 1.8 - 0.8 = 0.6% increase or 'profit' pa.aroominyork said:Growth could slow, inflation could increase and rates could rise, and bonds would then be as valuable again as they usually have been.0 -

But that compares and an index (global stocks) with an active fund (corporate bonds). We'll always find some active funds outperforming indices of similar asset class; and others that underperform, I think.bugbyte_2 said:This is really interesting because there is one period - 2000 to 2009 - when common convention went out of the window and corporate bonds returned greater than stocks. The effect of this can be seen on a comparison of corporate bonds vs stocks vs gilts over the last 20 years (Baillie Gifford represents Corp. Bonds). Corporate bonds come out massive winners both in returns and volatility.

0 -

Agreed. However Ballie Gifford is fairly representative of investment grade bonds (i.e. no junk bonds) and tracks just above the index.JohnWinder said:But that compares and an index (global stocks) with an active fund (corporate bonds). We'll always find some active funds outperforming indices of similar asset class; and others that underperform, I think.

Don't know for a bond fund. Usually go with the underlying yield which is just what you will get back pa - didn't know this could also eat into capital! I can see yield to maturity would be an excellent measure if you were buying a single bond as you would know exactly what you are getting over the lifetime of the bond. This is where 'invest in what you know about' kicks in I guess!Thrugelmir said:What's the yield to maturity on the bonds? Running income yield which is distributed could be high. The offset is that in buying the bonds you are baking in a guaranteed capital loss. As the purchase cost of £100 of nominal stock is far above par value.

Actually, I was slightly wrong about corporate Bonds and Stocks correlating. They did in 2008 and again in 2020 but they didn't during the dot.com crash in 2000 and were a good hedge then. Probably proves the point no one knows what is happening now let alone what is going to happen next! I would imagine bonds dropped in 2008 and 20 because investors saw a real possibility that companies would default. 2000 - was it just tec companies that collapsed (sizable part of a world index) and therefore the rest of the market just got on with it?

Edible geranium0 -

It's not a matter of active vs passive as though corporate bonds are usually highly correlated with general equity they are very different types of asset.JohnWinder said:

But that compares and an index (global stocks) with an active fund (corporate bonds). We'll always find some active funds outperforming indices of similar asset class; and others that underperform, I think.bugbyte_2 said:This is really interesting because there is one period - 2000 to 2009 - when common convention went out of the window and corporate bonds returned greater than stocks. The effect of this can be seen on a comparison of corporate bonds vs stocks vs gilts over the last 20 years (Baillie Gifford represents Corp. Bonds). Corporate bonds come out massive winners both in returns and volatility.

In the particular case the boom and bust around 2000 was mainly limited to high growth stocks. High growth companies generally dont issue bonds as they could not afford to pay the interest. A better comparison for corporate bonds would be provided with a defensive equity income fund.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards