We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Core and Satellite approach for a SIPP

Comments

-

Albermarle said:Interesting though that the real difference between the( presumably annual) return between 100% equities ( US ones anyway ) and the traditional 60:40 split is less than 1% pa .Bonds have had a good few decades powered by ever lowering interest rates. We are getting to the point where their opportunity is becoming mathematically limited given most just have a fixed coupon to redemption. At least with equities the opportunity is unlimited if you hold them long enough and accept the regular corrections and occasional crashes. Rather than trying to optimise risk adjusted return or worrying about price volatility maybe the best way to reduce the real risk that matters, shortfall, is to just accumulate very large investment pots that produce sustainable income and long term capital growth for inflation protection with a cash buffer for years in which income may be lower.2

-

With blips we've largely been in a bull market globally since March 2009 and it's to be expected that higher equities will produce higher returns during a bull market.aroominyork said:Is the bull market of the last 10 years unrepresentative? Or is it much more complex…?

Actually it's expected overall anyway but the pain of volatility shows up much less in a bull market so it's harder to appreciate the value of bonds.0 -

I think that's right. We all know the bull market could grand to a halt at any time, but I worry about those four (or is it five?) dangerous words "this time it's different" when people talk about a 'new normal' of low inflation and low interest rates. Growth could slow, inflation could increase and rates could rise, and bonds would then be as valuable again as they usually have been.jamesd said:

Actually it's expected overall anyway but the pain of volatility shows up much less in a bull market so it's harder to appreciate the value of bonds.aroominyork said:Is the bull market of the last 10 years unrepresentative? Or is it much more complex…?

0 -

This bit I don't get. Take a fund I used to hold, Baillie Gifford Strategic Bond. Current distribution yield is 3.2% with costs of about 0.8% on an average platform, inflation running at 1.8%? so 3.2 - 1.8 - 0.8 = 0.6% increase or 'profit' pa.aroominyork said:Growth could slow, inflation could increase and rates could rise, and bonds would then be as valuable again as they usually have been.

What happens if inflation rises by 5%? Either you 'loose' 4.4% pa in real terms or the price of the bond crashes through the floor until the price is low enough to compensate so you get your measly 0.6%, but have lost a shedload of capital in the process.

Factor in the volatility - bonds crashed at the same time as stocks in March 2020 - and I just don't see the value of holding them until the yields are a lot greater than inflation + costs and can therefore weather inflation, which lets face it can only go up from historic lows. So I can't (personally) answer the question why hold bonds? - hence the hedging with cash and 4% gold.

Back to the original OP - (s)he is 28, so the timescale of investment is massive. If over 37 years stocks don't out perform bonds I think we will have more to worry about than our investments! Therefore IMHO drop most of your investment into a world tracker + have a bit of fun with sectors that inspire you. Do it tax efficiently (S&S ISA or SIPP if you really don't want to see your money for 37 years) and pick a platform with low costs. Don't worry about falls as historically the market has always recovered (first time for anything though!)

Not a FA. Don't take anything I write seriously.Edible geranium0 -

Trying not to, but sometimes I just can't help myself.bugbyte_2 said:

Factor in the volatility - bonds crashed at the same time as stocks in March 2020 - ...

.... Don't take anything I write seriously.

There are many types of bonds; we need to be careful bunching them all together with generalisations. We hold stocks for their higher returns despite annoying volatility; we hold bonds for their price stability and whatever coupon they pay. If they're not paying enough, hold more stocks if you can stomach the ride. So, if you need to hold bonds, what did 10 year treasuries do in March 2020 when stocks took a dive? A fund holding 10 treasuries in January 2020 has ever since then been at a higher value than it was in January last year. There was no crash, not even a tiny slip.

0 -

bugbyte_2 said:

This bit I don't get. Take a fund I used to hold, Baillie Gifford Strategic Bond. Current distribution yield is 3.2% with costs of about 0.8% on an average platform, inflation running at 1.8%? so 3.2 - 1.8 - 0.8 = 0.6% increase or 'profit' pa.aroominyork said:Growth could slow, inflation could increase and rates could rise, and bonds would then be as valuable again as they usually have been.

What happens if inflation rises by 5%? Either you 'loose' 4.4% pa in real terms or the price of the bond crashes through the floor until the price is low enough to compensate so you get your measly 0.6%, but have lost a shedload of capital in the process.JohnWinder said:

we hold bonds for their price stability and whatever coupon they pay.bugbyte_2 said:

Factor in the volatility - bonds crashed at the same time as stocks in March 2020 - ...

.... Don't take anything I write seriously.

Strategic bond funds can be expensive to own based on the fee as a proportion of expected return. There are presumably two reasons for buying a strategic bond fund instead of an index bond fund. First, you think the manager can read the macro-economic environment and, for example, reduce duration if they see a likely rise in interest rates (and vice versa). Second, you think the manager can identify bonds that will show a capital gain - people may buy them for a premium in future - rather than just paying you the coupon. Do those factors figure in thinking about the 'bit you don't get'?

0 -

Sorry tend to use the term Bonds for corporate borrowing, Gilts for UK Government borrowing, US securities for....etc.

Whilst I accept that purchasing a bond on the primary market could lead to a relatively low volatile investment with a decent coupon, personally I am not going to do so because I would have to do a vast amount of due diligence which is beyond my capabilities, and as the inflation rate would be hard pressed to go any lower I can't see the value of the bond increasing. If inflation was running at 10% and a Bond was offered at say 12% you could see the value as inflation could go down making the bond more desirable.

As regards Gilts, from a quick check you can get a running yield of about 0.5% on short dated gilts and about 1.75 on (very) long dated gilts but you still (a) have to pay a platform to hold them and (b) pay up to 2% spread, which would increase if the gilt became less desirable. All this for a below inflation return. If I had several million to invest I would consider them for financial protection, but I don't. As with any investment you have to have a reason to hold it, and at this moment in time I cannot think of one. As previously stated my hedging is done through cash and a small amount of Gold for diversification.Edible geranium0 -

Sorry, guilty as charged. I wrote 'bonds' when I was imagining one might hold bond funds rather than individual bonds.In the current bond yield conditions your preference for a savings account is a fine alternative to short term government bonds. Indeed it probably was when savings accounts paid 12%/year in 1990 or any other year we choose, because both a similarly safe etc, so likely to yield similarly. But the reality is, that when you look at long term returns (and the OP is 28 years old), high quality bonds outperform savings accounts; they must, since they carry interest rate risk.But if we're talking about short periods to avoid bonds and use a savings account (forget the gold for a moment), then what we're saying is that we can predict where interest rates, bond yields and inflation will be in the short term future. That's not realistic anymore than thinking you can pick stock winners. Remember the 68 economists who all predicted interest rates heading in the wrong direction a few years back: https://www.marketwatch.com/story/yes-100-of-economists-were-dead-wrong-about-yields-2014-10-21I'm sure you weren't right about stock/bonds correlations or about bonds crashing last year which were the bases of your views about holding bonds (funds!) which prompted my comments. I couldn't say it would be wrong to choose savings accounts over bonds now, but the arguments in favour are pretty thin, and it would have been a poorer choice a year ago as far as returns go.

0 -

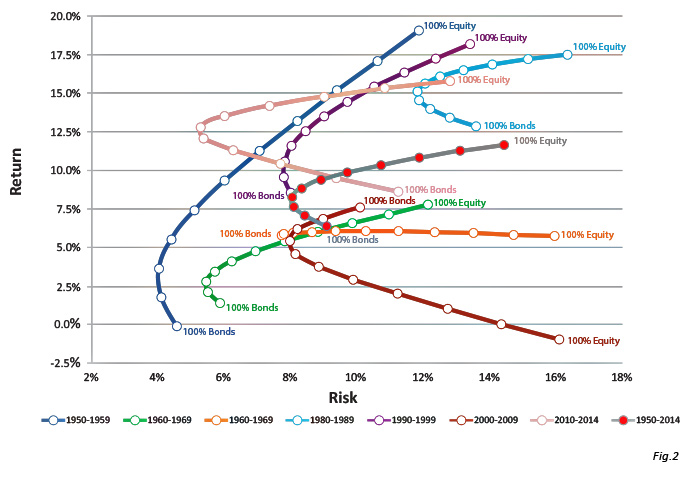

This is really interesting because there is one period - 2000 to 2009 - when common convention went out of the window and corporate bonds returned greater than stocks. The effect of this can be seen on a comparison of corporate bonds vs stocks vs gilts over the last 20 years (Baillie Gifford represents Corp. Bonds). Corporate bonds come out massive winners both in returns and volatility.aroominyork said:

The growth that Corp bonds had accumulated by 2010 was so great that world stocks have not managed to catch up, even after 11 years. However in aroominyork's chart 7 out of 8 times this didn't happen so it is very unusual and cannot be expected. In the other 7 out of 8 ten year periods normality resumed and stocks had the greatest increase.

As regards 'do bonds correlate with stocks' it really depends on definitions. Gilts don't correlate but it looks like corporate bonds do, as shown by the next two charts for the 2008 and 2020 crashes when corporate bonds dipped at the same time as stocks. Gilts or cash would therefore be your hedge option unless you found another asset class to do this job.

Edible geranium2 -

Whilst corp bonds are definite stock proxies (with lower volatility), another interesting point to note, particularly in the recent covid crash (above), is how they slightly lagged stocks in falling off the edge of the cliff, which allowed me to bail out before the really big losses.bugbyte_2 said:This is really interesting because there is one period - 2000 to 2009 - when common convention went out of the window and corporate bonds returned greater than stocks. The effect of this can be seen on a comparison of corporate bonds vs stocks vs gilts over the last 20 years (Baillie Gifford represents Corp. Bonds). Corporate bonds come out massive winners both in returns and volatility.

The growth that Corp bonds had accumulated by 2010 was so great that world stocks have not managed to catch up, even after 11 years. However in aroominyork's chart 7 out of 8 times this didn't happen so it is very unusual and cannot be expected. In the other 7 out of 8 ten year periods normality resumed and stocks had the greatest increase.

As regards 'do bonds correlate with stocks' it really depends on definitions. Gilts don't correlate but it looks like corporate bonds do, as shown by the next two charts for the 2008 and 2020 crashes when corporate bonds dipped at the same time as stocks. Gilts or cash would therefore be your hedge option unless you found another asset class to do this job.

Our green credentials: 12kW Samsung ASHP for heating, 7.2kWp Solar (South facing), Tesla Powerwall 3 (13.5kWh), Net exporter0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards