We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Economy crash =/= stock market crash?

Comments

-

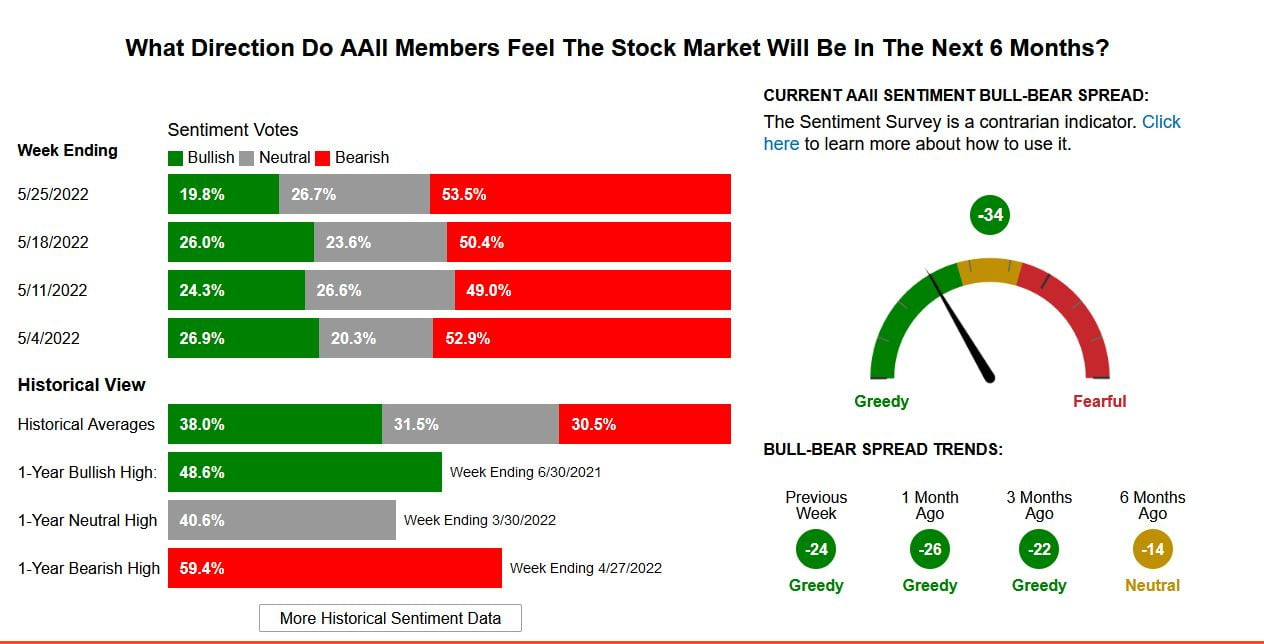

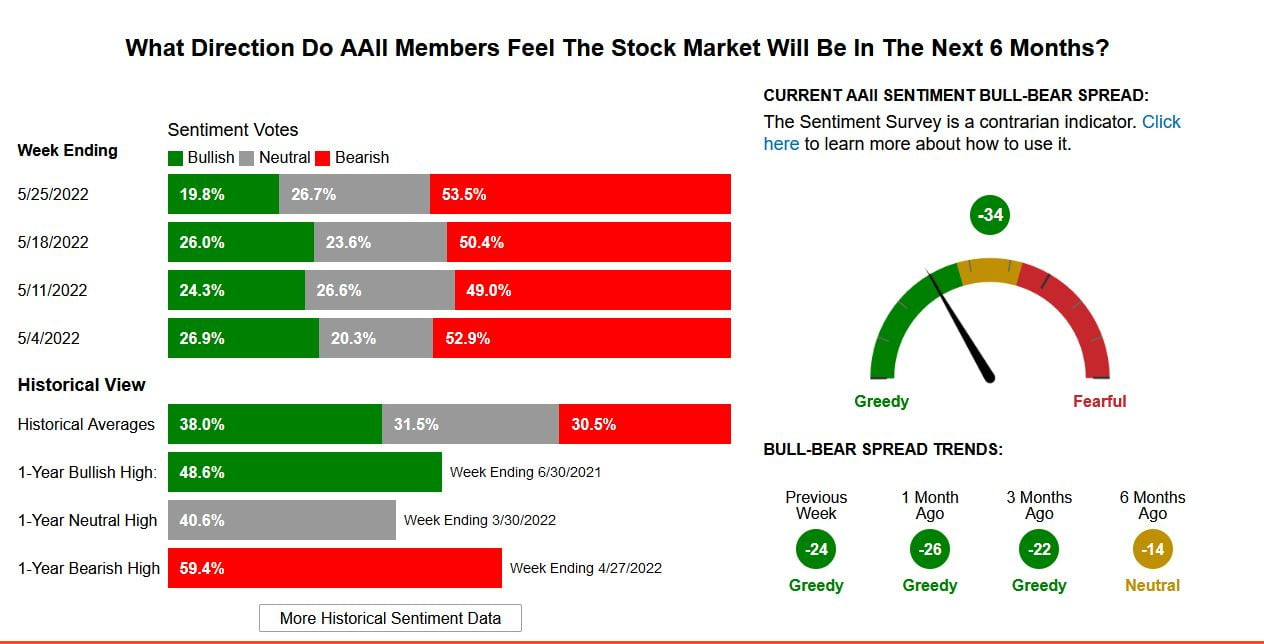

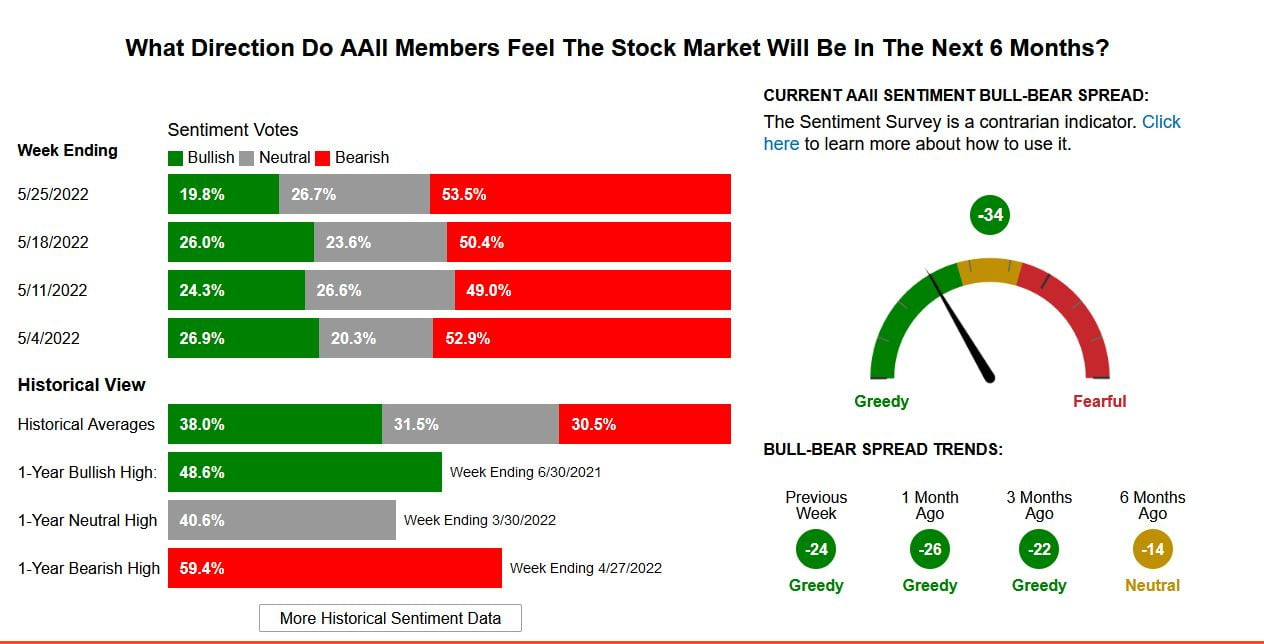

I thought the saying went; "Sell in May, don't come back till St Leger's Day" which is in September.adindas said:InvesterJones said:adindas said:Sell May and Go away, buy back in November ? (Please note noone is suggesting you do this !!!!)It is the historical pattern in the wall streetIf a lot of people Hedge-fund are still doing this during this current bear market it will put more further pressure on the stock market. Summer is a typical holiday season where many HFs, Traders are not doing trade as many as they do during the other seasons.This is what current survey of AAII is showing. These are the people who will normally put their money in the stock market

Doesn't that chart show that actually that's not the historical pattern? Seems historical average sentiment at this time of year is more bullish than bearish. (Or is the historical average an all-year term, not average for this time of year?)I refer the historical pattern for "Sell May and Go" buy back November.The chart"one year bearish is "One year bearish high" taking into consideration when the downtrend started in November 2021. 59.4% happened in week Ending April 27, 2022.This "sentiment survey" conducted May 25 for the next six months might not have taken into consideration the historical pattern "Sell May and Go, buy back November". Keep in mind the survey is conducted to Individual Investors (e.g retail investors). Not all retail Investors know about the historical pattern for "Sell May and Go, buy back November"."If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)1 -

It's an old one that's for sure. Sell in May and Go away or as you say St Ledger's. Many decades ago the brokers went off on holiday so they say . Basically a rally up to the end of April then the summer lull to end of September. Another rally to the year end.george4064 said:

I thought the saying went; "Sell in May, don't come back till St Leger's Day" which is in September.adindas said:InvesterJones said:adindas said:Sell May and Go away, buy back in November ? (Please note noone is suggesting you do this !!!!)It is the historical pattern in the wall streetIf a lot of people Hedge-fund are still doing this during this current bear market it will put more further pressure on the stock market. Summer is a typical holiday season where many HFs, Traders are not doing trade as many as they do during the other seasons.This is what current survey of AAII is showing. These are the people who will normally put their money in the stock market

Doesn't that chart show that actually that's not the historical pattern? Seems historical average sentiment at this time of year is more bullish than bearish. (Or is the historical average an all-year term, not average for this time of year?)I refer the historical pattern for "Sell May and Go" buy back November.The chart"one year bearish is "One year bearish high" taking into consideration when the downtrend started in November 2021. 59.4% happened in week Ending April 27, 2022.This "sentiment survey" conducted May 25 for the next six months might not have taken into consideration the historical pattern "Sell May and Go, buy back November". Keep in mind the survey is conducted to Individual Investors (e.g retail investors). Not all retail Investors know about the historical pattern for "Sell May and Go, buy back November".

FTSE ALL-SHARE Seasonal Chart | Equity Clock

FTSE 100 Index Seasonal Chart | Equity Clock

Dow Jones Industrial Average Seasonal Chart | Equity Clock

Dow Jones Industrial Average Four-year Election Cycle Seasonal Charts | Equity Clock

This site has a decent write up every week. Basically we're not too far away although it's early days.

Bond Market Reset: What's Next? | Charles Schwab

The Three Bears? | Charles Schwab

0 -

coastline said:

It's an old one that's for sure. Sell in May and Go away or as you say St Ledger's. Basically a rally up to the end of April then the summer lull to end of September. Another rally to the year end.george4064 said:

I thought the saying went; "Sell in May, don't come back till St Leger's Day" which is in September.adindas said:InvesterJones said:adindas said:Sell May and Go away, buy back in November ? (Please note noone is suggesting you do this !!!!)It is the historical pattern in the wall streetIf a lot of people Hedge-fund are still doing this during this current bear market it will put more further pressure on the stock market. Summer is a typical holiday season where many HFs, Traders are not doing trade as many as they do during the other seasons.This is what current survey of AAII is showing. These are the people who will normally put their money in the stock market

Doesn't that chart show that actually that's not the historical pattern? Seems historical average sentiment at this time of year is more bullish than bearish. (Or is the historical average an all-year term, not average for this time of year?)I refer the historical pattern for "Sell May and Go" buy back November.The chart"one year bearish is "One year bearish high" taking into consideration when the downtrend started in November 2021. 59.4% happened in week Ending April 27, 2022.This "sentiment survey" conducted May 25 for the next six months might not have taken into consideration the historical pattern "Sell May and Go, buy back November". Keep in mind the survey is conducted to Individual Investors (e.g retail investors). Not all retail Investors know about the historical pattern for "Sell May and Go, buy back November".

FTSE ALL-SHARE Seasonal Chart | Equity Clock

FTSE 100 Index Seasonal Chart | Equity Clock

Dow Jones Industrial Average Seasonal Chart | Equity Clock

Dow Jones Industrial Average Four-year Election Cycle Seasonal Charts | Equity ClockAFAIK a few people, hedgies doing that during the bull market. In the bear market there is an apparent risk that during this period the stock market come down to capitulation state where there is no more sellers left. At this point the buyer will step causing the stock market to rally.A few people like Hedgies, Acute Traders are in summer holiday during this period where they do not have much time for trading and watching the marker regularly. So for them in bull market it is probably better to just close some of their positions and buy back in October/November.0 -

This is what cause the Market to rally today.Headline PCE (Personal Consumption Expenditures PCEs) rose just 0.2%, a sharp reduction from March’s 0.9% increase. PCE which could also be linked to core CPI (e.g food,energy) is the method preferred by the Federal Reserve to measure inflation.https://www.cnbc.com/2022/05/27/goldman-sees-signs-inflation-is-peaking-could-be-positive-for-stocks.html

Goldman says signs that inflation is peaking could be positive for stocks

Published Fri, May 27 20220 -

Reasonable numbers of Individual growth stocks have tanked 80%+. But the US stock market is commonly associated to S&P500. We are currently in the bear market. But whether the market will tank so deep by 80% is a distance possibility because :Type_45 said:

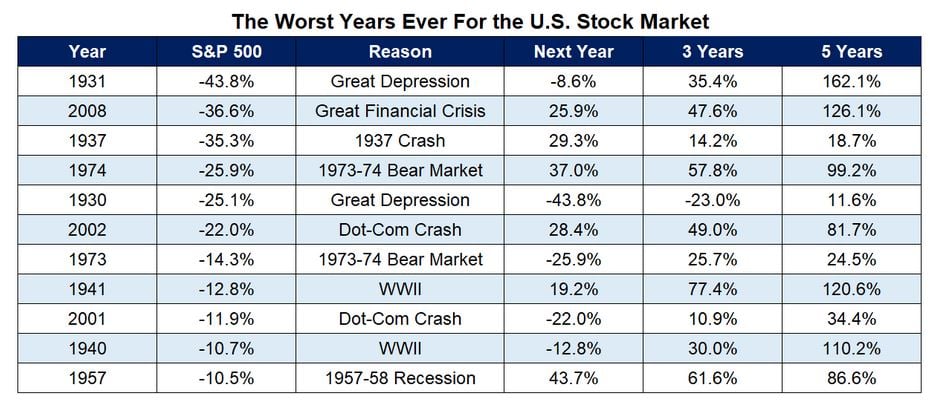

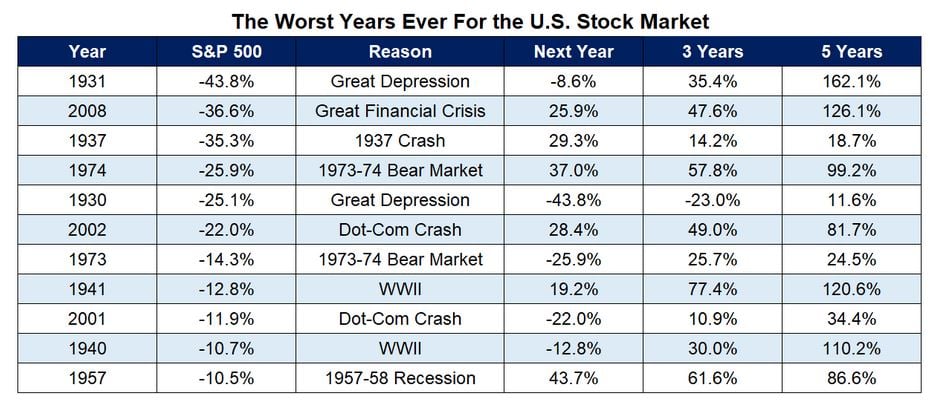

You obviously don't share my views about the financial Armageddon we are facing. But let me ask you this theoretical question: if you thought the market was about to tank by 80%, how would you be positioning your portfolio?- There has not been any expert opinion ever claim the market will tank by 80%. These experts will need to worry about their reputation making such a major claim if they do not personally firmly believe that. We might not reach the bottom yet, but reaching to that deep, AFAIK no expert has ever claim to this date.- Even Michael Burry "The King of Short" who frequently benefiting from the falling stock market, market crash, has never publicly made that 80% fall claim. Michael Burry has incentive to keep spreading FUD to spook the market as being "the king of short, he will benefit from the falling market. But the other hand he will also need to worry about his reputation.- Historically even during the great depression, the stock market has never tanked by 80%. But everything could happen we will never know that a black swan event could happen in the future such as China invades Taiwan where the US, Russia, Iran get involved. Russia might use Nuclear option.The good news is that even in the worst years including great depression, it only takes less than 5 years for the stock market to turn around making a reasonable gain.1

But everything could happen we will never know that a black swan event could happen in the future such as China invades Taiwan where the US, Russia, Iran get involved. Russia might use Nuclear option.The good news is that even in the worst years including great depression, it only takes less than 5 years for the stock market to turn around making a reasonable gain.1 -

Five years is typically enough time for markets to start to recover but sometimes it takes considerably longer to fully recover to an all time high. For example, it took around 12 years after the dot com crash. The good thing is that many of us are still contributing and those years of additional contributions help make the picture a lot rosier even though you can feel underwater for a very long time.adindas said:

Some Individual growth stocks have tanked 80%+. But the US stock market is commonly associated to S&P500. We are currently in the bear market. But the market will tank so deep by 80% is a very distance possibility because :Type_45 said:

You obviously don't share my views about the financial Armageddon we are facing. But let me ask you this theoretical question: if you thought the market was about to tank by 80%, how would you be positioning your portfolio?- There has not been any expert opinion that ever claim the market will tank by 80%. At least I have heard anyone. We might not reach the bottom yet, but reaching that deep no one has ever claim to this date.- Even Michael Burry "The King of Short" who frequently benefiting from the falling stock market, market crash has never publicly made that 80% fall claim.- Historically even during the great depression, the stock market has never tanked 80%. But everything could happen we will never know that a black swan even might happen where China invades Taiwan and the US, Russia, Iran get involved. Russia might use Nuclear option.The good news is that even in the worst years including great depression, it only takes around 5 years for the stock market to recover making a good gain.0

But everything could happen we will never know that a black swan even might happen where China invades Taiwan and the US, Russia, Iran get involved. Russia might use Nuclear option.The good news is that even in the worst years including great depression, it only takes around 5 years for the stock market to recover making a good gain.0 -

There are five convergent forces which will push the global economy over the edge and create a depression and an 80% drop on global equity markets:

1) the up-coming global famine

2) the cost of energy crisis3) inflation

4) global debt

5) supply chain crisis0 -

I think "global famine" is a stretch.

If things were looking that bad, then I'm pretty sure "richer" countries would adopt "war" rationing as a last resort.

I don't think we'll literally starve. Yes, we might not have unlimited choice and availability, but will that be a cause or effect 😉How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)1 -

Sea_Shell said:I think "global famine" is a stretch.

If things were looking that bad, then I'm pretty sure "richer" countries would adopt "war" rationing as a last resort.

I don't think we'll literally starve. Yes, we might not have unlimited choice and availability, but will that be a cause or effect 😉As I understand, the stock market is forward looking. All of these factors have been known thus IMHO they have been priced in the stock-market:- The inflation that we have seen the worst in the last 40 years.- The Supply chain problems, Chips shortages have happened and well known.- Oil and Gas shortages due to Ukrainian war have been known.- Ukraine is one of the largest Wheat producers, Food Shortage due to Ukrainian war have been known.Unless it is getting worse all of those factors have been priced in the current market.But none has a crystal ball. Everything could happen we will never know that a black swan event could happen in the future such as a geopolitical event where China invades Taiwan and the US, Russia, Iran start getting involved. Russia might trigger or keep threatening the use of the Nuclear option in the war.3 -

Sea_Shell said:I think "global famine" is a stretch.

If things were looking that bad, then I'm pretty sure "richer" countries would adopt "war" rationing as a last resort.

I don't think we'll literally starve. Yes, we might not have unlimited choice and availability, but will that be a cause or effect 😉

A few months ago I was accused of being a tin-foil hat wearing conspiracy theorist for suggesting food shortages.

Now I'm simply met with " don't exaggerate, we'll just have war-time-like rationing".

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards