We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Bitcoin

Comments

-

Its because the industry is good at marketing and covering the fact that there is nothing there with a lot of complicated software, and mathematics to make it seem that only 'clever' investors can see the value.RichTips said:The objective of my interjection, however, was to ask you to give your opinion of why Bitcoin's price might be trending consistently upwards despite multiple popped bubbles. In essence, if "there is nothing there," why does the Emperor keep buying the clothes following multiple "realisations"?

0 -

If all you saying Bitcoin is a Ponzi Scheme like the Tulip bubble then why all these mega institutions and multi- billion hedge funds world wide are buying bitcoin at high prices now? These super rich entities employ the smartest economists and mathematicians in the world to help them decide to buy bitcoins. So you telling this smart money going into bitcoin is dumb?

I remember back in the day early 90s the Internet was slacked off saying it will never take off and email will never beat post letters. Oh my look at were we are now.

The future is bitcoin a new generation of money that is decentralised. Central banks worldwide are trying to compete with bitcoin by releasing CBDC's Central Bank Digital Currencies but will fail at then end because its not decentralised like bitcoin. CBDC's is like programmable money which is a scary though as it wont have that privacy like paper cash does.1 -

-

Central banks are not trying to compete with bitcoin; bitcoin is a non-event for them; they can outlaw it whenever they choose but they don't need to (although they did move against ripple recently). The point of their own digital currency is to control money supply and indeed individuals if they want; there is no way ever that governments and central banks would allow bitcoin to become mainstream. The future might be digital currency but it will be government controlled and possibly have to backed by something tangible like gold depending on how the current crisis plays out.bery_451 said:If all you saying Bitcoin is a Ponzi Scheme like the Tulip bubble then why all these mega institutions and multi- billion hedge funds world wide are buying bitcoin at high prices now? These super rich entities employ the smartest economists and mathematicians in the world to help them decide to buy bitcoins. So you telling this smart money going into bitcoin is dumb?

I remember back in the day early 90s the Internet was slacked off saying it will never take off and email will never beat post letters. Oh my look at were we are now.

The future is bitcoin a new generation of money that is decentralised. Central banks worldwide are trying to compete with bitcoin by releasing CBDC's Central Bank Digital Currencies but will fail at then end because its not decentralised like bitcoin. CBDC's is like programmable money which is a scary though as it wont have that privacy like paper cash does.

0 -

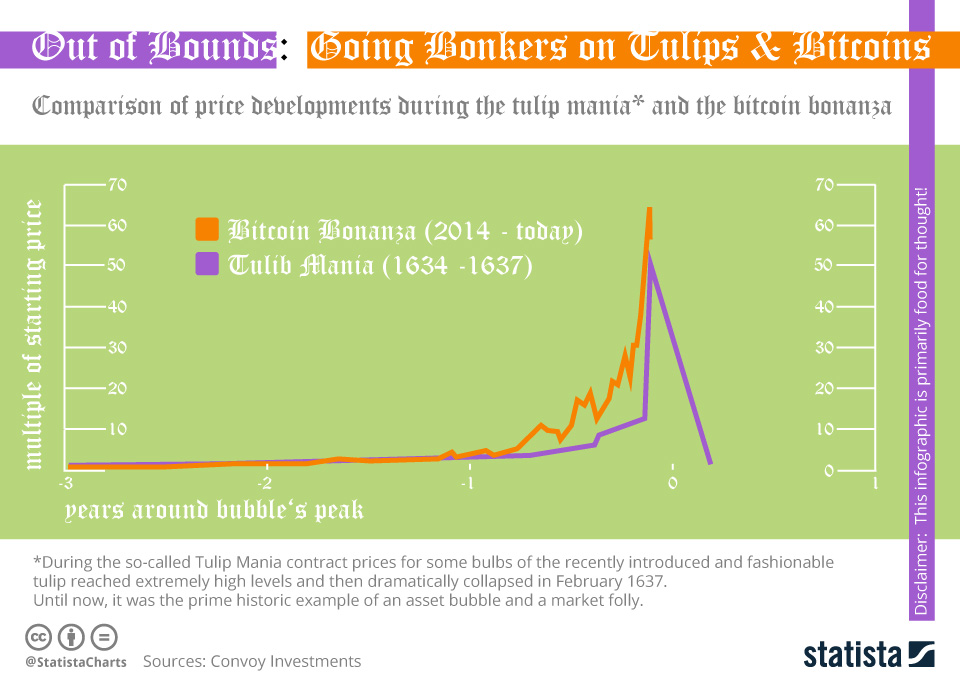

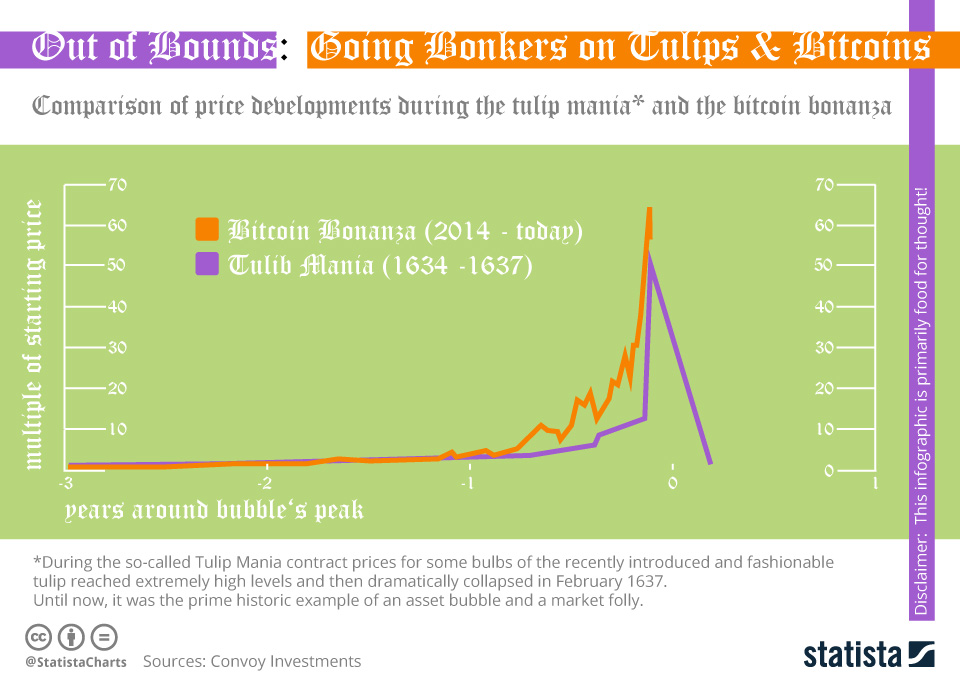

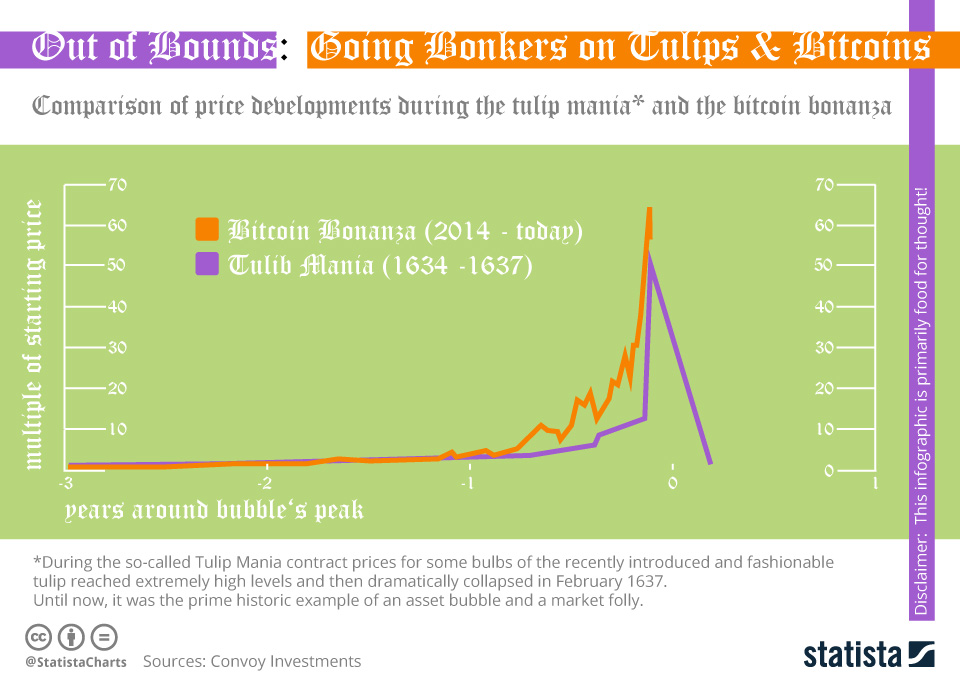

We've seen that graph before or one very like it, late 2017/ early 2018 when it was just past the peak then. It even makes it obvious it's a 2014-2017 graph because it has a spam of three years and is labelled 2014-today.HansOndabush said:

Its because the industry is good at marketing and covering the fact that there is nothing there with a lot of complicated software, and mathematics to make it seem that only 'clever' investors can see the value.RichTips said:The objective of my interjection, however, was to ask you to give your opinion of why Bitcoin's price might be trending consistently upwards despite multiple popped bubbles. In essence, if "there is nothing there," why does the Emperor keep buying the clothes following multiple "realisations"?

What point are you trying to make with three year old data?

Proud member of the wokerati, though I don't eat tofu.Home is where my books are.Solar PV 5.2kWp system, SE facing, >1% shading, installed March 2019.Mortgage free July 20230 -

HansOndabush said:

Its because the industry is good at marketing and covering the fact that there is nothing there with a lot of complicated software, and mathematics to make it seem that only 'clever' investors can see the value.RichTips said:The objective of my interjection, however, was to ask you to give your opinion of why Bitcoin's price might be trending consistently upwards despite multiple popped bubbles. In essence, if "there is nothing there," why does the Emperor keep buying the clothes following multiple "realisations"? I've (crudely) updated your graph. Do you happen to know how many times the Tulip bubble burst?

I've (crudely) updated your graph. Do you happen to know how many times the Tulip bubble burst? 2

2 -

If a bubble rises to twice its original high three years later, is it still a bubble? You can only judge these things in hindsight.I’m by no means a bitcoin evangelist, but it does seem to be an attractive asset to hold that can’t be devalued by inflated supply.0

-

Not if you bank with HSBC

https://www.thetimes.co.uk/article/bitcoin-holders-barred-from-depositing-profits-in-uk-banks-pgswbfrdz

No one has ever become poor by giving0 -

I have bought a small amount of Bitcoin with HSBC through Mode banking, which went through quite smoothly. I have not tried to withdraw my profits yet, but I have had no issues with small amounts.thegentleway said:Not if you bank with HSBC

https://www.thetimes.co.uk/article/bitcoin-holders-barred-from-depositing-profits-in-uk-banks-pgswbfrdz0 -

I bank with Natwest and have no problems paying into or withdrawing from the exchange I use (Luno). It’s just a simple BACS transaction either way. Takes a few minutes.Any reputable exchange has KYC requirements so the money laundering angle should be a non issue.

It seems a very backward step for banks to ban withdrawals from crypto exchanges. If you want to prevent money laundering, why would you force people to sell their cryptocurrency in private, untraceable transactions rather than on an exchange where KYC details are held?

I could sell my bitcoin on localbitcoins dot com to a stranger who could be a criminal, or I could do it via an above-board exchange. Why would banks prefer me to do the former?1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards