We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

BITCOIN

Comments

-

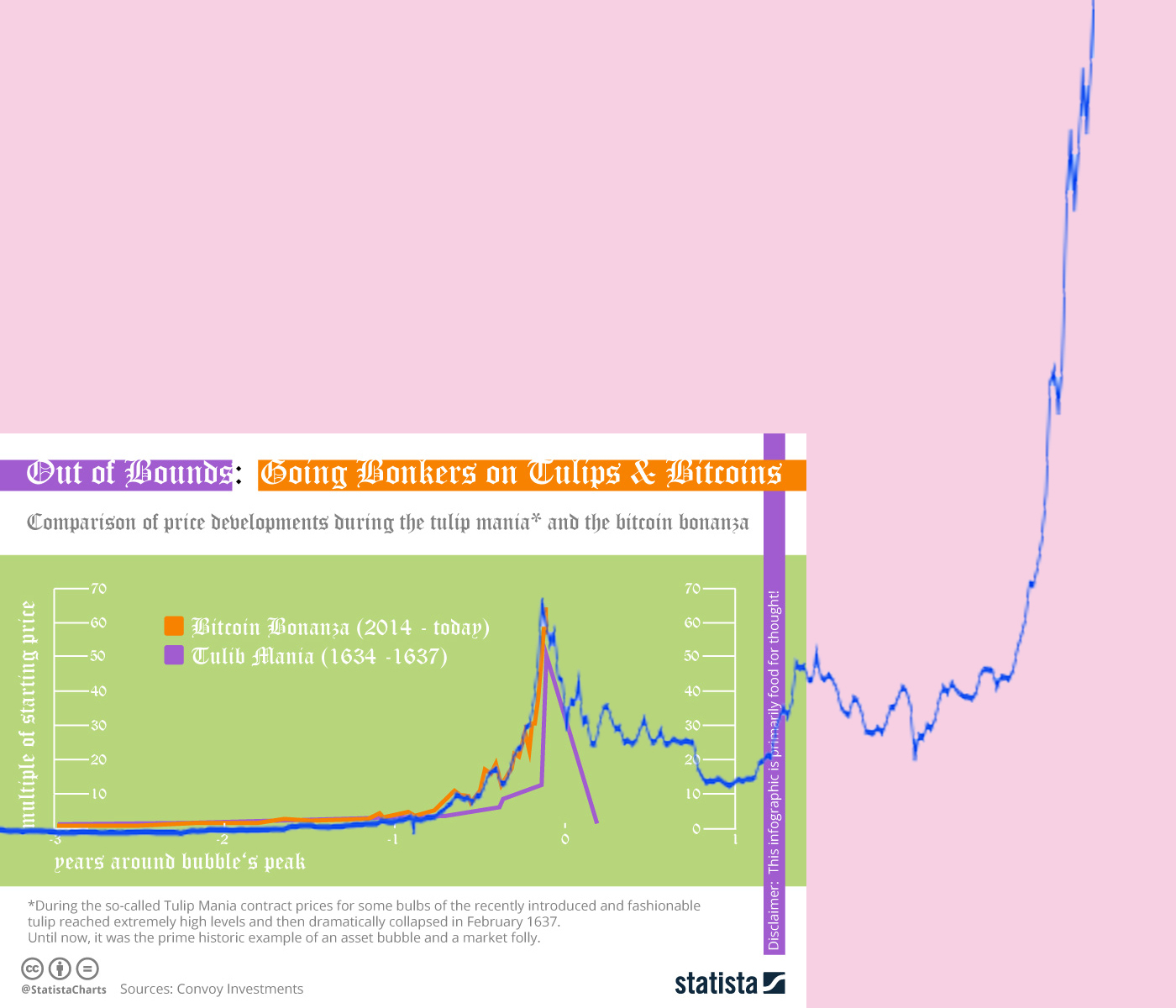

You're not the first person to compare Bitcoin to the Tulip Bubble. In fact, you're in some remarkably inaccurate company if you look to the following (updated) graph:HansOndabush said:darren232002 said:

Looking into it and concluding nah is tantamount to saying you don't get it. People (well, prosperous people) don't look at the internet in its current form and go 'nah, I'll live my life without it.'HansOndabush said:Exactly; most investors here understand bitcoin, blockchain, crypto exchanges etc. We have looked into it and concluded 'nah'.Bitcoin has:1) Failed as a currency to buy goods and services2) At 7 transactions per second is far too slow to be used in everyday transactions3) Consumes a disgraceful amount of energy; more than many countries use4) Is far to volatile to be a 'store of wealth'5) Can be usurped anytime by a 'superior' crypto thus wiping out its price6) Is after all just a number and has no value other than what gamblers assign to it; just like money put on a number on a roulette table.7) All points to it being another bubble just like previous ones where only the 'smart' guys were in it.You can research all the above and conclude they are true statements.

1. Currency =/= Money. Bitcoin is not a currency. It is money though.

2. Bitcoin is not a payment network; it is a settlement layer. Again, sit down and understand the difference between the two.

3. I know every awful technology reporter has loved to roll this story out over the last 3 months, but its just lazy thinking. Firstly, the technology to transfer large amounts of energy over large distances isn't efficient, so producers of renewable energy have an incentive to sell off their excess energy locally at a reduced price. Game theory incentivises participants (miners) to seek out cheap energy given that it affects their bottom line and mining is location independent. The result? Large mining operations exist in a symbiotic way with a local producers of renewable energy and are almost universally located around these (ie. Iceland/China/USA) and 70%+ of their energy is renewable. Secondly, the absolute emissions are considerably lower than the legacy banking system uses, its even considerably less than the amount of emissions used in mining gold. You need to think comparatively, not absolutely.

4. Volatility is not a bug, its an intrinsic feature of a new asset class. Volatility brings traders, traders bring liquidity, liquidity brings stability. Gold didn't just birth in to a $10 trillion dollar low vol asset overnight. By the way, volatility is a mathematical value based on standard deviation; volatility of BTC is less than oil and gold and is approaching the level of US real estate. Its trending down over time. You can wait until the volatility is low when BTC is $1m/coin if you want. Lastly, BTC has the best sharpe ratio (risk adjusted returns) of any asset out there, which is why every hedge fund manager is currently falling over themselves to get BTC on their books.

5. Just no. There are technically superior crypto's already out there, they have been out there for many years, and none of them are close to Bitcoin. Normies who have hot takes like 'blockchain is great technology, but bitcoin will not win' have a fundamental misunderstanding of what makes bitcoin valuable. Money needs a network; BTC has the biggest.

6. This is the 'no intrinsic value' argument and again is just bad normie logic. I'll point out that fiat (£/$) has nothing backing it and therefore no intrinsic value and you'll, ironically and unashamedly, say that it has value because we, the people, all believe it has value...

7. Are the previous bubbles actually bubbles if we are currently at ATHs? Not sure that makes sense.

Any more hot takes there champ?

You can research all the above and conclude they are true statements 1) Bitcoin is clearly not money as it fails the 'Stable' attribute:Bitcoin failed as a currency and is now being pushed as a 'store of value' which it clearly isn't but lets see in 10 years shall we?2) Visa handles 10000 transactions in the same time that bitcoin manages 73) The banking system does something useful unlike bitcoin which is just wasting energy so speculators can gamble4) Gold and silver have been money for thousands of years5) VHS was worse than Betamax but still reigned supreme until it died a death with the invention of video disks6) £/$ used to be backed by gold but now only belief however that belief is reinforced by the fact that you can go to the shop and buy something with it which you can't with bitcoin7) Meanwhile some history for you:

1) Bitcoin is clearly not money as it fails the 'Stable' attribute:Bitcoin failed as a currency and is now being pushed as a 'store of value' which it clearly isn't but lets see in 10 years shall we?2) Visa handles 10000 transactions in the same time that bitcoin manages 73) The banking system does something useful unlike bitcoin which is just wasting energy so speculators can gamble4) Gold and silver have been money for thousands of years5) VHS was worse than Betamax but still reigned supreme until it died a death with the invention of video disks6) £/$ used to be backed by gold but now only belief however that belief is reinforced by the fact that you can go to the shop and buy something with it which you can't with bitcoin7) Meanwhile some history for you:

Compare the different crypto coins to the different tulip bulbs; should be edifying.

0 -

Easy peasy bro, haha.RichTips said:

Seems it only took 3 hours for your "ATH incoming" to be proved correct.Scottex99 said:

Lol, good for you. ATH incoming, I'll come back and @ you at $100k.HansOndabush said:Exactly; most investors here understand bitcoin, blockchain, crypto exchanges etc. We have looked into it and concluded 'nah'.Bitcoin has:1) Failed as a currency to buy goods and services2) At 7 transactions per second is far too slow to be used in everyday transactions3) Consumes a disgraceful amount of energy; more than many countries use4) Is far to volatile to be a 'store of wealth'5) Can be usurped anytime by a 'superior' crypto thus wiping out its price6) Is after all just a number and has no value other than what gamblers assign to it; just like money put on a number on a roulette table.7) All points to it being another bubble just like previous ones where only the 'smart' guys were in it.You can research all the above and conclude they are true statements.

1 - False, I bought something with it earlier this year

2 - Possible but there's thousands of other coins and multiple other chains for that

3- Valid, as far as I know people are using hydro, green, excess flare energy where possible, makes sense to make money from excess energy regardless

4- Nah, if your house price crashes 30% because of the economy does that means nobody should buy houses ever again as an investment?

5 - Actual lol, showing zero understanding here, why hasn't it already happened then?

6 - False, $61k today, determined by the market, scarcity, block rewards, etc etc

7 - Smart or not, irrelevant

HFSP0 -

Written so much better than me, bravo.darren232002 said:

Looking into it and concluding nah is tantamount to saying you don't get it. People (well, prosperous people) don't look at the internet in its current form and go 'nah, I'll live my life without it.'HansOndabush said:Exactly; most investors here understand bitcoin, blockchain, crypto exchanges etc. We have looked into it and concluded 'nah'.Bitcoin has:1) Failed as a currency to buy goods and services2) At 7 transactions per second is far too slow to be used in everyday transactions3) Consumes a disgraceful amount of energy; more than many countries use4) Is far to volatile to be a 'store of wealth'5) Can be usurped anytime by a 'superior' crypto thus wiping out its price6) Is after all just a number and has no value other than what gamblers assign to it; just like money put on a number on a roulette table.7) All points to it being another bubble just like previous ones where only the 'smart' guys were in it.You can research all the above and conclude they are true statements.

1. Currency =/= Money. Bitcoin is not a currency. It is money though.

2. Bitcoin is not a payment network; it is a settlement layer. Again, sit down and understand the difference between the two.

3. I know every awful technology reporter has loved to roll this story out over the last 3 months, but its just lazy thinking. Firstly, the technology to transfer large amounts of energy over large distances isn't efficient, so producers of renewable energy have an incentive to sell off their excess energy locally at a reduced price. Game theory incentivises participants (miners) to seek out cheap energy given that it affects their bottom line and mining is location independent. The result? Large mining operations exist in a symbiotic way with a local producers of renewable energy and are almost universally located around these (ie. Iceland/China/USA) and 70%+ of their energy is renewable. Secondly, the absolute emissions are considerably lower than the legacy banking system uses, its even considerably less than the amount of emissions used in mining gold. You need to think comparatively, not absolutely.

4. Volatility is not a bug, its an intrinsic feature of a new asset class. Volatility brings traders, traders bring liquidity, liquidity brings stability. Gold didn't just birth in to a $10 trillion dollar low vol asset overnight. By the way, volatility is a mathematical value based on standard deviation; volatility of BTC is less than oil and gold and is approaching the level of US real estate. Its trending down over time. You can wait until the volatility is low when BTC is $1m/coin if you want. Lastly, BTC has the best sharpe ratio (risk adjusted returns) of any asset out there, which is why every hedge fund manager is currently falling over themselves to get BTC on their books.

5. Just no. There are technically superior crypto's already out there, they have been out there for many years, and none of them are close to Bitcoin. Normies who have hot takes like 'blockchain is great technology, but bitcoin will not win' have a fundamental misunderstanding of what makes bitcoin valuable. Money needs a network; BTC has the biggest.

6. This is the 'no intrinsic value' argument and again is just bad normie logic. I'll point out that fiat (£/$) has nothing backing it and therefore no intrinsic value and you'll, ironically and unashamedly, say that it has value because we, the people, all believe it has value...

7. Are the previous bubbles actually bubbles if we are currently at ATHs? Not sure that makes sense.

Any more hot takes there champ?

You can research all the above and conclude they are true statements 0

0 -

My guess they generally have no clue what this post even means.YellowStarling said:Genuine question: for those knocking Bitcoin, do they (consciously or not) substitute "cryptocurrency" (as a whole) with it, or not? In other words, are those not in favour of Bitcoin also not in favour of other cryptocurrency projects, or just Bitcoin? I know the title of this thread is specific but some posts appear more aimed at the crypto space in general, hence my question.

Just wondering whether any anti-BTC are more bullish on alternative projects, perhaps those that are aiming for the scalability/TPS targets more akin to fiat monetary systems, or smart contract/app networks, or something else. E.g. Proof-of-Stake projects like Ethereum 2.0, Cardano, Polkadot, or hashgraph projects like Hedera, etc.

They don't know what the different blockchains are or even what POS is. From what I can see hardly any of the pro crypto guys are shilling at all, just giving some info on our experience in the space. I'm gonna retire from it as clearly the boomers don't fancy learning anything, and it's getting boring.

For context, I've traded approx €5m so far this week for my firm. We've got 24 people who love their job and are making a good living. We were 4 guys when I joined two years ago, we'll be on Crowdcube raising 2m at a 55m valuation in summer. See you there.

Oh and see you at $100k BTC in a few months. Peace1 -

YellowStarling said:Genuine question: for those knocking Bitcoin, do they (consciously or not) substitute "cryptocurrency" (as a whole) with it, or not? In other words, are those not in favour of Bitcoin also not in favour of other cryptocurrency projects, or just Bitcoin? I know the title of this thread is specific but some posts appear more aimed at the crypto space in general, hence my question.

Just wondering whether any anti-BTC are more bullish on alternative projects, perhaps those that are aiming for the scalability/TPS targets more akin to fiat monetary systems, or smart contract/app networks, or something else. E.g. Proof-of-Stake projects like Ethereum 2.0, Cardano, Polkadot, or hashgraph projects like Hedera, etc.New systems will always be interesting, but what you have to remember is that when you buy a coin, you are not buying any sort of interest in the technology.When you buy a (fraction of a) Bitcoin, all you are buying is the token that drops out of the crypto machine when you turn the handle. It gives you absolutely no rights to the technology, nor is its value linked in any way to the value of the companies that might in future take the technology forward.A good analogy in this context is someone who decides to invest in the oil industry by buying petrol. Or someone that chooses to invest in Tesla by buying a Model 3. It is very common for people to say that their investment in cryptocurrency is buying them a stake in the technology - but it simply isn't true.I personally don't have any doubt that blockchain and cryptographic techniques will be successfully developed in future. I expect to invest in the companies behind that. I don't expect to be buying the tokens as an investment.3 -

Thanks for the response. But what about projects where the token is used to ‘fuel’ the transactions on the underlying technology? Ie those wanting to use the underlying technology for whatever value they would take from it (e.g. they want to use it to process a transaction, or create a decentralised app, etc) - do they have to ‘use’/spend the technology’s native token to do that? If so, then would holding some of that token be akin to holding an equity interest in the underlying technology? Ie if the demand for the technology exploded to a level where there was a high demand for the token (to be able to use the tech), holding some of that token to be able to sell to those wanting to use the technology could create (growable) value for the holder, similar to holding shares in a company judged to succeed/grow.fwor said:YellowStarling said:Genuine question: for those knocking Bitcoin, do they (consciously or not) substitute "cryptocurrency" (as a whole) with it, or not? In other words, are those not in favour of Bitcoin also not in favour of other cryptocurrency projects, or just Bitcoin? I know the title of this thread is specific but some posts appear more aimed at the crypto space in general, hence my question.

Just wondering whether any anti-BTC are more bullish on alternative projects, perhaps those that are aiming for the scalability/TPS targets more akin to fiat monetary systems, or smart contract/app networks, or something else. E.g. Proof-of-Stake projects like Ethereum 2.0, Cardano, Polkadot, or hashgraph projects like Hedera, etc.New systems will always be interesting, but what you have to remember is that when you buy a coin, you are not buying any sort of interest in the technology.When you buy a (fraction of a) Bitcoin, all you are buying is the token that drops out of the crypto machine when you turn the handle. It gives you absolutely no rights to the technology, nor is its value linked in any way to the value of the companies that might in future take the technology forward.A good analogy in this context is someone who decides to invest in the oil industry by buying petrol. Or someone that chooses to invest in Tesla by buying a Model 3. It is very common for people to say that their investment in cryptocurrency is buying them a stake in the technology - but it simply isn't true.I personally don't have any doubt that blockchain and cryptographic techniques will be successfully developed in future. I expect to invest in the companies behind that. I don't expect to be buying the tokens as an investment.

Or am I mistaken about projects that require certain tokens to be used as the ‘gas’, or fuel as I’ve used here?0 -

Coinbase IPO today btw, holding off on getting it until the initial volatility passes I think but likely will make CB worth more than some banks.

Legooo0 -

YellowStarling said:Genuine question: for those knocking Bitcoin, do they (consciously or not) substitute "cryptocurrency" (as a whole) with it, or not? In other words, are those not in favour of Bitcoin also not in favour of other cryptocurrency projects, or just Bitcoin? I know the title of this thread is specific but some posts appear more aimed at the crypto space in general, hence my question.

Just wondering whether any anti-BTC are more bullish on alternative projects, perhaps those that are aiming for the scalability/TPS targets more akin to fiat monetary systems, or smart contract/app networks, or something else. E.g. Proof-of-Stake projects like Ethereum 2.0, Cardano, Polkadot, or hashgraph projects like Hedera, etc.That's a good question.Bitcoin - Looks like a bubble, floats like a bubble, with a fan club of 'clever' people who know all about crypto and nothing about investing; well then I think it must be a bubble. Will pop sometime for sure.Cryptos in general. Just google sh*tcoins and you will see how many there have been, are, and are being dreamt up all the time. How can you assign a value to any of them?Look, central banks and governments are never going to allow bitcoin or any other independent crypto to become the next world reserve currency; it just will not happen. So forget any idea of bitcoin taking over from the dollar.We already have digital currency in the sense that you just tap your card or type your number into a computer to pay for things. Any extension of that would be controlled by governments where a real crypto-currency would track absolutely everything you do. So they could have negative interest on your account to force you to spend; they would know exactly when currency changes hands and tax you on it, and if you aren't a sociably good person, they can restrict your account - most of which are negative developments in my view. But in and of itself, I have no objection to digital currency in lieu of cash; it's just the big brother part that worries me.Investing in Crypto - if one came out that was fully or fractionally backed by gold, had some practical use, and could be held with FCA regulated institutions then I would be extremely interested. Otherwise you aren't buying into anything other than a number or part of a number on a computer somewhere in cyberspace only useful for criminals or speculators.I don't know if that answers your question?

4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://www.youtube.com/watch?v=TVEoIyLA9IE

https://www.youtube.com/watch?v=TVEoIyLA9IE