We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Assistance with improving my pension fund choices

Comments

-

I'd pick the closest thing they've got to a world tracker and go with that. I'd deal with trying to derisk / rebalance outside of the workplace pension i.e. pay off a bit of mortgage / increase cash savings / set up a SIPP or ISA and put minimal risk assets there / reduce spending / increase savings rate. With the WP make a decision and stick with it - focus on the things that are directly under your day to day control. Your savings rate will have a far bigger impact on your future wealth than the difference between any of the potential portfolios you've suggested.danlightbulb said:Sailtheworld said:There's nothing particularly wrong with your existing portfolio- Its too high in UK equities? (32% UK equities), which has dragged back performance.

- One of my funds has performed 79th out of 83 possible funds for the last five years (returning an average of 3.1% per year).

Given that I didn't get to pick what funds I wanted when the scheme was set up, and that it has a sub-optimal mix, and that alot of the funds available to me have done better (I appreciate that is with the benefit of hindsight but what other data do I have), I can't help but feel I can do better than the default portfolio.

I'm not just cherry picking funds either, to make these comparisons. I've ruled out some of the ones at the very top of the list as they are more risky (eg the gold fund).

I understand you get an NI benefit in the WP but maybe you should ask yourself if it's worth it. For me it would be but you might be different.

0 -

Dan, pick something which doesn't require quarterly rebalancing. That's OTT and will lead to you chasing your tail as random market movements occur. Yearly is sufficient.0

-

Ok I just assumed quarterly was better but I can leave either of these options for a yearly rebalancing. Once I have it set up its a half hour job to populate my spreadsheet and then log in and make a change to the proportions.

I have broadly 3 options that I can see right now:- Stay as I am. UK equities at 32% is high, multi-asset fund hasn't done great.

- Move everything into the Blackrock Consensus Index (@sailtheworld this is the closest i can see to a 'world tracker' as you put it. It has a 70/30 equity/bond split but is still fairly UK heavy at 27%)

- Go for a mix between Blackrock Consensus Index and another ex-UK equity fund, which is just being used to pull down the UK allocation of the first fund).

0 -

What I would do in rebalancing terms is look at your split at end of tax year v what your ideal is and then adjust the split of the next 12 months contributions to get you back in balance by the end of next tax year. That ignores the monthly ups and downs and random movements and provides a simple structure and approach combined with a "drip feed" effect as you slowly increase / lower your exposure to each fund.

Personally I would try and minimise the number of funds which may be difficult given your choices.

Why not go Blackrock plus 2 or 3 others as satellites to tweak your UK Equity exposure and just accept that the manager at Blackrock knows more about Bonds than you do :-)0 -

There's nothing in the Blackrock Consensus Index's mandate that commits it to 27% UK equity, it is a management decision that may change and may have changed in the past (I don't know if you have access to prior fact sheets). Balancing against a potentially moving target could be problematic.

0 -

(1) You've built up a nice pot by doing precisely nothing. UK equities have dragged it down but you didn't know that would happen and you don't know if it will persist. The WP has also been a nice vehicle for collecting free money from the employer contribution and reduction in NI whilst you were busy not worrying about UK exposures.

(2) UK still high from a diversification perspective. Whether that impacts future performance - who knows. A couple of advantages though - it's roughly the equity/bond split you're looking for and, if your risk appetite stays the same, you'll never need to rebalance.

(3) I've got a not dissimilar fund in my WP pension but as I work for a small company I was late to the world of workplace pensions so had built up my own funds in a SIPP already - it allows me to ignore the WP UK bias because I can balance that out elsewhere. I just see the WP as a vehicle to collect the employer contribution. If, like you, I had an incentive to pay more than the bare minimum into the WP I'd probably be more bothered about the UK bias and would probably do this to reduce it. I'd rebalance every couple of years if that.

If I was going to use my WP as my main retirement vehicle I'd go for (3).1 -

I don't know if I can change what funds my ongoing contributions go into, compared to what my existing funds are. I haven't seen that option on the dashboard tool, but I'll have a look. I would still have to make a one off switch now to get the mix roughly in the right place otherwise it would take decades to offset the existing funds. On your other points, I think that's what my option 3 is essentially so its looking like the favourite.AlanP_2 said:What I would do in rebalancing terms is look at your split at end of tax year v what your ideal is and then adjust the split of the next 12 months contributions to get you back in balance by the end of next tax year. That ignores the monthly ups and downs and random movements and provides a simple structure and approach combined with a "drip feed" effect as you slowly increase / lower your exposure to each fund.

Personally I would try and minimise the number of funds which may be difficult given your choices.

Why not go Blackrock plus 2 or 3 others as satellites to tweak your UK Equity exposure and just accept that the manager at Blackrock knows more about Bonds than you do :-)

Hmm no I don't have prior factsheets as far as I can tell. I would have to check the mix occasionally then I guess.coyrls said:There's nothing in the Blackrock Consensus Index's mandate that commits it to 27% UK equity, it is a management decision that may change and may have changed in the past (I don't know if you have access to prior fact sheets). Balancing against a potentially moving target could be problematic.

Thanks. I understand your previous points about maximising other savings etc, and without wanting to make this thread even more complicated, essentially I am not in a great position financially. I was divorced a few years ago and so I don't have my own house, and I pay child maintenance which does have a significant impact on my monthly income. I have another savings pot that is primarily for a house deposit which is currently sitting in premium bonds because I expect this to be utilised in the short term, so I can't invest it. Once I buy a house, I'll then focus on how I can rebuild some savings. In the meantime my pension fund is the only other asset that I have so obviously I want to make it work as best as it can.Sailtheworld said:(1) You've built up a nice pot by doing precisely nothing. UK equities have dragged it down but you didn't know that would happen and you don't know if it will persist. The WP has also been a nice vehicle for collecting free money from the employer contribution and reduction in NI whilst you were busy not worrying about UK exposures.

(2) UK still high from a diversification perspective. Whether that impacts future performance - who knows. A couple of advantages though - it's roughly the equity/bond split you're looking for and, if your risk appetite stays the same, you'll never need to rebalance.

(3) I've got a not dissimilar fund in my WP pension but as I work for a small company I was late to the world of workplace pensions so had built up my own funds in a SIPP already - it allows me to ignore the WP UK bias because I can balance that out elsewhere. I just see the WP as a vehicle to collect the employer contribution. If, like you, I had an incentive to pay more than the bare minimum into the WP I'd probably be more bothered about the UK bias and would probably do this to reduce it. I'd rebalance every couple of years if that.

If I was going to use my WP as my main retirement vehicle I'd go for (3).

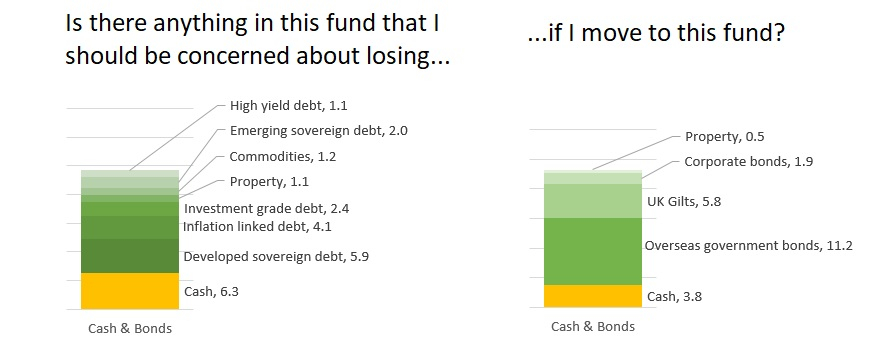

Just in terms of the funds again. If I make the change to the Blackrock Consensus index I will be getting rid of the Blackrock Market Advantage. So is any of the below components worth trying to keep, or does the new fund cover everything just fine:

0 -

The one on the right is likely to be less volatile than the one on the left.

0 -

You wouldn't be changing your funds though.danlightbulb said:

I don't know if I can change what funds my ongoing contributions go into, compared to what my existing funds are. I haven't seen that option on the dashboard tool, but I'll have a look. I would still have to make a one off switch now to get the mix roughly in the right place otherwise it would take decades to offset the existing funds. On your other points, I think that's what my option 3 is essentially so its looking like the favourite.AlanP_2 said:What I would do in rebalancing terms is look at your split at end of tax year v what your ideal is and then adjust the split of the next 12 months contributions to get you back in balance by the end of next tax year. That ignores the monthly ups and downs and random movements and provides a simple structure and approach combined with a "drip feed" effect as you slowly increase / lower your exposure to each fund.

Personally I would try and minimise the number of funds which may be difficult given your choices.

Why not go Blackrock plus 2 or 3 others as satellites to tweak your UK Equity exposure and just accept that the manager at Blackrock knows more about Bonds than you do :-)

If your target is Blackrock - 70%. Fund-A - 10%, Fund B - 10%, Fund C - 10% you make your one off switch to that allocation and then adjust monthly contribution split once every 12 months to keep everything in those proportions. You don't add a random Fund D,1 -

@AlanP_2 sorry yes I got what you meant, didn't explain myself very well. I don't think I have the option to only change where my monthly contributions go.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards