We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Assistance with improving my pension fund choices

Comments

-

Hmm. As you can see my multi-asset fund is a right hodge podge of things. Plus it has cash in it - I'm pretty sure I don't want any cash holdings at this stage in my investment.Albermarle said:Can anyone suggest how I should be looking to configure the bonds side of my portfolio please?Bonds is an whole new area and I would venture to say less well understood by your average DIY investor ( including me but learning )

Hence partly the reason for multi asset funds , so you do not have to get to grips with the complexities of bond markets .

Ive been looking through the bond funds and the best performing ones are just simple UK government index linked gilts. Can you point me to any information on why these have performed so well over the last ten years, as it seems that 8% per year on bonds is rather above what would typically be expected?

If I wanted to keep 30% in bonds, would I just go for 30% UK government bonds or would I have to diversify within the bonds category?0 -

Gilts have performed well over the last decade as interest rates have fallen, so capital values have risen. There's a desire for safety and security and uk debt ticks the box for many, with negative yields now then the likelihood of future capital increase is far lower, indeed if interest rates rise then capital losses are almost guaranteed.0

-

In the short term I think its looking unlikely that UK interest rates will rise. They have created a big problem here, any significant rises in interest rates now will really hurt people mortgaged up to the hilt and they wouldn't want to undermine the property market if they can help it.NottinghamKnight said:Gilts have performed well over the last decade as interest rates have fallen, so capital values have risen. There's a desire for safety and security and uk debt ticks the box for many, with negative yields now then the likelihood of future capital increase is far lower, indeed if interest rates rise then capital losses are almost guaranteed.

However your post reads as if bonds are possibly in a bubble now themselves? In which case, what does one decide to do with the 30% they need to hold in bonds? You seem to be suggesting they are more likely to go down from here, in which case now would be a silly time to move a big chunk of cash into bonds?

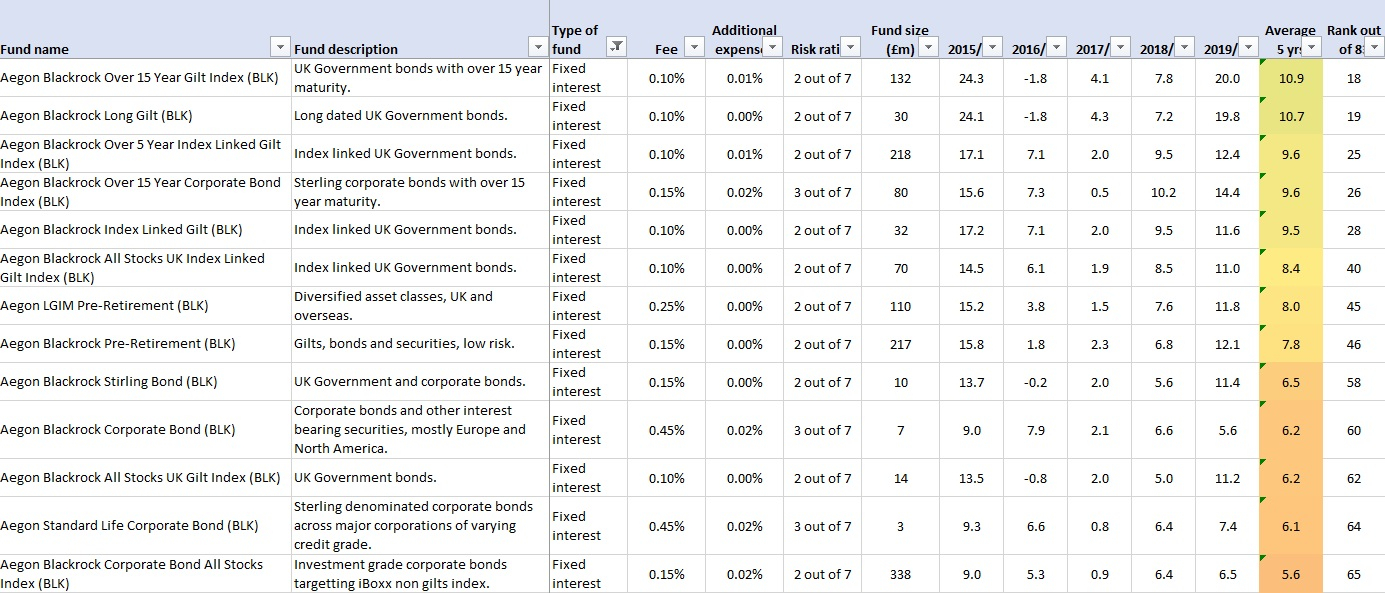

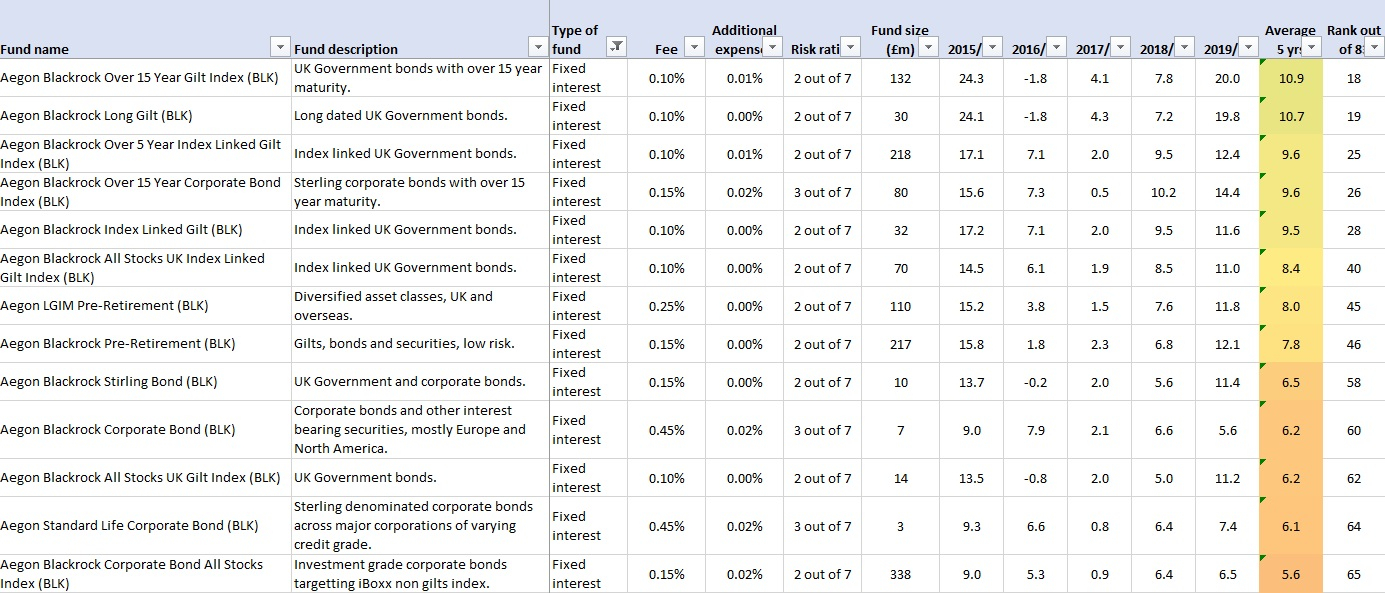

I have 13 bond funds I can choose from, of which 7 are solely UK Government bonds funds. The rest are either corporate bonds or a mix of corporate and government bonds. Here they are:

There is a wide range of performance here. The top ones are returning around 10% per year and are doing better than many equity funds. However many of them have some quite low dips in the middle years, with a couple even showing some negatives. That is quite a variance for something meant to be low risk and stable! Indeed, notice one of the funds is badged as 'pre-retirement'. That particular one hasn't gone negative but its hardly a pre-retirement fund with growth of 8% average over the past five years!?

This makes it difficult to know what to do here. I would have hoped to see the bond funds all at middling performance and steady, consistent. This volatility is concerning especially if we are in a bond bubble.

As you can see, I also don't have many/any options for diversified bond funds. The LGIM pre-retirement fund seems to invest in a mix of government and corporate bonds, 70% UK but also globally. However would it right to invest in a fund meant to be for 'pre-retirement', at this stage?

0 -

You invest in bonds to mitigate risk and reduce inflation eroding your otherwise cash. Looking at the top headlining interest rate is one thing, but it is a 15 year lock in rate. Can you wait that long as it is a pre retirement fund?danlightbulb said:

In the short term I think its looking unlikely that UK interest rates will rise. They have created a big problem here, any significant rises in interest rates now will really hurt people mortgaged up to the hilt and they wouldn't want to undermine the property market if they can help it.NottinghamKnight said:Gilts have performed well over the last decade as interest rates have fallen, so capital values have risen. There's a desire for safety and security and uk debt ticks the box for many, with negative yields now then the likelihood of future capital increase is far lower, indeed if interest rates rise then capital losses are almost guaranteed.

However your post reads as if bonds are possibly in a bubble now themselves? In which case, what does one decide to do with the 30% they need to hold in bonds? You seem to be suggesting they are more likely to go down from here, in which case now would be a silly time to move a big chunk of cash into bonds?

I have 13 bond funds I can choose from, of which 7 are solely UK Government bonds funds. The rest are either corporate bonds or a mix of corporate and government bonds. Here they are:

There is a wide range of performance here. The top ones are returning around 10% per year and are doing better than many equity funds. However many of them have some quite low dips in the middle years, with a couple even showing some negatives. That is quite a variance for something meant to be low risk and stable! Indeed, notice one of the funds is badged as 'pre-retirement'. That particular one hasn't gone negative but its hardly a pre-retirement fund with growth of 8% average over the past five years!?

This makes it difficult to know what to do here. I would have hoped to see the bond funds all at middling performance and steady, consistent. This volatility is concerning especially if we are in a bond bubble.

As you can see, I also don't have many/any options for diversified bond funds. The LGIM pre-retirement fund seems to invest in a mix of government and corporate bonds, 70% UK but also globally. However would it right to invest in a fund meant to be for 'pre-retirement', at this stage?

It isn't always about the high interest rates, but also about suitability for you"It is prudent when shopping for something important, not to limit yourself to Pound land/Estate Agents"

G_M/ Bowlhead99 RIP0 -

Except by choosing the FTSE100 you are just getting a random selection of medium sized global companies.always been the case. It seems that that random selection is now perhaps more balanced than it was six months ago, but if you are that much in favour of random you might as well either throw a dart at the FT. Why have some of your investments chosen almost literally at random ? Better imnsho to pick a global fund (so you get some UK) and a smaller companies fund (so you aren't totally biased towards bigger companies ) . Or a fund* that's not random but is in an area tpyou think is better for the future - health, energy, home working, whatever. But something you picked deliberately rather than from a blind monkey with 20 darts.Prism said:

Yes fair enough. I was being a bit too simplistic to highlight my point. I actually quite like the new look FTSE 100 now that the banks and oil companies have taken a tumble. Its actually quite balanced except for the missing tech. My UK allocation is doing quite nicely for the year - up about 6% so far.Thrugelmir said:Prism said:

AstraZeneca is now the largest stock on the LSE.

So the question is will the big US tech companies continue to grow at a much faster rate than the UK oil companies and banks,danlightbulb said:I was thinking about making the first significant change today - moving 30% from the existing fund to the new fund to get the mix broadly in the right place as discussed above.

Then I looked again at the current performance of the two funds and read some articles. Am I too late to this party? There are strong suggestions that US equities are overvalued at the moment and UK is possibly undervalued (although this isn't so clear).

We've seen massive growth in the US equity funds over the past ten years. If my mix had been right ten years ago, I'd have benefited but is now the right time to be making the change? I know that things can go either way but when indicators are suggesting I could be moving funds at a significant peak, this is a big risk isn't it? But then so is staying where I am now.

I agree with everything said so far in the thread, but the problem is Im now already invested in a fund and moving (even if for the right reasons) could go wrong.* where fund might be fund, IT, ETF etc.2 -

To repeat something I said earlier, if you were in your proposed mix now and had been for some time, would you be debating whether to move some of it to your current crappy investments? I suggest not. So why does the fact you are currently in your crappy investments make any difference?danlightbulb said:I was thinking about making the first significant change today - moving 30% from the existing fund to the new fund to get the mix broadly in the right place as discussed above.

Then I looked again at the current performance of the two funds and read some articles. Am I too late to this party? There are strong suggestions that US equities are overvalued at the moment and UK is possibly undervalued (although this isn't so clear).

We've seen massive growth in the US equity funds over the past ten years. If my mix had been right ten years ago, I'd have benefited but is now the right time to be making the change? I know that things can go either way but when indicators are suggesting I could be moving funds at a significant peak, this is a big risk isn't it? But then so is staying where I am now.

I agree with everything said so far in the thread, but the problem is Im now already invested in a fund and moving (even if for the right reasons) could go wrong.FWIW you look back 1,2 5 years and find articles talking about how the US is overvalued. And if you are in a global fund, then if/as/when the US declines that will be catered for by other investments in that global fund growing as the US decline.If you are so set on deciding what your geographic allocations should be then pick geographic funds, though that approach is I suggest now very old fashioned because you should be doing sector allocation not geographic because most businesses are global these days. Is Samsung a South Korean company Ora global one? Is. Apple US or global? Tesla? Is Unilever british? A year ago it could have become Dutch overnight.1 -

OP be decisive and not be a hot potato on your investments. Stick to your investment strategy. If your still not sure after doing your research/reading, stick it into a cheap global index tracker. HSBC, VG, e.t.c your choice.

We all have different objectives and funds we invest, find what you want, not what others have

"It is prudent when shopping for something important, not to limit yourself to Pound land/Estate Agents"

G_M/ Bowlhead99 RIP0 -

@AnotherJoe i have looked at the sector split within the funds im looking at using. I am limited what funds I can choose from so using another geographical split fund seems to be the only way to lower my UK allocation.

@csgohan4 are you saying if I buy those bond funds I have to stay locked in for 15 years? It doesnt say that anywhere in the information.

Guys I have limited fund choices - could really do with some more discussion on bonds side of things as i have an ok plan on the equities now.0 -

Hi, thats what im trying to do. Ive got a plan for the equities now but i cant implement it until I figure out the bonds, because my existing funds are all tied together.csgohan4 said:OP be decisive and not be a hot potato on your investments. Stick to your investment strategy. If your still not sure after doing your research/reading, stick it into a cheap global index tracker. HSBC, VG, e.t.c your choice.

We all have different objectives and funds we invest, find what you want, not what others have

I have to stick to the set of funds available to me in my pension scheme.0 -

danlightbulb said:@AnotherJoe i have looked at the sector split within the funds im looking at using. I am limited what funds I can choose from so using another geographical split fund seems to be the only way to lower my UK allocation.Or just pick a big gobal fund (the sharia one) and have it done by default. Or does the sharia come bundled with some other garbage? I forget now....@csgohan4 are you saying if I buy those bond funds I have to stay locked in for 15 years? It doesnt say that anywhere in the information.

No they re saying (pardon me csg if im wrong) that a lot of your money will be invested for at least 15 years so why would you tie such a large amount of it in bonds for that time when it shoudl be in equities.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards