We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

TSB launches new 'Spend and Save' current account

Comments

-

alandaniel132 said:What does "quirkydeptless said:It was easiest to repeat the same value and 30x£1 was a convenient total toward my monthly bill.I do pay by DD, but the amount can be adjusted." mean?I was answering two seperate questions which might make more sense like...Yorkshire_Pud said:their screens etc!

Do you make 1p type payments or bigger ones to pay off the monthly bill?"It was easiest to repeat the same value and 30x£1 was a convenient total toward my monthly bill."

"I do pay by DD, but the amount can be adjusted."Yorkshire_Pud said:I’m assuming if you pay by direct debit they adjust the next DD accordingly?I normally pay my utility bill by DD. So making additonal payments manually by using my TSB Debit card to satisfy the 30 transaction condition just means £30 is paid off towards the bill and the DD will be less.It also means constructing replies with multiple quotes is a PITA I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.

I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."0 -

I decided on 30x deposits to NS&I DS to see if that satisfies for the November reward. It would be great if they had a reward tracker in the same way Halifax does.

"I do pay by DD, but the amount can be adjusted."Yorkshire_Pud said:I’m assuming if you pay by direct debit they adjust the next DD accordingly?I normally pay my utility bill by DD. So making additonal payments manually by using my TSB Debit card to satisfy the 30 transaction condition just means £30 is paid off towards the bill and the DD will be less.It also means constructing replies with multiple quotes is a PITA I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.

I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.

0 -

I can't see why it wouldn't count. Only another 40 days or so before you will know for sure. That is, if they keep their promise and pay by the 20th of the next month.ischris85 said:

I decided on 30x deposits to NS&I DS to see if that satisfies for the November reward. It would be great if they had a reward tracker in the same way Halifax does.

"I do pay by DD, but the amount can be adjusted."Yorkshire_Pud said:I’m assuming if you pay by direct debit they adjust the next DD accordingly?I normally pay my utility bill by DD. So making additonal payments manually by using my TSB Debit card to satisfy the 30 transaction condition just means £30 is paid off towards the bill and the DD will be less.It also means constructing replies with multiple quotes is a PITA I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.1

I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.1 -

Stand to be corrected but I thought it was clear that funding payments to you or another person don’t count? Only bill payments, goods and services etc. Unless you did it from with ns&i a la Halifax but that’s just once not having to do it 30 times!ischris85 said:

I decided on 30x deposits to NS&I DS to see if that satisfies for the November reward. It would be great if they had a reward tracker in the same way Halifax does.

"I do pay by DD, but the amount can be adjusted."Yorkshire_Pud said:I’m assuming if you pay by direct debit they adjust the next DD accordingly?I normally pay my utility bill by DD. So making additonal payments manually by using my TSB Debit card to satisfy the 30 transaction condition just means £30 is paid off towards the bill and the DD will be less.It also means constructing replies with multiple quotes is a PITA I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.1

I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.1 -

Thanks, just checked the t&c's which indicates that cashback is paid on debit card payments for goods and services. I'll therefore need to forget NSI and make small debit card payments towards my utilities or credit cards bill instead.Yorkshire_Pud said:

Stand to be corrected but I thought it was clear that funding payments to you or another person don’t count? Only bill payments, goods and services etc. Unless you did it from with ns&i a large Halifax but that’s just once not 30 times for Chris sake!ischris85 said:

I decided on 30x deposits to NS&I DS to see if that satisfies for the November reward. It would be great if they had a reward tracker in the same way Halifax does.

"I do pay by DD, but the amount can be adjusted."Yorkshire_Pud said:I’m assuming if you pay by direct debit they adjust the next DD accordingly?I normally pay my utility bill by DD. So making additonal payments manually by using my TSB Debit card to satisfy the 30 transaction condition just means £30 is paid off towards the bill and the DD will be less.It also means constructing replies with multiple quotes is a PITA I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.0

I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.0 -

pphillips said:

Thanks, just checked the t&c's which indicates that cashback is paid on debit card payments for goods and services. I'll therefore need to forget NSI and make small debit card payments towards my utilities or credit cards bill instead.Yorkshire_Pud said:

Stand to be corrected but I thought it was clear that funding payments to you or another person don’t count? Only bill payments, goods and services etc. Unless you did it from with ns&i a large Halifax but that’s just once not 30 times for Chris sake!ischris85 said:

I decided on 30x deposits to NS&I DS to see if that satisfies for the November reward. It would be great if they had a reward tracker in the same way Halifax does.

"I do pay by DD, but the amount can be adjusted."Yorkshire_Pud said:I’m assuming if you pay by direct debit they adjust the next DD accordingly?I normally pay my utility bill by DD. So making additonal payments manually by using my TSB Debit card to satisfy the 30 transaction condition just means £30 is paid off towards the bill and the DD will be less.It also means constructing replies with multiple quotes is a PITA I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.Spend & Save – you must make 30 or more payments using your debit card each calendar month to earn £5 cashback. You can earn cashback for the first six calendar months, which includes the month your Spend & Save account is opened.

I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.Spend & Save – you must make 30 or more payments using your debit card each calendar month to earn £5 cashback. You can earn cashback for the first six calendar months, which includes the month your Spend & Save account is opened.

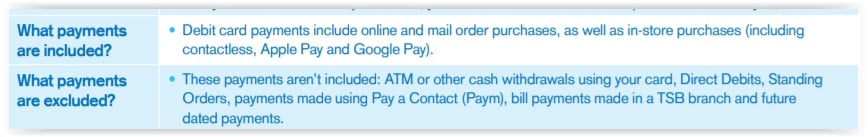

Debit card payments include online and mail order purchases, as well as in-store purchases (including contactless, Apple Pay and Google Pay).Interesting - if NS&I payments are exempt from cashback then in the same logic surely a credit card bill payment also would be since neither is for an online order.

1 -

Leaving aside whether such payments would be ridiculous or not, where does it say indicate that online transactions to NS&I would be excluded.?pphillips said:

Thanks, just checked the t&c's which indicates that cashback is paid on debit card payments for goods and services. I'll therefore need to forget NSI and make small debit card payments towards my utilities or credit cards bill instead.Yorkshire_Pud said:

Stand to be corrected but I thought it was clear that funding payments to you or another person don’t count? Only bill payments, goods and services etc. Unless you did it from with ns&i a large Halifax but that’s just once not 30 times for Chris sake!ischris85 said:

I decided on 30x deposits to NS&I DS to see if that satisfies for the November reward. It would be great if they had a reward tracker in the same way Halifax does.

"I do pay by DD, but the amount can be adjusted."Yorkshire_Pud said:I’m assuming if you pay by direct debit they adjust the next DD accordingly?I normally pay my utility bill by DD. So making additonal payments manually by using my TSB Debit card to satisfy the 30 transaction condition just means £30 is paid off towards the bill and the DD will be less.It also means constructing replies with multiple quotes is a PITA I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.

I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.

2 -

So I'm now hired as a professional debit card transaction generator by TSB.I'm on a zero-hour contract, but I expect to only work about 10 minutes a month, for which they pay me £5

Better than my job at the Co-Op where they only pay me £1.50

Better than my job at the Co-Op where they only pay me £1.50

Retired 1st July 2021.

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."7 -

I would be surprised if TSB still existed in two years time. Sabadell will have probably sold it to another bank, with Virgin Money being a likely buyer.Yorkshire_Pud said:So you can keep the plus in the hope it might start offering interest again ‘in about two years’ if things pick up. Or change a Plus to a standard S+S account with six months eligibility for cashback. So no going back if you change.

If TSB are still around by then, I can't see them reintroducing interest on the Classic Plus account as it's a withdrawn brand, and they've already got those account holders as customers. They are far more likely to launch a brand new account for "new customers only", in order to attract new business.1 -

I was trying to do multiple faster payments to my credit card and tsb kept blocking me after one payment and a message said in order to stop you making the same payment twice you need to wait an hour. Adjusted the amount but still the same message. Talked to tsb and he assured me that the credit card ‘bill ‘ faster payments DONT count! So maybe it has to be back to utilities although that’s still a faster payment of a bill as are many transactions buying goods and services online!? Thought paying a credit card debt was ‘purchasing credit’?ischris85 said:pphillips said:

Thanks, just checked the t&c's which indicates that cashback is paid on debit card payments for goods and services. I'll therefore need to forget NSI and make small debit card payments towards my utilities or credit cards bill instead.Yorkshire_Pud said:

Stand to be corrected but I thought it was clear that funding payments to you or another person don’t count? Only bill payments, goods and services etc. Unless you did it from with ns&i a large Halifax but that’s just once not 30 times for Chris sake!ischris85 said:

I decided on 30x deposits to NS&I DS to see if that satisfies for the November reward. It would be great if they had a reward tracker in the same way Halifax does.

"I do pay by DD, but the amount can be adjusted."Yorkshire_Pud said:I’m assuming if you pay by direct debit they adjust the next DD accordingly?I normally pay my utility bill by DD. So making additonal payments manually by using my TSB Debit card to satisfy the 30 transaction condition just means £30 is paid off towards the bill and the DD will be less.It also means constructing replies with multiple quotes is a PITA I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.Spend & Save – you must make 30 or more payments using your debit card each calendar month to earn £5 cashback. You can earn cashback for the first six calendar months, which includes the month your Spend & Save account is opened.

I wanted a method that was quick and easy to repeat multiple times, and with saved card details I could do each transaction with a few mouse clicks. There was also only one "verified by visa" check (on the first transaction) and no intervention by fraud teams.Spend & Save – you must make 30 or more payments using your debit card each calendar month to earn £5 cashback. You can earn cashback for the first six calendar months, which includes the month your Spend & Save account is opened.

Debit card payments include online and mail order purchases, as well as in-store purchases (including contactless, Apple Pay and Google Pay).Interesting - if NS&I payments are exempt from cashback then in the same logic surely a credit card bill payment also would be since neither is for an online order.

Two sure fire ways to qualify are using at the shops and using the debit card within say ns&i a la Halifax reward.

No ones received the £5 yet so won’t know until around 20th November what works and what doesn’t.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards