We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Advice on Mortgage Decline and Appeal.

Options

Comments

-

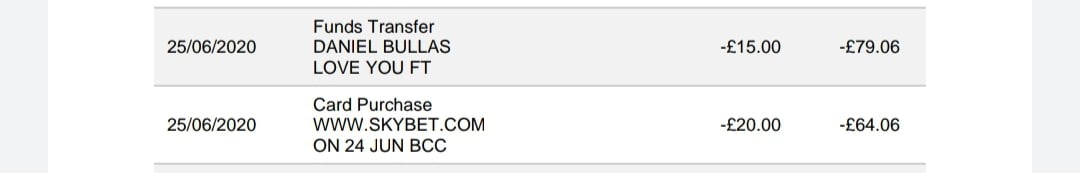

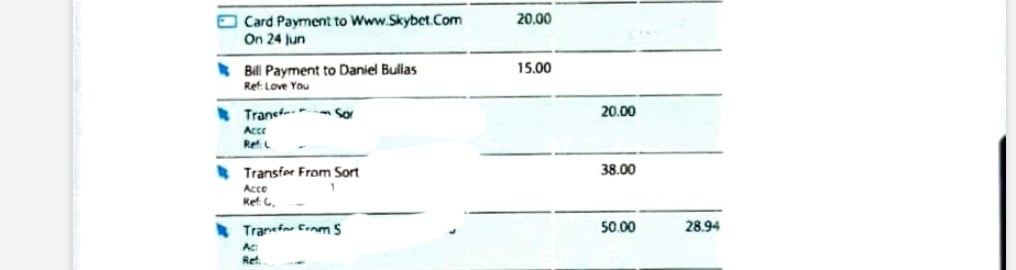

Just to offer a bit more information, here's the difference between online transactions versus bank statement.. As you can see the first picture does look like my account goes overdrawn, but officially on the bank statement it clearly doesn't.1 -

I’m not sure why betting shops are a thing these days at all? Why go into a shop when you can gamble on your phone?Comms69 said:

The transactions can appear at odd times, but the balance is always accurate.Stenwold said:

It's not uncommon for transactions to appear in online services at different times to the transaction dates/times, so the OP may not have gone overdrawn at any point.Comms69 said:Im not sure on what basis you're appealing tbh. You will have gone overdrawn at some point, even if it's for a few hours.

They arent obliged to lend to you, either you're desperate to borrow and then you shouldn't - especially if you work in a bookies. Or another lender will lend you the money.

Sorry

Not sure why someone who is trying to move house shouldn't just because they are desperate to? And what does working in a bookies have to do with anything?

Sounds like there is good grounds for appeal, especially if you've got the original statements to prove your case - I'd be surprised if your broker doesn't get the decision overturned.

Good luck

Bookies are currently closing left right and centre, so job insecurity would be my concernShops used to make money on the gambling machines, but that’s been curtailed.No reliance should be placed on the above! Absolutely none, do you hear?0 -

Ah right, that makes sense. As it stands my job is secure but I can see your reasoning.Comms69 said:

Only because of the current job insecurity is all i meantSammie1987 said:

We would like to borrow Yes because we have found the house we want, not sure why I shouldn't get a mortgage because I work in a bookies, any reason for that?Comms69 said:Im not sure on what basis you're appealing tbh. You will have gone overdrawn at some point, even if it's for a few hours.

They arent obliged to lend to you, either you're desperate to borrow and then you shouldn't - especially if you work in a bookies. Or another lender will lend you the money.

Sorry1 -

Agreed, we use to make a lot more money prior to the change of stake on machines, online gambling is taking over massively, but we still have a lot of old fashioned betters that like to come in to shops and bet on their horses with a human haha, fortunately as it keeps me employed.Shops used to make money on the gambling machines, but that’s been ccurtailed.2 -

Would you give yourself a loan based on that information?

It looks like you're living paycheck to paycheck, and with hardly any money left in the bank account you spent £20 on gambling.

I'm sure if the overall account balance was £10,000 a £20 bet would be negligible and treated in that way.

Maybe you have other savings but fact is at the moment the banks can pick and choose who they want to lend to.1 -

I see your reasoning here, I get money paid into my account weekly and tend to make sure I pay off extra on balances when I'm due another payment.numbercruncher8 said:Would you give yourself a loan based on that information?

It looks like you're living paycheck to paycheck, and with hardly any money left in the bank account you spent £20 on gambling.

I'm sure if the overall account balance was £10,000 a £20 bet would be negligible and treated in that way.

Maybe you have other savings but fact is at the moment the banks can pick and choose who they want to lend to.0 -

The fact you are going so close to the wire on your monthly salary is probably working against you when a real person looks at it as opposed to 'computer he say yes', maybe it would help if you could point out regular savings from that account? If I was looking at that I'd be assuming you are transferring money in to fund/cover a gambling habit. If 6 months statements show that as a regular transfer i.e. money out to savings then some transferred back in to keep the balance up and there are a number of gambling transactions on there, then at the least it would be ringing a few alarm bells.I'm amazed that anyone working in a bookies gambles, seeing what they must see virtually every day. My dad used to say "You never see a poor bookie", there's a reason for that. I've known exactly one person make OK money from gambling and he used to be a stable boy for 10 years in a couple of racing stables near us and kept up his contacts.2

-

To add, you work in a bookies, which is fine.Your gambling is with Sky Bet, which don't have bookies, so working in the bookies and your gambling are not the same. They aren't related.The banks probably seeing that you are transferring money from another account, to fund the bets you are making. So you could appear to be right on the wire or gambling beyond your means. Both may be totally untrue but it is very easy to look at your statements and assume that. If your balance was going up £200 a month over the 6 months but you also gambled £50 a month, then it wouldn't be seen as the issue. As it shows you can save money while still gambling responsibility.1

-

Thank you all, on the whole the balance looks low but generally I use spare money to pay towards any balances before my next payment or transfer most to help to buy isa to help towards deposit and solicitors fees etc but that said can understand everyone's reasoning and views.0

-

The problems in reality are this: you're current account, whether technically going overdrawn or not is not showing you to have a lot of spare cash - and in fact shows you are living 'on the edge'. I would bet if you have a savings account and show them this with sufficient funding most of these problems go away. But I know Santander will ask questions like 'how are you paying for fees, what debts do you have an are these covered in assets...' so it might be a case of just proving to them you have sufficient cash resource to finance your move and a suitable buffer. I would reapply elsewhere but before you do ensure your current account has a buffer in it and show your savings. Lenders usually want to see someone with appropriate finances which means usually that their deposit won't completely clear them out - and make sure you don't have any credit card or other debt (other than arranged finance deals) that you can't pay off - Santander for example once asked us to prove we could pay our 0% credit card off (and pay deposit etc). I don''t think a few small bets matter here or there, but if half your transactions are betting - I'd think about stopping them.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599.2K Mortgages, Homes & Bills

- 177K Life & Family

- 257.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards