We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Suggestions for a speculative punt?

Comments

-

There may be some psychological comfort in the maxims "Never sell at a loss" and "Never buy at an all time high" but they have no logical basis and potentially will cause harm. Easily demonstrated. The price at which you buy an investment has no bearing on its price after you sell it.4

-

I was more broadly referring to shares for the loss. You advise seems to be buy low, sell high, which sounds like it will obviously work, but in reality, it's about as useful as saying only back winning horses and you can't fail. We can all list individuals shares and use hindsight to make a point - for example LLOYDS can be used as a brilliant example of when you should sell at a loss. If you're buying individual shares, you should be looking at the fundamentals of the company, not historic share prices. Sell if you think there's a better stock to own.adindas said:underground99 said:Never buy at all time high, however good the stock is.

Nonsense. There are all kinds of stocks which have been worth buying at their all time highs and a lot of funds spend most of their time within 10% of their highs. SMT was at an all time high of 674p on 6 May last year. By your logic nobody should have bought it then. But it hasn't closed a day at a lower price since, and is now over 1100p.

If you bought NIO at the end of June last year for about $7.50, you'd have been buying at all all time high. It was a good move as it has never been lower since and is 5x that price at the moment.kinger101 said:That's terrible advice. On average, the direction of the stop market is upwards. Hence a lot of stocks or funds will be at all time highs a lot of the time. Particular small cap stocks and growth funds.

As for selling at a loss, why hold onto something in a downward spiral?What Nonsense / What terrible. Does commnon sense apply here ??

Which one you prefer: to buy now or to buy back in November - February 2020 ?? . Did you buy it during that time ? If you bought during that time you would not say that.

I really sorry those who bought during that time.

This is what happen you believe to people who apply the principles blindly. They will keep telling you the time to plant a tree is now. Buy at any time even if you see the knife is falling. They are a lot of these sort of people here on MSE. Those who blidly follow this principles have lost a lot of opportunities.

Also, you will need to differentiate if you are buying an index fund and an individual share. Plant a tree is now might only be applicable to a well-diversified index fund and you do not have tme to observe the market but not to individual stock, let alone a specuative stock .

I have index fund which I never sold but I will only add my position when I see a market dip, market correction, market crash not to buy blindly even at all time high like many MSEr here have advised in the past. "They will keep telling you the time to plant a tree is now" I remember keep reading this pharse many times.here on MSE

I agree it is very difficult to time the market. But in Investment world there is always be a market correction, market rotation, price dip due to non fudamental issue sometimes a few times a year where you could start your position or keep adding up your positions during that period. Those who do not know those cycle/pattern, who can not see that the knife is falling should either blind or should seek a financial advise.

You buy/add a good stock when there is dip sell it back a small part of it at all time high and keep adding your position when there is a dip due to non fundamental issue.

kinger101 said:As for selling at a loss, why hold onto something in a downward spiral?FAANG. Microsoft stocks have been going spiral many times due to non-fundamental issue. are you advising people to sell at loss for these stocks?

You will only be selling it at loss of there is a fundamental change in business, such as fraud about to go bankrupt. If it is just about market correction, market rotation you do not sell it. If you believe in selling it at loss, supposed you or other people own SMT why do not you sell now ??

Even you are talking about index fund they will also be affected by marker rotation, market correction.

As for timing, whether shares or funds, on average buying sooner is better. You say there are stock market cycles. While it is inevitable there will be a stock market crash, there isn't any fixed periodicity to the stock market cycle. Or reliable way of knowing when the market has bottomed out. Who'd have predicted the market response to Covid?

"Real knowledge is to know the extent of one's ignorance" - Confucius1 -

Lol, If I hadn't been so stupid as to avoid buying SMT because it was at an all time high, I'd be up £8/share by now!

1

1 -

Apodemus said:Lol, If I hadn't been so stupid as to avoid buying SMT because it was at an all time high, I'd be up £8/share by now!

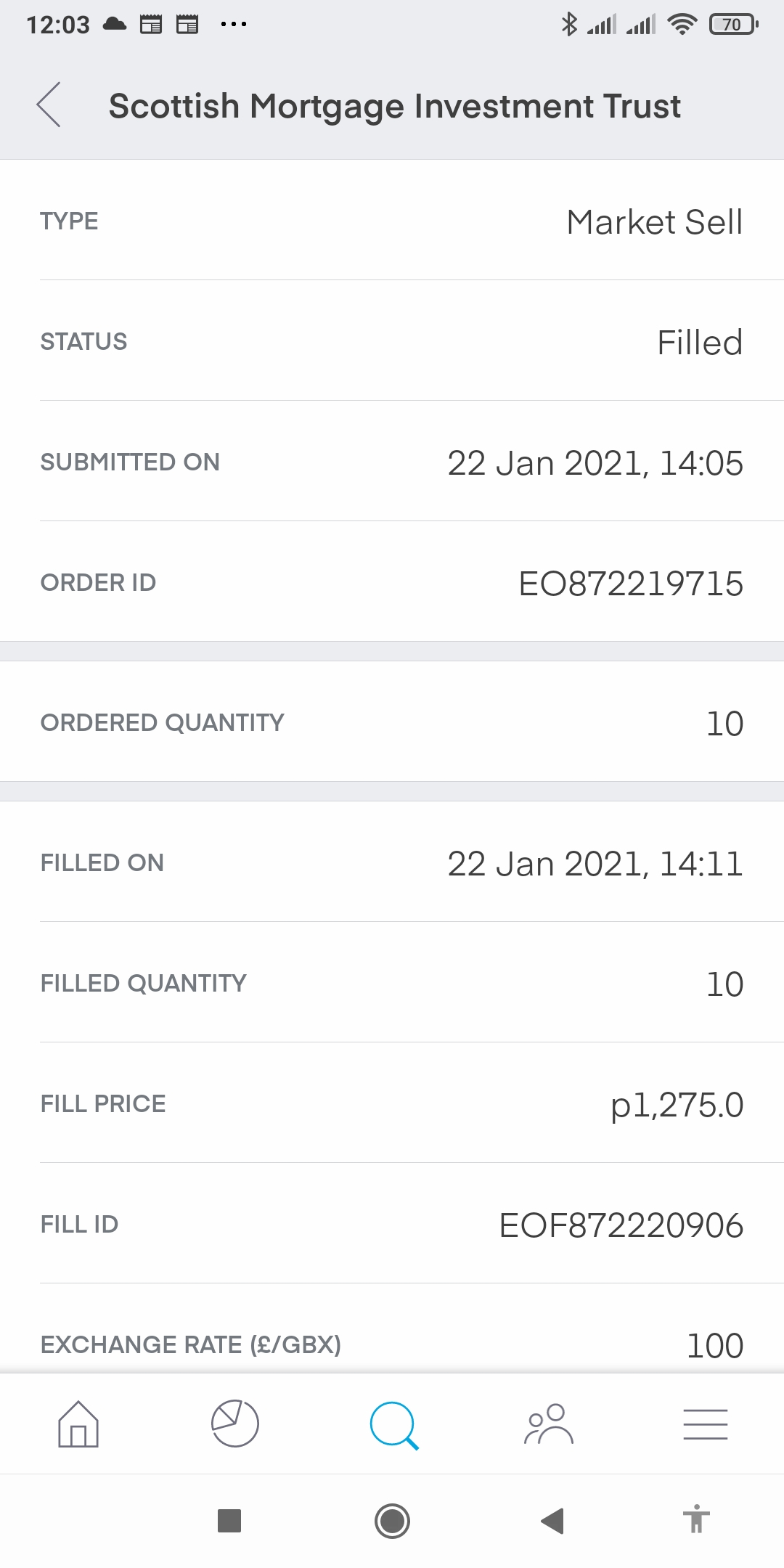

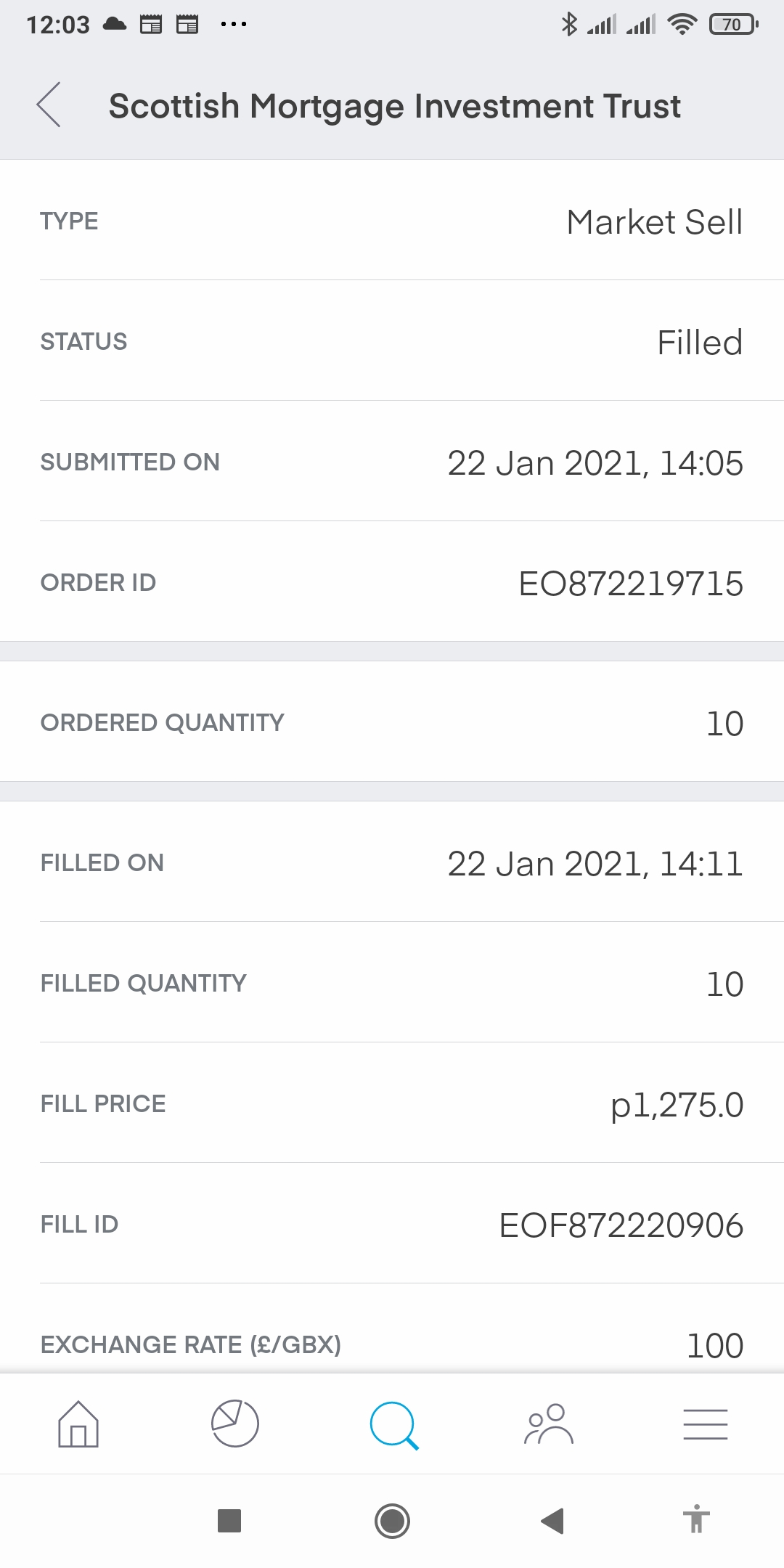

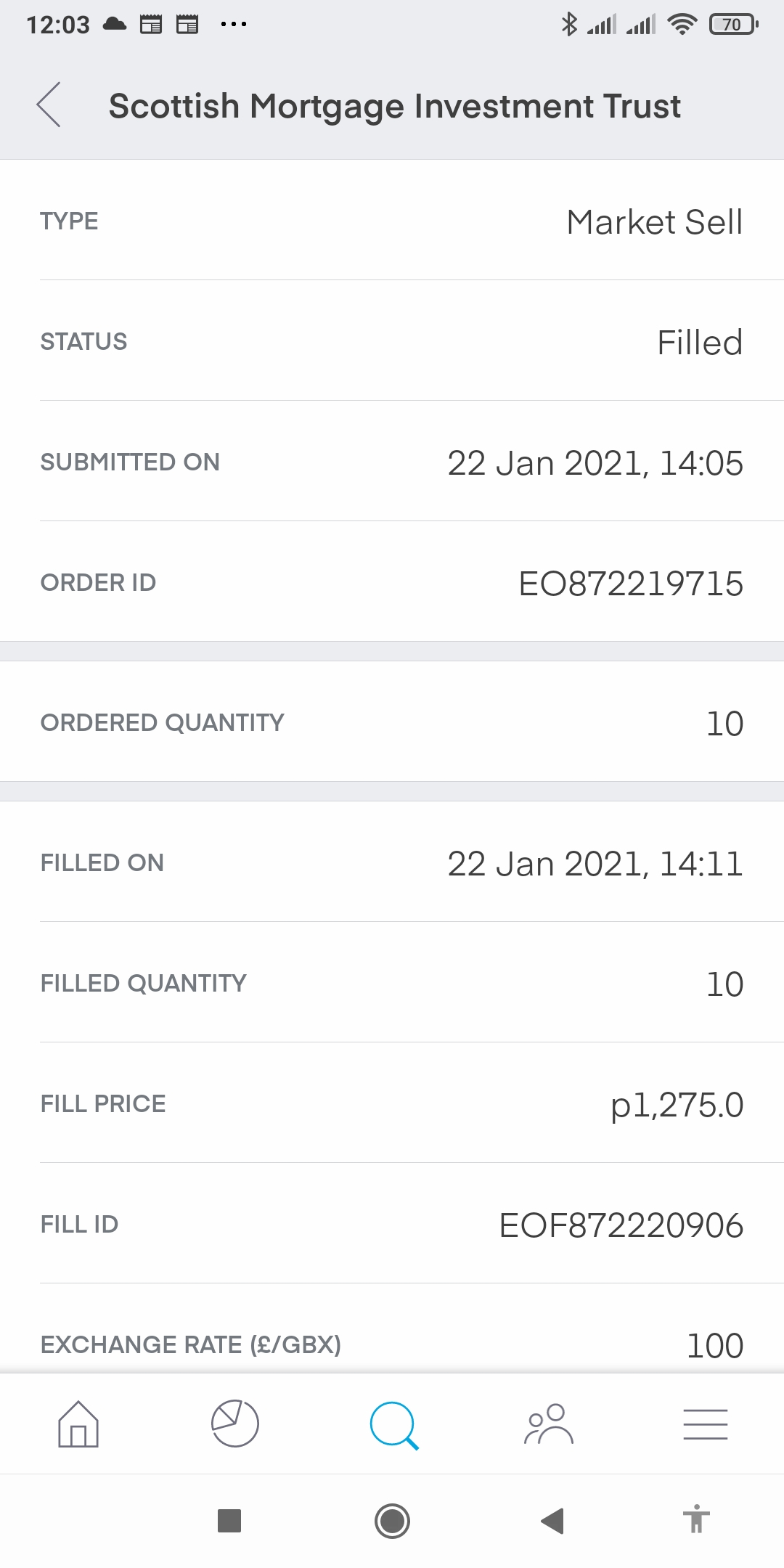

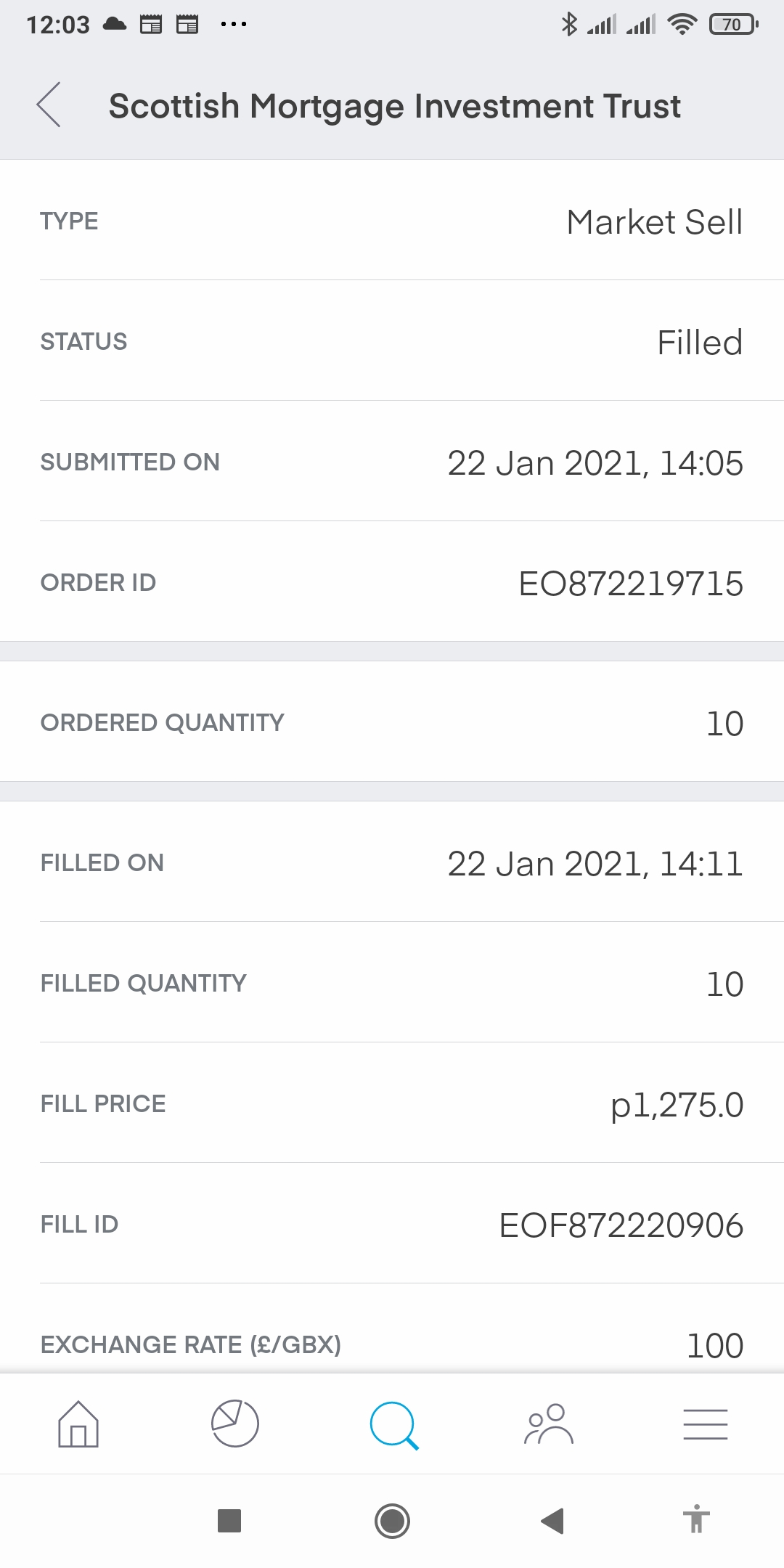

I sold my SMT at GBX 1275 and If I want, I could buy SMT @ GBX1089 now as everyone could see it is now a market correction. It does not need a sophisticated technical skill to understand when the market is in correction / crash mode or rotation for certain sectors

Also what about opportunity cost that you would have used that profit you make buying the dip and sell high for another good stock on making the dip. Now you could go back to SMT ? which one produce a better result ?? You keep doing the same thing over and over again. But do not complain if you keep getting the same result as this famous guy said

You keep doing the same thing over and over again. But do not complain if you keep getting the same result as this famous guy said

“if you want to plant a tree the best time is now”. You read this phrase many times on this MSE and people just repeating it, apply this princile blindly without using a common sense. This principle might be highly relevant to a very well-diversified index fund and people who do not have time to observe the market but might not be relevant to individual stock, let alone a speculative stock.

I agree it is very difficult to time the market. But unless you are blind you could always see when there is a market correction, market rotation, siginifcant price dip

It is difficult to get the very bottom, but you could always use DCA Dollar Cost Avareging. e.g buy at a smaller chunk during the dip rather than in one go. You could exploit this option if you are using a fee free platform not a plarform which will charge you £15 per deal.

0 -

Am I missing something here, or did you really just own 10 SMT shares?adindas said:Apodemus said:Lol, If I hadn't been so stupid as to avoid buying SMT because it was at an all time high, I'd be up £8/share by now!

I sold my SMT at GBX 1275 and If I want, I could buy SMT @ GBX1089 now as everyone could see it is now a market correction. It does not need a sophisticated technical skill to understand when the market is in correction / crash mode or rotation for certain sectors

Also what about opportunity cost that you would have used that profit you make buying the dip and sell high for another good stock on making the dip. Now you could go back to SMT ? which one produce a better result ?? You keep doing the same thing over and over again. But do not complain if you keep getting the same result as this famous guy said

You keep doing the same thing over and over again. But do not complain if you keep getting the same result as this famous guy said

“if you want to plant a tree the best time is now”. You read this phrase many times on this MSE and people just repeating it, apply this princile blindly without using a common sense. This principle might be highly relevant to a very well-diversified index fund and people who do not have time to observe the market but might not be relevant to individual stock, let alone a speculative stock.

I agree it is very difficult to time the market. But unless you are blind you could always see when there is a market correction, market rotation, siginifcant price dip

It is difficult to get the very bottom, but you could always use DCA Dollar Cost Avareging. e.g buy at a smaller chunk during the dip rather than in one go. You could exploit this option if you are using a fee free platform not a plarform which will charge you £15 per deal.

"Real knowledge is to know the extent of one's ignorance" - Confucius1 -

See my previous post the way I trade.kinger101 said:

Am I missing something here, or did you really just own 10 SMT shares?adindas said:Apodemus said:Lol, If I hadn't been so stupid as to avoid buying SMT because it was at an all time high, I'd be up £8/share by now!

I sold my SMT at GBX 1275 and If I want, I could buy SMT @ GBX1089 now as everyone could see it is now a market correction. It does not need a sophisticated technical skill to understand when the market is in correction / crash mode or rotation for certain sectors

Also what about opportunity cost that you would have used that profit you make buying the dip and sell high for another good stock on making the dip. Now you could go back to SMT ? which one produce a better result ?? You keep doing the same thing over and over again. But do not complain if you keep getting the same result as this famous guy said

You keep doing the same thing over and over again. But do not complain if you keep getting the same result as this famous guy said

“if you want to plant a tree the best time is now”. You read this phrase many times on this MSE and people just repeating it, apply this princile blindly without using a common sense. This principle might be highly relevant to a very well-diversified index fund and people who do not have time to observe the market but might not be relevant to individual stock, let alone a speculative stock.

I agree it is very difficult to time the market. But unless you are blind you could always see when there is a market correction, market rotation, siginifcant price dip

It is difficult to get the very bottom, but you could always use DCA Dollar Cost Avareging. e.g buy at a smaller chunk during the dip rather than in one go. You could exploit this option if you are using a fee free platform not a plarform which will charge you £15 per deal.

0 -

Based on previous posts on the thread, they just use a zero fee broker to buy or sell £50-£100 of stock in a company a time and then if it really takes off and multibags in a matter of months they can make a couple of hundred quid. All while putting hours into the 'due diligence', and dodging the market rotation, catching the dips, etc etc. It seems like a lot of work for little reward, but one man's chump change is another's fortune. It can be quite a cheap hobby if you have lots of time to kill and the small deal sizes means you are not going to lose much if you call it wrong.kinger101 said:

Am I missing something here, or did you really just own 10 SMT shares?adindas said:Apodemus said:Lol, If I hadn't been so stupid as to avoid buying SMT because it was at an all time high, I'd be up £8/share by now!

I sold my SMT at GBX 1275 and If I want, I could buy SMT @ GBX1089 now as everyone could see it is now a market correction. It does not need a sophisticated technical skill to understand when the market is in correction / crash mode or rotation for certain sectors

Also what about opportunity cost that you would have used that profit you make buying the dip and sell high for another good stock on making the dip. Now you could go back to SMT ? which one produce a better result ?? You keep doing the same thing over and over again. But do not complain if you keep getting the same result as this famous guy said

You keep doing the same thing over and over again. But do not complain if you keep getting the same result as this famous guy said

“if you want to plant a tree the best time is now”. You read this phrase many times on this MSE and people just repeating it, apply this princile blindly without using a common sense. This principle might be highly relevant to a very well-diversified index fund and people who do not have time to observe the market but might not be relevant to individual stock, let alone a speculative stock.

I agree it is very difficult to time the market. But unless you are blind you could always see when there is a market correction, market rotation, siginifcant price dip

It is difficult to get the very bottom, but you could always use DCA Dollar Cost Avareging. e.g buy at a smaller chunk during the dip rather than in one go. You could exploit this option if you are using a fee free platform not a plarform which will charge you £15 per deal.

As they say, 'unless you are blind' you would always be able to see market corrections and rotations when they are due so there would be little risk in applying the techniques to more lifechanging amounts of money. Just make sure you don't buy at a high or sell at a loss, unless it's the right time to do either of those things. 0

0 -

To be fair to adindas in what to him must feel like a bit of a pile on, most posters on this board adhere to "top slicing", "rebalancing", "cyclical markets", "reversion to the mean" or other versions of saying "what goes up must go down, or vice versa."0

-

Has anyone read the BIDS annual accounts today. I'm disappointed to be fair. Its like they're trying to talk the company up by giving away as little negatives as possible. As a concept, its a great idea and worth of this thread imo, but in the same sense, the main owner hasn't bought a share since 2019.

0 -

ZingPowZing said:To be fair to adindas in what to him must feel like a bit of a pile on, most posters on this board adhere to "top slicing", "rebalancing", "cyclical markets", "reversion to the mean" or other versions of saying "what goes up must go down, or vice versa."Most posters on this board adhere to "What goes up must go down occasionally but will then carry on going up. And there is no evidence that anyone can consistently guess when it's about to go down and when it's about to start going up again." Which starts off the same but has a very different meaning.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards