We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Suggestions for a speculative punt?

Comments

-

He is saying you posted a chart for NASDAQ the company, not NASDAQ the index.

"And one thing important there is an ignore button outthere." - Nothing fosters success quite like ignoring views opposed to your own.

Im A Budding Neil Woodford.3 -

I remember a few people here were saying, avoid investing in Oil Companies like RDSB, BP. Well, this sector has come back. Also COVID-19 pandemic will end soon and summer holiday season is coming which might push the oil price further up and therefore push up inflation rate. The interest rate will need to be increased to match inflation which is bad for investor.

0 -

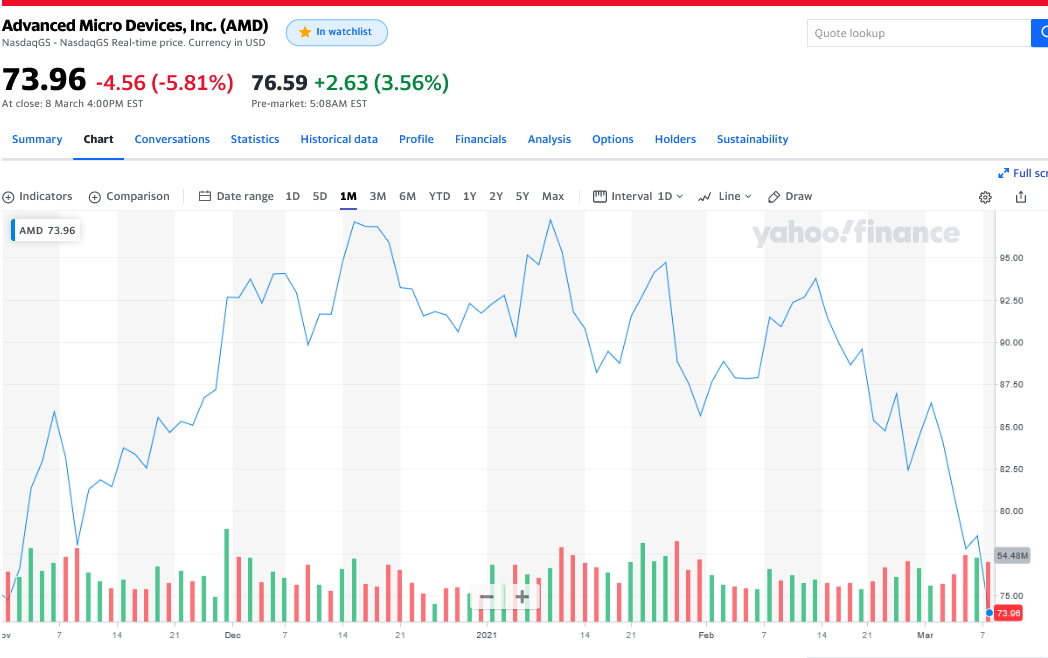

If you think using traditional Matrix of valuation will protect you against the market Crash/ Market correction rethink about that. This Advanced Micro Devices, Inc. (AMD) is one of a good example a very good company the leader in a pack in semiconductor industry.

https://uk.finance.yahoo.com/quote/AMD/financials?p=AMD

https://uk.finance.yahoo.com/quote/AMD?p=AMD

https://csimarket.com/Industry/Industry_Valuation.php?ind=1010

Brilliant Balance sheet, Good P/E ratio compare to the industry,

Net income increases dramatically from 341,000 To 2,490,000

EBITDA Increase dramatically from 724,000 to 1,676,000

Very good management, in a very good industry as there is currently shortage in semi-conductor chips, spike demand in IoT, chips needed in AIs

But are they immune against the market Crash/ Market correction? Look at the chart below, compare it with other growth companies. Also look at the history of market crashes and market correction. Draw your conclusion.

Please bear in mind I am not saying that Advanced Micro Devices, Inc. (AMD) is not a good buy. In fact, I myself will be using this opportunity to act as a contrarian investor/trader. But If I decide to buy this stock I will just take advatage of the momenetum and I will not keep it for long as I will sell it when it reaches all time high and will put more weight on growth stocks that still have a lot of headroom to grow.

To keep tracking the benefit of investing in the company like this I already have a good fund that track that market performance which include this stock as part of their holding.

Please do your own DDs and make your own decision.

You will never know how the people react to the market condition. In some cases, people just react irrationally and you take it for your advantage.

If you do not want to take a risk the best thing to do is to put the money in government, treasury bond, saving/bond protected by the government scheme. But for this you will need to be happy to accept the return of less than 1% a year.

1 -

It seems the market correction is over is it not ?.Green day today. Time to get rewarded for taking risk.0

-

Volatility is still very much in play. May well last for the remainder of the year. The genie is out of the bottle.adindas said:The market correction is over is it not ?.Green day today. Time to get rewarded for taking risk.0 -

Tesla up nearly 20%. Crazy stuff, that probably equates to the entire gdp of a small country 😂1

-

I'm not convinced that those "in the know" are investing in Tesla because of their cars.benbay001 said:If you bought Tesla today, the company is worth $570 billion.

If you were expecting a 20% return per year for the next 10 years (i think thats fair, considering the risk youre taking on) then Tesla would need to be worth $3.5 trillion in 2031.

Lets assume Tesla then trades at a PE of 20x and then have profit margins of 14% which is double what the car industry historically have, Tesla would need $1.2 trillion in Revenue.

$1.2 trillion is 6x greater than Volkswagens revenue from 2019.

And i think ive been generous to Tesla here- Their market cap has recently taken a big tumble, it was previously alot higher.

- Lets face it, most people holding Tesla are probably expecting gains much higher than 20% per year.

“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0 -

Youre right, i didnt account for the bitcoin growth.Steve182 said:

I'm not convinced that those "in the know" are investing in Tesla because of their cars.benbay001 said:If you bought Tesla today, the company is worth $570 billion.

If you were expecting a 20% return per year for the next 10 years (i think thats fair, considering the risk youre taking on) then Tesla would need to be worth $3.5 trillion in 2031.

Lets assume Tesla then trades at a PE of 20x and then have profit margins of 14% which is double what the car industry historically have, Tesla would need $1.2 trillion in Revenue.

$1.2 trillion is 6x greater than Volkswagens revenue from 2019.

And i think ive been generous to Tesla here- Their market cap has recently taken a big tumble, it was previously alot higher.

- Lets face it, most people holding Tesla are probably expecting gains much higher than 20% per year.

Im A Budding Neil Woodford.0 -

I’ve been following this thread with interest for a good few months. I’m tempted to begin investing maybe 5-10k in some of the stocks mentioned here. In terms of money I’m pretty competent. I’m no stranger to financial instruments or accounts.However, I am lacking in the overall market awareness that frequently gets demonstrated here. A lot of you tie together scenarios well. Is that just experience or from reading around the subject of investing?

do any of you have any recommendations about where to start reading around the subject that may set me off on an even keel? I’ve learnt a lot from this thread but keen to have a more structured approach to it.Thanks0 -

I like The Economist Publications Series and would suggest their Guide to Investment Strategy and/or their Guide to Financial Markets, both of which are available on Amazon.JamesN said:I’ve been following this thread with interest for a good few months. I’m tempted to begin investing maybe 5-10k in some of the stocks mentioned here. In terms of money I’m pretty competent. I’m no stranger to financial instruments or accounts.However, I am lacking in the overall market awareness that frequently gets demonstrated here. A lot of you tie together scenarios well. Is that just experience or from reading around the subject of investing?

do any of you have any recommendations about where to start reading around the subject that may set me off on an even keel? I’ve learnt a lot from this thread but keen to have a more structured approach to it.Thanks1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards