We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Suggestions for a speculative punt?

Comments

-

If you bought Tesla today, the company is worth $570 billion.

If you were expecting a 20% return per year for the next 10 years (i think thats fair, considering the risk youre taking on) then Tesla would need to be worth $3.5 trillion in 2031.

Lets assume Tesla then trades at a PE of 20x and then have profit margins of 14% which is double what the car industry historically have, Tesla would need $1.2 trillion in Revenue.

$1.2 trillion is 6x greater than Volkswagens revenue from 2019.

And i think ive been generous to Tesla here- Their market cap has recently taken a big tumble, it was previously alot higher.

- Lets face it, most people holding Tesla are probably expecting gains much higher than 20% per year.

Im A Budding Neil Woodford.2 -

https://www.statista.com/statistics/574151/global-automotive-industry-revenue/

"It is projected that the global automotive industry will grow to just under nine trillion U.S. dollars by 2030. It is anticipated that new vehicle sales will account for about 38 percent of this value."

So, in 2030 new car sales will be worth $3.4 trillion. So Tesla's market share will be 30% of the global market. But lets be real, they arent going to allowed to become a big player in China, so thats out. Plus all the countries where a Tesla just wont be affordable or rechargeable.Im A Budding Neil Woodford.2 -

It seems that they are few people in here think that they are better that fund managers in Vanguard Group, Inc., Blackrock Inc, Baillie Gifford and Company, JP Morgan Chase, Fidelity. ARK Invest.

Also the claim like this

"Investing in the latest and greatest hot stock intended to mug punters through the door. If there is a crash close the fund and start again."

Hoping someone will ever buy that argument

Do you think these fund managers want to sacrifice their reputation closing their fund just for the sake of a company like TSLA if they do not believe that it will improve their performance?

Do you have any idea where the Top mutual fund are holding TSLA (or other growth stock) as part of their portfolio?? Have a look of it, what otheer stocks in those fund before making such a nonsense argument.

If you think your idea could get attention and you are better than these fund managers, I suggest you write your ideas or sensations in the electronic news such as Bloomberg, CNBC, CNN finance, you might get a very good pay for your article if they ever believe in your argument.

0 -

The fund managers only have to match their peer group to not lose customers.

In the short term "hot stocks" are very much a self fulfilling prophecy.

Time will tell i guess.Im A Budding Neil Woodford.1 -

“Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria,”benbay001 said:

Time will tell i guess.

3 -

If the tech bubble bursts and we emerge relatively unscathed, would that make us better fund managers?adindas said:It seems that they are few people in here think that they are better that fund managers in Vanguard Group, Inc., Blackrock Inc, Baillie Gifford and Company, JP Morgan Chase, Fidelity. ARK Invest.

Also the claim like this

"Investing in the latest and greatest hot stock intended to mug punters through the door. If there is a crash close the fund and start again."

Hoping someone will ever buy that argument

Do you think these fund managers want to sacrifice their reputation closing their fund just for the sake of a company like TSLA if they do not believe that it will improve their performance?

Do you have any idea where the Top mutual fund are holding TSLA (or other growth stock) as part of their portfolio?? Have a look of it, what otheer stocks in those fund before making such a nonsense argument.

If you think your idea could get attention and you are better than these fund managers, I suggest you write your ideas or sensations in the electronic news such as Bloomberg, CNBC, CNN finance, you might get a very good pay for your article if they ever believe in your argument.

0 -

Adindas, I agree with a lot of what you say, but not this bit:adindas said:

I think these people is from an old school who could not see that the nature of many businessess have changed,, world of investing has changed dramatically since recent years. They are reading the books publication published in 1970s which is more suitable in that era. In that era there is no or very little companies in Fintech, SaaS, EV companies, ESG, Biotech (Genome), block chain.

Some of the investment books I've enjoyed most were written in the 1920's and 30's. There is nothing new about investment bubbles, technology start-ups, growth shares, volatility etc. The biggest mistake is to ascribe to the view that "this time it's different"!1 -

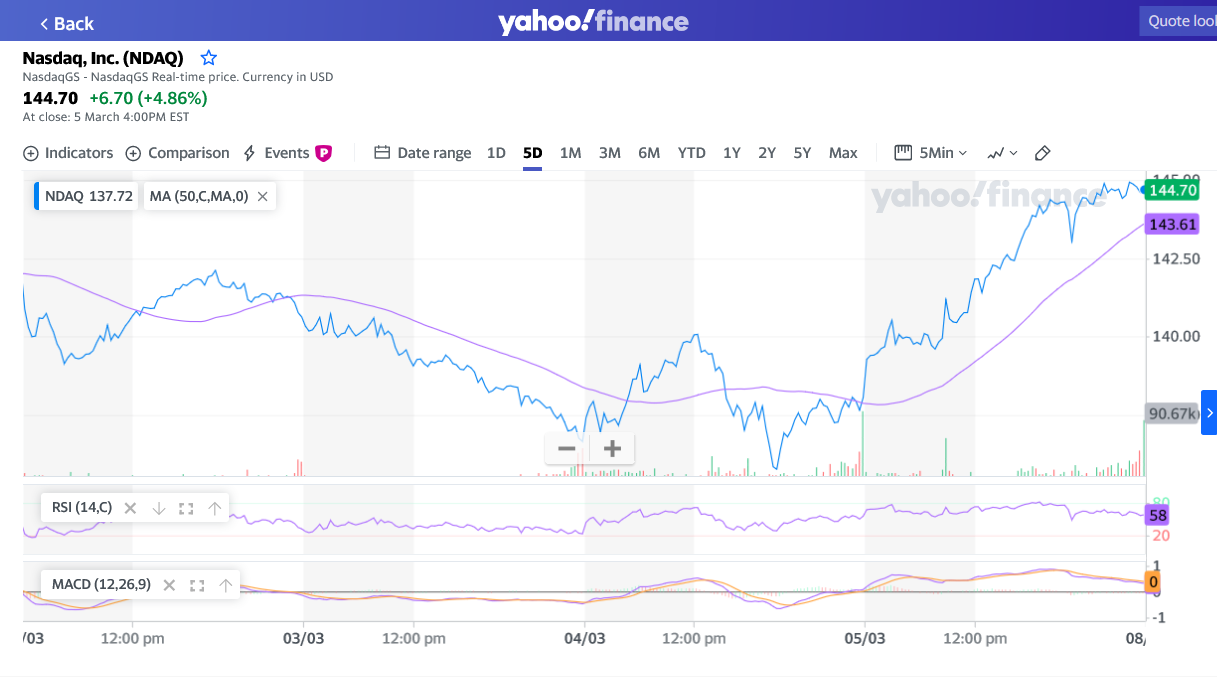

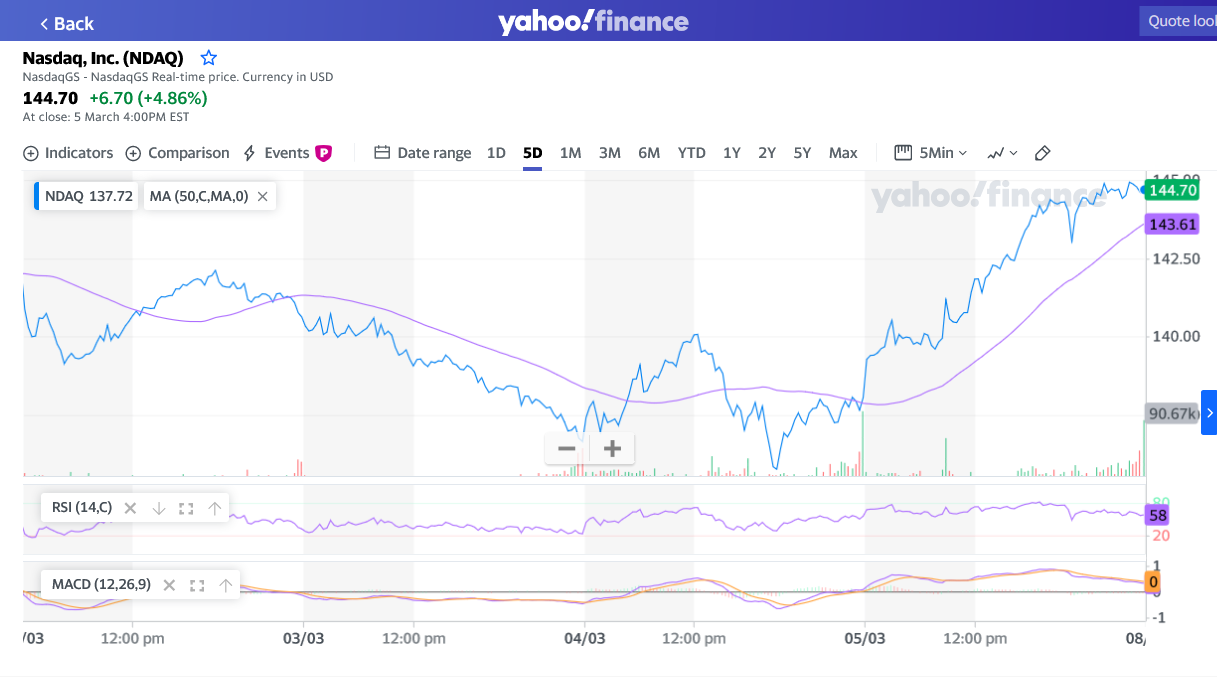

Is the market correction over? What do you think ? I think they are if you see of this nice chart since a few days ago.1

Is the market correction over? What do you think ? I think they are if you see of this nice chart since a few days ago.1 -

inrg begs to differadindas said: Is the market correction over? What do you think ? I think they are if you see of this nice chart since a few days ago."It is prudent when shopping for something important, not to limit yourself to Pound land/Estate Agents"

Is the market correction over? What do you think ? I think they are if you see of this nice chart since a few days ago."It is prudent when shopping for something important, not to limit yourself to Pound land/Estate Agents"

G_M/ Bowlhead99 RIP1 -

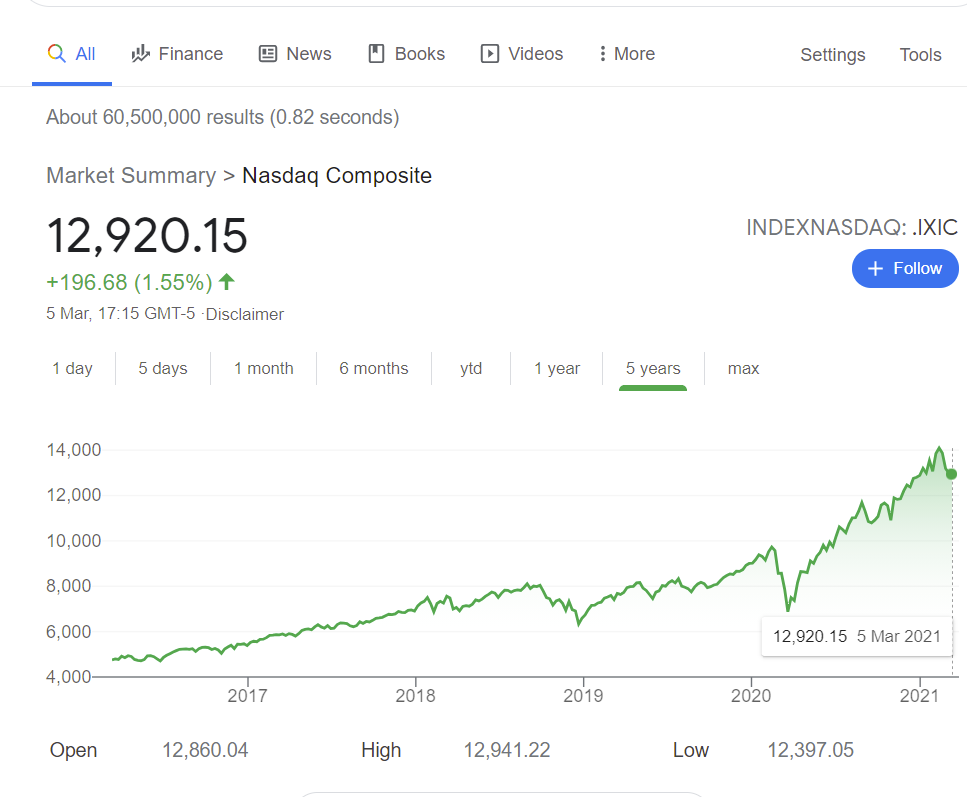

The market corrects itself all the time. So every day, it's where it thinks it 'should' be. But from its current position of ~13000 for the Nasdaq Composite index, nobody actually knows whether it will be 10,000 or 16,000 next.adindas said:

[Nasdaq, Inc share price]

Is the market correction over? What do you think ? I think they are if you see of this nice chart since a few days ago.

A year ago, a move to 10,000 would have been an upwards one, to an all time high. Some would say 12-13000 is a fairer price for the nasdaq constituents than the 14000 was last month. But with the US stimulus package getting agreed this weekend, the 'feelgood factor' may stop it tanking too far and Monday may be up again.

Best not to get too excited about day to day movements.

Note the stock price of Nasdaq Inc is going to give a different chart from that of the index itself or its individual constituents in which you might invest.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards