We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Has the dead cat finished bouncing?

Comments

-

Agreed. I did more tinkering that normal for me and used the opportunity to make a small allocation change I had been wanting to do for a while. I did something I have never done before - buying and selling an equity fund within an 8 week window. Felt quite dirty about it!takesyourchances said:

It just shows how unpredictable the market's are and keeping to a steady consistent plan I just invest as much as I can each month and have not changed anything as in for the long term too. I didn't expect my investments to be back were they are now so quickly but know it can change the other way as quick but sticking to a plan in all conditions helpsPrism said:Looks like another up day for me. I think is is going to be my best ever calendar month - not that it matters at all in the long run.

Most stuff was completely untouched except for regular monthly contributions.2 -

I'm back at where I started the year after the best calendar month ever by a country mile. My strategy has remained unchanged - World tracker ETF (happens to be VWRL for now but new contributions will go wherever is cheapest) tempered by UK Gilts at a level where I'm comfortable with the risk (via VGOV) and a bit of legacy home bias which has been a drag on performance.

Nothing touched or tweaked apart from a big top up in April and a mopping up of dividends in January.

When things go the other way I'll just update my stock prices less frequently - monthly instead of weekly. I seem to remember I used to be perfectly happy to update them once a year.

Coronavirus has exposed market predictions for what they are - guesses.

2 -

Ref: how often to monitor prices. Just had a look on Youinvest which tells me that to mid March 2020 I had my worst annualised performance over 3 months, 6 months, 3 years and 5 years. Wish I'd not looked. Easy to see why some people were running around like headless chickens - Youinvest and the rest of them must've made a bomb.0

-

To be honest I'm glad I was monitoring, gave me a chance to get into some ITs at good discountsSailtheworld said:Ref: how often to monitor prices. Just had a look on Youinvest which tells me that to mid March 2020 I had my worst annualised performance over 3 months, 6 months, 3 years and 5 years. Wish I'd not looked. Easy to see why some people were running around like headless chickens - Youinvest and the rest of them must've made a bomb.2 -

The thread lives and so does the cat.

I think I might dump my legacy FTSE All share tracker into the rally. I wish I'd never seen the thing - I only kept it as a punishment.1 -

Huge boost today with US job figures. A return to work and then see how things unfold over the next year ?Sailtheworld said:The thread lives and so does the cat.

I think I might dump my legacy FTSE All share tracker into the rally. I wish I'd never seen the thing - I only kept it as a punishment.

https://www.marketwatch.com/story/us-regains-25-million-jobs-in-may-bls-says-and-unemployment-falls-to-133-in-shockingly-upbeat-report-2020-06-05

Markets have SP 500 on a forward PE of nearly 25 looking at the link. 3180/128 as of today.

https://insight.factset.com/record-high-cuts-to-sp-500-eps-estimates-for-cy-2020-to-date

Growth stocks have carried the market forward and this might be a reason the FTSE continues to struggle.

https://pbs.twimg.com/media/EZvAXq0XgAA3Xd4?format=png&name=900x900

Who knows where next but indicators out there are showing extremes. A pause at least you would think ?

https://pbs.twimg.com/media/EZ5fGfJX0AA5xM6?format=png&name=900x900

http://www.indexindicators.com/charts/djia-vs-djia-stocks-above-50d-sma-params-5y-x-x-x/

2 -

...

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."1 -

This thread could prove to be a limit-case of aftertiming.1

-

Those who said the cat was dead a few weeks ago didn't pay much attention at vet school. It doesn't look very well today to be fair so maybe they can hit the guess machine's reset button.1

-

heh, looks like I picked the right day to guess the Fed was going to say it wasn't looking very rosy (https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20200610.pdf) and the market wouldn't like itquirkydeptless said:...

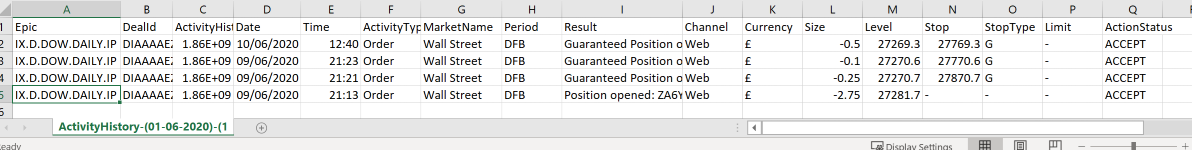

Down now under 25650 so I will close some of these positions while the going's good.

Nice to see you back, zpz!Diplodicus said:This thread could prove to be a limit-case of aftertiming.-2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards