We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Nationwide Building Society Loyalty!

Comments

-

teddysmum said:Anyone considering Marcus' 1.2%, who is over 50, may prefer to take the same deal via Saga as there is a tiny perk of special offers .So, I did that, and, irony of ironies, two days later they send me an email telling me they're reducing my interest rate

By 0.2 percentage points.I'm surprised so many providers have waited this long to do it, but there are obviously quite a few doing it at the moment, so again I'll try and wait for things to settle.0

By 0.2 percentage points.I'm surprised so many providers have waited this long to do it, but there are obviously quite a few doing it at the moment, so again I'll try and wait for things to settle.0 -

You could say a building society being taken over by a bank is demutualisation. I was a Britannia member when it happened and remember getting a letter saying they are being taken over by a bank and explaining that usually a building society being acquired by a bank would mean members get a payout but in the financial circumstances the board has decided that no payout will be made. They made the very generous offer of giving all Britannia members Co-op loyalty cards for free as a result of the takeover instead of charging us £1 to opt in to Co-op's loyalty scheme!wmb194 said:

Britannia didn't demutualise and what happened to it? IIRC it was poor management in relation to commercial property loans that sunk it and then concomitantly sunk the Co-op Bank, another mutual, after it unwisely rescued it. The type of ownership structure Nationwide employs doesn't really count for anything.Thrugelmir said:

The Nationwide unlike many other building societies. Decided not to demutualise and has grown from strength to strength. With no shareholders to account to. Just members.epm-84 said:

Look at what happened to the likes of RBS and Northern Rock - people highly experienced in the banking sector screwed up their respective bank's finances to the point where they were on the brink of collapse.bowlhead99 said:

If you have a couple of billion pound a year interest bill and want to reduce it, the most immediate and effective way to do that is to reduce the variable rate interest paid to existing depositors - rather than simply withdrawing the highest rate saving products from sale to new customers, which would have an extremely limited effect on reducing the existing bill.epm-84 said:

So you'd think rather than hefty interest rate reductions, they would withdraw the highest interest rate saving products to new customers and leave any significant interest changes or new product launches, until they have the staff available to cope with the high demand that will cause. Some other banks and building societies have done that but not Nationwide.digalumps said:No idea - it's almost like there was some sort of disease suddenly striking all their staff at once.On all the interest rate moan threads we get people saying "you'd think the'd just do [x], why does the CEO and board of directors get paid big salaries for this shambles", but perhaps the complainants have never tried to manage a financial institution with a 200 billion pound balance sheet; the organisation is likely better leaving it to the professionals and remunerating them at market rate, rather than taking comments from people on a moneysaving forum.

Given that by that time the Halifax demutualisation had happened, anyone who switched to another building society at that point would have found they had to agree to donate any windfall they are entitled to, to the charity chosen by the building society, as a condition of being a new member.0 -

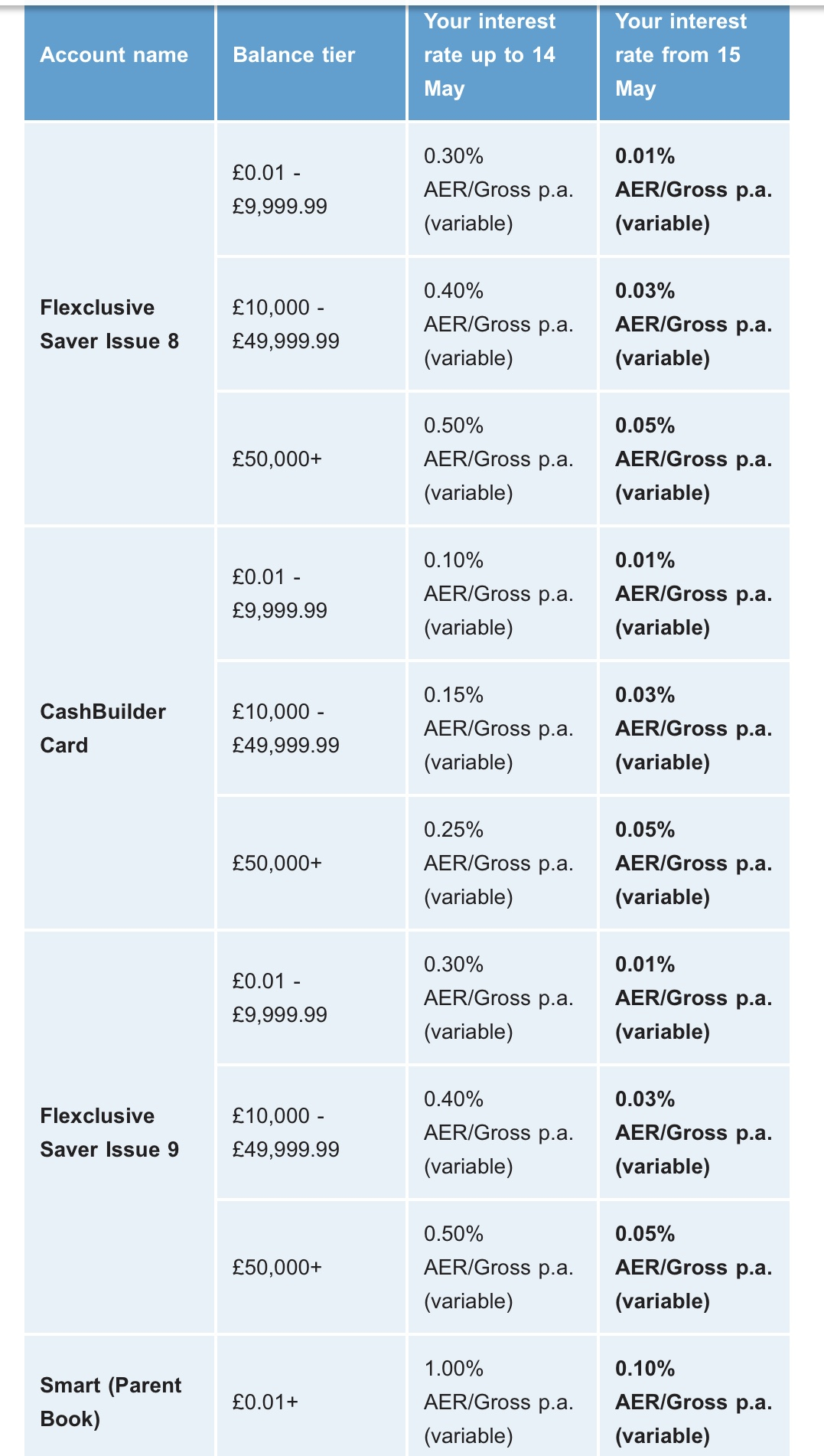

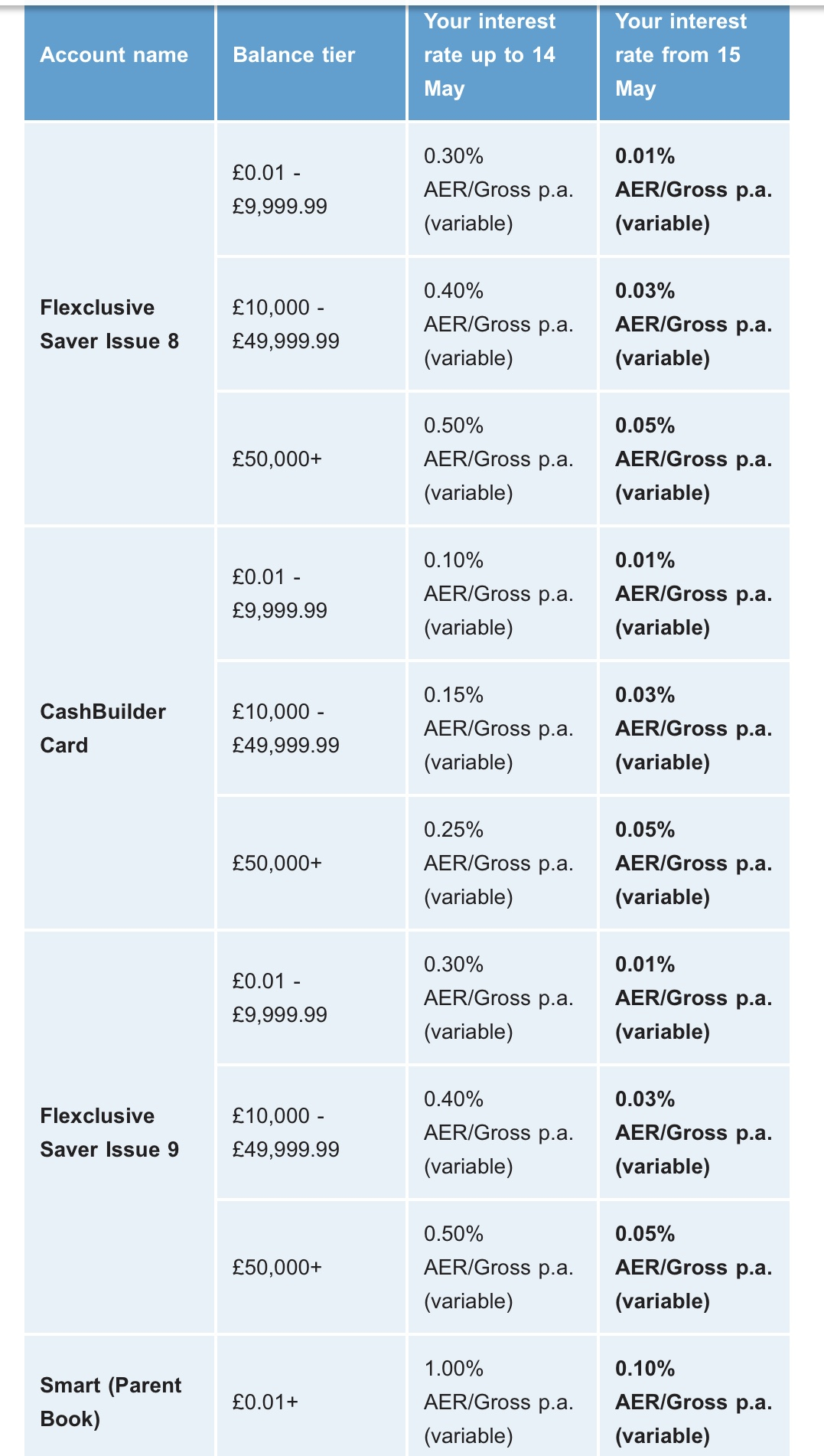

None of these rates are worth having are they!

0 -

It wasn't really though in the usual sense that people talk about it as the alternative was being wound up, plus the Co-op Bank at the time was a mutual-type organisation, too. There have been plenty of badly run, failed building societies over the years, it's just that you don't really hear about them as they're merged with others. The most recent I remember is Holmsdale. It was very odd how it just decided to quit one day and merge with Skipton.epm-84 said:

You could say a building society being taken over by a bank is demutualisation. I was a Britannia member when it happened and remember getting a letter saying they are being taken over by a bank and explaining that usually a building society being acquired by a bank would mean members get a payout but in the financial circumstances the board has decided that no payout will be made. They made the very generous offer of giving all Britannia members Co-op loyalty cards for free as a result of the takeover instead of charging us £1 to opt in to Co-op's loyalty scheme!wmb194 said:

Britannia didn't demutualise and what happened to it? IIRC it was poor management in relation to commercial property loans that sunk it and then concomitantly sunk the Co-op Bank, another mutual, after it unwisely rescued it. The type of ownership structure Nationwide employs doesn't really count for anything.Thrugelmir said:

The Nationwide unlike many other building societies. Decided not to demutualise and has grown from strength to strength. With no shareholders to account to. Just members.epm-84 said:

Look at what happened to the likes of RBS and Northern Rock - people highly experienced in the banking sector screwed up their respective bank's finances to the point where they were on the brink of collapse.bowlhead99 said:

If you have a couple of billion pound a year interest bill and want to reduce it, the most immediate and effective way to do that is to reduce the variable rate interest paid to existing depositors - rather than simply withdrawing the highest rate saving products from sale to new customers, which would have an extremely limited effect on reducing the existing bill.epm-84 said:

So you'd think rather than hefty interest rate reductions, they would withdraw the highest interest rate saving products to new customers and leave any significant interest changes or new product launches, until they have the staff available to cope with the high demand that will cause. Some other banks and building societies have done that but not Nationwide.digalumps said:No idea - it's almost like there was some sort of disease suddenly striking all their staff at once.On all the interest rate moan threads we get people saying "you'd think the'd just do [x], why does the CEO and board of directors get paid big salaries for this shambles", but perhaps the complainants have never tried to manage a financial institution with a 200 billion pound balance sheet; the organisation is likely better leaving it to the professionals and remunerating them at market rate, rather than taking comments from people on a moneysaving forum.

Given that by that time the Halifax demutualisation had happened, anyone who switched to another building society at that point would have found they had to agree to donate any windfall they are entitled to, to the charity chosen by the building society, as a condition of being a new member.0 -

In total over 200 building societies have been merged in to Nationwide.wmb194 said:

It wasn't really though in the usual sense that people talk about it as the alternative was being wound up, plus the Co-op Bank at the time was a mutual-type organisation, too. There have been plenty of badly run, failed building societies over the years, it's just that you don't really hear about them as they're merged with others. The most recent I remember is Holmsdale. It was very odd how it just decided to quit one day and merge with Skipton.epm-84 said:

You could say a building society being taken over by a bank is demutualisation. I was a Britannia member when it happened and remember getting a letter saying they are being taken over by a bank and explaining that usually a building society being acquired by a bank would mean members get a payout but in the financial circumstances the board has decided that no payout will be made. They made the very generous offer of giving all Britannia members Co-op loyalty cards for free as a result of the takeover instead of charging us £1 to opt in to Co-op's loyalty scheme!wmb194 said:

Britannia didn't demutualise and what happened to it? IIRC it was poor management in relation to commercial property loans that sunk it and then concomitantly sunk the Co-op Bank, another mutual, after it unwisely rescued it. The type of ownership structure Nationwide employs doesn't really count for anything.Thrugelmir said:

The Nationwide unlike many other building societies. Decided not to demutualise and has grown from strength to strength. With no shareholders to account to. Just members.epm-84 said:

Look at what happened to the likes of RBS and Northern Rock - people highly experienced in the banking sector screwed up their respective bank's finances to the point where they were on the brink of collapse.bowlhead99 said:

If you have a couple of billion pound a year interest bill and want to reduce it, the most immediate and effective way to do that is to reduce the variable rate interest paid to existing depositors - rather than simply withdrawing the highest rate saving products from sale to new customers, which would have an extremely limited effect on reducing the existing bill.epm-84 said:

So you'd think rather than hefty interest rate reductions, they would withdraw the highest interest rate saving products to new customers and leave any significant interest changes or new product launches, until they have the staff available to cope with the high demand that will cause. Some other banks and building societies have done that but not Nationwide.digalumps said:No idea - it's almost like there was some sort of disease suddenly striking all their staff at once.On all the interest rate moan threads we get people saying "you'd think the'd just do [x], why does the CEO and board of directors get paid big salaries for this shambles", but perhaps the complainants have never tried to manage a financial institution with a 200 billion pound balance sheet; the organisation is likely better leaving it to the professionals and remunerating them at market rate, rather than taking comments from people on a moneysaving forum.

Given that by that time the Halifax demutualisation had happened, anyone who switched to another building society at that point would have found they had to agree to donate any windfall they are entitled to, to the charity chosen by the building society, as a condition of being a new member.

0 -

To call an account "CashBuilder" with a rate of one hundredth of one percent is surely a breach of the Trade Descriptions Act?2

-

Nationwide could argue that it grows at least as fast as a stalagmite growsVortigern said:To call an account "CashBuilder" with a rate of one hundredth of one percent is surely a breach of the Trade Descriptions Act? 3

3 -

Of course it grows. As long as you keep paying in to it!Vortigern said:To call an account "CashBuilder" with a rate of one hundredth of one percent is surely a breach of the Trade Descriptions Act?

Actually that's the only account I now have with them, the same account I opened over 30 years ago. Token £100 in it just in case of demutualisation, but otherwise I'm done with them. Even the credit card only gets used now when we go abroad. So in other words, not at all!0 -

They only exist because they have a high street presence. That attracts some investors who you see queuing for a couple of notes every day. But as the younger people move away from the high street, they will become irrelevant.

It may be too late for them already.0 -

i got an email like this too today, very odd. i thought their savingswatch scheme was to let you know a couple of weeks in advance of any rate changes, not 2 weeks after. guess i never read the small print carefully enough. pity. might've even have saved a few pennies moving my money out sooner if they had. should've gone to specsavers, perhaps.ffacoffipawb said:None of these rates are worth having are they! 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards