We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Liquidate entire portfolio until virus is over?

Comments

-

That's not due to the virus though, it's an oil price war and poor Japanese economic figures.

Though I confess to being a bit confused why the lower oil price should have a negative effect on anybody other than oil companies. Surely it reduces the costs for other businesses?0 -

So FTSE100 now down a total of about 20% from it's peak.Do the holders still say that was the right thing? Too late to sell now but surely they must agree it would have been a smart move 2 weeks ago?1

-

Presumably it is an indicator of lower demand, which in turn suggests a less productive economy.Reaper said:Though I confess to being a bit confused why the lower oil price should have a negative effect on anybody other than oil companies. Surely it reduces the costs for other businesses?

1 -

ProDave said:So FTSE100 now down a total of about 20% from it's peak.Do the holders still say that was the right thing? Too late to sell now but surely they must agree it would have been a smart move 2 weeks ago?Those who sold 2 weeks ago have indeed been lucky, while those who have held have been unlucky. The person who puts a pound in the fruit machine because they know it is due to pay out, then wins, would tell the person who refrained from doing so they didn't do the right thing.It's never too late to sell. Several have mentioned that markets have much further to fall so holders could still profit from selling today if they believe that.1

-

Don't believe that. Coronavirus is the main reason, any bad news is just magnified by the disease.Reaper said:That's not due to the virus though, it's an oil price war and poor Japanese economic figures.

Though I confess to being a bit confused why the lower oil price should have a negative effect on anybody other than oil companies. Surely it reduces the costs for other businesses?

ProDave said:

I agree with that. I thought about it but just made a gesture by selling small percentage half of which was re-invested in more defensive funds.So FTSE100 now down a total of about 20% from it's peak.Do the holders still say that was the right thing? Too late to sell now but surely they must agree it would have been a smart move 2 weeks ago?0 -

0

-

Will be interesting to see what happens.masonic said:2010 said:

Good show, keep us informed when you sell and for how much, then buy them back later at a cheaper price.masonic said:

Happy to try this experiment with a virtual holding in VWRL. I'll note the price I "sell" on the next rally and wait for your signal to buy it back.2010 said:Markets don`t rise in a straight line.

They also don`t fall in a straight line.

But it`s pretty obvious the way things are looking at the moment, it`s a downward trend.

Anyone brave enough should sell (if they can) a percentage of their portofolio on the next rally, sit on the cash and wait.

Say what you like, but the indices will be llower later than they are now.

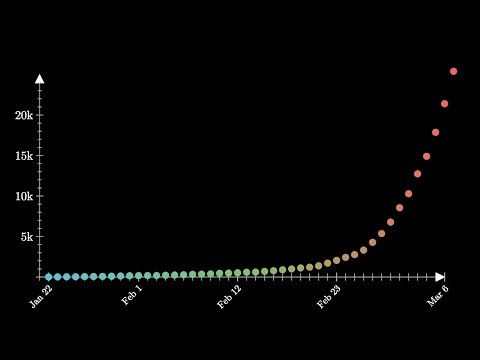

Ftse100 6,462, Dow 25,864 March 6th 2020

Sounds a bit like short selling.I now have 3 virtual portfolios open to track how someone would perform if they do as you or others have suggested.1) Sell on the next rally, sit on the cash and wait (status: waiting for rally, will then sell):VWRL: Qty 170, current value £10.2kCash: £02) Sell ASAP, and sit out of the market until markets are much lower (status: sold, waiting for buying opportunity):VWRL: Sold 170 @ 60.01GBP, current Qty 0, value £0Cash: £10.2k3) Long term buy and hold (status: holding):VWRL: Qty 170, current value £10.2kFor my real investments I'm taking an approach closest to (3), although I have 45% of my assets in cash and bonds which I will be using to buy over the next 2-3 months. I would have bought some today but am waiting for an ISA transfer that is not yet complete.

The trouble with the next rally is, will it go back up the 550 points that`s just been lost on opening this morning.

I doubt it.

Oil price down because of less demand, with Russia and Saudi having a price war.0 -

A clearer indication of not just what China produces but what it consumes.newatc said:

Don't believe that. Coronavirus is the main reason, any bad news is just magnified by the disease.Reaper said:That's not due to the virus though, it's an oil price war and poor Japanese economic figures.

Though I confess to being a bit confused why the lower oil price should have a negative effect on anybody other than oil companies. Surely it reduces the costs for other businesses?0 -

We know which way they went this morning.Prism said:

There is nothing blindingly obvious to see. You have no idea which way the markets will go. Nobody does. Your guess is they will go down a long way. You might be right but since nobody actually knows the best thing to do is carry on like normal. Nothing to see here2010 said:

Good post, unlike others like rabbits caught in the headlights and failing to see the blindingly obvious.worldtraveller said:IMHO, I'm expecting, at least, a 30% decline in major western markets from peak, at this time. Just like in 2008/09, I'm planning on reinvesting accumulted cash, built up over the past 6 months or so, expecting a market correction, just as I did in late 2008.I'm planning to start feeding accumulated cash back in to equities when we see c. 20% decline from peak, which we'll see, almost certainly, next week. It'll be measured, and it'll increase, if and when the markets declines further, which I expect.It suited me very well in 2008/2009, when, TBH, I made more return on my equity investments, than any time in the previous 20 years, at least.Quite frankly, I love these rare opportunities, in a lifetime, to make major returns on investments, when others are panicking...It's something you learn over time, and, for those that are prepared to take the risk, enjoy the ride...For those that aren't, then fine, I have no issue, whatsoever, with that. Your choice, your money! Good luck!

Good luck!

Markets are on the drop, big time.0 -

One of the reasons that I will be able to retire in a little over 3 years' time is that I continued to invest in my work's AVC through the 2009 Global Financial Crisis and I would only check my funds once a year via a statement from the provider. I wasn't able to react to market news' ups or downs, but as the years went by the cheap units I was buying slowly increased in value until the total met the threshold at which I could use the money to fund an early retirement without drawing on other funds. I transferred my AVC to a SIPP and it is held in cash. I think if it wasn't for the GFC of 2009 I wouldn't have been able to retire early in the next few years! Funny that isn't it?..I did nothing apart from drip feed monthly and here I am.

If you want to be rich, live like you're poor; if you want to be poor, live like you're rich.4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://youtu.be/Kas0tIxDvrg

https://youtu.be/Kas0tIxDvrg