We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Regular Savings Accounts: The Best Currently Available List!

Comments

-

It doesn't show once you have deposited the max for the month, and the earliest it can show is 1 day after you opened the account.janusdesign said:Growingold said:No D/C option to pay in on my new YBS Loyalty saver unlike my other accounts.it's there as an option for me - the button now works.

2 -

I keep an old YBS internet saver loyally lurking around with £1 in it. Has more than paid its way.Nick_C said:Unable to open the YBS LRS on line yesterday. Just finished a 10 minute telephone appointment. Now opened and funded. (Annoying they have to send me a passbook which will never be used.)

(Been a member for many years but none of my open accounts are more than a year old.)1 -

So are you of the opinion that bank transfers are better in terms of how quickly I might get interest?Section62 said:Bridlington1 said:

Have you made a deposit into it yet? When logged into online banking I've found all of my YBS EA accounts have the debit card option but all of my regular savers do not. Since I've fully funded each of my regular savers this month I imagine it's because their systems recognise when you've made the maximum monthly deposit into the account so therefore remove the debit card deposit option since you can't possibly add further funds at that point. I think it should reappear on 1st October though.Growingold said:No D/C option to pay in on my new YBS Loyalty saver unlike my other accounts.I think you are probably correct.But as an aside, since YBS don't clear and pay interest on debit card deposits for two to three working days it isn't good MSE practice to make debit card deposits directly into the regular saver accounts anyway.Making the debit card deposits into the highest interest EA account a few days before the end of one month allows the deposit to be transferred internally to the RS account on the first of the following month and start earning the RS rate those few days earlier.0 -

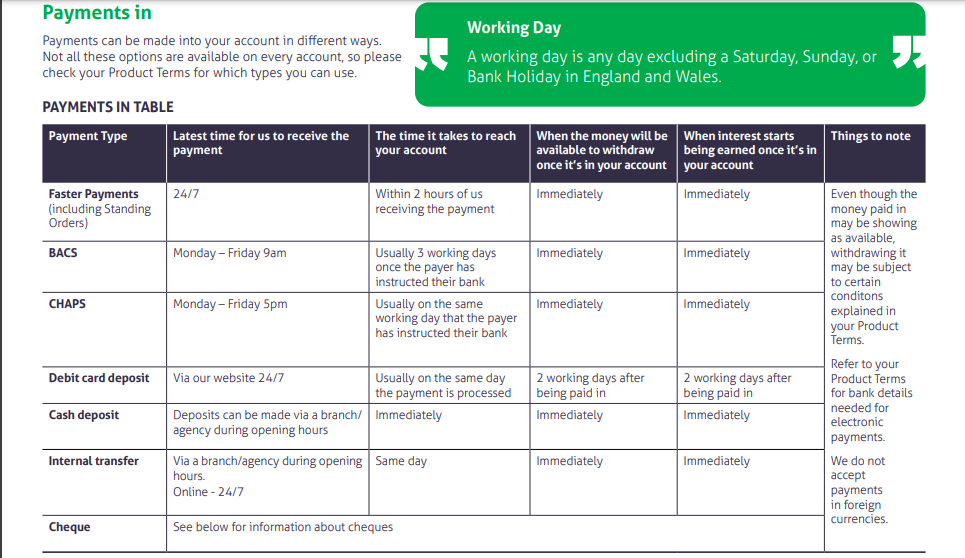

From YBS's general Ts&Cs:Bazzalona13295 said:

So are you of the opinion that bank transfers are better in terms of how quickly I might get interest?Section62 said:Bridlington1 said:

Have you made a deposit into it yet? When logged into online banking I've found all of my YBS EA accounts have the debit card option but all of my regular savers do not. Since I've fully funded each of my regular savers this month I imagine it's because their systems recognise when you've made the maximum monthly deposit into the account so therefore remove the debit card deposit option since you can't possibly add further funds at that point. I think it should reappear on 1st October though.Growingold said:No D/C option to pay in on my new YBS Loyalty saver unlike my other accounts.I think you are probably correct.But as an aside, since YBS don't clear and pay interest on debit card deposits for two to three working days it isn't good MSE practice to make debit card deposits directly into the regular saver accounts anyway.Making the debit card deposits into the highest interest EA account a few days before the end of one month allows the deposit to be transferred internally to the RS account on the first of the following month and start earning the RS rate those few days earlier.

If you deposit into a YBS account by faster payment interest is earned immediately after arriving in your account but if you deposit by debit card interest won't be earned until 2 working days after being processed, resulting in you effectively having the money sat in the account earning no interest for a few days (exact number of days varies depending on weekends/bank holidays).

This isn't true of all banks/building societies though, some pay interest on debit card deposits from the day of deposit, whereas others take longer to start earning interest so as ever check the Ts&Cs before depositing.5 -

The wife opened hers without any issues. I've also got their Regular e-saver (£250pm) but believe you can have both.fonesaver said:

I got the same yesterday when I applied. I have had multiple accounts with YBS for over 30 years. Could this be another Newcastle BS type !!!!!!-up???kar999 said:I've got a number of accounts with YBS but just got this email after RS application... not sure why. .

"We need to carry out some further checks."Hi Mr *****

We wanted to let you know that your account is open, but before you can begin using it we just need to carry out a few further checks. Don't worry - this should only take a couple of days for us to complete.

What happens next?

Once these checks have been completed we'll write to you and let you know when your account is ready to use. You'll then be able to make deposits to your account by bank transfer.

For security reasons, we'll send you your customer number by post. You will need this to be able to log in, manage your account online and make further deposits by debit card.

I'll ring customer service tomorrow if I don't hear from them.If the ball had gone in the net it would have been a goal.If my Auntie had been a man she'd have been my Uncle.0 -

Bridlington1 said:

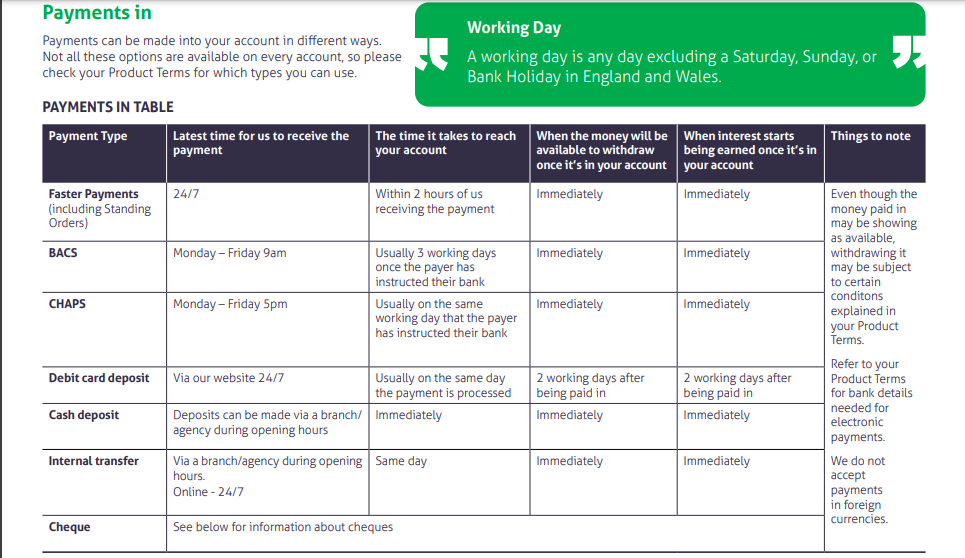

From YBS's general Ts&Cs:Bazzalona13295 said:

So are you of the opinion that bank transfers are better in terms of how quickly I might get interest?Section62 said:Bridlington1 said:

Have you made a deposit into it yet? When logged into online banking I've found all of my YBS EA accounts have the debit card option but all of my regular savers do not. Since I've fully funded each of my regular savers this month I imagine it's because their systems recognise when you've made the maximum monthly deposit into the account so therefore remove the debit card deposit option since you can't possibly add further funds at that point. I think it should reappear on 1st October though.Growingold said:No D/C option to pay in on my new YBS Loyalty saver unlike my other accounts.I think you are probably correct.But as an aside, since YBS don't clear and pay interest on debit card deposits for two to three working days it isn't good MSE practice to make debit card deposits directly into the regular saver accounts anyway.Making the debit card deposits into the highest interest EA account a few days before the end of one month allows the deposit to be transferred internally to the RS account on the first of the following month and start earning the RS rate those few days earlier.

If you deposit into a YBS account by faster payment interest is earned immediately after arriving in your account but if you deposit by debit card interest won't be earned until 2 working days after being processed, resulting in you effectively having the money sat in the account earning no interest for a few days (exact number of days varies depending on weekends/bank holidays).

This isn't true of all banks/building societies though, some pay interest on debit card deposits from the day of deposit, whereas others take longer to start earning interest so as ever check the Ts&Cs before depositing.

Thanks for the advice. Normally pay into my YBS accounts (incl. the reg savers) using the halifax debit cards to meet the minimum debit card spend for the rewards, but may do bank transfers into the reg savers instead, going forward.

0 -

Thats great, thankyou.Bridlington1 said:

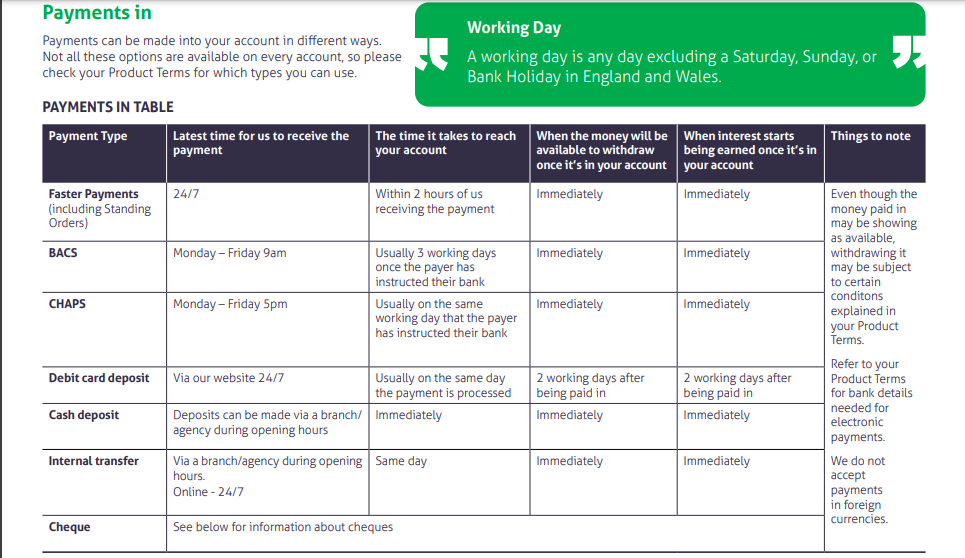

From YBS's general Ts&Cs:Bazzalona13295 said:

So are you of the opinion that bank transfers are better in terms of how quickly I might get interest?Section62 said:Bridlington1 said:

Have you made a deposit into it yet? When logged into online banking I've found all of my YBS EA accounts have the debit card option but all of my regular savers do not. Since I've fully funded each of my regular savers this month I imagine it's because their systems recognise when you've made the maximum monthly deposit into the account so therefore remove the debit card deposit option since you can't possibly add further funds at that point. I think it should reappear on 1st October though.Growingold said:No D/C option to pay in on my new YBS Loyalty saver unlike my other accounts.I think you are probably correct.But as an aside, since YBS don't clear and pay interest on debit card deposits for two to three working days it isn't good MSE practice to make debit card deposits directly into the regular saver accounts anyway.Making the debit card deposits into the highest interest EA account a few days before the end of one month allows the deposit to be transferred internally to the RS account on the first of the following month and start earning the RS rate those few days earlier.

If you deposit into a YBS account by faster payment interest is earned immediately after arriving in your account but if you deposit by debit card interest won't be earned until 2 working days after being processed, resulting in you effectively having the money sat in the account earning no interest for a few days (exact number of days varies depending on weekends/bank holidays).

This isn't true of all banks/building societies though, some pay interest on debit card deposits from the day of deposit, whereas others take longer to start earning interest so as ever check the Ts&Cs before depositing.

Looks like faster payments from now on.0 -

Nationwide Building Society are launching a new regular saver, called 'Flex Regular Saver (Issue 2)', paying 8.00%

- Deposit up to £200 per month

- The account is available to new and existing Nationwide current account customers

- You can make up to 3 penalty-free withdrawals

- It reverts into an instant access savings account after 12 months

- The account can be opened and managed online or via Nationwide's mobile app

Please call me 'Kazza'.37 -

Would be nice if they would offer a switch bonus again. One of the very few I haven't used for a switch incentive.Kazza242 said:Nationwide Building Society are launching a new regular saver, called 'Flex Regular Saver (Issue 2)', paying 8.00%- Deposit up to £200 per month

- The account is available to new and existing Nationwide current account customers

- You can make up to 3 penalty-free withdrawals

- It reverts into an instant access savings account after 12 months

- The account can be opened and managed online or via Nationwide's mobile app

Edit: Just googled when the last offer was and BOOM, they also launched a new offer for £200.

https://www.nationwide.co.uk/current-accounts/switch/

https://www.nationwide.co.uk/current-accounts/help/terms/current-account-online-switch-offer-terms-and-conditions/

6 -

Thanks. Showing now, but tried applying and it's not having it: "We can't complete your application at the moment"Kazza242 said:Nationwide Building Society are launching a new regular saver, called 'Flex Regular Saver (Issue 2)', paying 8.00%- Deposit up to £200 per month

- The account is available to new and existing Nationwide current account customers

- You can make up to 3 penalty-free withdrawals

- It reverts into an instant access savings account after 12 months

- The account can be opened and managed online or via Nationwide's mobile app

Will try again at a saner hour!4

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards