We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Congratulations - very well done. I didn't win.SueDebt said:

Me! I've just received the email.t1redmonkey said:Anyone won in the Nationwide Start to Save prize draw? I just got an email saying I didn't win unfortunately, but wasn't expecting to anyway

Probably the first time I've ever won anything in my life.1 -

I've used them for sometime now, If you want 7 and 8% accounts it's worth a bit of 'archaic' in my books.Stargunner said:Everything about Monmouthshire BS seems so archaic, Their website is awful, they only use snail mail and who nowadays needs a passbook.They seem to have no automated systems for anything.

I applied on Tuesday for the 7% saver and I have not received an email, text or anything in the post so far,

I am wondering whether to pursue with it, because if it is this tedious to just set an account up, what is it like trying to withdraw money from it.I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.2 -

Way back I was staying in Chepstow so rang up made an appointment to open the previous Christmas R.S. Well I was greeted with a smile, taken into the managers office and given a cup of coffee. That's what I call good service.subjecttocontract said:I love the Monmouthshire B/Soc.....already got 2 accounts with them. When we were in Cardiff recently I blew them a kiss thru the window as we walked past. Don't suppose that's gonna speed up my 2 new applications but we like a good laugh.I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.4 -

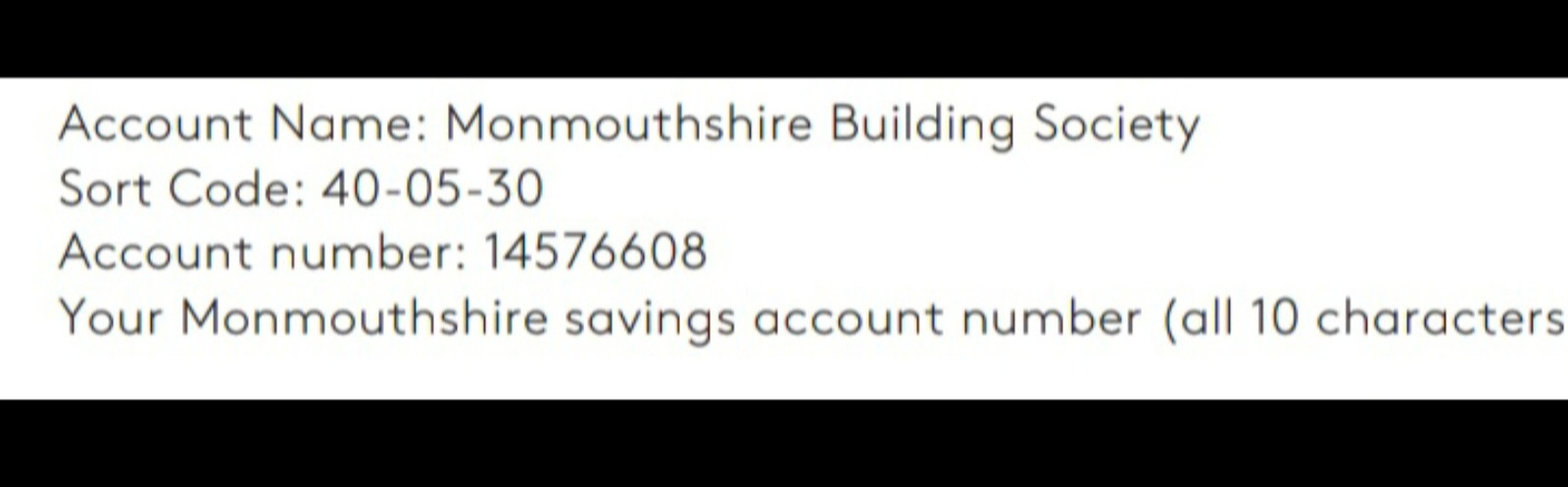

Monmouthshire

I've received a signature form in the post today (just for one of the regular savers so far). It has an account number on it. Can I therefore make a payment into the account for Tuesday before they receive my returned form? What is the format as there are no other instructions with it?0 -

..........granta said:Monmouthshire

I've received a signature form in the post today (just for one of the regular savers so far). It has an account number on it. Can I therefore make a payment into the account for Tuesday before they receive my returned form? What is the format as there are no other instructions with it?

2 -

granta said:Monmouthshire

I've received a signature form in the post today (just for one of the regular savers so far). It has an account number on it. Can I therefore make a payment into the account for Tuesday before they receive my returned form? What is the format as there are no other instructions with it?

I have had no problems in the past making an initial deposit into a new MBS RS once I had the account number. However you will not be able to withdraw money until you have completed all the opening criteria. But why would want to do that? The sooner you deposit the sooner your money starts to earn interest.

2 -

Applied for both Monmouthshire accounts when released on Wednesday morning using the first set of application forms (think revised around 11am). Left them to it without any phone calls and had confirmation emails yesterday morning and this morning then passbooks in post an hour ago. Both accounts added to my online profile and deposits sent.

Think how many more peoples accounts could have been processed if they didn't have to deal with so many phone calls by people checking on status of their application!!

Well done MBS for providing 2 very competitive products allowing £600 per month for existing members and £300 for new members. Maybe not instantly opened buy who cares when 3 days after applying you can have £600 earning and come the turn of month £1200 without having to chase them up once!!!3 -

If I set up a first direct monthly saver, can I deposit £300 today and £300 on 1st September please m0

-

If you are a new member it might be worth sending small test amount as seem to recall some people had their deposits returned if signature form hadn't been processed yet and membership therefore not officially opened. Seems less likely for people already with online access but completely new members are liable to have it returned. Suppose its a personal choice, if money sitting earning nothing then might aswell give it a shot but if earning 5% already hardly worth risking for an extra 2% for a few days whilst payment floating back and forth between accounts minimal amount either way but depends on attitude to maximising interest.granta said:Monmouthshire

I've received a signature form in the post today (just for one of the regular savers so far). It has an account number on it. Can I therefore make a payment into the account for Tuesday before they receive my returned form? What is the format as there are no other instructions with it?1 -

I got this as well, bit weird since I've had accounts with them for over a year so not sure why it's necessary.granta said:Monmouthshire

I've received a signature form in the post today (just for one of the regular savers so far). It has an account number on it. Can I therefore make a payment into the account for Tuesday before they receive my returned form? What is the format as there are no other instructions with it?1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards