We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Thanks for that, been keeping an eye on their website but it still says they "will make an announcement in due course"Bridlington1 said:I can't see it mentioned anywhere but according to moneyfacts from 10/8/23:

Cumberland Regular Saver Issue 3 will pay 5.25%

Cumberland First Home Saver Issue 2 will pay 4.35%

Also, on the geographical topic, slightly weird how Cumberland, a relatively large building society are much more restrictive on their "heartland" in comparison to their neighbour and the smallest building society in the UK, Penrith.2 -

Principality BS First Home Saver Online Issue 2:

Some other accounts have gone up too (learner earner issue 3, gift saver etc.). No new fixed rate RS issue at this time.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.5 -

Yay! My YBS CHRISTMAS 23 regular saver now showing at 5.75%

big money (LOL)4 -

Learner Earner Issue 1&2 from 5.55% to 5.75%.ForumUser7 said:Principality BS First Home Saver Online Issue 2:

Some other accounts have gone up too (learner earner issue 3, gift saver etc.). No new fixed rate RS issue at this time.1 -

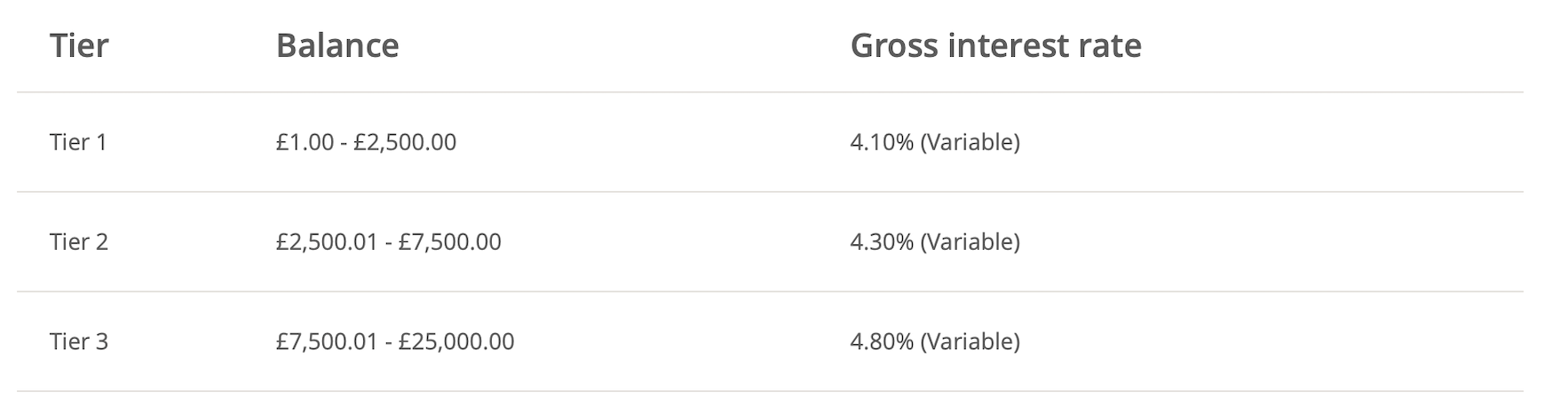

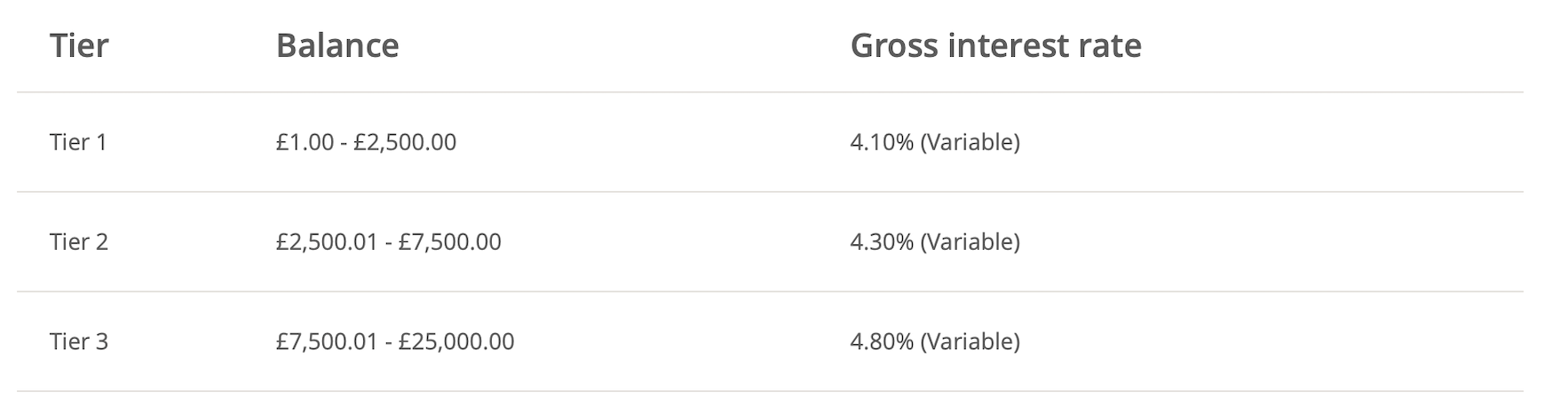

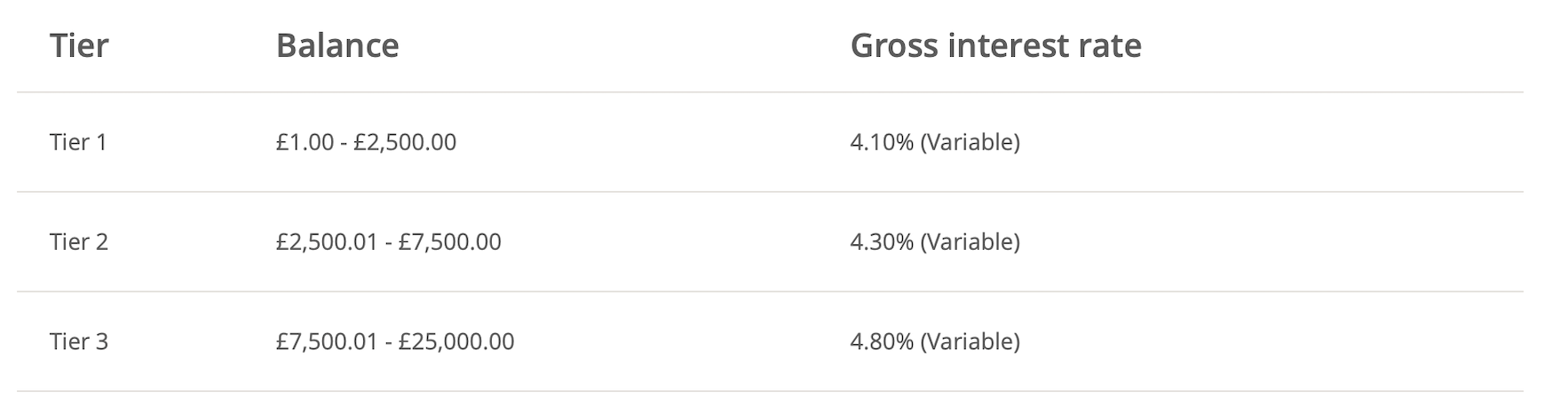

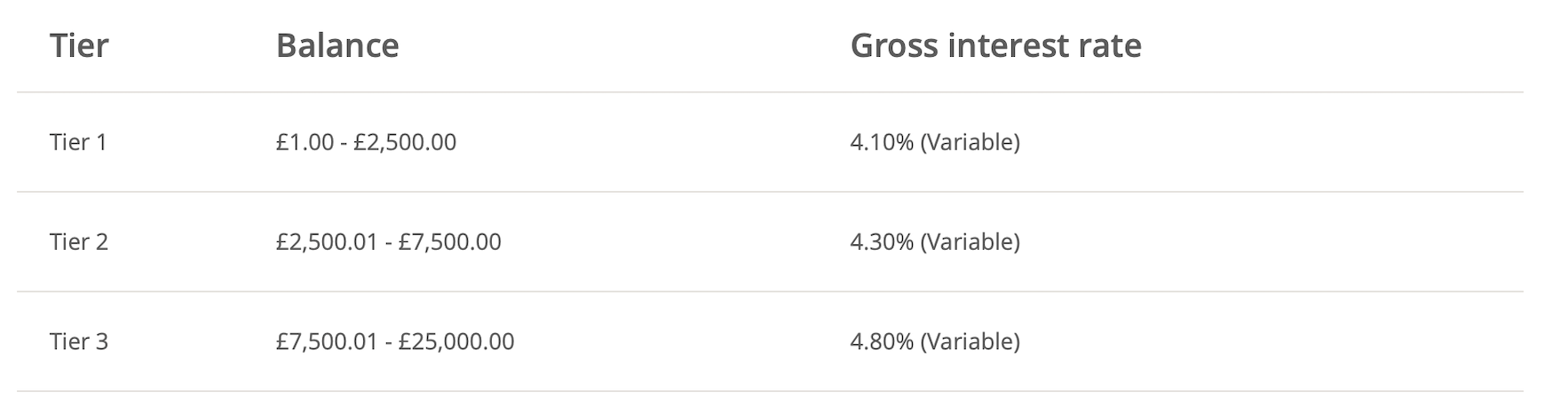

This used to be a top regular saver but it might be time to ditch it as its top tier rate is now the same as the top easy access accounts.ForumUser7 said:Principality BS First Home Saver Online Issue 2:

Some other accounts have gone up too (learner earner issue 3, gift saver etc.). No new fixed rate RS issue at this time.

1 -

These and Darlington used to be up there with the best, I removed all but £1 from my 4 Darlington accounts a couple of months ago and had withdrawn funds to leave enough in the Principality FHS1 and 2 to stay in the top tier, but now it looks as if it's time to shut them down and move it all into Tandem.rallycurve said:

This used to be a top regular saver but it might be time to ditch it as its top tier rate is now the same as the top easy access accounts.ForumUser7 said:Principality BS First Home Saver Online Issue 2:

Some other accounts have gone up too (learner earner issue 3, gift saver etc.). No new fixed rate RS issue at this time.

Furness 4.75% and SRBS 4.90% accounts in danger of going to unless there are imminent announcements to increase along with another 8 at 5%, but 4 of those are fixed at 5% so could go now.0 -

Principality BS First Home Saver(s)rallycurve said:

This used to be a top regular saver but it might be time to ditch it as its top tier rate is now the same as the top easy access accounts.ForumUser7 said:Principality BS First Home Saver Online Issue 2:

Some other accounts have gone up too (learner earner issue 3, gift saver etc.). No new fixed rate RS issue at this time.

I have three different issues/modes of these. Like you say rates have deteriorated compared to market. It felt like recent rises where not been passed on fully. All three accounts have been "on notice" for some time waiting to see if they lurch forward. Two accounts already cleared out and one left with £7501 waiting for what happens next. Based on this it seems like they will sit the accounts under BoE base rate going forward so pulled the plug on the last one today. 5% at easy access for now (better rate, improved terms, all win win for now).More generallyReg saver wise anything under 6% is not interesting, there is currently one 5% that I will probably renew as it it sits along side main current account and allows instant access so will treat as spare change if there is issues accessing money to cover something that has to be paid that day.Personally it will be nice to let some of these accounts lapse and close just to simplify my affairs.PSA is quite restrictive at higher rates so ISAs are my main focus. Circumstances mean S&S ISA wont yet get continuation but will be keeping that under review.1 -

Just wondering if people's interpretations of the key features of this are the same as mine:MDMD said:

Christmas saver is here: https://web.archive.org/web/20221203093556/https://www.monbs.com/products/christmas-saver-bond-issue-5/t1redmonkey said:Bit of a long shot but does anyone here have PDF's and/or Key Features saved for the Monmouthshire Xmas Regular Saver + the Coronation Saver?

- 12 month duration from when we would've opened it

- Can be closed before 1st October 2023 but interest paid at 0.2% if you do so

- However can be closed after 1st October 2023 (even if this is less than 12 months from when it was opened) and also will receive interest at 5.5% if closure happens on or after this date?0 -

That’s my interpretation. I stopped paying in months ago when better offers came along and the interest rate after tax was lower than my ISA.t1redmonkey said:

Just wondering if people's interpretations of the key features of this are the same as mine:MDMD said:

Christmas saver is here: https://web.archive.org/web/20221203093556/https://www.monbs.com/products/christmas-saver-bond-issue-5/t1redmonkey said:Bit of a long shot but does anyone here have PDF's and/or Key Features saved for the Monmouthshire Xmas Regular Saver + the Coronation Saver?

- 12 month duration from when we would've opened it

- Can be closed before 1st October 2023 but interest paid at 0.2% if you do so

- However can be closed after 1st October 2023 (even if this is less than 12 months from when it was opened) and also will receive interest at 5.5% if closure happens on or after this date?Just going to sit it out but won’t close early as want to maintain membership.1 -

Yeah I'm not planning to close it early, since I paid the max into it from November until June this year, haven't contributed to it since then. Just trying to figure out the earliest date I can close it to get the money + interest without forfeiting anyMDMD said:

That’s my interpretation. I stopped paying in months ago when better offers came along and the interest rate after tax was lower than my ISA.t1redmonkey said:

Just wondering if people's interpretations of the key features of this are the same as mine:MDMD said:

Christmas saver is here: https://web.archive.org/web/20221203093556/https://www.monbs.com/products/christmas-saver-bond-issue-5/t1redmonkey said:Bit of a long shot but does anyone here have PDF's and/or Key Features saved for the Monmouthshire Xmas Regular Saver + the Coronation Saver?

- 12 month duration from when we would've opened it

- Can be closed before 1st October 2023 but interest paid at 0.2% if you do so

- However can be closed after 1st October 2023 (even if this is less than 12 months from when it was opened) and also will receive interest at 5.5% if closure happens on or after this date?Just going to sit it out but won’t close early as want to maintain membership. 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards