We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Yes, I knowForumUser7 said:

The rate on the Regular e-Saver has gone from 4.50% to 5.00%. YBS product page still shows the 4.50%.Kazza242 said:

Hi, I think you meant to quote the post from the MSE member called Middle_of_the_Road (above). They were referring to a different account, the YBS Christmas 23 Regular e-Saver, which has not had an interest rate change today. It is still paying 5.00% (as of 17th May 2023).DJDools said:Kazza242 said:

I logged into YBS Online and my Regular E-Saver account (opened on the 1st June 2023) and which previously paid 4.50% is now 5.00%ForumUser7 said:YBS not showing RS on moneyfacts anymore - could either be going NLA, or increasing as easy access YBS not showing either

Confirmed, YBS Regular Savers on MoneyFacts at 5% - not 100% sure, but I think it is a rate increase rather than new issue. Will be able to confirm tomorrowI believe the YBS Christmas 2023 Regular e-Saver went Up from 4.75% to 5% on 17/05/2023, and previously up from 4.5% on 4/4/23

Please note that my post was referring to the YBS Regular e-Saver account, which has had its interest rate increased from 4.75% to 5.00% as of today (29/06/2023). I checked this on YBS Online banking earlier, as I have this account and it is definitely now paying an increased rate of 5.00%.

It was Christmas Regular e-Saver that was 4.75%, then went to 5% effective 17th May

. I was explaining this to the MSE members called, DJDools (and wisesomeofthetime) above. They got the YBS accounts mixed up. No problem.

. I was explaining this to the MSE members called, DJDools (and wisesomeofthetime) above. They got the YBS accounts mixed up. No problem.  Please call me 'Kazza'.1

Please call me 'Kazza'.1 -

No increase to the Loyalty regular esaver eitherForumUser7 said:

Christmas Saver was already 5% IIRCMiddle_of_the_Road said:Christmas saver now 5%

It was ~ https://forums.moneysavingexpert.com/discussion/comment/80044650/#Comment_80044650

Still at 5.5%

They are not an RS but the Loyalty 6 esaver remains at 4% too. The Loyalty ISA remains at 4.5% too

So much for loyalty eh?

0 -

If you look at https://www.ybs.co.uk/documents/productdata/YBM1607RC.pdf a lot of YBS accounts are getting an update on 7th Julysimonsmithsays said:

No increase to the Loyalty regular esaver eitherForumUser7 said:

Christmas Saver was already 5% IIRCMiddle_of_the_Road said:Christmas saver now 5%

It was ~ https://forums.moneysavingexpert.com/discussion/comment/80044650/#Comment_80044650

Still at 5.5%

They are not an RS but the Loyalty 6 esaver remains at 4% too. The Loyalty ISA remains at 4.5% too

So much for loyalty eh?

Xmas regular saver getting the full 0.5% points increase to 5.5%

Loyalty regular saver getting the full 0.5% points increase to 6%

Loyalty 6 access esaver and ISA getting the full 0.5% points increase to 4.5% and 5% respectively

and today:

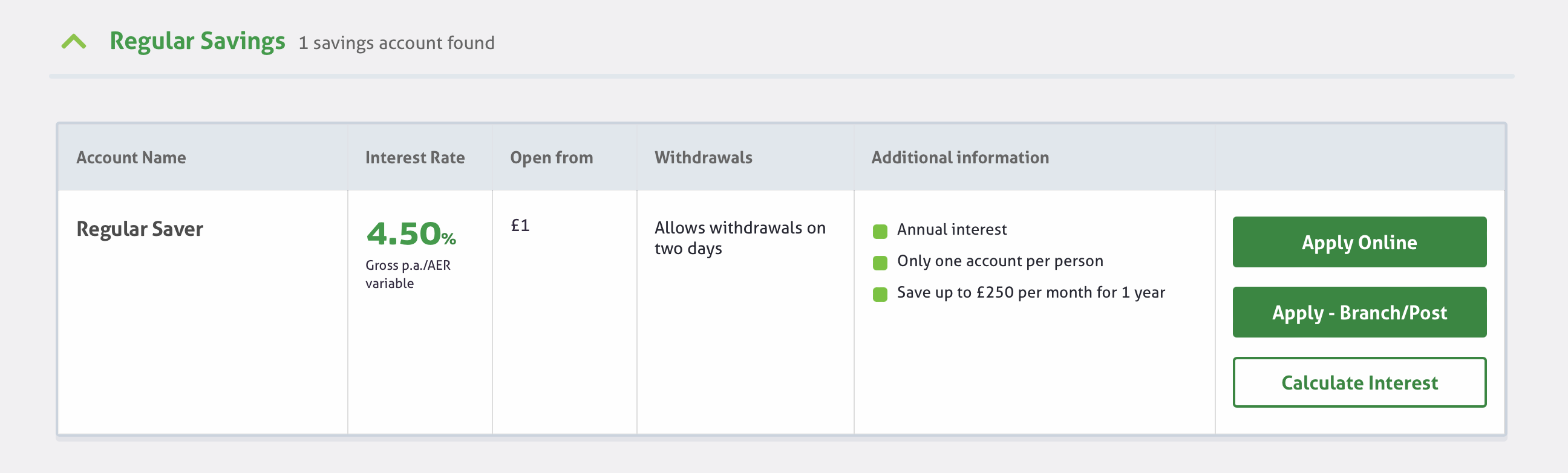

Regular saver (the 4.5% one) getting updated to 5%

13 -

-

AndyTh_2 said:

If you look at https://www.ybs.co.uk/documents/productdata/YBM1607RC.pdf a lot of YBS accounts are getting an update on 7th Julysimonsmithsays said:

No increase to the Loyalty regular esaver eitherForumUser7 said:

Christmas Saver was already 5% IIRCMiddle_of_the_Road said:Christmas saver now 5%

It was ~ https://forums.moneysavingexpert.com/discussion/comment/80044650/#Comment_80044650

Still at 5.5%

They are not an RS but the Loyalty 6 esaver remains at 4% too. The Loyalty ISA remains at 4.5% too

So much for loyalty eh?

Xmas regular saver getting the full 0.5% points increase to 5.5%

Loyalty regular saver getting the full 0.5% points increase to 6%

Loyalty 6 access esaver and ISA getting the full 0.5% points increase to 4.5% and 5% respectively

and today:

Regular saver (the 4.5% one) getting updated to 5%

I've just made my final payment into my Loyalty regular saver - just missed out on 6%. I'm hoping they have a new one in the pipeline!AndyTh_2 said:

If you look at https://www.ybs.co.uk/documents/productdata/YBM1607RC.pdf a lot of YBS accounts are getting an update on 7th Julysimonsmithsays said:

No increase to the Loyalty regular esaver eitherForumUser7 said:

Christmas Saver was already 5% IIRCMiddle_of_the_Road said:Christmas saver now 5%

It was ~ https://forums.moneysavingexpert.com/discussion/comment/80044650/#Comment_80044650

Still at 5.5%

They are not an RS but the Loyalty 6 esaver remains at 4% too. The Loyalty ISA remains at 4.5% too

So much for loyalty eh?

Xmas regular saver getting the full 0.5% points increase to 5.5%

Loyalty regular saver getting the full 0.5% points increase to 6%

Loyalty 6 access esaver and ISA getting the full 0.5% points increase to 4.5% and 5% respectively

and today:

Regular saver (the 4.5% one) getting updated to 5%Not Rachmaninov

But Nyman

The heart asks for pleasure first

SPC 8 £1567.31 SPC 9 £1014.64 SPC 10 # £1164.13 SPC 11 £1598.15 SPC 12 # £994.67 SPC 13 £962.54 SPC 14 £1154.79 SPC15 £715.38 SPC16 £1071.81⭐⭐⭐⭐⭐⭐⭐⭐⭐Declutter thread - ⭐⭐🏅0 -

https://www.express.co.uk/finance/personalfinance/1785703/Yorkshire-Building-Society-interest-rates-increase

"For the Loyalty Saver which has a new rate of five percent, a person can deposit up to £250 each month.The account has a one-year term so a person can deposit up to £3,000 over this time. Interest is calculated daily on cleared balances."

Anyone know which account this is? Thinking they've mis-named the Regular Saver and Regular eSaver

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2 -

Is anyone here using Beehive’s 6% RS? Mentioned in MSE recommendations but not seen it discussed here,0

-

Lots of us are ~ https://forums.moneysavingexpert.com/discussion/comment/80136255/#Comment_80136255jaypers said:Is anyone here using Beehive’s 6% RS? Mentioned in MSE recommendations but not seen it discussed here,If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.4 -

Thanks. If I open today (June), presumably I can pay another £250 on Monday (July)?ForumUser7 said:

Lots of us are ~ https://forums.moneysavingexpert.com/discussion/comment/80136255/#Comment_80136255jaypers said:Is anyone here using Beehive’s 6% RS? Mentioned in MSE recommendations but not seen it discussed here,0 -

Someone asked them and found out it was calendar month - based on that, I’d say as long as your deposit is marked as June then you’ll be fine to make another deposit in Julyjaypers said:

Thanks. If I open today (June), presumably I can pay another £250 on Monday (July)?ForumUser7 said:

Lots of us are ~ https://forums.moneysavingexpert.com/discussion/comment/80136255/#Comment_80136255jaypers said:Is anyone here using Beehive’s 6% RS? Mentioned in MSE recommendations but not seen it discussed here,If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards