We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Thank you for the suggestion but all of these require you to be existing account holder and i dont have any of those, and dont really want to move from santanderpookey said:

Have you looked at the first page?alrk said:I only started opening regular savers this year and already have halifax, nationwide, YBS and principality, all running fro a few months.

there dont seem to have been any new ones to add. (I dont have saffron etc etc account)

am i missing anything?

First Direct 7%

Natwest and RBS 6.17%0 -

You don't have to move from Santander, you can just open accounts with them without doing the switching

2 -

You don't have to leave Santander to join a different bank you just have to open a new account.alrk said:

Thank you for the suggestion but all of these require you to be existing account holder and i dont have any of those, and dont really want to move from santanderpookey said:

Have you looked at the first page?alrk said:I only started opening regular savers this year and already have halifax, nationwide, YBS and principality, all running fro a few months.

there dont seem to have been any new ones to add. (I dont have saffron etc etc account)

am i missing anything?

First Direct 7%

Natwest and RBS 6.17%

I'm sometimes a bit hesitant but if a different bank has a good rate it is worthwhile in the long run. I usually calculate the interest I can make to determine if it's worth it for myself1 -

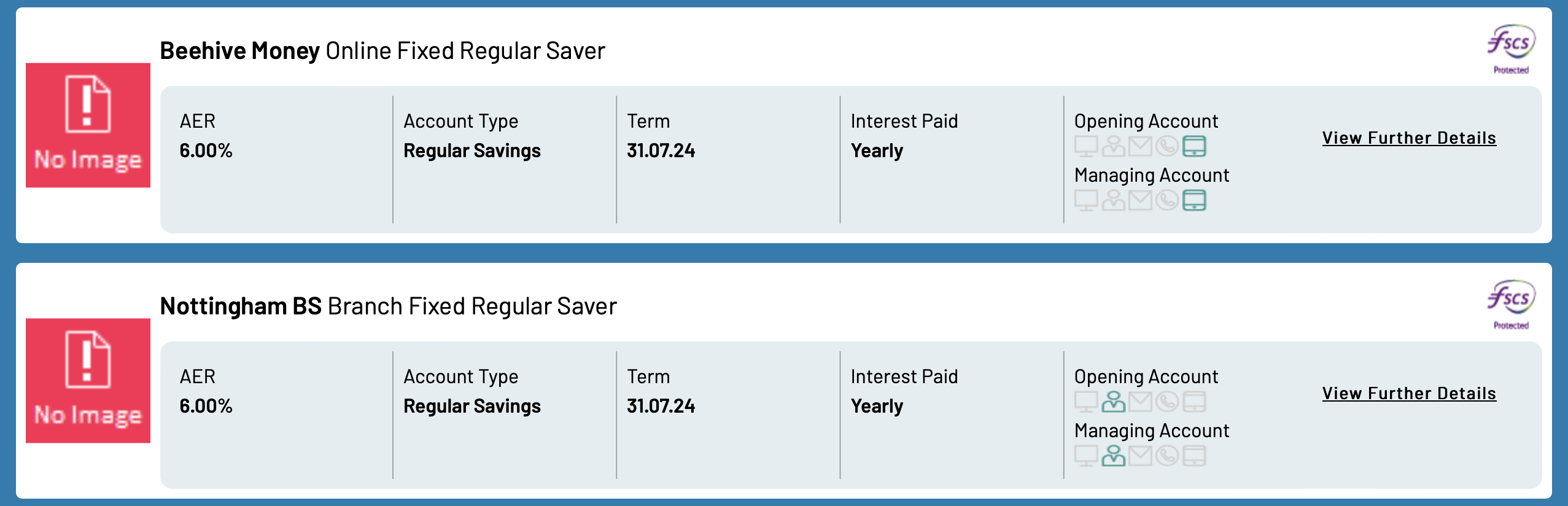

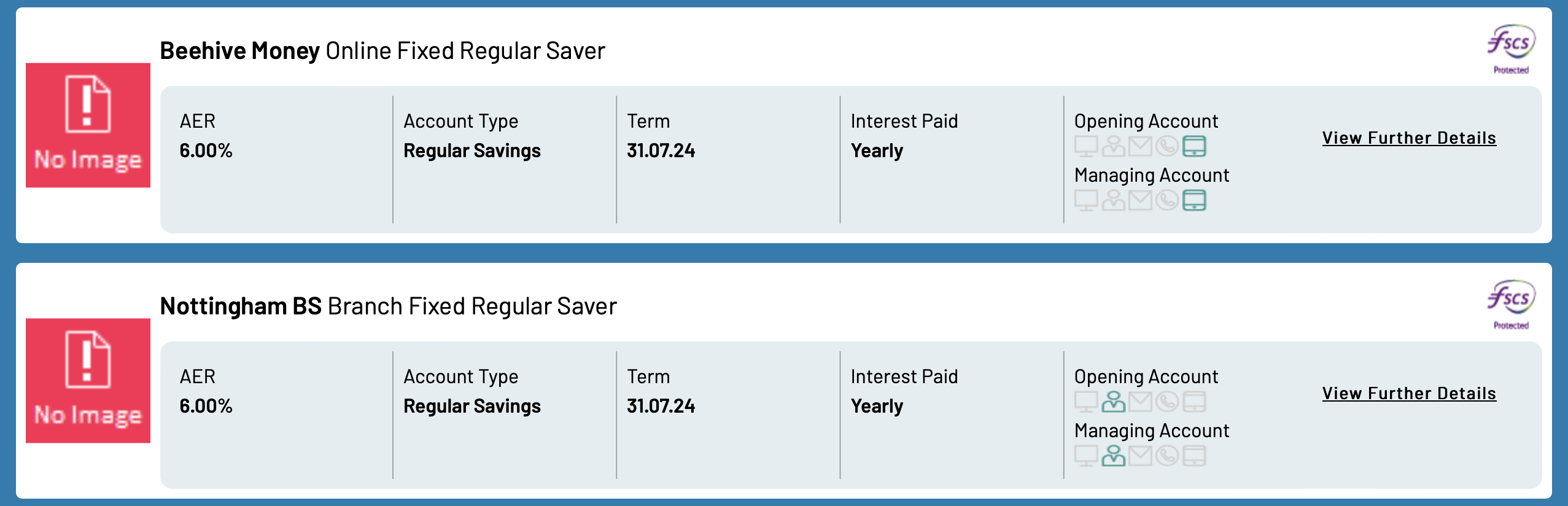

Some more RSs today

Beehive Money Online Fixed Regular Saver:- 6%

- £250 max monthly deposit

Nottingham BS Branch Fixed Regular Saver:- 6%

- £250 max monthly deposit

Both state 'no early access', so likely no withdrawals or closure.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.23 -

I haven't got the Beehive app, or online account, yet, but does this mean it's not available yet . . .ForumUser7 said:Some more RSs today

Beehive Money Online Fixed Regular Saver:- 6%

- £250 max monthly deposit

Nottingham BS Branch Fixed Regular Saver:- 6%

- £250 max monthly deposit

Both state 'no early access', so likely no withdrawals or closure.

Clicking on FIND OUT MORE just takes you back to the same screen/page.

I am trying to clarify what Beehive deem as a month, i.e. calendar month or anniversary month.

For example, if I open and fund one today, can I deposit on Sat 1 July too?

Anyone with previous experience who can confirm please?

Update: Beebot has helped me confirm it's CALENDAR month

1 -

Is Beehive Money regular saver an app only account ?0

-

I don't know.subjecttocontract said:Is Beehive Money regular saver an app only account ?

I have gone through the process of creating a profile account in the app, only to find that (a) the regular saver is not listed, and (b) they will not accept Starling as my linked account!!

Not great first impressions tbh.

Can log in online too, but still no sign of the regular saver.

Had to open an Easy Access account, which I don't need, just to gain access!!1 -

Yes, I think it's Nottingham BS's online seperately branded service (they both share the same FSCS limit).subjecttocontract said:Is Beehive Money regular saver an app only account ?

Good to see a new entry into the RS market anyway, I hope 6% becomes the 'new' 5% for Regular Savers, since a lot of them are starting to lose their appeal with rates going up elsewhere.2 -

Beehive 6% Regular Saver now visible in app

1 -

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards