We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Velvet_Monkey said:A certain dynamic has definitely changed in recent times with respect to savings accounts. It used to be that savings rates were above the base rate. Now, the base rate goes up by 0.5%, and institutions raise their rate by 0.3% expecting us to be happy?

Base rate is 4%, and banks offer savings accounts at 3%, with ability to simply deposit funds risk free with BoE at 4%? We deserve better!

The world is absolutely swimming in trillions of excess cash looking for a home. UK banks can borrow billions from central banks or money markets at the tap of a button. They no longer really need cash from retailer savers. Surprised some UK retail savers recently went as high as 5-7%, to be honest!0 -

Chase is listed on page 1 as one of the best feeder accounts, so this is on topic and helpful.RG2015 said:

Think you have posted on the wrong thread. This is the regular saver not easy access.DoneWorking said:From Chase just now

Good news – we're increasing the Chase saver account interest rate from 2.7% AER (2.67% gross) variable to 3% AER (2.96% gross) variable, effective from 13 February 2023.

Thanks @DoneWorking2 -

Thank you. I was not aware of this.Nick_C said:

Chase is listed on page 1 as one of the best feeder accounts, so this is on topic and helpful.RG2015 said:

Think you have posted on the wrong thread. This is the regular saver not easy access.DoneWorking said:From Chase just now

Good news – we're increasing the Chase saver account interest rate from 2.7% AER (2.67% gross) variable to 3% AER (2.96% gross) variable, effective from 13 February 2023.

Thanks @DoneWorking

Sincere apologies to @DoneWorking

1 -

I want to close my TSB monthly saver due to interest rate now too low.

With most online accounts with other providers there is an option to "close" the account and it will than add interest.

However, it is only giving me the option to "transfer" money. How do I actually close it?0 -

You'd probably have to ask them to close it. Alternatively, you can just withdraw your balance, cancel any SO you may have for the RS, and wait for maturity to pick up your accrued interest. As you aren't able to open a new TSB RS before maturity of your current one, this seems to be the least painful option.arsenalboy said:I want to close my TSB monthly saver due to interest rate now too low.

With most online accounts with other providers there is an option to "close" the account and it will than add interest.

However, it is only giving me the option to "transfer" money. How do I actually close it?

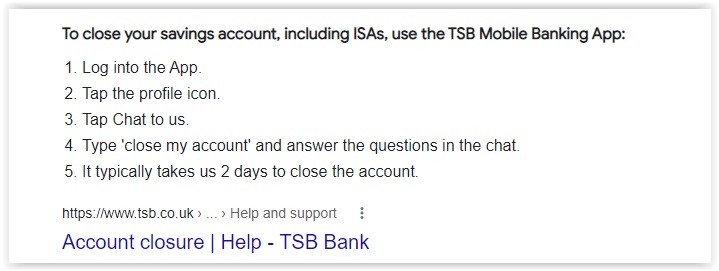

Although there is this:

3 -

It can be done through the app.arsenalboy said:I want to close my TSB monthly saver due to interest rate now too low.

With most online accounts with other providers there is an option to "close" the account and it will than add interest.

However, it is only giving me the option to "transfer" money. How do I actually close it?Log into the App

Tap the profile icon

Tap Chat to us

Type ‘close my account’ and answer the questions in the chat

It typically takes 2 days to close the account

But, other than collecting the interest, there is no real gain to closing the TSB saver as you can't open the higher rate one until the anniversary of the old one.

I, amongst others upthread, tried it personally when the 5% was launched.

4 -

Hi Folks,

I have changed the following items on page 1 of this thread.

- Stafford Railway BS Regular Saver (Issue 1) interest rate increased to 4.15%

- Leeds BS Regular Saver (Issue 37) added to the list of accounts that mature after more than 12 months, paying 3.7% variable on up to £250 per month until 2nd February 2025

- Leek BS Regular Saver added to the list of accounts with no maturity date for locals and existing members only, paying 3.5% variable on up to £500 per month with a maximum balance of £50,000

- Principality BS Christmas 2023 Regular Saver Bond withdrawn and removed from the list

- Principality BS 1 Year Regular Saver Bond (Issue 31) added to the list of accounts maturing after 12 months, paying 4% fixed on up to £250 per month

- Chase Saver Account (in the feeder account section) interest rate updated to 3% AER from 13th February 2023

I will do the next update next weekend.

SS2

For those new to this thread, the first few posts are constantly updated and are on the first page

https://forums.moneysavingexpert.com/discussion/6106986/regular-savings-accounts-the-best-currently-available-list/p1

36 -

You can ask them to close via their chat linearsenalboy said:I want to close my TSB monthly saver due to interest rate now too low.

With most online accounts with other providers there is an option to "close" the account and it will than add interest.

However, it is only giving me the option to "transfer" money. How do I actually close it?"Look after your pennies and your pounds will look after themselves"1 -

Thanks for TSB replies, I will try chat line first but from past experience of banking chat lines, they will only advise and not action. They will probably direct me to the App but I will probably end up transferring out and waiting 9 months for my £2 interest!0

-

If you don't mind waiting you could phone them, I closed mine and a couple of old savers last Wednesday

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards