We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Conversely, if rates start to fall over the period of the fixed rate account, the variable rate RS accounts and the EA feeders might fall behind. As said by someone else above, each person has their own circumstances to weigh up.2

-

This aged wellReg_Smeeton said:Is it just me or does the Regular Saver market seem a bit moribund right now? I’m closing/reducing my funding of almost all of mine given that I can by and large get better rates easy access or 1 yr fixes. , three months on and the situation has completely reversed!

, three months on and the situation has completely reversed!

Save £12k in 2020 #42 £12,551.25 / £14,000 89.65%5 -

Could you try another moribund assessment of the Regular Saver market, please, to see whether your prediction can spur another rally? ta very muchlyReg_Smeeton said:

This aged wellReg_Smeeton said:Is it just me or does the Regular Saver market seem a bit moribund right now? I’m closing/reducing my funding of almost all of mine given that I can by and large get better rates easy access or 1 yr fixes. , three months on and the situation has completely reversed! 9

, three months on and the situation has completely reversed! 9 -

I've been following the methods described by JamesRobinson48 for some years, had up to three RSs maturing each month to feed my existing RSs, but that has now been turned on its head. My next maturities are May, August, September. So my ongoing payments are coming out of easy access money (principally Santander 2.75% and Coventry 3.25%) and if and when that runs out I'll be withdrawing funds from ongoing RSs, or even closing them.

4 -

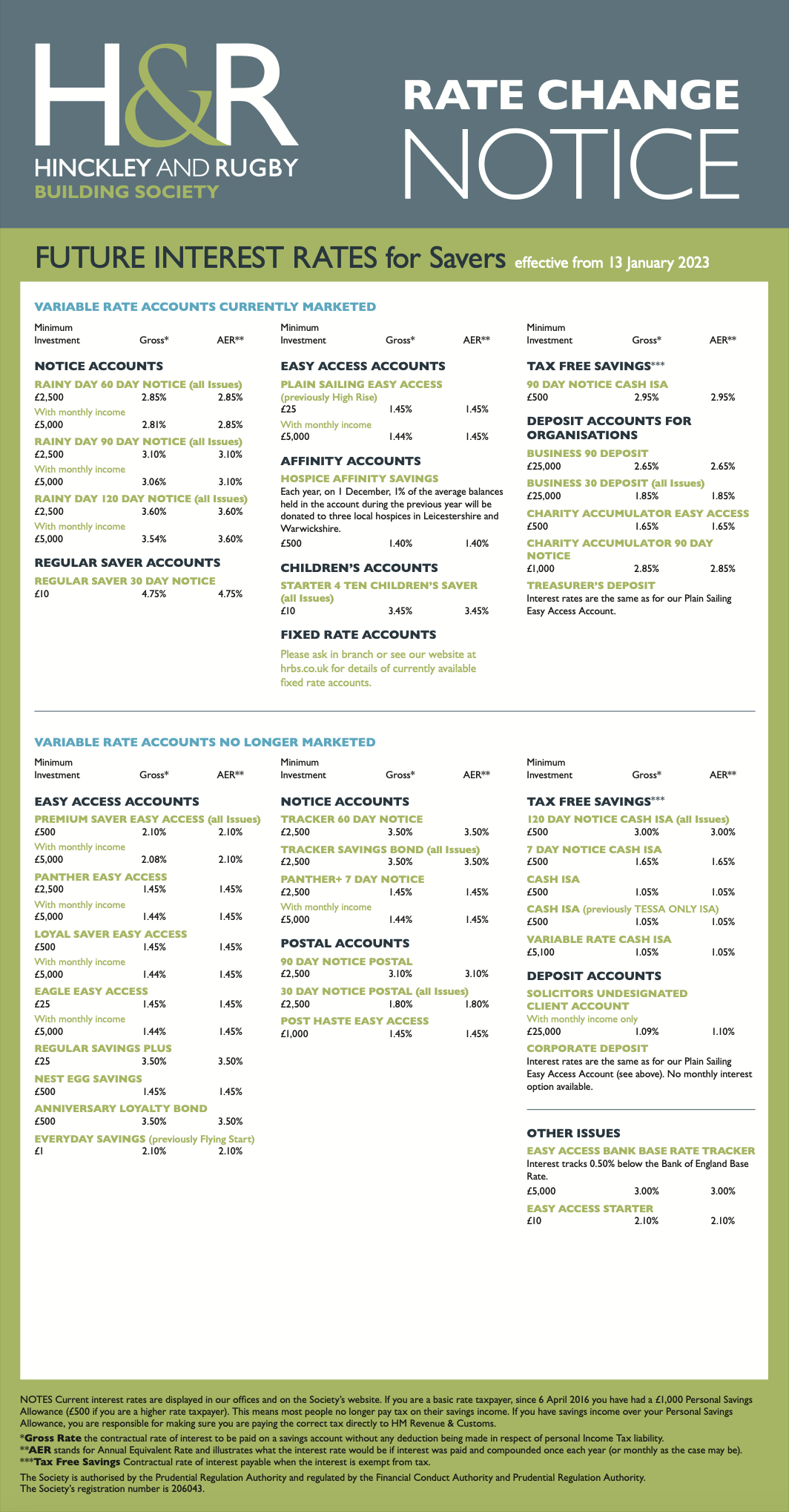

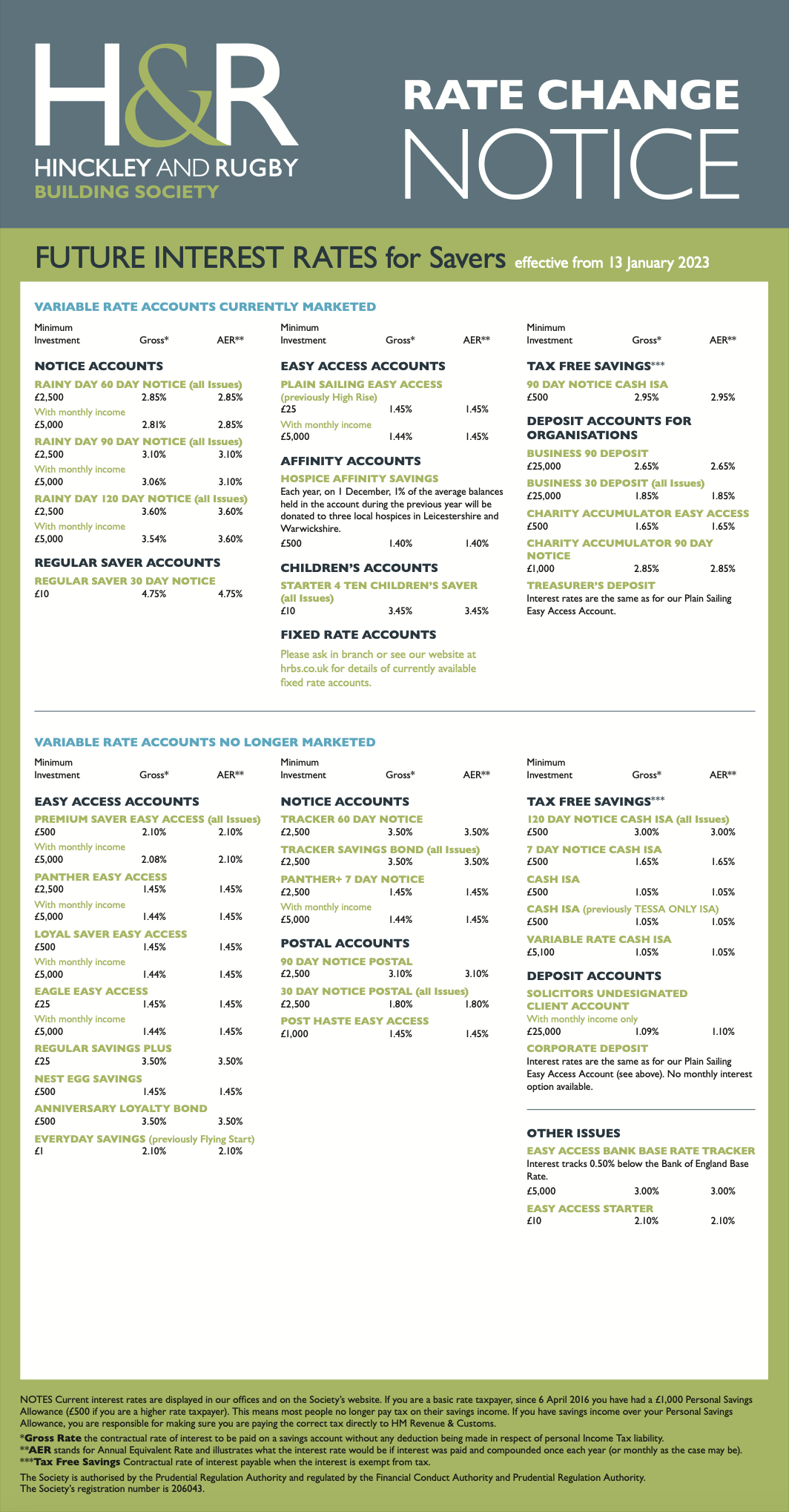

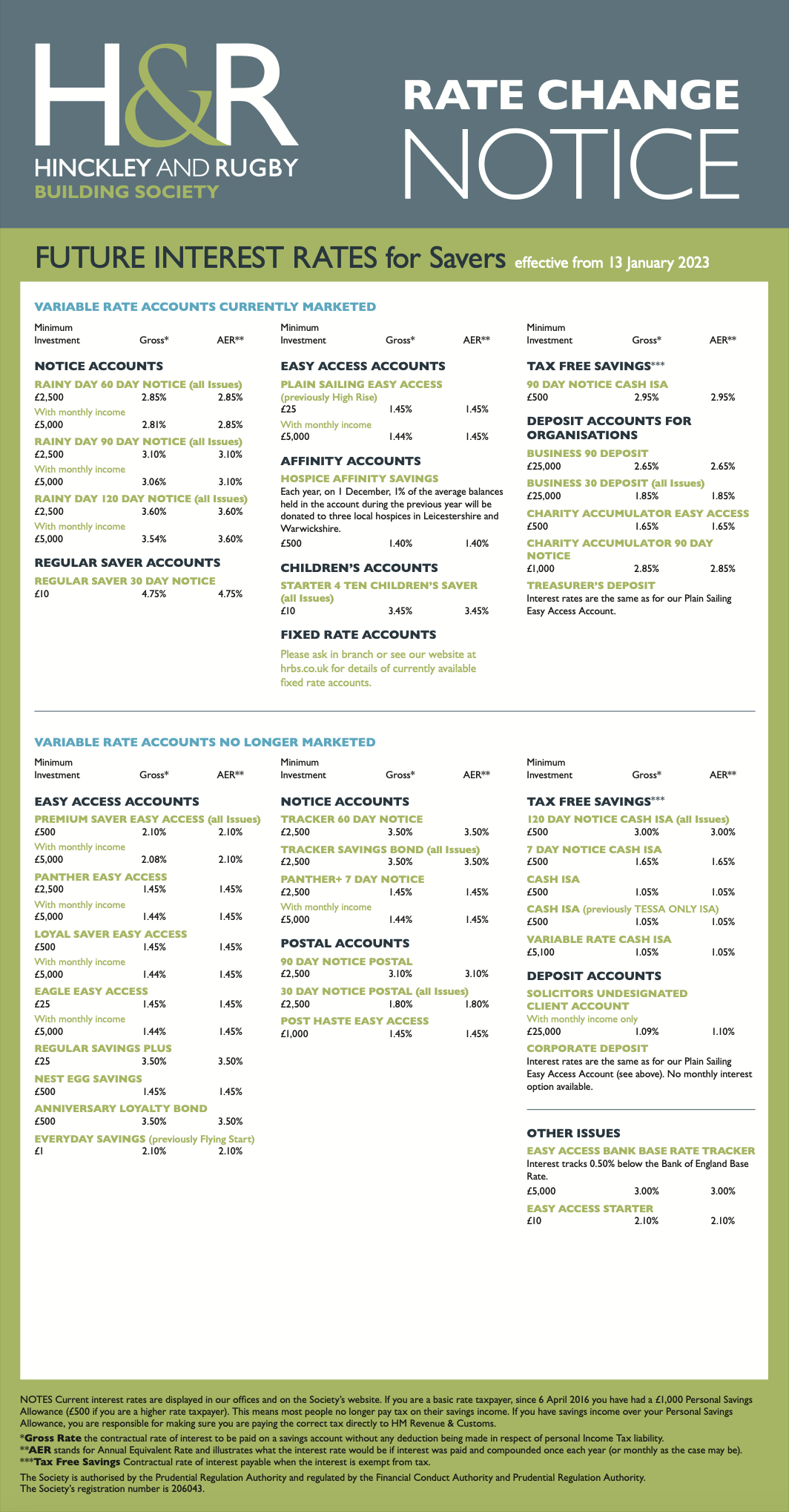

Effective 13th Jan, Hinckley And Rugby Building Society rates are increasing (Source ~ https://www.hrbs.co.uk/wp-content/uploads/2023/01/Interest-Rates-Notice-01-23.pdf):

- Regular Saver 30 Day Notice is going from 4.25% to 4.75%

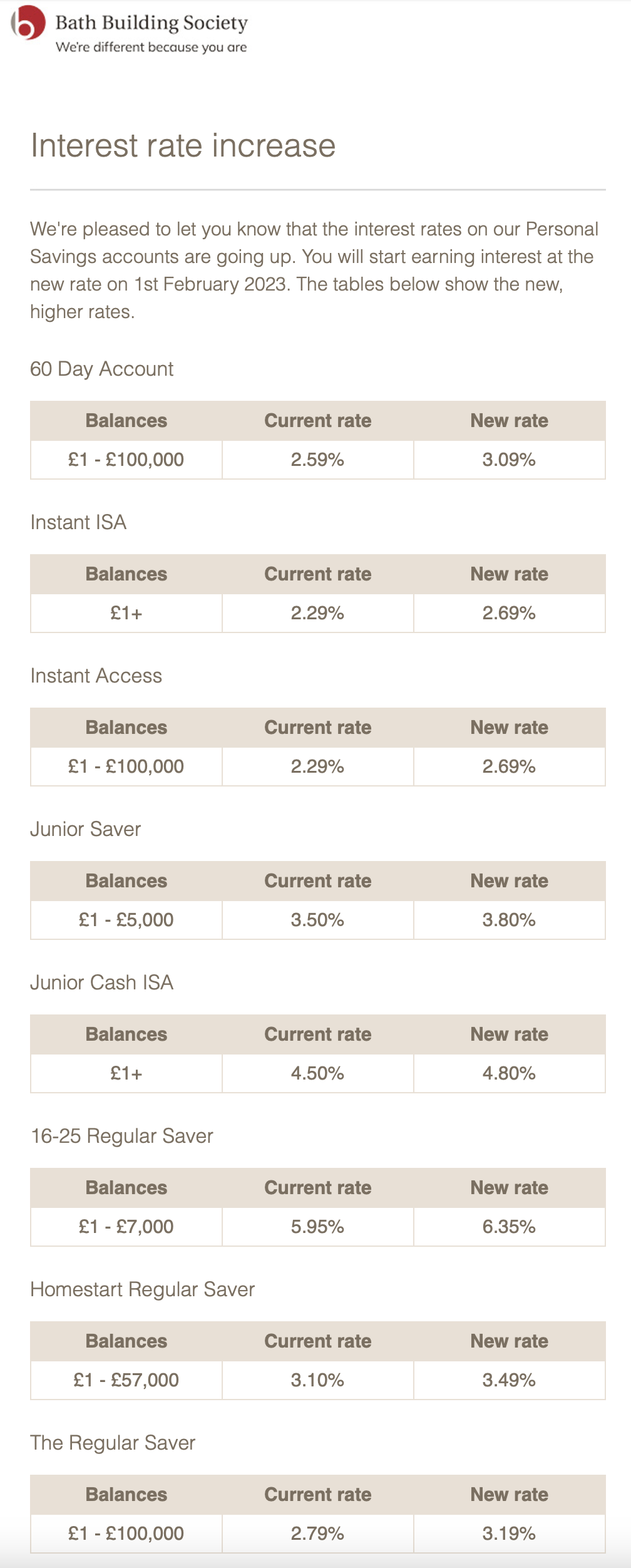

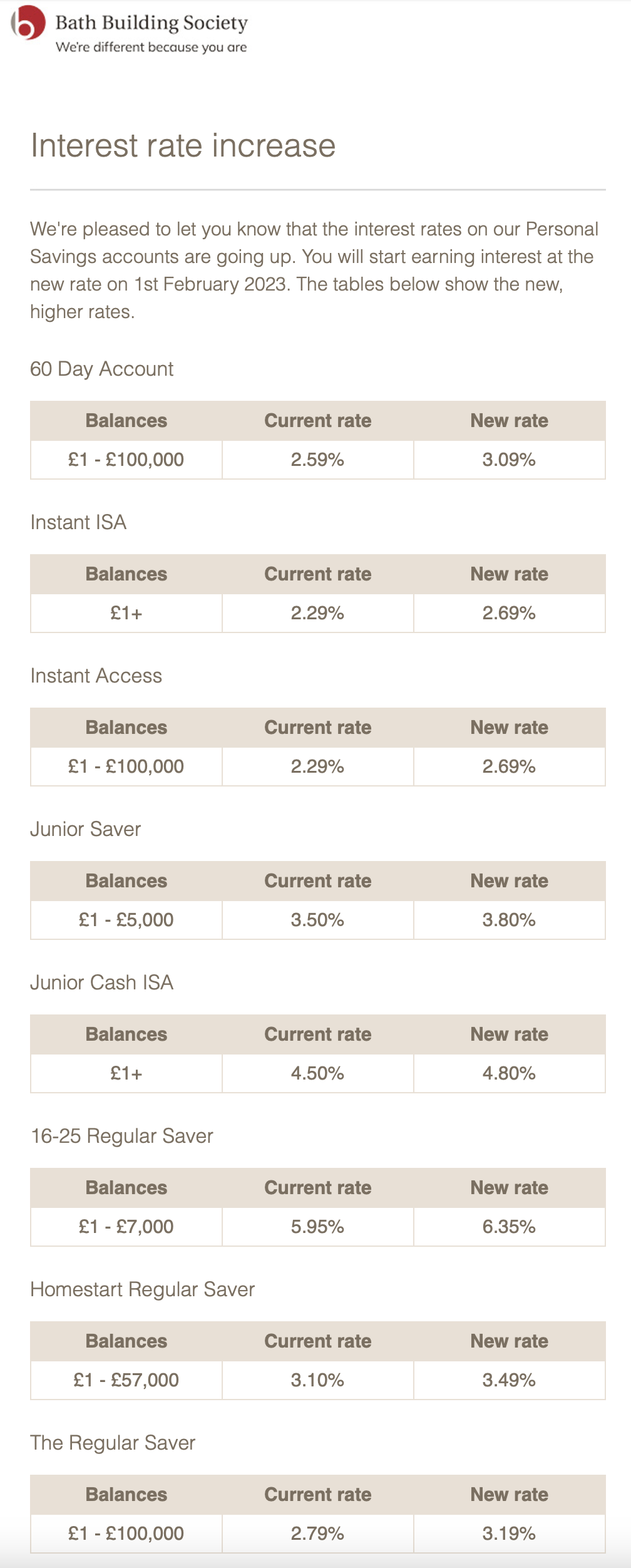

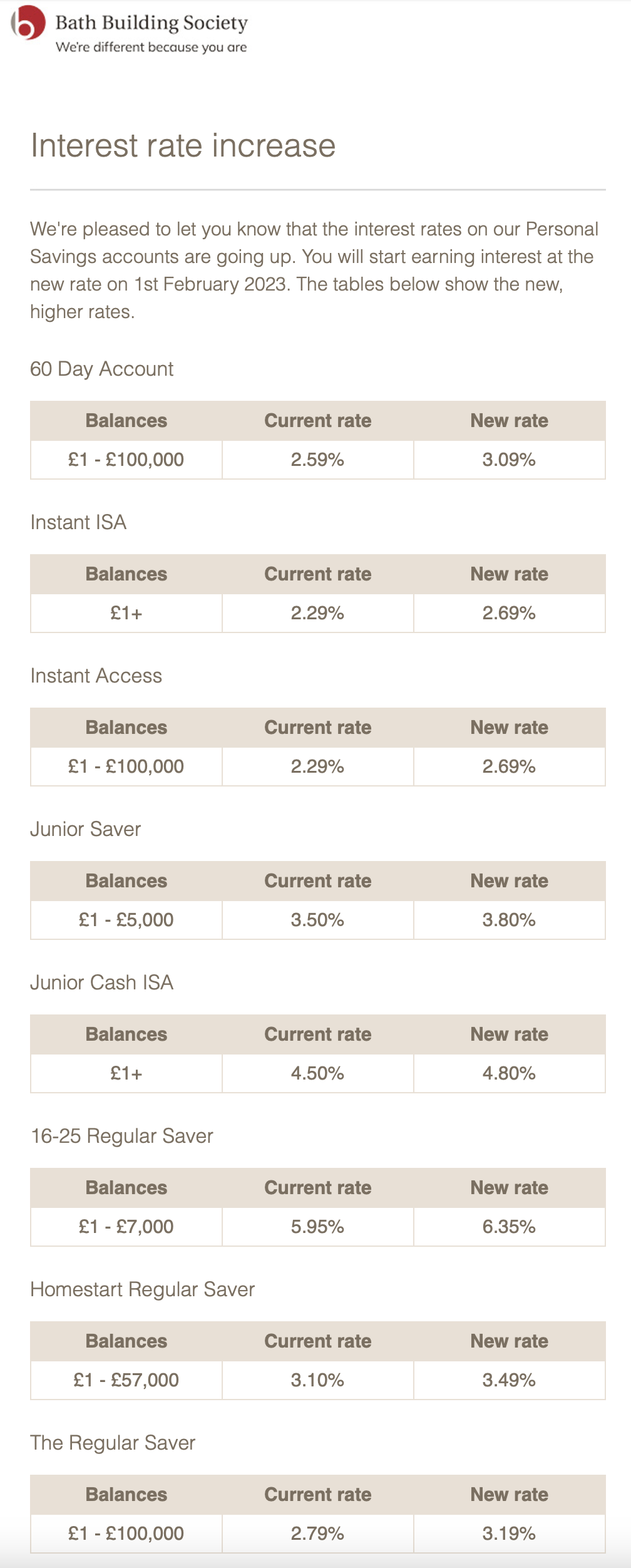

Effective 1st Feb, Bath Building Society rates are increasing (Source ~ Customer Marketing Email):- 16-25 Regular Saver is going from 5.95% to 6.35%!

- Homestart Regular Saver is going from 3.10% to 3.49%

- The Regular Saver is going from 2.79% to 3.19%

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.7 -

ForumUser7 said:Effective 13th Jan, Hinckley And Rugby Building Society rates are increasing (Source ~ https://www.hrbs.co.uk/wp-content/uploads/2023/01/Interest-Rates-Notice-01-23.pdf):

- Regular Saver 30 Day Notice is going from 4.25% to 4.75%

Effective 1st Feb, Bath Building Society rates are increasing (Source ~ Customer Marketing Email):- 16-25 Regular Saver is going from 5.95% to 6.35%!

- Homestart Regular Saver is going from 3.10% to 3.49%

- The Regular Saver is going from 2.79% to 3.19%

I’ve just been to the Hinckley & Rugby website regarding the regular saver and can’t find the forms to fill in for the account! Am I loosing the plot, can some one direct me to them please.

I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.1 -

I couldn't find it either so just rang them instead and they sent me an application pack, which arrived the next day. Quite a quick account to set up considering it's a postal account.trickydicky14 said:ForumUser7 said:Effective 13th Jan, Hinckley And Rugby Building Society rates are increasing (Source ~ https://www.hrbs.co.uk/wp-content/uploads/2023/01/Interest-Rates-Notice-01-23.pdf):- Regular Saver 30 Day Notice is going from 4.25% to 4.75%

Effective 1st Feb, Bath Building Society rates are increasing (Source ~ Customer Marketing Email):- 16-25 Regular Saver is going from 5.95% to 6.35%!

- Homestart Regular Saver is going from 3.10% to 3.49%

- The Regular Saver is going from 2.79% to 3.19%

I’ve just been to the Hinckley & Rugby website regarding the regular saver and can’t find the forms to fill in for the account! Am I loosing the plot, can some one direct me to them please.

2 -

I had trouble locating the application button a couple of months back

You need to hit the 'Apply Now' tab which is located immediately above the Summary Box.

https://www.hrbs.co.uk/saving-product/regular-saver-30-day-notice-account/

6 -

For those with an existing Cambridge regular saver account who are interested in the reward regular saver, it is possible to request this be opened at maturity of your existing regular saver account with the first month's funds being taken from the maturing account.1

-

According to the MSE site the Barclays rainy day account is a regular saver with no limits on monthly credits. So, can I just deposit £5k once into the account ?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards