We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Yes...........subjecttocontract said:According to the MSE site the Barclays rainy day account is a regular saver with no limits on monthly credits. So, can I just deposit £5k once into the account ?1 -

That's a really odd one from MSE. Barclays aren't calling it a Regular Saver, and the account has none of the characteristics of a Regular Saver account. Yes, you can put £5k in at once, and you can withdraw and deposit as much as you like whenever you like.subjecttocontract said:According to the MSE site the Barclays rainy day account is a regular saver with no limits on monthly credits. So, can I just deposit £5k once into the account ?1 -

I wonder if that is because it beats most regular savings accounts (normally RS rates are better than EA).Band7 said:

That's a really odd one from MSE. Barclays aren't calling it a Regular Saver, and the account has none of the characteristics of a Regular Saver account. Yes, you can put £5k in at once, and you can withdraw and deposit as much as you like whenever you like.subjecttocontract said:According to the MSE site the Barclays rainy day account is a regular saver with no limits on monthly credits. So, can I just deposit £5k once into the account ?

Be daft to miss/avoid it just because it's not an RS.0 -

I have no idea what the reason might be. I also certainly don't advocate to miss the account. I was amongst the first ones opening it. AFAIK, this forum lists the account in the Easy Access thread.k_man said:

I wonder if that is because it beats most regular savings accounts (normally RS rates are better than EA).Band7 said:

That's a really odd one from MSE. Barclays aren't calling it a Regular Saver, and the account has none of the characteristics of a Regular Saver account. Yes, you can put £5k in at once, and you can withdraw and deposit as much as you like whenever you like.subjecttocontract said:According to the MSE site the Barclays rainy day account is a regular saver with no limits on monthly credits. So, can I just deposit £5k once into the account ?

Be daft to miss/avoid it just because it's not an RS.0 -

subjecttocontract said:According to the MSE site the Barclays rainy day account is a regular saver with no limits on monthly credits. So, can I just deposit £5k once into the account ?

Above the comparison table:

"Alternatively, Barclays Blue Rewards members can get its Rainy Day Saver, which pays 5.12% on up to £5,000. It's not a regular savings account (you could choose to pay in £5,000 on day one), so it has more flexibility than the others. Though here the rate is variable, so keep watch."1 -

Penrith BS and Loughborough BS have made changes to their interest rates effective today, but NONE of their RS accounts (open issue or closed issues) have changed with the rates now really poor.

Suffolk BS has an open RS at 3.15%, their closed issue Smart Save / Holiday Save rises to 4.35%, and their RS ISA closed issue goes up to 2.70%. All effective 1 Feb 2023.4 -

Oh good. Perhaps they'll now have time to provide me with my activation code. Only applied for the account in November last year.......can't attribute all the delays to the post office. Some time in 2023......I don't know when, perhaps I'll be able to get online access to my account.JamesRobinson48 said:Monmouthshire BS has withdrawn its Christmas RS (5.5%). That account now appears on the list of withdrawn fixed rate accounts which was updated today on the MonBS's website.

HSBC aren't far behind. I applied for an account with them 6th December......still Don't have online access to the account on 13th January.

Can't wait for the satisfaction questionnaires.2 -

Great news.......the HSBC satisfaction questionnaire arrived. I enjoyed venting my anger. Who knows, perhaps they might ring me.1

-

subjecttocontract said:Great news.......the HSBC satisfaction questionnaire arrived. I enjoyed venting my anger. Who knows, perhaps they might ring me.Yes - I seem to remember Monmouthshire Building Society requesting my thoughts on them recently!I didn`t participate!

0 -

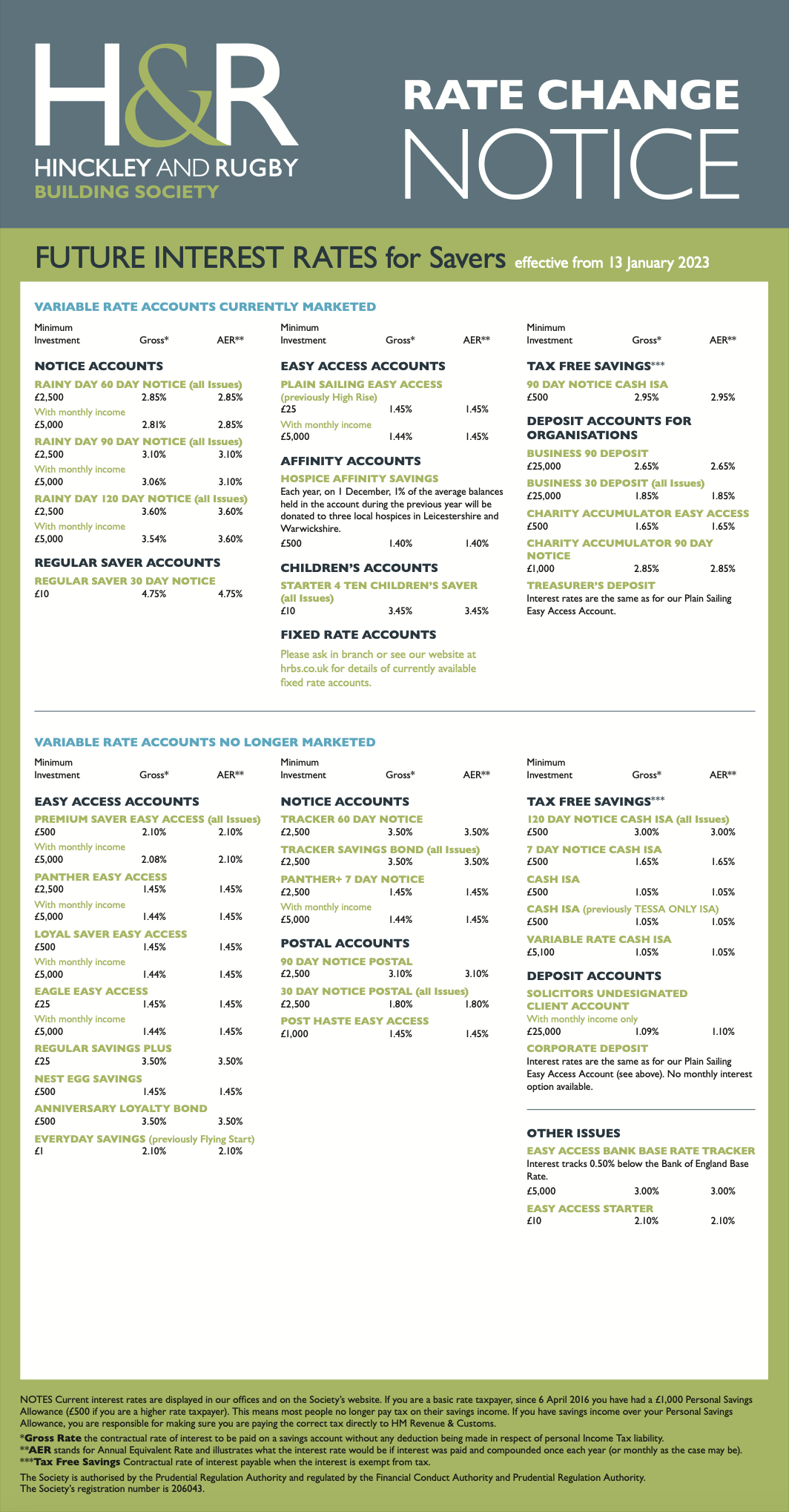

ForumUser7 said:Effective 13th Jan, Hinckley And Rugby Building Society rates are increasing (Source ~ https://www.hrbs.co.uk/wp-content/uploads/2023/01/Interest-Rates-Notice-01-23.pdf):

- Regular Saver 30 Day Notice is going from 4.25% to 4.75%

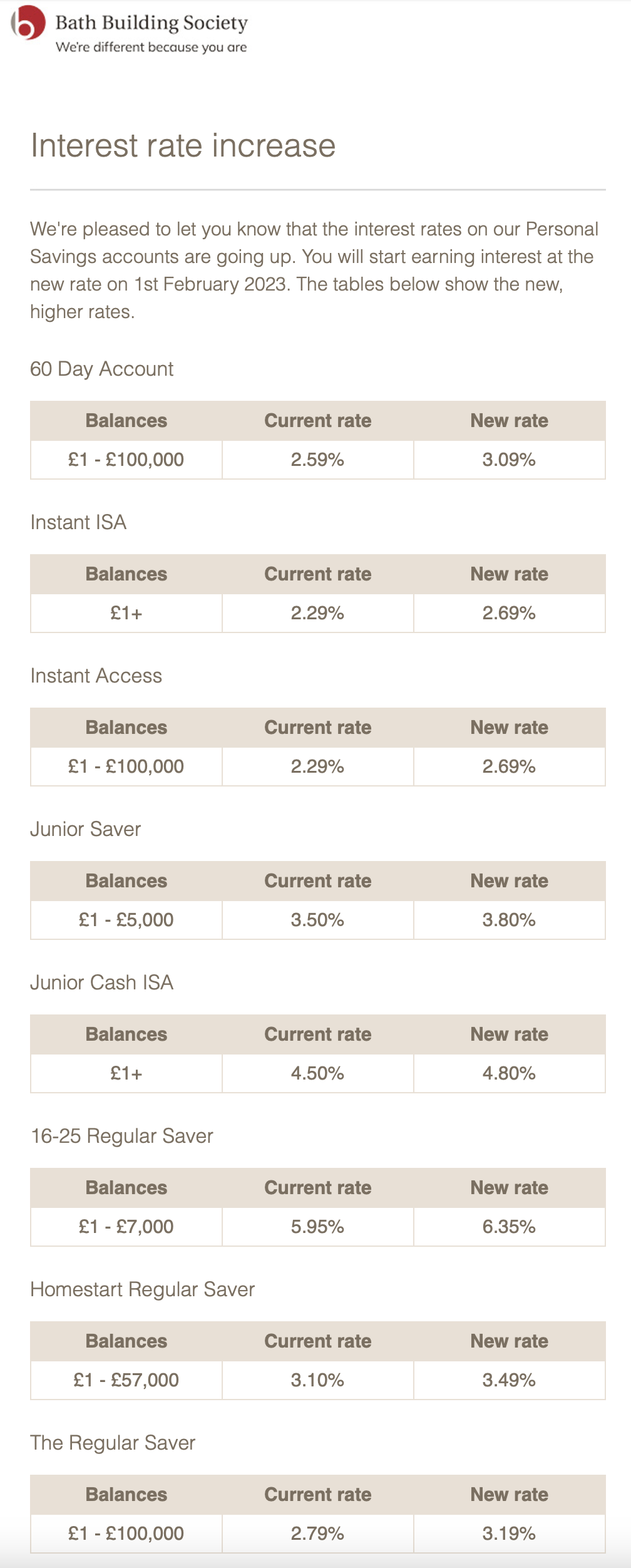

Effective 1st Feb, Bath Building Society rates are increasing (Source ~ Customer Marketing Email):- 16-25 Regular Saver is going from 5.95% to 6.35%!

- Homestart Regular Saver is going from 3.10% to 3.49%

- The Regular Saver is going from 2.79% to 3.19%

Hinckley and Rugby regular saver.

Sent application forms off Thursday 11am with a second class stamp, 1pm the next day call from H&R to inform me account is now being setup. Good rate, large deposit allowed, happy with that.

Refreshing after my Monmouth B.S experience.

I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards