We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

surreysaver said:The danger of waiting is they pull the product. Open it now and put £1 in to secure the product, then you can put £999 in at the beginning of the final month.

But if you put £1k in now, it might only be earning 2.95% for a couple of weeks, but it will be earning (subject to interest rate changes) 5% for nearly the next three years. If you pay it in the last month, it will only be earning 5% for the last few days its in the accountYou can put in £1k now AND £1k in the final month. The a/c allows total deposits of £37k as long as the initial deposit is not on 1st of the month. Coventry BS website gives an example of this.1 -

pecunianonolet said:...Section62 said:...Thank you both - account opened before I even realised I had completed the process! I abstain from banking with mainstream banks like Barclays for ethical reasons. I've been happy to save with BSs even if I wasn't getting the best interest, but it's doubly pleasing to know I'll be getting near the top interest rate - at least for now...I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.0

-

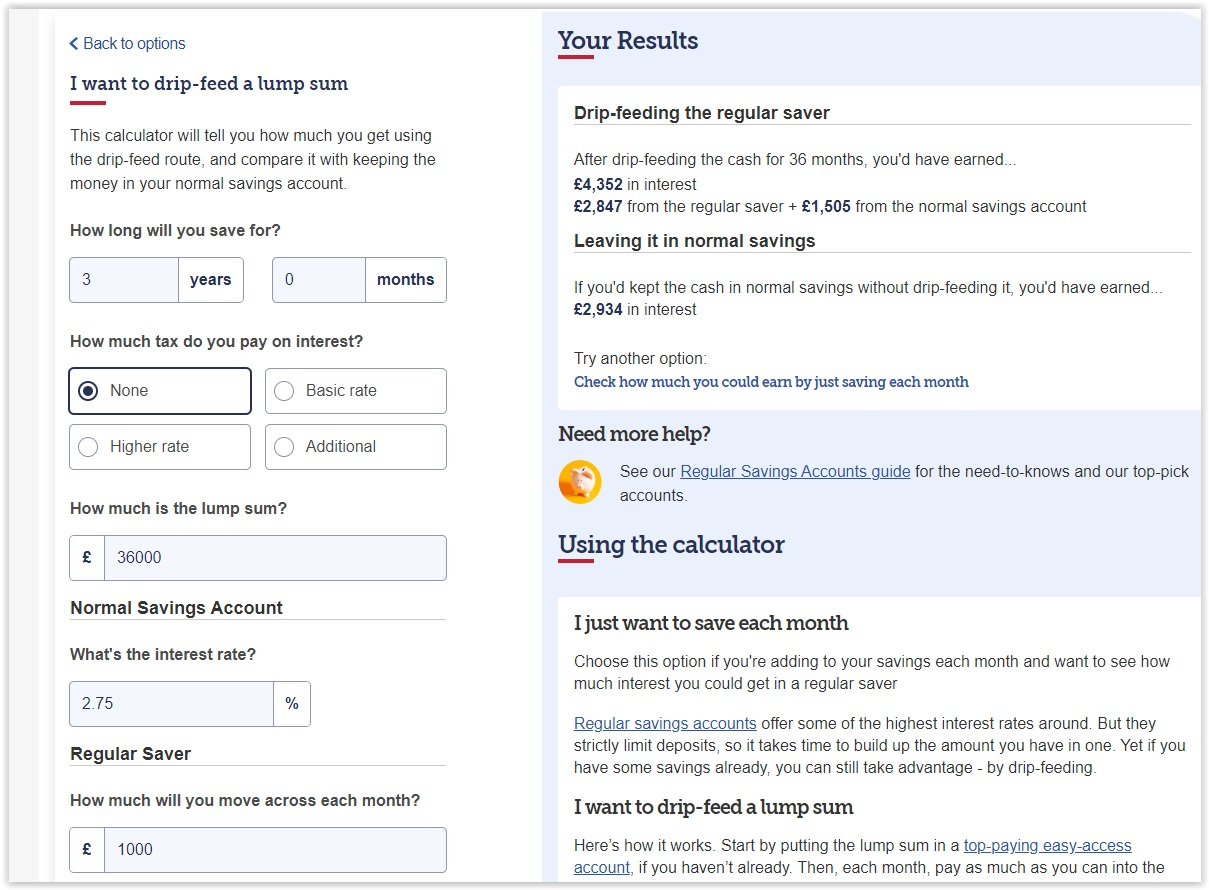

I can't get the RS calculator to work on my phone.Could some kind person please work out the interest amount gained over the three years if I save the £36K in the FH saver by drip feeding from a 2.75% account, rather than leaving it just in the 2.75% account ?( On the hypothesis that neither the Coventry TH saver rate of 5% in January, or the 2.75 % rates remain unchaged)

TIA0 -

Hi Folks,

I have changed the following items on page 1 of this thread for this weekend's update.

- HSBC Regular Saver Account updated to show the maximum monthly deposit is £250 (apologies that I had £300 - this account is so similar to the First Direct account that I copied, pasted and edited my First Direct entry to create the HSBC entry and the maximum monthly deposit is £300 per month on the First Direct account)

- Monmouthshire BS Christmas Saver (Issue 5) and Monmouthshire BS Regular Saver Bond (Issue 8) updated to show the minimum monthly deposit is £0

- Beehive (part of Nottingham BS) Home Starter Regular Saver entry updated to show it is "Issue 2"

- Yorkshire BS Loyalty Regular Saver (Issue 2) / Regular eSaver withdrawn and removed from the list on page 1

- Chase Saver Account from the feeder account section interest rate updated to show it will be paying 2.67% gross / 2.7% AER from 4th January 2023

- Coventry BS Regular Saver (Issue 5) interest rate updated to show it will be 4% from 6th January 2023

- Coventry BS First Home Saver interest rate updated to show it will be 5% from 6th January 2023

I will do the next update in early January. Happy holidays everybody!!!

SS2

For those new to this thread, the first few posts are constantly updated and are on the first page

https://forums.moneysavingexpert.com/discussion/6106986/regular-savings-accounts-the-best-currently-available-list/p1

31 -

movingon said:I can't get the RS calculator to work on my phone.Could some kind person please work out the interest amount gained over the three years if I save the £36K in the FH saver by drip feeding from a 2.75% account, rather than leaving it just in the 2.75% account ?( On the hypothesis that neither the Coventry TH saver rate of 5% in January, or the 2.75 % rates remain unchaged)

TIADrip-feeding the regular saver

After drip-feeding the cash for 36 months, you'd have earned...

£4,352 in interest

£2,847 from the regular saver + £1,505 from the normal savings accountLeaving it in normal savings

If you'd kept the cash in normal savings without drip-feeding it, you'd have earned...

£2,934 in interestI'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.6 -

Here you go. Though keeping your principal in the 2.75% one doesn't give you the best return. Plenty of higher rates available, e.g. with Zopa, Coventry 6 access, other Regular Savers etcmovingon said:I can't get the RS calculator to work on my phone.Could some kind person please work out the interest amount gained over the three years if I save the £36K in the FH saver by drip feeding from a 2.75% account, rather than leaving it just in the 2.75% account ?( On the hypothesis that neither the Coventry TH saver rate of 5% in January, or the 2.75 % rates remain unchaged)

TIA

3 -

Thank you both0

-

Just had a text....

"Just letting you know the interest of 5.00% / 5.12% Gross/AER p.a.(variable) on your Digital Regular Saver is now available on balances right up to £5,0000 (Previously £1,000)."

I thought that was the case for about two weeks...

1 -

Yes, the change was effective from 6th December.phillw said:Just had a text....

"Just letting you know the interest of 5.00% / 5.12% Gross/AER p.a.(variable) on your Digital Regular Saver is now available on balances right up to £5,0000 (Previously £1,000)."

I thought that was the case for about two weeks...

https://forums.moneysavingexpert.com/discussion/6402502/rbs-and-natwest-digital-saver-changes/p1

0 -

I deposited a second £150 into my RBS Digital Saver this month by mistake - both on December 6th, one by a one-off scheduled payment that I had forgotten about, and one I made manually. When logging into my RBS account today, I noticed it's been returned on the 12th. I can't tell whether this happened automatically or whether it was a manual intervention.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards