We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Section62 said:Coventry Building SocietyIf you opened the Regular Saver issue 5 when it was first launched and it has since matured, there appears to be nothing stopping you opening a new (replacement) one to take advantage of the soon to be 4% interest rate paid on this account.The 'one only' rule here seems to be for accounts held concurrently, not sequentially.Whether there might be an issue 6 launched (perhaps with a better rate) in the near future I didn't think was worth gambling on, when the issue 5 was still available and will pay a better rate soon.The main issue with this Coventry RS i5 is flexibility if you have not maxed out the RSA paying 4%+ interest easy access.Can I withdraw money?After the 14 day ‘cooling-off period’, you can take out money or close your account, but you’ll be charged the equivalent of 30 days’ interest on the amount you withdraw. This will be taken off your balance. You can’t give notice to withdraw. Money you take out must be paid into your Named Bank Account or another CBS account.

0 -

You can miss payments if you wish.adindas said:Section62 said:Coventry Building SocietyIf you opened the Regular Saver issue 5 when it was first launched and it has since matured, there appears to be nothing stopping you opening a new (replacement) one to take advantage of the soon to be 4% interest rate paid on this account.The 'one only' rule here seems to be for accounts held concurrently, not sequentially.Whether there might be an issue 6 launched (perhaps with a better rate) in the near future I didn't think was worth gambling on, when the issue 5 was still available and will pay a better rate soon.The main issue with this Coventry RS i5 is flexibility if you have not maxed out the RSA paying 4%+ interest easy access.Can I withdraw money?After the 14 day ‘cooling-off period’, you can take out money or close your account, but you’ll be charged the equivalent of 30 days’ interest on the amount you withdraw. This will be taken off your balance. You can’t give notice to withdraw. Money you take out must be paid into your Named Bank Account or another CBS account.1 -

Yes but the interest rate is variable, so it can go up or down at any time while there is penalty for withdrawal. If it was fixed people could use it to secure the guaranteed rate of 4% until maturity to be used at any time before maturity, if there is no better RSA instant access paying 4%+ at one particular time.chris_the_bee said:

You can miss payments if you wish.adindas said:Section62 said:Coventry Building SocietyIf you opened the Regular Saver issue 5 when it was first launched and it has since matured, there appears to be nothing stopping you opening a new (replacement) one to take advantage of the soon to be 4% interest rate paid on this account.The 'one only' rule here seems to be for accounts held concurrently, not sequentially.Whether there might be an issue 6 launched (perhaps with a better rate) in the near future I didn't think was worth gambling on, when the issue 5 was still available and will pay a better rate soon.The main issue with this Coventry RS i5 is flexibility if you have not maxed out the RSA paying 4%+ interest easy access.Can I withdraw money?After the 14 day ‘cooling-off period’, you can take out money or close your account, but you’ll be charged the equivalent of 30 days’ interest on the amount you withdraw. This will be taken off your balance. You can’t give notice to withdraw. Money you take out must be paid into your Named Bank Account or another CBS account.

0 -

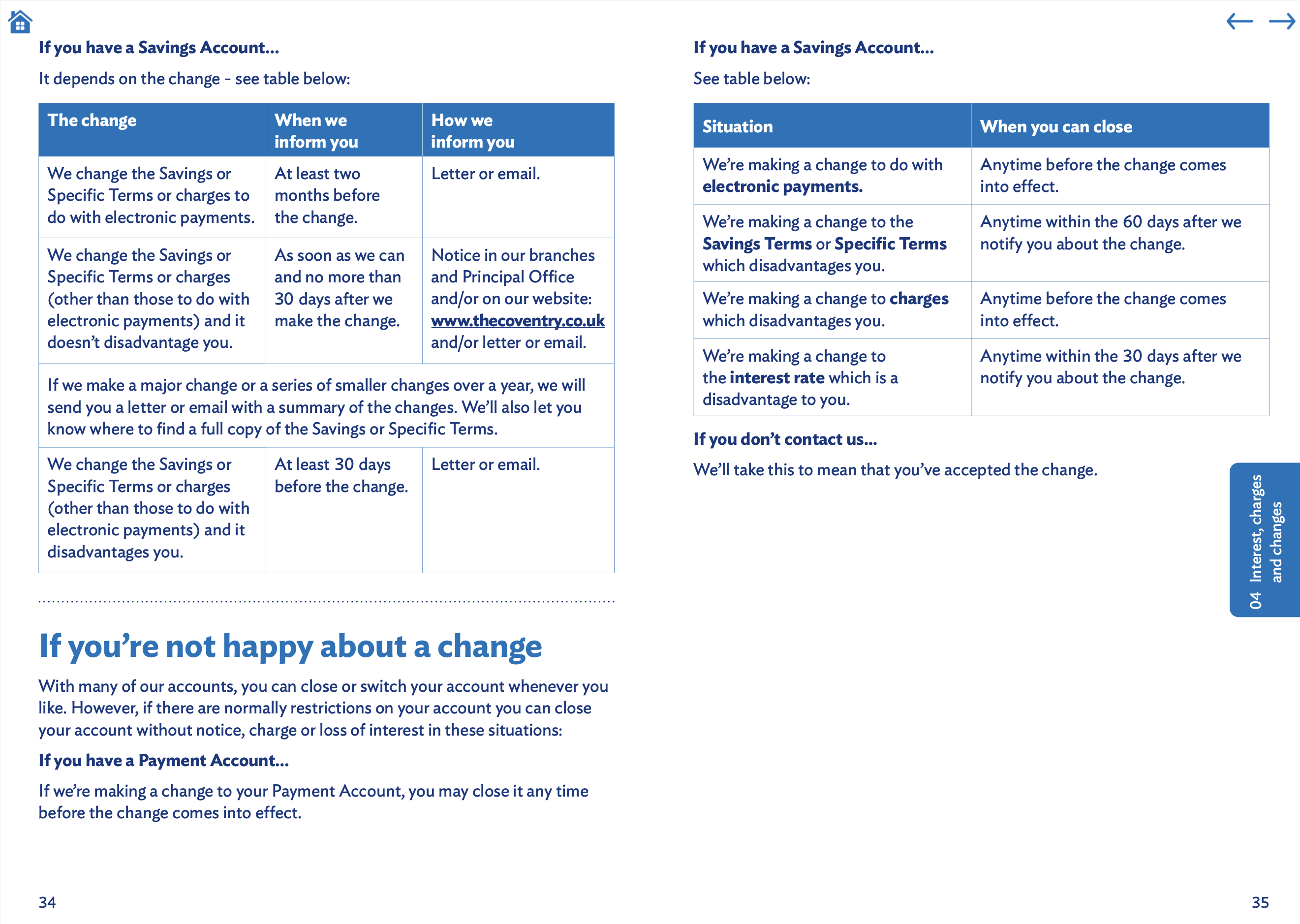

I think if they reduce the rate, we can close it penalty free though according to their ts and cs.adindas said:

Yes but the interest rate is variable, so it can go up or down at any time while there is penalty for withdrawal. If it was fixed people could use it to secure the guaranteed rate of 4% until maturity to be used at any time before maturity, if there is no better RSA instant access paying 4%+ at one particular time.chris_the_bee said:

You can miss payments if you wish.adindas said:Section62 said:Coventry Building SocietyIf you opened the Regular Saver issue 5 when it was first launched and it has since matured, there appears to be nothing stopping you opening a new (replacement) one to take advantage of the soon to be 4% interest rate paid on this account.The 'one only' rule here seems to be for accounts held concurrently, not sequentially.Whether there might be an issue 6 launched (perhaps with a better rate) in the near future I didn't think was worth gambling on, when the issue 5 was still available and will pay a better rate soon.The main issue with this Coventry RS i5 is flexibility if you have not maxed out the RSA paying 4%+ interest easy access.Can I withdraw money?After the 14 day ‘cooling-off period’, you can take out money or close your account, but you’ll be charged the equivalent of 30 days’ interest on the amount you withdraw. This will be taken off your balance. You can’t give notice to withdraw. Money you take out must be paid into your Named Bank Account or another CBS account.

https://www.coventrybuildingsociety.co.uk/content/dam/cbs/member/pdfs/savings/saving-accounts-terms-and-conditions.pdf

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.4 -

The danger of waiting is they pull the product. Open it now and put £1 in to secure the product, then you can put £999 in at the beginning of the final month.adindas said:chris_the_bee said:where_are_we said:Coventry RS is an anniversary month account whereas the FHS is a calendar month account. Thus if you don`t have a FHS it is best to open it now in December and fund £1000 before the end of the month. Then fund £1000 monthly SO from beginning of January for 35 months (its a 36 month term account). That way you will have £2000 earning 5% from 6/1/23. I have had a FHS for more than a year, but unfortunately I withdrew a lot when the rate wasn`t so competitive otherwise I could have had £15K earning 5% from 6/1/23. "Thats Life"!- But you could make 37 payments depending when you open it..

- If you open your account part-way through a month, you may still deposit up to £1,000 until the end of that calendar month. Likewise, if your account term ends part-way through a month, you may still deposit up to £1,000 in the final calendar month up until the date your account term ends. This means that if you open your account on the 1st of a month, your maximum balance is £36,000. If you open your account on any other day of the month, your maximum balance is £37,000.

Rudyson said:

If you open the account now, you can have 36 more payments from 1st Jan, it's explicitly stated that you can have £37,000 in total if you do this.where_are_we said:Coventry RS is an anniversary month account whereas the FHS is a calendar month account. Thus if you don`t have a FHS it is best to open it now in December and fund £1000 before the end of the month. Then fund £1000 monthly SO from beginning of January for 35 months (its a 36 month term account). That way you will have £2000 earning 5% from 6/1/23. I have had a FHS for more than a year, but unfortunately I withdrew a lot when the rate wasn`t so competitive otherwise I could have had £15K earning 5% from 6/1/23. "Thats Life"!If you open it now (not after the interest rate is lifted up) you do not want to maximise £37,000 (e.g maximising £1,000) if you have a better alternative-before January 6, 2023. Your £1,000 in December will only earn 2.95% until January 5, 2023.You put another £1,000 in January 1, 2023, This another £1,000 will only earn 2.95% until January 5, 2023.You might want to do that if you open it from January 6, 2023.But if you wait until January 6, to chase the full 5% for each pound you put into this saving, you might be missing the bigger picture e.g this product might be withdrawn before you manage to open one. In investing this is what Warren Buffet is calling missing the forest for a tree. Anyway we are talking a relatively small amount of difference in interest for a few days.

But if you put £1k in now, it might only be earning 2.95% for a couple of weeks, but it will be earning (subject to interest rate changes) 5% for nearly the next three years. If you pay it in the last month, it will only be earning 5% for the last few days its in the accountI consider myself to be a male feminist. Is that allowed?0 -

Coventry BS RS issue 5ForumUser7 said:

I think if they reduce the rate, we can close it penalty free though according to their ts and cs.adindas said:

Yes but the interest rate is variable, so it can go up or down at any time while there is penalty for withdrawal. If it was fixed people could use it to secure the guaranteed rate of 4% until maturity to be used at any time before maturity, if there is no better RSA instant access paying 4%+ at one particular time.I agree, and was about to post the same information.The main reason for my original post wasn't to say this was necessarily a great product compared to others, rather to point out the relatively unusual circumstances where an issue of an account is still available after accounts opened early in the product's life will have matured already. And that there appears to be no reason why a new account of that issue can't be opened after maturity of the original one. (It has worked for me)

2 -

Can someone please check my understanding of the First Home Saver is correct, because this almost seems too good to be true...I have an emergency fund of ~£4k that I've mostly got in an EA at Coventry earning 2.32%, with the rest being drip fed into RS accounts elsewhere. But if I open the FHS and "drip feed" the entire lot into it by March, I could be earning 5% on the whole thing from then? And not have to make any more deposits into it if I did not wish to? And then use it as an EA account, so I could withdraw from/close it, whenever I wish, without loss of interest?I no longer check the forums as regularly as I used to. If you wish to catch my attention please remember to tag me (@ircE) so I get a notification.0

-

That's correct. So once you have the full 4k in it in March nobody tells you that you need to make any further payments. You can just leave your 4k in as long as you wish. If you then in April need access to the full 4k you can withdraw it all. If you wish to start feeding again in June you are free to do so and the monthly limit is again a max of 1000 you can pay in.ircE said:Can someone please check my understanding of the First Home Saver is correct, because this almost seems too good to be true...I have an emergency fund of ~£4k that I've mostly got in an EA at Coventry earning 2.32%, with the rest being drip fed into RS accounts elsewhere. But if I open the FHS and "drip feed" the entire lot into it by March, I could be earning 5% on the whole thing from then? And not have to make any more deposits into it if I did not wish to? And then use it as an EA account, so I could withdraw from/close it, whenever I wish, without loss of interest?

If you pay in your last 1000 on 1st of March and on the 15th of March you withdraw part or all, you won't be able to make any further additions in March, but could do so again on 1st April.6 -

ircE said:Can someone please check my understanding of the First Home Saver is correct, because this almost seems too good to be true...I have an emergency fund of ~£4k that I've mostly got in an EA at Coventry earning 2.32%, with the rest being drip fed into RS accounts elsewhere. But if I open the FHS and "drip feed" the entire lot into it by March, I could be earning 5% on the whole thing from then? And not have to make any more deposits into it if I did not wish to? And then use it as an EA account, so I could withdraw from/close it, whenever I wish, without loss of interest?The catch here is that you are restricted to paying in £1000 per month, so if you needed to use the account as an EA one you might be marginally better off with the Barclays Blue Rewards Rainy Day Saver as that doesn't have the £1000 monthly restriction - which would mean you could get 5% on the ~£4k from day one, and if you had to withdraw money (>£1000) for an emergency, you'd be able to return it all to the account immediately rather than having to drip feed it back in. You would need a Barclays current account and meet the Blue Rewards conditions though.As the Blue Rewards RDS isn't a regular saver it would be off-topic to discuss it here further (there are other threads about it) but I mentioned it as it may be a more suitable product than the Coventry FHS, and it also demonstrates that a 5% interest rate on what amounts to an EA account (with strings) isn't too good to be true as it isn't the only very special product currently available.

1

1 -

It doesn’t have to be either or - if you have more than £5,000, the Coventry FHS can be a nice complement to the Barclays RDS. Also, some people might not have £5,000 at the ready, so the FHS could be much easier to manage than the Blue Rewards and RDS.Section62 saidAs the Blue Rewards RDS isn't a regular saver it would be off-topic to discuss it here further (there are other threads about it) but I mentioned it as it may be a more suitable product than the Coventry FHS, and it also demonstrates that a 5% interest rate on what amounts to an EA account (with strings) isn't too good to be true as it isn't the only very special product currently available. 2

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards