We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

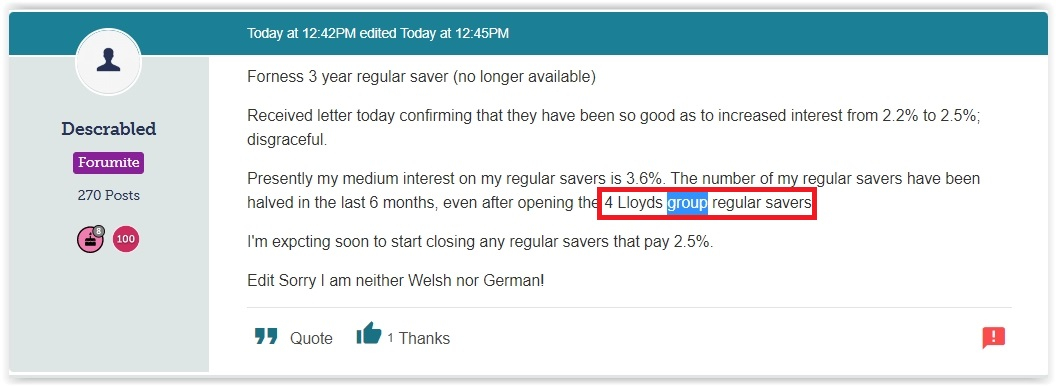

I haven't seen anyone claiming that they have 4 regular savers at Lloyds. The only reference I can find is to 4 regular savers at the Lloyds group, which is entirely correct.polymaff said:Section62 that is two - and your post said "my" ... "4". That was the issue.Section62 said:ForumUser7 said:

When you say the 4 Lloyds group regular savers, what do you mean please? I have the Bank of Scotland, Halifax and Lloyds ones all at 4.5%, but if there is a 4th available I'd certainly like to look at opening it. Thank youLloyds do two - Club Lloyds RS (at 5.25%) and the standard RS (at 4.5%)If you are a Club Lloyds member you can have both.

5 -

There are 4 1 year regular savers that can be opened through Lloyds Banking group, which comprises Halifax, bank of Scotland and Lloyds. As I am currently ineligible for the club Lloyds one, I’d semi-forgotten about it - hence I’ve got 3 of the 4. Thanks everyone for reminding me.RG2015 said:

Once again, you have me totally lost. Looks clear to me, both the Lloyds ones and BOS and Halifax. Unless I am missing something.polymaff said:Section62 that is two - and your post said "my" ... "4". That was the issue.Section62 said:ForumUser7 said:

When you say the 4 Lloyds group regular savers, what do you mean please? I have the Bank of Scotland, Halifax and Lloyds ones all at 4.5%, but if there is a 4th available I'd certainly like to look at opening it. Thank youLloyds do two - Club Lloyds RS (at 5.25%) and the standard RS (at 4.5%)If you are a Club Lloyds member you can have both.

Lloyds Group

1) Lloyds RS 4.5%

2) Club Lloyds RS 5.25%

3) BOS RS 4.5%

4) Halifax RS 4.5%

Hoping to see some good new regular saver rates after tomorrows base rate increase!If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

According to Moneyfacts, Principality Building Society will be launching their Christmas 2023 Regular Saver Bond, paying 5.00%

Pay in between £1 - £125 per month. The maximum account balance (not including interest) is £1,500.

The account has a 1 year term. Withdrawals are NOT permitted before maturity.

The account can be opened online or in branch.

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/Christmas-2023-Regular-Saver-Bond

Please call me 'Kazza'.29 -

Kazza242 said:According to Moneyfacts, Principality Building Society will be launching their Christmas 2023 Regular Saver Bond, paying 5.00%

Pay in between £1 - £125 per month. The maximum account balance (not including interest) is £1,500.

The account has a 1 year term. Withdrawals are NOT permitted before maturity.

The account can be opened online or in branch.

https://www.principality.co.uk/en/savings-accounts/Regular-Saver

> Withdrawals are NOT permitted before maturity.

I guess, if like the 1 year regular saver bond, you can still close the account without taking a penalty.0 -

Yes, you can close the bond early. The Christmas 2023 Regular Saver Bond page now states:AndyTh_2 said:Kazza242 said:According to Moneyfacts, Principality Building Society will be launching their Christmas 2023 Regular Saver Bond, paying 5.00%

Pay in between £1 - £125 per month. The maximum account balance (not including interest) is £1,500.

The account has a 1 year term. Withdrawals are NOT permitted before maturity.

The account can be opened online or in branch.

https://www.principality.co.uk/en/savings-accounts/Regular-Saver

> Withdrawals are NOT permitted before maturity.

I guess, if like the 1 year regular saver bond, you can still close the account without taking a penalty.

"You can close your bond before it matures. Any interest you’ve earned will be added to the account balance and paid to you."

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/Christmas-2023-Regular-Saver-Bond

Please call me 'Kazza'.8 -

Every_Penny_Counts said:I seem to remember that it wasn’t offered in their letter last year either but was available online in the maturity area a few days after the letters arrived.kaMelo said:Maturity instructions letter arrived today for the Principality Christmas Regular Saver, sadly there is no maturity option to take another one for next year. I'm slightly disappointed as this was the only reason I had kept this years account in place.EPCAs with last year, the Christmas RS is now available as a maturity option in the online area.EPC2

-

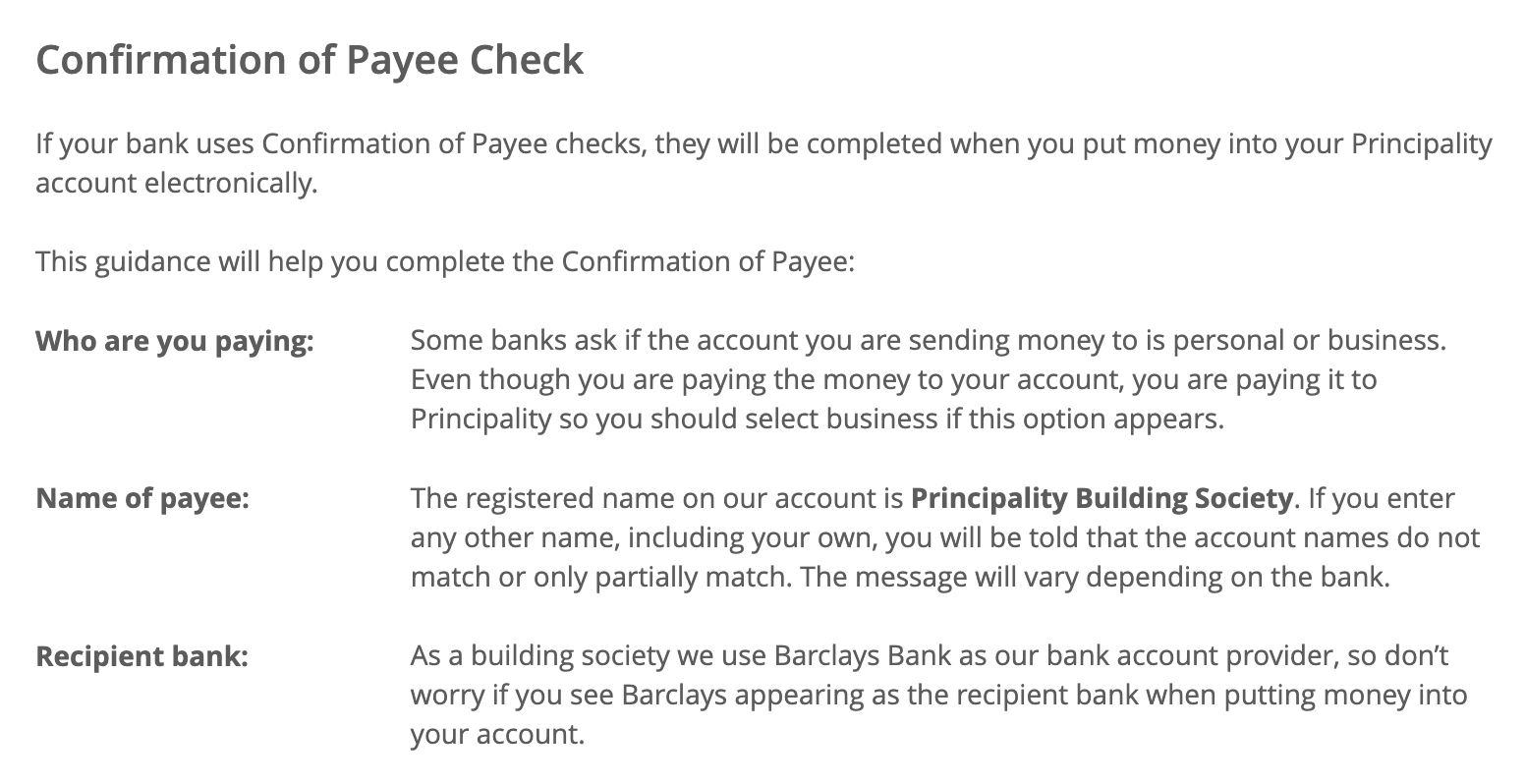

Just wondering if anyone's opened and tried paying into this yet? I just tried paying into it but CoP was failing. The email they send you doesn't tell you what to use as the account name, so not sure if this is meant to be our actual full name or Principality.Kazza242 said:According to Moneyfacts, Principality Building Society will be launching their Christmas 2023 Regular Saver Bond, paying 5.00%

Pay in between £1 - £125 per month. The maximum account balance (not including interest) is £1,500.

The account has a 1 year term. Withdrawals are NOT permitted before maturity.

The account can be opened online or in branch.

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/Christmas-2023-Regular-Saver-Bond0 -

Choose business account and the payee "Principality Building Society"t1redmonkey said:

Just wondering if anyone's opened and tried paying into this yet? I just tried paying into it but CoP was failing. The email they send you doesn't tell you what to use as the account name, so not sure if this is meant to be our actual full name or Principality.Kazza242 said:According to Moneyfacts, Principality Building Society will be launching their Christmas 2023 Regular Saver Bond, paying 5.00%

Pay in between £1 - £125 per month. The maximum account balance (not including interest) is £1,500.

The account has a 1 year term. Withdrawals are NOT permitted before maturity.

The account can be opened online or in branch.

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/Christmas-2023-Regular-Saver-Bond3 -

Opened and funded really quickly as an Existing Customer.

As stated by kaMelo above, the details on how to pay in to it were clearly displayed at the end of the application process, where it gives you your account number.

3 -

May I ask how does that work? Do they allow you transferring the whole balance to the new issue so that you start earning 5% on the £1500 from day one?Every_Penny_Counts said:Every_Penny_Counts said:I seem to remember that it wasn’t offered in their letter last year either but was available online in the maturity area a few days after the letters arrived.kaMelo said:Maturity instructions letter arrived today for the Principality Christmas Regular Saver, sadly there is no maturity option to take another one for next year. I'm slightly disappointed as this was the only reason I had kept this years account in place.EPCAs with last year, the Christmas RS is now available as a maturity option in the online area.EPC0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards