We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Hi,

Thought I'd let you know that RBS are offering the regular saver 3% up to £1 - £150 a month this started on 15th March. Its was an aweful rate before and was only £50 a month.

Not sure if this is only for current RBS regular savers.

Bizzy

0 -

A UK resident, aged 16 years or over and a Royal Bank of Scotland current account holder.

3% on first £1k0 -

Bizzywizard said:Hi,

Thought I'd let you know that RBS are offering the regular saver 3% up to £1 - £150 a month this started on 15th March. Its was an aweful rate before and was only £50 a month.

Not sure if this is only for current RBS regular savers.

Bizzy

Already covered from this post on page 424 onwards. The account always had 3.04% AER on up to £1,000, and the same pre-reqs.castle96 said:A UK resident, aged 16 years or over and a Royal Bank of Scotland current account holder.

3% on first £1k1 -

Re Natwest:Daliah said:Bizzywizard said:Hi,

Thought I'd let you know that RBS are offering the regular saver 3% up to £1 - £150 a month this started on 15th March. Its was an aweful rate before and was only £50 a month.

Not sure if this is only for current RBS regular savers.

Bizzy

Already covered from this post on page 424 onwards. The account always had 3.04% AER on up to £1,000, and the same pre-reqs.castle96 said:A UK resident, aged 16 years or over and a Royal Bank of Scotland current account holder.

3% on first £1kI think what Bizzywizard may have been referring to was Natwest’s ‘Savings Builder’ regular saver account which paid 0.25% provided one increased the account balance by a minimum of £50 per month.

This account was withdrawn a few days ago on the day the Digital Regular Saver rules changed.

In effect Natwest seem to have merged the Savings Builder into the Digital Regular Saver for balances over £1k but removed the £50 minimum monthly funding requirement of the Savings Builder.

A few years ago the Savings Builder was quite competitive, but over time the interest rate dwindled down to a paltry 0.25%. I still have mine open with just over a quid in it and didn’t bother earning any interest on it, just in case they ever improved the account – which they never did.

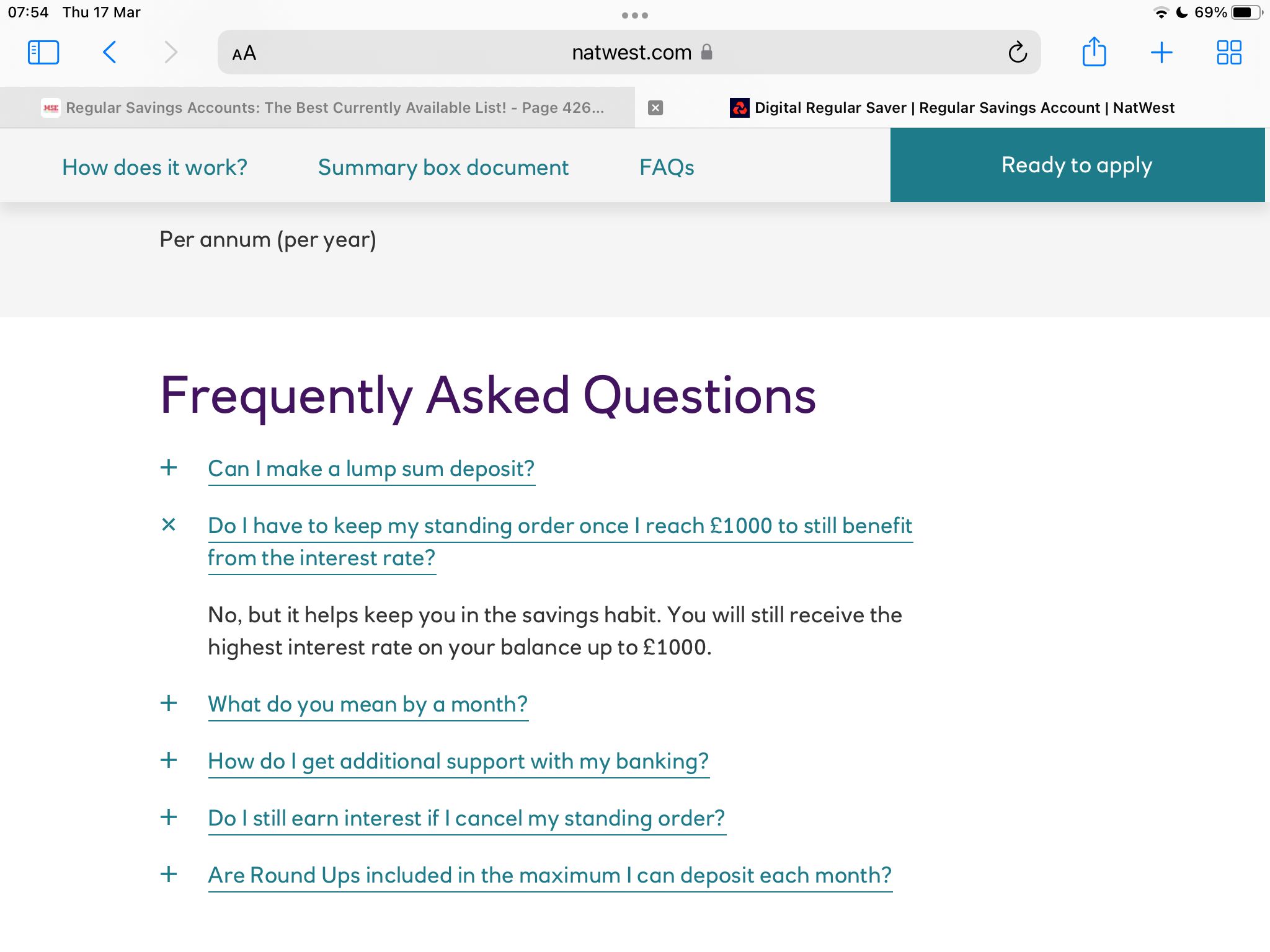

Incidentally, I spoke with Natwest via online chat yesterday after topping up my Digital Regular Saver to a balance of £1k (only required £28.00 to make the balance £1k). Their view was that you need to continue to pay in a minimum of £1.00 per month by standing order to comply with the account rules (despite the ambiguity mentioned in posts above regarding funding the account once hitting the £1k balance).

I thus changed my standing order for the account to pay in £1.00 per month.

I will occasionally sweep the monthly payments and interest to just leave the £1k balance and move the ‘swept’ money to a better paying account.

2 -

This does not appear ambiguous to me.JamesPeter said:

Re Natwest:Daliah said:Bizzywizard said:Hi,

Thought I'd let you know that RBS are offering the regular saver 3% up to £1 - £150 a month this started on 15th March. Its was an aweful rate before and was only £50 a month.

Not sure if this is only for current RBS regular savers.

Bizzy

Already covered from this post on page 424 onwards. The account always had 3.04% AER on up to £1,000, and the same pre-reqs.castle96 said:A UK resident, aged 16 years or over and a Royal Bank of Scotland current account holder.

3% on first £1kIncidentally, I spoke with Natwest via online chat yesterday after topping up my Digital Regular Saver to a balance of £1k (only required £28.00 to make the balance £1k). Their view was that you need to continue to pay in a minimum of £1.00 per month by standing order to comply with the account rules (despite the ambiguity mentioned in posts above regarding funding the account once hitting the £1k balance).

I thus changed my standing order for the account to pay in £1.00 per month.

2 -

RG2015 said:

This does not appear ambiguous to me.JamesPeter said:

Re Natwest:Daliah said:Bizzywizard said:Hi,

Thought I'd let you know that RBS are offering the regular saver 3% up to £1 - £150 a month this started on 15th March. Its was an aweful rate before and was only £50 a month.

Not sure if this is only for current RBS regular savers.

Bizzy

Already covered from this post on page 424 onwards. The account always had 3.04% AER on up to £1,000, and the same pre-reqs.castle96 said:A UK resident, aged 16 years or over and a Royal Bank of Scotland current account holder.

3% on first £1kIncidentally, I spoke with Natwest via online chat yesterday after topping up my Digital Regular Saver to a balance of £1k (only required £28.00 to make the balance £1k). Their view was that you need to continue to pay in a minimum of £1.00 per month by standing order to comply with the account rules (despite the ambiguity mentioned in posts above regarding funding the account once hitting the £1k balance).

I thus changed my standing order for the account to pay in £1.00 per month.

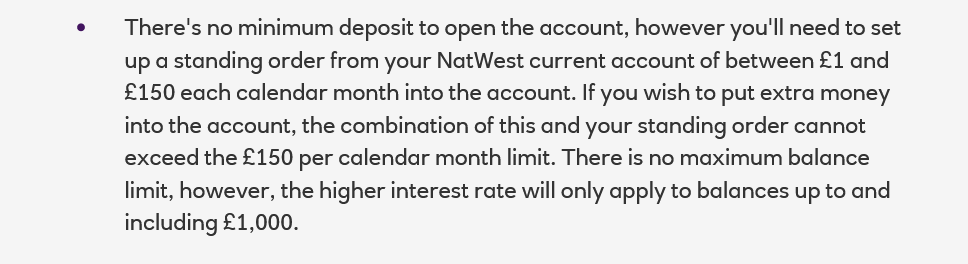

It is the following paragraph in the Digital Regular Saver account summary box which has caused the ambiguity (as it is at odds with your quote from the account FAQ's), hence my enquiry with them in online chat:

It is the following paragraph in the Digital Regular Saver account summary box which has caused the ambiguity (as it is at odds with your quote from the account FAQ's), hence my enquiry with them in online chat:

1 -

I understand, but if you combine them, it would read that you need to set up a standing order but do not need to keep the standing order once you have reached £1,000.JamesPeter said:LoRG2015 said:

This does not appear ambiguous to me.JamesPeter said:

Re Natwest:Daliah said:Bizzywizard said:Hi,

Thought I'd let you know that RBS are offering the regular saver 3% up to £1 - £150 a month this started on 15th March. Its was an aweful rate before and was only £50 a month.

Not sure if this is only for current RBS regular savers.

Bizzy

Already covered from this post on page 424 onwards. The account always had 3.04% AER on up to £1,000, and the same pre-reqs.castle96 said:A UK resident, aged 16 years or over and a Royal Bank of Scotland current account holder.

3% on first £1kIncidentally, I spoke with Natwest via online chat yesterday after topping up my Digital Regular Saver to a balance of £1k (only required £28.00 to make the balance £1k). Their view was that you need to continue to pay in a minimum of £1.00 per month by standing order to comply with the account rules (despite the ambiguity mentioned in posts above regarding funding the account once hitting the £1k balance).

I thus changed my standing order for the account to pay in £1.00 per month.

It is the following paragraph in the Digital Regular Saver account summary box which has caused the ambiguity (as it is at odds with your quote from the account FAQ's), hence my enquiry with them in online chat:

It is the following paragraph in the Digital Regular Saver account summary box which has caused the ambiguity (as it is at odds with your quote from the account FAQ's), hence my enquiry with them in online chat:

I do accept that the wording is clumsy and disjointed, but this is just my interpretation.0 -

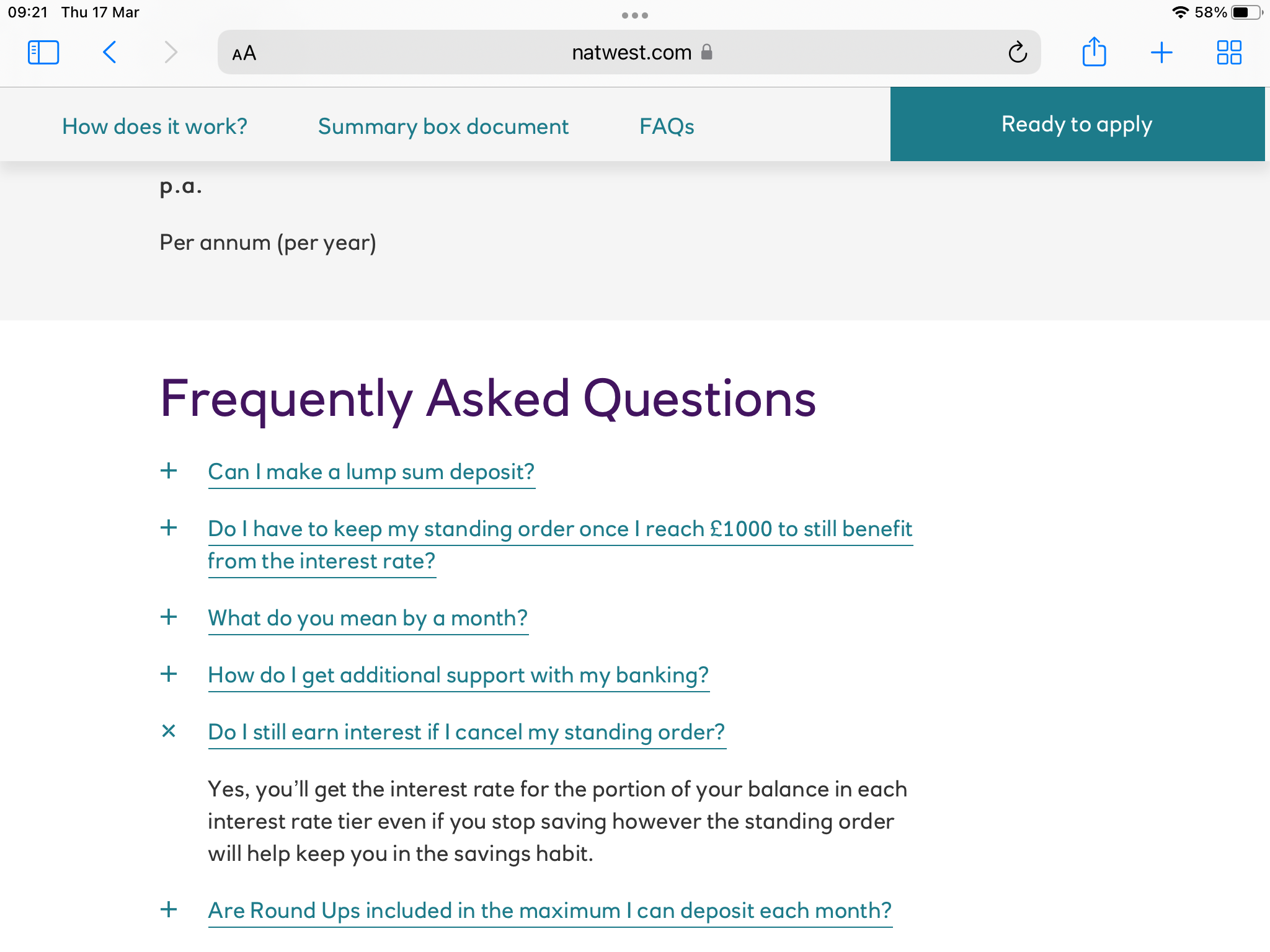

Sorry to labour the point but the following does reinforce my interpretation.

0 -

Re NatWest/RBS Digital SaverI guess the way to solve this is if anyone here has already hit the £1K amount & stopped paying in (prior to this week)... And if so, are they still getting the interest?EPC0

-

No one will have as the earliest that was possible under the original terms was next month.For what it's worth I have topped up to£1000 and cancelled the standing order. I fully expect to receive the interest as my understanding of the terms is that a regular payment is no longer required.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards