We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

It updates to the correct rate as soon as your first deposit has cleared.lantanna said:Set up a Coventry RS today, issue 3, I already have a issue 2. When I look at the account it says interest is 0.00 %. Anybody else who has the two with Coventry find this?0 -

It's been speculated that HSBC may well split from their UK businesses and sell it off. I doubt they care much now!Gray001 said:Ah gr8 HSBC and First Direct.... the best reg saver rate is like 1.5% and easy access saver 0.75%. I've had a few accounts maturing and am wondering with the best rates so cut is it worth opening and maintaining them? I at least thought the HSBC /FD would have stayed at 2.75 or competitive as it was always best on the market!

Things for savers gonna get a lot worse0 -

Regarding the Tipton regular saver, on the application form is asks, 'Tick to confirm you have received a savings welcome pack?

How can you do that if you are only just sending off the application form or am I missing something?

The other two questions about privacy notice and deposit guarantee scheme can be found on the web site.I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.0 -

nearly sent off my application form then saw this.veryintrigued said:

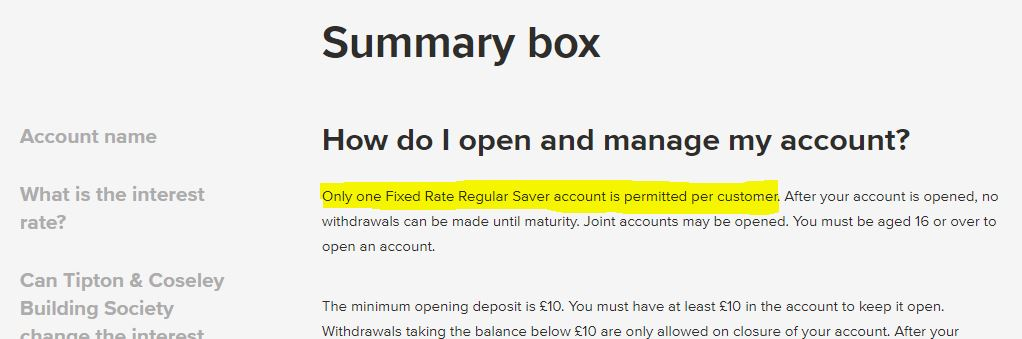

I can't see any restriction (online at least) for those of us who already hold the 2020/21 Tipton's Regular Saver.JamesRobinson48 said:Tipton BS has just launched a fixed rate RS paying 1.35% (max £500 pm, matures Feb-2022). For this one there's no app, or even any online access: it involves a manual application form and cheque. I couldn't find any postcode restrictions.

But in the paper copy of the 2019/20 Fixed Regular Saver (which matured and i started again as a 2% 2020/21 Fixed Regular Saver with the same account details) it states:

Only one account can be opened per customer.

I wonder if this means per issue or per Fixed Regular Saver?

EDIT: Just spoke to them and they confirmed that you are allowed to open one of each issue.

3 -

It’s updated to the 1.55% interest rate now.0

-

Any mention of other RS rate changes?Separately, Leek BS is cutting the rate on its currently open RS product from 1.35% to 1.10% effective 2nd December.

I have the old Leek RS (open-ended, closed issue) account. When the rate was cut in April I requested a withdrawal by cheque. It took 41 days: 21 to reach a cashier then 20 to come back.

I have sent off another withdrawal request as the old bonus has now ended and is paying just 0.85%. It has already been 2 weeks.1 -

Assuming JR received the same letter as me it only mentions the Flexible Saver RS reduction they've mentioned in their post.happybagger said:

Any mention of other RS rate changes?Separately, Leek BS is cutting the rate on its currently open RS product from 1.35% to 1.10% effective 2nd December.

I have the old Leek RS (open-ended, closed issue) account. When the rate was cut in April I requested a withdrawal by cheque. It took 41 days: 21 to reach a cashier then 20 to come back.

I have sent off another withdrawal request as the old bonus has now ended and is paying just 0.85%. It has already been 2 weeks.1 -

Tipton BS I sent my maturity options letter back over the weekend there were no regular savers in options. I Contacted them and they are sending me an application form out for the new regular saver and attaching a note to my maturity letter. I have another regular saver with them that matures end of January."Look after your pennies and your pounds will look after themselves"0

-

Do you tick you've received a savings welcome pack? Also the monthly deposit is that calendar month wise or depending when you open the account?trickydicky14 said:Regarding the Tipton regular saver, on the application form is asks, 'Tick to confirm you have received a savings welcome pack?

How can you do that if you are only just sending off the application form or am I missing something?

The other two questions about privacy notice and deposit guarantee scheme can be found on the web site.0 -

Tipton: On past form, they would mail out a savings welcome pack along with the passbook. With a mainly local customer base, I imagine their process is more oriented towards branch customers. The monthly deposit is by calendar month.Growingold said:Do you tick you've received a savings welcome pack? Also the monthly deposit is that calendar month wise or depending when you open the account?

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards