We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Just a reminder the first batch of Coventry BS interest rate reductions come into effect tomorrow (Mon 2/12/24). Of note:

Account Old rate New rate Date Coventry BS Young Saver 5.00% 4.75% 02/12/24

These shall be followed by the following the day after:Account Old rate New rate Date Coventry BS Children's Regular Saver 4.40% 4.15% 03/12/24 Coventry BS Colleague Regular Saver 5.25% 5.00% 03/12/24 Coventry BS First Home Saver 5.35% 5.10% 03/12/24 Coventry BS Loyalty Regular Saver 6.75% 6.50% 03/12/24 Coventry BS Loyalty Regular Saver (2) 6.50% 6.25% 03/12/24 Coventry BS Regular Saver 4.80% 4.55% 03/12/24 Coventry BS Regular Saver (5) 5.25% 5.00% 03/12/24 Coventry BS Regular Saver ISA 4.80% 4.55% 03/12/24

Note the following accounts are not affected by this set of rate cuts so shall remain at their present rates for the time being, these include:Account Old rate New rate Coventry BS First Home Saver (2) 4.80% NO CHANGE Coventry BS Loyalty Mortgage RS 6.00% NO CHANGE Coventry BS Sunny Day Saver 6.25% NO CHANGE Coventry BS Regular Saver (6) 4.75% NO CHANGE

12 -

Lloyds Reg Saver

OH put 400 into the reg saver yesterday (newly opened) and tried to fund with another 400 today and Lloyds is saying that it isn't possible as it would exceed the monthly limit. I put 400 into mine just now and it shows the date of 2nd December. Looks like funding Lloyds on a weekend isn't an option.

Nationwide Reg Saver

Payment made and showing as 2nd December

Virgin Money Reg Saver

Confirmed via chat that interest accrues from the date of deposit received so a payment in today earns from today.1 -

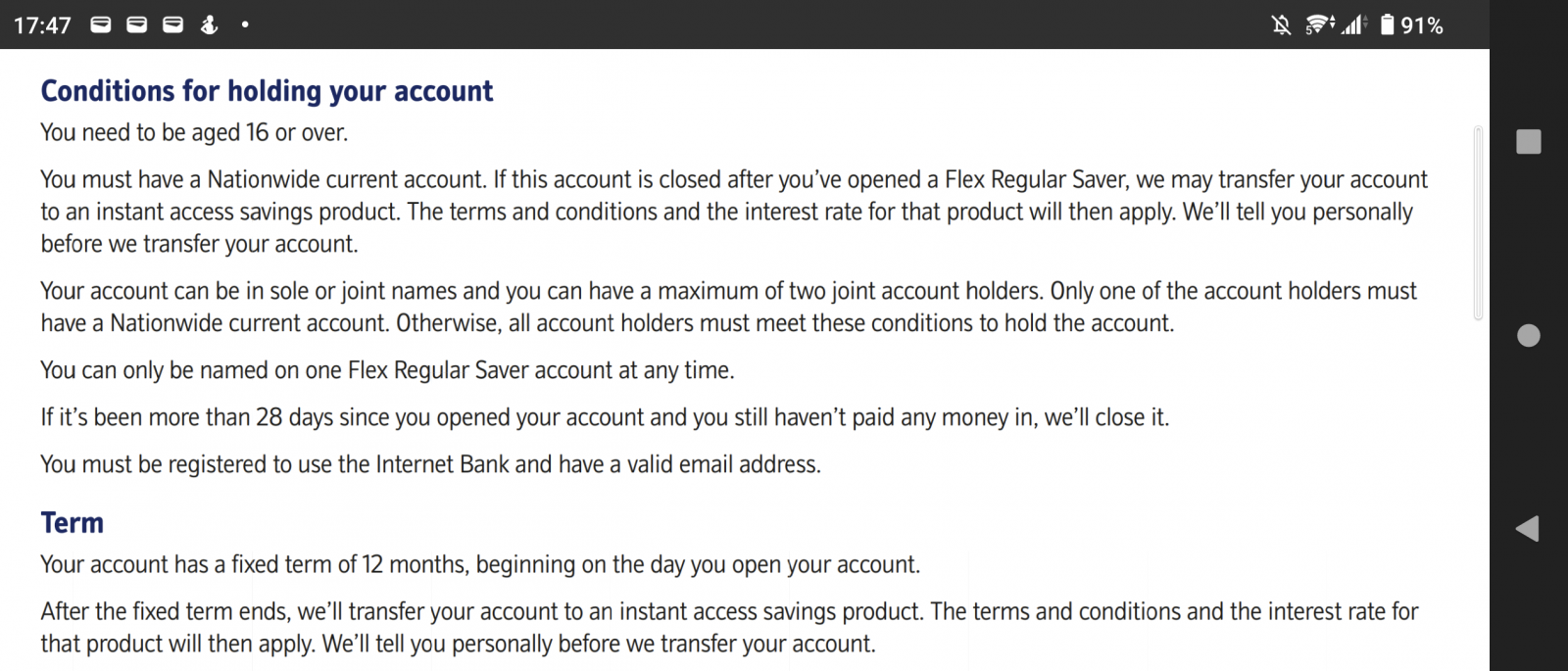

Can't remember which bank it was, but I recall breaking this rule and my RS stayed alive until the end of its original term. However, I wouldn't recommend doing this. I think the best solution is opening another qualifying current account with Nationwide before switching. You can then switch the existing account with all its direct debits and the new one will serve the purpose of keeping your RS going. There's no point risking the closure of well performing RS.GetRichOrDieSaving said:

Thanks, I did read that in the T&Cs but they use the word “may” meaning that they may not and was wondering if anyone had experience of this themselves. I do appreciate you taking the time to search and post that though.surreysaver said:

Probably be transferred to a lesser paying account .GetRichOrDieSaving said:I currently have a Current Account with Nationwide and hold a Flex RS. However I’m switching to Lloyds this week, will the Flex RS be closed or will it remain open? I have a credit card with them so will still hold an account and have access to the app.

If you're doing switching, its worth using donor accounts rather than switching main accounts With regards to the doner account use. I’ve never really bothered too much in getting involved to that level. I’m happy to move my custom over to another bank if the incentives are there. Plus as you will be aware, you often have to meet and maintain certain criteria to avoid monthly fee's, e.g for Lloyds the account I’ve gone for requires £2000 payment per month and three direct debits. So I just find it easier to go along with it all and move every couple of years or so 👍🏼

With regards to the doner account use. I’ve never really bothered too much in getting involved to that level. I’m happy to move my custom over to another bank if the incentives are there. Plus as you will be aware, you often have to meet and maintain certain criteria to avoid monthly fee's, e.g for Lloyds the account I’ve gone for requires £2000 payment per month and three direct debits. So I just find it easier to go along with it all and move every couple of years or so 👍🏼

I'm not sure if your Nationwide credit card will qualify. According to t&c you have to have current account.1 -

Lloyds say the payment needs to be made by 25th, although in reality last working day of the month is fine as long as there's no delays.pecunianonolet said:Lloyds Reg Saver

OH put 400 into the reg saver yesterday (newly opened) and tried to fund with another 400 today and Lloyds is saying that it isn't possible as it would exceed the monthly limit. I put 400 into mine just now and it shows the date of 2nd December. Looks like funding Lloyds on a weekend isn't an option.

Nationwide Reg Saver

Payment made and showing as 2nd December

I think opening on a weekend when the month changes is pushing your luck!I consider myself to be a male feminist. Is that allowed?0 -

Not on a Sunday it doesn't is my experience after depositing on Sunday 1st September and doing the maths with the interest received at the end of Sept.pecunianonolet said:Virgin Money Reg Saver

Confirmed via chat that interest accrues from the date of deposit received so a payment in today earns from today.6 -

Looks like the chat representative was wrong in that case.skitskut said:

Not on a Sunday it doesn't is my experience after depositing on Sunday 1st September and doing the maths with the interest received at the end of Sept.pecunianonolet said:Virgin Money Reg Saver

Confirmed via chat that interest accrues from the date of deposit received so a payment in today earns from today.

"If your sort code begins with 05 or 82, please note we that we do not calculate interest based on weekend balances, we use your balance on Friday to calculate your interest for these days."

https://uk.virginmoney.com/savings/helpful-information/interest-calculations/5 -

pecunianonolet said:

Lloyds Reg Saver

OH put 400 into the reg saver yesterday (newly opened) and tried to fund with another 400 today and Lloyds is saying that it isn't possible as it would exceed the monthly limit. I put 400 into mine just now and it shows the date of 2nd December. Looks like funding Lloyds on a weekend isn't an option.Yes it is, but LBG has quirk #4:

- Deposits are credited on non-working days.

- Deposits earn interest when credited on non-working days.

- On non-working days, transaction post dates are future-dated to the next working day, and the true transaction date (and value date for interest purposes) is included in the transaction details.

- The monthly contribution limit per calendar month is based on the post date, so a deposit on Saturday 30th September November will have a post date of 2nd December and therefore count towards December's contribution, yet still earn interest from 30th November.

pecunianonolet said:Nationwide Reg Saver

Payment made and showing as 2nd DecemberAs above with LBG, but #4 does not apply; Nationwide will accept a monthly deposit on Saturday 30th November and another deposit on Sunday 1st December (both transactions will have the same post date of 2nd December and their respective true/value dates in their transaction details).

11 -

Most helpful and interesting that very little details could make such a difference.AmityNeon said:pecunianonolet said:Lloyds Reg Saver

OH put 400 into the reg saver yesterday (newly opened) and tried to fund with another 400 today and Lloyds is saying that it isn't possible as it would exceed the monthly limit. I put 400 into mine just now and it shows the date of 2nd December. Looks like funding Lloyds on a weekend isn't an option.Yes it is, but LBG has quirk #4:

- Deposits are credited on non-working days.

- Deposits earn interest when credited on non-working days.

- On non-working days, transaction post dates are future-dated to the next working day, and the true transaction date (and value date for interest purposes) is included in the transaction details.

- The monthly contribution limit per calendar month is based on the post date, so a deposit on Saturday 30th September will have a post date of 2nd December and therefore count towards December's contribution, yet still earn interest from 30th September.

pecunianonolet said:Nationwide Reg Saver

Payment made and showing as 2nd DecemberAs above with LBG, but #4 does not apply; Nationwide will accept a monthly deposit on Saturday 30th September and another deposit on Sunday 1st December (both transactions will have the same post date of 2nd December and their respective true/value dates in their transaction details).

0 -

I suspect you have your months wrong here as this makes no sense to me in current text.AmityNeon said:pecunianonolet said:Lloyds Reg Saver

OH put 400 into the reg saver yesterday (newly opened) and tried to fund with another 400 today and Lloyds is saying that it isn't possible as it would exceed the monthly limit. I put 400 into mine just now and it shows the date of 2nd December. Looks like funding Lloyds on a weekend isn't an option.Yes it is, but LBG has quirk #4:

- Deposits are credited on non-working days.

- Deposits earn interest when credited on non-working days.

- On non-working days, transaction post dates are future-dated to the next working day, and the true transaction date (and value date for interest purposes) is included in the transaction details.

- The monthly contribution limit per calendar month is based on the post date, so a deposit on Saturday 30th September will have a post date of 2nd December and therefore count towards December's contribution, yet still earn interest from 30th September.

pecunianonolet said:Nationwide Reg Saver

Payment made and showing as 2nd DecemberAs above with LBG, but #4 does not apply; Nationwide will accept a monthly deposit on Saturday 30th September and another deposit on Sunday 1st December (both transactions will have the same post date of 2nd December and their respective true/value dates in their transaction details).

0 -

September = Novemberwiseonesomeofthetime said:

I suspect you have your months wrong here as this makes no sense to me in current text.AmityNeon said:pecunianonolet said:Lloyds Reg Saver

OH put 400 into the reg saver yesterday (newly opened) and tried to fund with another 400 today and Lloyds is saying that it isn't possible as it would exceed the monthly limit. I put 400 into mine just now and it shows the date of 2nd December. Looks like funding Lloyds on a weekend isn't an option.Yes it is, but LBG has quirk #4:

- Deposits are credited on non-working days.

- Deposits earn interest when credited on non-working days.

- On non-working days, transaction post dates are future-dated to the next working day, and the true transaction date (and value date for interest purposes) is included in the transaction details.

- The monthly contribution limit per calendar month is based on the post date, so a deposit on Saturday 30th September will have a post date of 2nd December and therefore count towards December's contribution, yet still earn interest from 30th September.

pecunianonolet said:Nationwide Reg Saver

Payment made and showing as 2nd DecemberAs above with LBG, but #4 does not apply; Nationwide will accept a monthly deposit on Saturday 30th September and another deposit on Sunday 1st December (both transactions will have the same post date of 2nd December and their respective true/value dates in their transaction details).

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards