We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

I have the Christmas 2025 too. I am basically using these 5 to 5.5% regular savers to park my instant access money.Thomas_Crown said:

My Principality Maturity Regular Saver Bond at 6.25% matures this Wednesday. I opened a Christmas 2025 Regular Saver Bond at 7%, on the 1st November. I know that it's a maximum of £125.00 pm but I think 5.15% is too low at the moment.Speculator said:

I’ve opened a few regular savers with a fixed rate of 5% (with penalty free and notice free access) or higher since BOE lowered the base rate and wife has done the same.jaypers said:Based on the rates dropping I might just grab a Halifax RS at 5.5% while it’s still there.

Halifax 5.5%, Lloyds 5.25%, Santander 5%.

Will open the Principality 5.15% later today.

Shame I can’t renew my BOS 5.5%6 -

Speculator said:

I have the Christmas 2025 too. I am basically using these 5 to 5.5% regular savers to park my instant access money.Thomas_Crown said:My Principality Maturity Regular Saver Bond at 6.25% matures this Wednesday. I opened a Christmas 2025 Regular Saver Bond at 7%, on the 1st November. I know that it's a maximum of £125.00 pm but I think 5.15% is too low at the moment.

Exactly that, the reg savers with rates better than actual easy-access now are still likely to be better as time goes on, even the reg savers with variable rates. Better to look for fixed obviously.

Those that allow penalty-free closure are a gift.

They say that in investing the portfolio should be diversified; same principle applies kind of

- having a mix of fully fixed savers plus those which allow withdrawals or closure.2 -

Just opened the Halifax RS to add to my portfolio. Already had the app as have a credit card with them. Have to say that it’s probably the quickest and easiest account I’ve ever opened. Funded and showing immediately too. Well done Halifax.1

-

I have 6 regular savers with Principality at he moment, all between 5.5% and 7%. Currently my minimum threshold for RS is 5.25%. This is because my easy/instant access account (Cahoot Simple Saver) is paying 5.12%, but this will end in two month's time, I will have to go with whatever is paying best out of my EA collection at the time - don't know what it will be but I'm sure it will be something below 5%. This makes me think that perhaps now is the time to reconsider my RS margins. I don't have a crystal ball but it looks like 5.15% RS offers will be at the top of the league in a very near future.Thomas_Crown said:

My Principality Maturity Regular Saver Bond at 6.25% matures this Wednesday. I opened a Christmas 2025 Regular Saver Bond at 7%, on the 1st November. I know that it's a maximum of £125.00 pm but I think 5.15% is too low at the moment.Speculator said:

I’ve opened a few regular savers with a fixed rate of 5% (with penalty free and notice free access) or higher since BOE lowered the base rate and wife has done the same.jaypers said:Based on the rates dropping I might just grab a Halifax RS at 5.5% while it’s still there.

Halifax 5.5%, Lloyds 5.25%, Santander 5%.

Will open the Principality 5.15% later today.

Shame I can’t renew my BOS 5.5%4 -

I have a Halifax 5.5% regular saver due to mature on the 21st November - I didn't fund it last year, it simply rolled over from the previous year. Is there any way I can close it early, and open a new one this week? I've had a letter today saying that on the 21st it will mature then automatically renew but I think the rate will drop before then. I'd like to be able to get it going for another year from now but I daren't cancel it in case it then doesn't allow me to start on the renewal date. Should I hold out for the 21st or is there another option? Thanks in advance

0 -

Sorry, just realised my question probably shouldn't be in the "best available list" section! I'll pop it on a new thread0

-

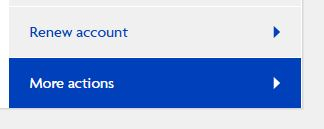

Just "renew" it to everyday saver then log out log in and open new 5.5% regular saver.CricketLady said:I have a Halifax 5.5% regular saver due to mature on the 21st November - I didn't fund it last year, it simply rolled over from the previous year. Is there any way I can close it early, and open a new one this week? I've had a letter today saying that on the 21st it will mature then automatically renew but I think the rate will drop before then. I'd like to be able to get it going for another year from now but I daren't cancel it in case it then doesn't allow me to start on the renewal date. Should I hold out for the 21st or is there another option? Thanks in advance

3 -

Thanks Speculator, it is saying that if I don't want to renew I can open an Everyday Saver but would it do this instantly or would it roll over into this on the renewal date (21st?) Sorry to be dense!0

-

I always renew it to Everyday saver, then log out and log back in to open a new regular saver. Takes 5 mins. You don't need to wait until the 21st.CricketLady said:Thanks Speculator, it is saying that if I don't want to renew I can open an Everyday Saver but would it do this instantly or would it roll over into this on the renewal date (21st?) Sorry to be dense!2 -

Thanks so much, it was instant!! Really appreciate your swift responses2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards