We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

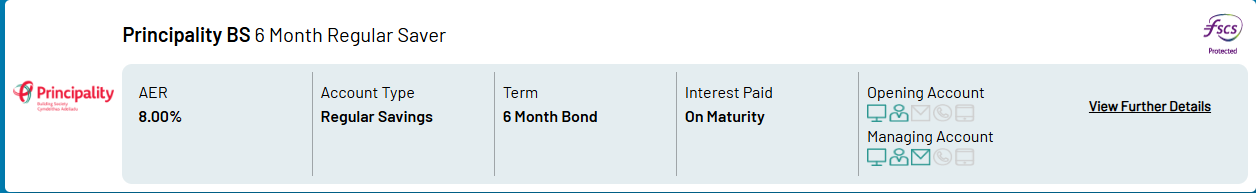

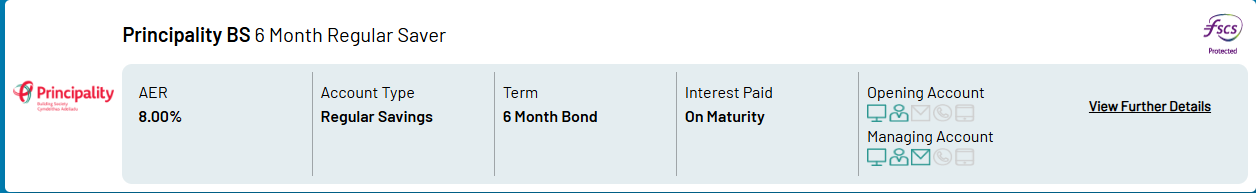

10_66 said:Principality

I've just tried closing my 6 month regular saver in order to try to reopen one, but its still showing as open and the message I got when I requested closure was it should be actioned within 1 day. I was in two minds as to whether to close it as it still had until the 24 December before it matured, not too hopeful it'll still be available by tomorrow. Does anyone know if each of their closures have to be manually checked?

It does seem to involve a manual action by Principality but they are quite quick with it, a couple of hours or thereabouts during working hours. As soon as they have actioned your closure request, you can then apply for the RS again, if it's still there. Nobody here can tell you whether that will be the case.

If you requested your balanace to be paid to your current account, it should be there by the end of the working day the request got processed.

1 -

Not sure there IS a rule of thumb. I'm not convinced of the strategy, especially when combined with the strategy many use of opening-at-month-end-and funding-2nd-deposit-next-day on-1st-of-month.flaneurs_lobster said:Can someone remind me of the rule of thumb as to when renewing a fixed reg saver is more lucrative than leaving it to mature? The rate that the removed funds can earn is an obvious variable in the equation.

My Club RS has 6 mths-worth of deposits.

I did a spreadsheet and played with scenarios for my reg savers. I found that keeping to maturity, and then taking up a new reg saver at a lower rate, say 6% next time instead of 7.85% because rates are dropping, actually got me MORE interest overall than closing nearly 2 months early and re-opening the same type at 7.85%.

Mind you, that was with nearly 2 months til maturity. Got to bear in mind would have been missing out on 50-odd days of the full balance achieved.

Happy to be proved wrong of course4 -

Received money within a couple of hours after closure. Opened the new one straight away.Digital_Payback said:

Did the same myself. Closed my Principality 6 Month Saver, due to mature next month, and opened a new one within about 90 mins.OneUser1 said:I took the risk and closed my Principality 6 Month and - this was the risk - I have been able to open a new 6 Month. I was worrying between closing and reopening but now I’ve done it I am feeling smug!Does anyone know how long it takes for the Principality BS, on account closure, to transfer out the funds to an external account?1 -

My money arrived within about three hours of getting a confirmation of closure. A good experience. Well done, Principality.allegro120 said:

Received money within a couple of hours after closure. Opened the new one straight away.Digital_Payback said:

Did the same myself. Closed my Principality 6 Month Saver, due to mature next month, and opened a new one within about 90 mins.OneUser1 said:I took the risk and closed my Principality 6 Month and - this was the risk - I have been able to open a new 6 Month. I was worrying between closing and reopening but now I’ve done it I am feeling smug!Does anyone know how long it takes for the Principality BS, on account closure, to transfer out the funds to an external account?Digital Payback

The National Lottery : A tax on those who aren’t good at maths.0 -

I've had a look. The application process specifically asks if I was a member of Vernon prior to 1st May 2024, which I wasn't!happybagger said:

If you log in and go to "Products" in the left hand pane you get the list of options of which the ORS is there. I opened it in June though. The product info does say the postcodes but IIRC it said the same when I opened it.surreysaver said:

On Moneyfacts it says existing customers as well, but cannot find any reference to that on Vernon's website. I think originally it was also available for existing customers, but perhaps Moneyfacts hasn't updated its websites71hj said:

Locals only isn't it?Bridlington1 said:I consider myself to be a male feminist. Is that allowed?1 -

It's no longer showing on Moneyfacts, which would tend to indicate it's NLA from tomorrow10_66 said:Principality

I've just tried closing my 6 month regular saver in order to try to reopen one, but its still showing as open and the message I got when I requested closure was it should be actioned within 1 day. I was in two minds as to whether to close it as it still had until the 24 December before it matured, not too hopeful it'll still be available by tomorrow. Does anyone know if each of their closures have to be manually checked?I consider myself to be a male feminist. Is that allowed?0 -

It still shows on moneyfacts for me:surreysaver said:

It's no longer showing on Moneyfacts, which would tend to indicate it's NLA from tomorrow10_66 said:Principality

I've just tried closing my 6 month regular saver in order to try to reopen one, but its still showing as open and the message I got when I requested closure was it should be actioned within 1 day. I was in two minds as to whether to close it as it still had until the 24 December before it matured, not too hopeful it'll still be available by tomorrow. Does anyone know if each of their closures have to be manually checked?

https://moneyfactscompare.co.uk/savings-accounts/regular-savings-accounts/?quick-links-first=false&product-favorites-first=false&sort-order=AER&sort-order-text=Rate

Annoyingly moneyfacts have very recently decided to start sorting the accounts in alphabetical order of bank/building society by default so I've just had to update my bookmarked moneyfacts links.

4 -

We'll see reductions following BoE across the board, "renewing" the "still available" fixed rate RSs is a good idea for now. I've done PBS 6-months and Skipton Loyalty today, thinking of "renewing" LBGs sometime soon too.surreysaver said:

I wonder how many of the accounts at 6% and above will reduce their rates for new openingsSpeculator said:Just opened Lloyds monthly @ 5.25%. Also, renewed and reopened the club lloyds monthly.

Rate on both is fixed and allows unlimited withdrawals.1 -

Wish there is a way to sort so that it only displays Fixed rate regular savers.Bridlington1 said:

It still shows on moneyfacts for me:surreysaver said:

It's no longer showing on Moneyfacts, which would tend to indicate it's NLA from tomorrow10_66 said:Principality

I've just tried closing my 6 month regular saver in order to try to reopen one, but its still showing as open and the message I got when I requested closure was it should be actioned within 1 day. I was in two minds as to whether to close it as it still had until the 24 December before it matured, not too hopeful it'll still be available by tomorrow. Does anyone know if each of their closures have to be manually checked?

https://moneyfactscompare.co.uk/savings-accounts/regular-savings-accounts/?quick-links-first=false&product-favorites-first=false&sort-order=AER&sort-order-text=Rate

Annoyingly moneyfacts have very recently decided to start sorting the accounts in alphabetical order of bank/building society by default so I've just had to update my bookmarked moneyfacts links.

I don't think it's possible, even in the "Full search"0 -

Lasted for 16 days.Dizzycap said:Aldermore 5.25 RS NLA0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards