We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Regular Savings Accounts: The Best Currently Available List!

Comments

-

This has genuinely blown my mind. Can I ask how much (total) you put into these RS accounts every month, and what kind of return you get annually?Bridlington1 said:

I've over 100 savings accounts including just over 50 regular savers, a spreadsheet makes the admin far easier.WindfallWendy said:These are super sneeky sneekies, you guys! I love it! There was me thinking must be the only one daft enough to have spreadsheets and reminders of which specific day things need to happen to maximise the returns!!1 -

I don't fund all of them, a decent chunk are open with £1 in case they come in useful later on or for ``membership purposes".winkowinko said:

This has genuinely blown my mind. Can I ask how much (total) you put into these RS accounts every month, and what kind of return you get annually?Bridlington1 said:

I've over 100 savings accounts including just over 50 regular savers, a spreadsheet makes the admin far easier.WindfallWendy said:These are super sneeky sneekies, you guys! I love it! There was me thinking must be the only one daft enough to have spreadsheets and reminders of which specific day things need to happen to maximise the returns!!

This month, as things stand, I'll be fully funding 32 of them (interest rates between 5.25% and 10%) with a total of £7725, mostly made up of funds from the Nationwide Flex Regular Saver Issue 2 at 8% and the YBS Loyalty 2023 Regular eSaver, both of which matured in September.

4 -

Woah. Money saving experts with the emphasis on Experts!!

I realise this might derail the thread, but do you counter the tax owed on interest gained by non ISA accounts by overpaying into your pension, too?

I'd love to play the regular saver game with accounts, but don't want the hassle of £1000+ interest and the associated tax return.

Also.... Can I assume whilst we are talking about Regular Saver accounts, actually what you could do is recycle the Y1 savings and simply re-deposit that money I to a different RS each month? So whilst there may be £7k a month going into savings, that might all be from recycling RS funds from previous years? Something I've only just thought of, and will definitely build I to my forward plans!!!1 -

I only have around 15 at last count but once you get into the habit it is invaluable and pays for itself in a way.Bridlington1 said:

I don't fund all of them, a decent chunk are open with £1 in case they come in useful later on or for ``membership purposes".winkowinko said:

This has genuinely blown my mind. Can I ask how much (total) you put into these RS accounts every month, and what kind of return you get annually?Bridlington1 said:

I've over 100 savings accounts including just over 50 regular savers, a spreadsheet makes the admin far easier.WindfallWendy said:These are super sneeky sneekies, you guys! I love it! There was me thinking must be the only one daft enough to have spreadsheets and reminders of which specific day things need to happen to maximise the returns!!

This month, as things stand, I'll be fully funding 32 of them (interest rates between 5.25% and 10%) with a total of £7725, mostly made up of funds from the Nationwide Flex Regular Saver Issue 2 at 8% and the YBS Loyalty 2023 Regular eSaver, both of which matured in September.

Those 2 you mention above funded my next 2 months plus a bit more to the ISA.

Next one matures Nov.

But if you have 32 you will have an average of 3 maturing each month, just keep rolling on to the next one.

Works a treat.4 -

WindfallWendy said:

I'd love to play the regular saver game with accounts, but don't want the hassle of £1000+ interest and the associated tax return.

You only need to do a tax return if you receive £10,000/interest per year (unless something else triggers it)

See https://www.gov.uk/check-if-you-need-tax-return5 -

The tax return hassle starts at £10,000. If exceeding £1,000, your tax code will be amended to collect the extra tax, and HMRC may or may not do this correctly.WindfallWendy said:Woah. Money saving experts with the emphasis on Experts!!

I realise this might derail the thread, but do you counter the tax owed on interest gained by non ISA accounts by overpaying into your pension, too?

I'd love to play the regular saver game with accounts, but don't want the hassle of £1000+ interest and the associated tax return.

Also.... Can I assume whilst we are talking about Regular Saver accounts, actually what you could do is recycle the Y1 savings and simply re-deposit that money I to a different RS each month? So whilst there may be £7k a month going into savings, that might all be from recycling RS funds from previous years? Something I've only just thought of, and will definitely build I to my forward plans!!!There are a handful of Regular Saver ISAs (with the best offers typically at the start of the tax year) so you may wish to collect one of these to take sufficient funds so that you do not end up needing to file a tax return/pushing yourself into a higher tax bracket.

I don’t have a spreadsheet but I do have a notebook, though I plan to only be actively funding a dozen at most going forward. I’ve opened too many ‘in case’ this year only to not use them.1 -

Usual drill:

Leeds BS Regular Saver (Issue 56) is now NLA, replaced by Issue 57 at the same rate but with a new maturity date of 5/10/26.5 -

Interest added in the last hour (£112.28) and account now Online Easy Access Issue 4simonsmithsays said:Beehive UK savings week RS 2023/24

Should mature overnight tonight and be available tomorrow even though the maturity date (on mine at least) is showing as 30/9/24.

Notts BS always tend to do this in my experience.

Transferred, all but £10, to my nominated acct which it should hit tomorrow1 -

BestSeagull said:

It'd be nice if Beehive came out with a competitive new RS. What do we think the chances of that are?simonsmithsays said:Beehive UK savings week RS 2023/24

Should mature overnight tonight and be available tomorrow even though the maturity date (on mine at least) is showing as 30/9/24.

Notts BS always tend to do this in my experience.Unlikely. No new products since the start of the year. Missed UK Savings Week when they usually offered a similar product to The Nottingham (which happened).Multiple branch staff confirming it's being relaunched/rebranded in the next 6 months (in my case I was told without asking!)4 -

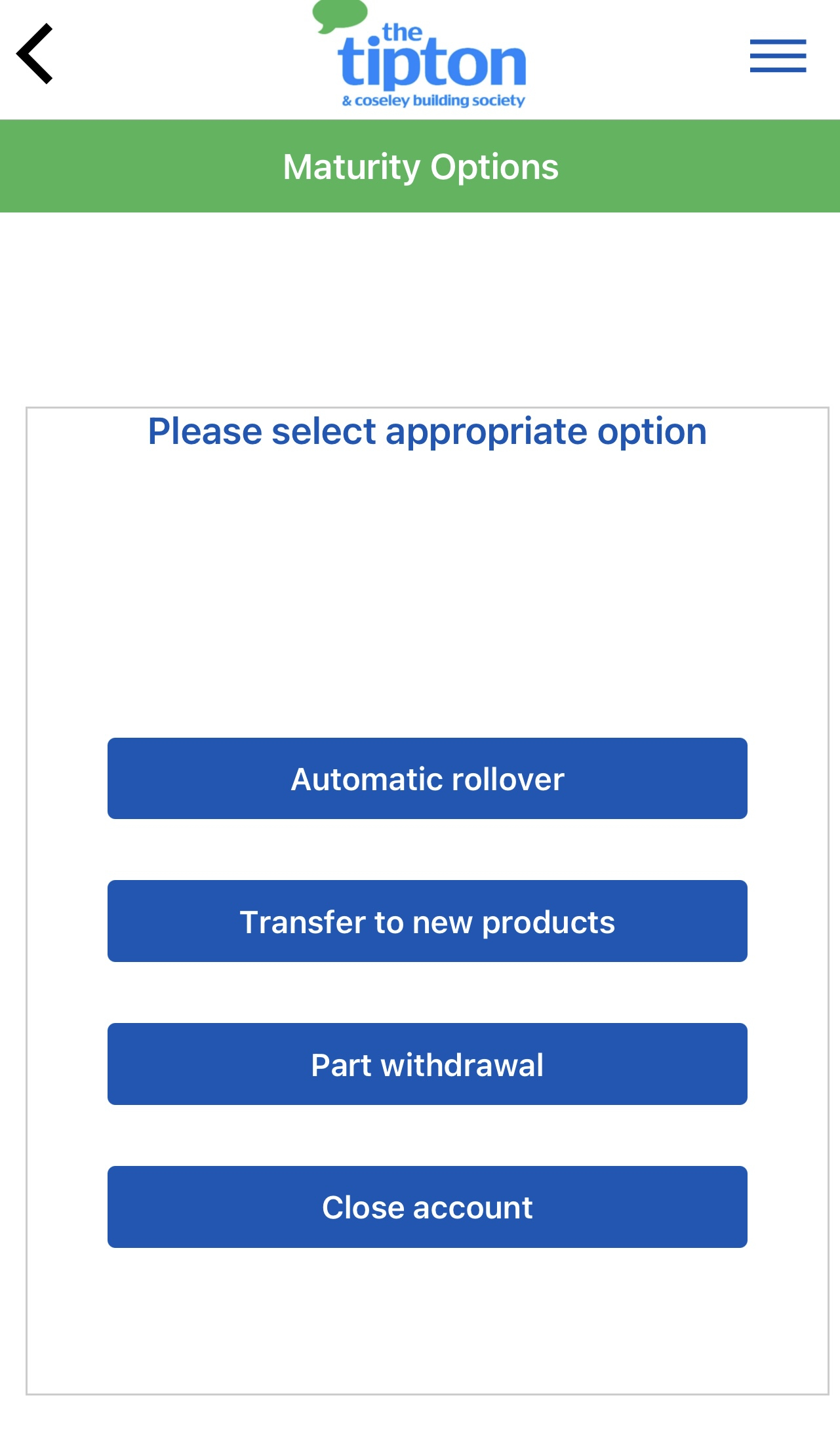

Tipton Regular Saver

Just received this in the Tipton app.On selecting an option, without ANY further information, it asks me to confirm my choice.I’ve made no choice yet.(Ideally I just want an easy access account to keep a relationship with Tipton.)If I choose one of the options, are further details available, and if I don’t like what I read, is it possible to return to make another choice.

Thanks for reading and any clarification. Digital Payback

Digital Payback

The National Lottery : A tax on those who aren’t good at maths.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards