We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

jameseonline said:

They appear to be getting more modern so cheques shouldn't need to be anything again for me because they've proved they can credit my Virgin Money account.WillPS said:jameseonline said:

Do Monmouthshire require me to do paperwork so like signatures, do I need to get codes or whatever to my phone/through post?, send ID etc?.allegro120 said:

They send passbook by post, but you don't have to send it back to get your money. On maturity, I let the accounts morph into easy access and request transfer from there to my bank account.jameseonline said:I'm thinking it might be worth exploring opening an easy access account with Monmouthshire now.

Had a regular saver with them ages ago, did nothing with it after funding it once because I didn't realise how old fashioned they were, like they sent passbook, had no idea what they were, for a while they kept being like we can send you a cheque etc, eventually more recently they were like they can send money back to the account I paid them from.

So my question would be are they still going to give me a passbook?, can I easily get at MY money ?, they still old fashioned etc?

Is the website easy to request my money out, like they do fast payments?, will I be wanting several days for money?.

Sorry if this seems a bit much but I want to be sure before starting things up again with them, even if this time I'm only going to initially set up an easy access with them to build up loyalty/get in the systemIn common with all building societies I know of (other than Nationwide) you won't have immediate access to your money unless you go to an agency or branch; in the case of the former there are limits on the amount of cash but they'll normally sort out a cheque for you. You can request a withdrawal online but there will be a wait.They will likely send paperwork for you to sign and return in the post, depending on whether or not they can revive the profile you had from last time.In order to get web access you need to wait for your passbook to be sent out, which will have your account number - then sign up. Then wait for them to send you an activation code by post. An app is promised and slated for the end of the year, but I imagine it'll be the same procedure then.Incidentally my wife and I 'nipped' to our nearest agency recently (Hereford, 2.5 hrs drive from Nottm - we didn't go specifically for the building society!) and received very good service; passbooks all dutifullly made up and my wife got her name changed - another one off the list!I'm very happy with the service we've received from Monmouthshire but it's certainly not a good fit if immediacy and modernity are priorities for you.

Surely they can email me my details? text my phone?

I'm not interested in going to a branch/agency?(Even though I probably could living in Wales), I'm only interested in website/app access.

I applied earlier so hopefully not going to be a total b ache.They don't send out codes by SMS/email in my experience. Of course they potentially could, but they don't.You clearly know the limitations of the building society's admittedly anachronistic systems, so you have no excuse for not setting your own expectations accordingly now that you're chosing to do business with them again. Be patient and all is well.0 -

jameseonline said:

Do Monmouthshire require me to do paperwork so like signatures, do I need to get codes or whatever to my phone/through post?, send ID etc?.allegro120 said:

They send passbook by post, but you don't have to send it back to get your money. On maturity, I let the accounts morph into easy access and request transfer from there to my bank account.jameseonline said:I'm thinking it might be worth exploring opening an easy access account with Monmouthshire now.

Had a regular saver with them ages ago, did nothing with it after funding it once because I didn't realise how old fashioned they were, like they sent passbook, had no idea what they were, for a while they kept being like we can send you a cheque etc, eventually more recently they were like they can send money back to the account I paid them from.

So my question would be are they still going to give me a passbook?, can I easily get at MY money ?, they still old fashioned etc?

Is the website easy to request my money out, like they do fast payments?, will I be wanting several days for money?.

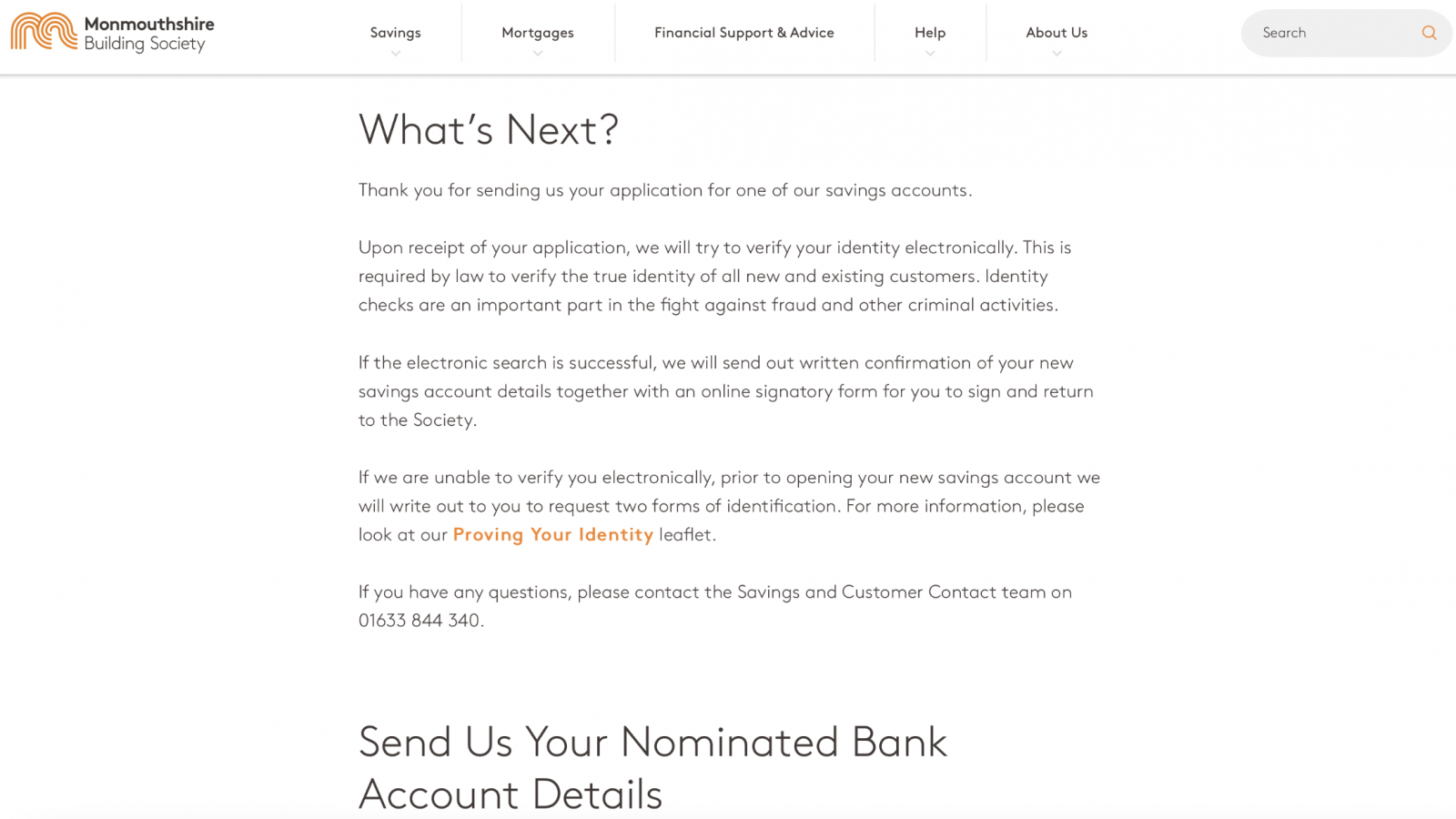

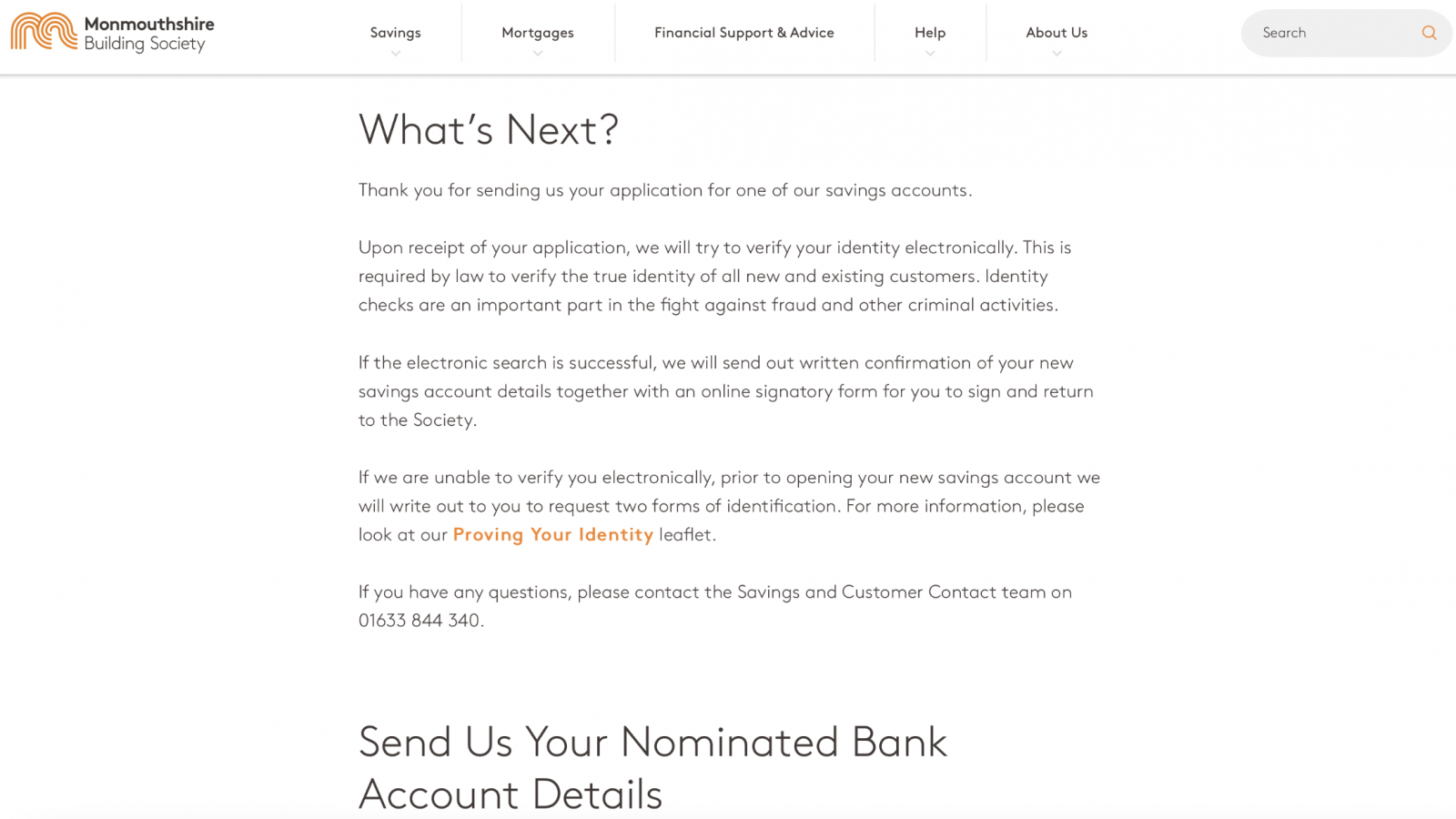

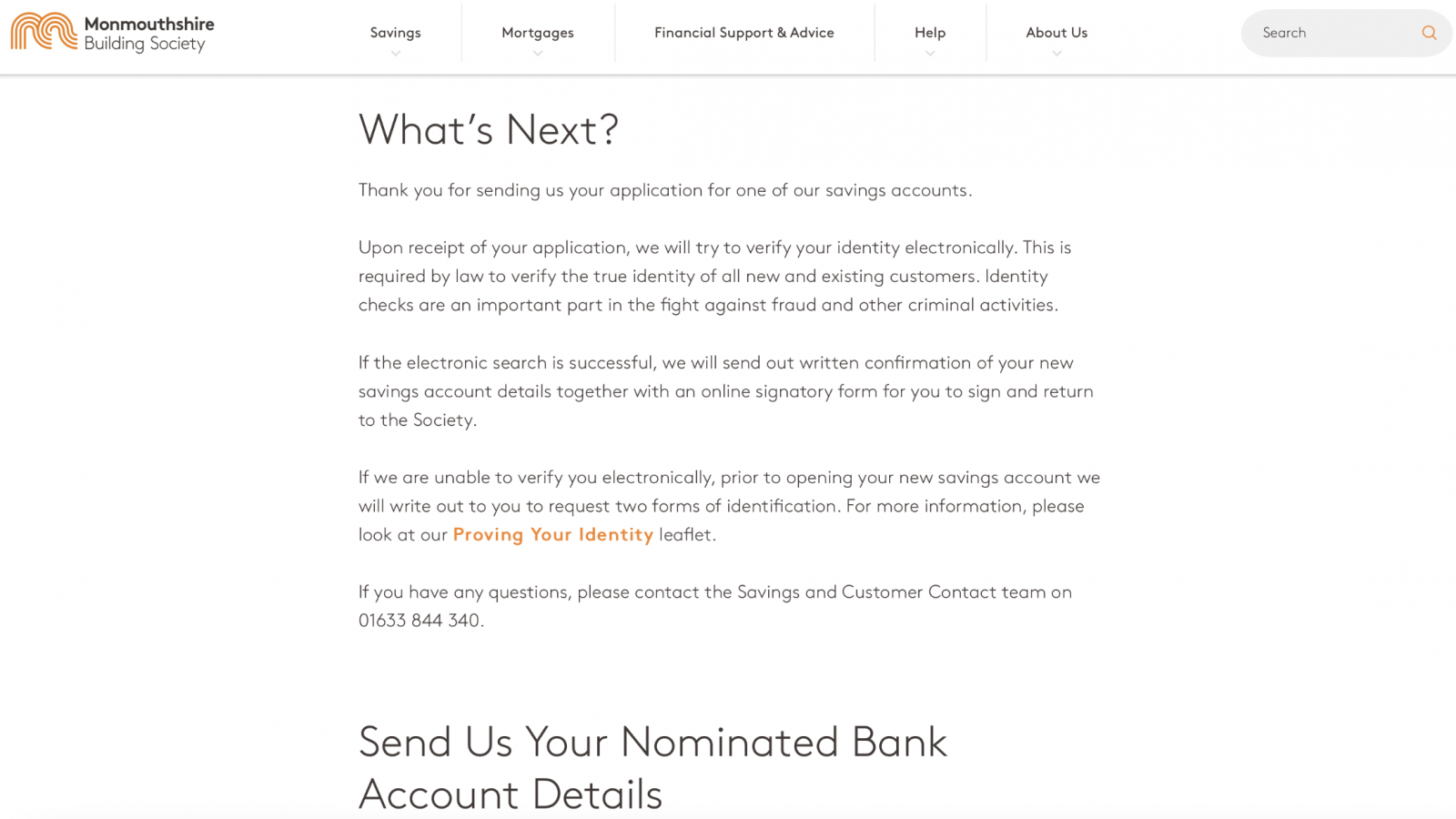

Sorry if this seems a bit much but I want to be sure before starting things up again with them, even if this time I'm only going to initially set up an easy access with them to build up loyalty/get in the system I managed to do everything (apart from the signatory element) online, if I remember correctly. Here's a screenshot of the Monmouthshire Reg Saver application confirmation I received while applying — hope it helps:0

I managed to do everything (apart from the signatory element) online, if I remember correctly. Here's a screenshot of the Monmouthshire Reg Saver application confirmation I received while applying — hope it helps:0 -

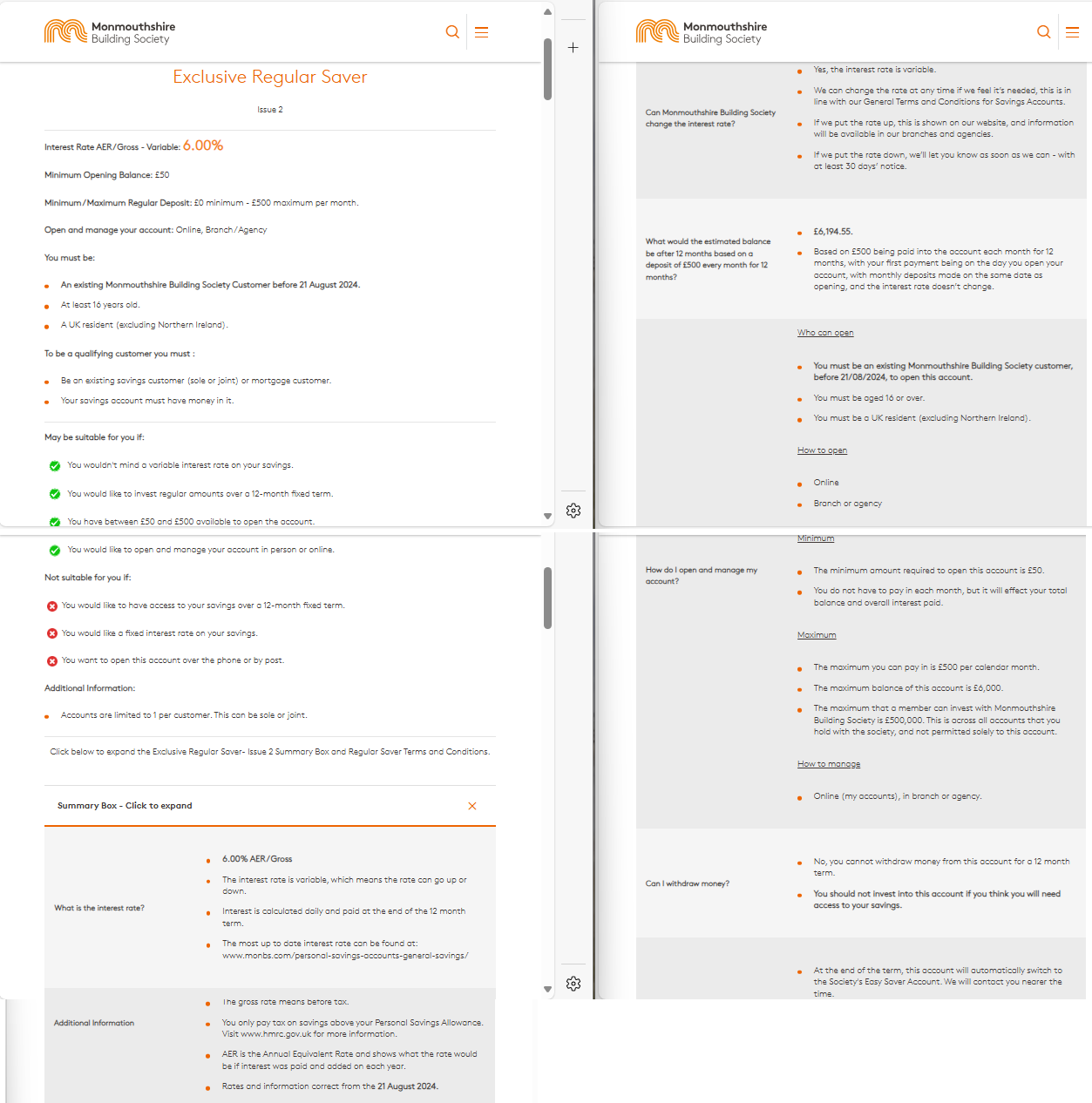

The wayback machine seems to be having some technical issues when it comes to archiving the Ts&Cs for this account, with there being a delay between the archived link being generated and the website actually being archived to it.OneUser1 said:New 6% Regular Saver at Monmouthshire. On website. £500 maximum per month, existing members and the rate variable.

Previously when this has happened the issue has resolved itself within 24 hours but given that one of Monmouthshire BS's regular savers from last year was only available for around 18 hours I've decided not to risk it so as a precautionary measure I've decided to screenshot their product page and paste it here for future reference.

I've saved a PDF version of the account specific Ts&Cs which can be uploaded to the wayback machine at a later date if necessary.

13 -

From memory, Monmouthshire consider the account opened on the day, they get the first depositDJDools said:jameseonline said:

Do Monmouthshire require me to do paperwork so like signatures, do I need to get codes or whatever to my phone/through post?, send ID etc?.allegro120 said:

They send passbook by post, but you don't have to send it back to get your money. On maturity, I let the accounts morph into easy access and request transfer from there to my bank account.jameseonline said:I'm thinking it might be worth exploring opening an easy access account with Monmouthshire now.

Had a regular saver with them ages ago, did nothing with it after funding it once because I didn't realise how old fashioned they were, like they sent passbook, had no idea what they were, for a while they kept being like we can send you a cheque etc, eventually more recently they were like they can send money back to the account I paid them from.

So my question would be are they still going to give me a passbook?, can I easily get at MY money ?, they still old fashioned etc?

Is the website easy to request my money out, like they do fast payments?, will I be wanting several days for money?.

Sorry if this seems a bit much but I want to be sure before starting things up again with them, even if this time I'm only going to initially set up an easy access with them to build up loyalty/get in the system I managed to do everything (apart from the signatory element) online, if I remember correctly. Here's a screenshot of the Monmouthshire Reg Saver application confirmation I received while applying — hope it helps:

I managed to do everything (apart from the signatory element) online, if I remember correctly. Here's a screenshot of the Monmouthshire Reg Saver application confirmation I received while applying — hope it helps:

Even so, does anyone know how long the identify identity electronically process takes and is it automated? I note that some have already managed to fund their new accounts..

0 -

Oops, apologies. Yes, of course you do.chris_the_bee said:

For that you need the Security Code from the maturity letter10_66 said:

If you wish to re-invest with them, you can give instructions via;Snapdragon said:Monmouthshire BS

Anyone else got their 7% saver maturing shortly and not had any maturity info yet?

My 8% matures next Friday (30th) and I finally got the maturity letter this week, and the 7% matures 04/09 so surprised I've not heard anything from them about maturity options yet. I was hoping I could maybe give maturity instructions if I signed in, but there isn't anything about maturity options online. Am guessing I will just have to let them mature into Easy Access and move the money myself afterwards. On that thought, will they open new EA accounts or use the one I already have?

apply.monbs.com/switch-savings0 -

Last year it took me a couple of weeks as a new member, to get online access and fund the accounts. I didn’t need to send ID, just return the signature, wait on passbooks wait on online access.gt94sss2 said:

From memory, Monmouthshire consider the account opened on the day, they get the first depositDJDools said:jameseonline said:

Do Monmouthshire require me to do paperwork so like signatures, do I need to get codes or whatever to my phone/through post?, send ID etc?.allegro120 said:

They send passbook by post, but you don't have to send it back to get your money. On maturity, I let the accounts morph into easy access and request transfer from there to my bank account.jameseonline said:I'm thinking it might be worth exploring opening an easy access account with Monmouthshire now.

Had a regular saver with them ages ago, did nothing with it after funding it once because I didn't realise how old fashioned they were, like they sent passbook, had no idea what they were, for a while they kept being like we can send you a cheque etc, eventually more recently they were like they can send money back to the account I paid them from.

So my question would be are they still going to give me a passbook?, can I easily get at MY money ?, they still old fashioned etc?

Is the website easy to request my money out, like they do fast payments?, will I be wanting several days for money?.

Sorry if this seems a bit much but I want to be sure before starting things up again with them, even if this time I'm only going to initially set up an easy access with them to build up loyalty/get in the system I managed to do everything (apart from the signatory element) online, if I remember correctly. Here's a screenshot of the Monmouthshire Reg Saver application confirmation I received while applying — hope it helps:

I managed to do everything (apart from the signatory element) online, if I remember correctly. Here's a screenshot of the Monmouthshire Reg Saver application confirmation I received while applying — hope it helps:

Even so, does anyone know how long the identify identity electronically process takes and is it automated? I note that some have already managed to fund their new accounts..I have applied today but not heard anything further, don’t have account number to add and fund online as yet.0 -

Those of us who have applied today for the new Mon BS Exclusive RS and are awaiting the signature form and account details:- I think we will be lucky to get the first payment in by the end of the month but we shall see.

As someone pointed out upthread, Mon BS account-opening procedures are not the quickest, so it is best to be aware of this and be patient. They get there in the end.

Although the 6% rate is variable, I reckon that it will be maintained for the full year unless there is more than one base rate drop between now and then. So definitely worth having this account, IMHO.4 -

Hi, thanks for this great thread!Special_Saver2 said:Accounts only for people who live locally or existing members

Interest rate: 6% gross p.a. variable (this interest rate first noted by me on 8th July 2023)

Monthly payment: £1-£300

Miss any payments: Can miss three payments per calendar year

Penalty-free withdrawals: Three per calendar year

Age of applicant: Not specified

How to open account: Branch or post

Special conditions: The account matures after 36 months. Available only to existing members or people who live in Cumbria, Northumberland, Tyne & Wear, County Durham, Lancashire and Yorkshire.

Was just looking at this link and it seems to be NLA. Unless you have to create an account or something first? The summary box is still showing at the bottom but it looks like it shouldn't be there.1 -

Possibly, but if I'm not mistaken last year MBS launched their 7% and 8% regular savers on 23/8/23 yet many, myself included, were able to get payments in by the end of August (just).Hattie627 said:Those of us who have applied today for the new Mon BS Exclusive RS and are awaiting the signature form and account details:- I think we will be lucky to get the first payment in by the end of the month but we shall see.

As someone pointed out upthread, Mon BS account-opening procedures are not the quickest, so it is best to be aware of this and be patient. They get there in the end.

Although the 6% rate is variable, I reckon that it will be maintained for the full year unless there is more than one base rate drop between now and then. So definitely worth having this account, IMHO.

We should be receiving online signatory forms in the post within the next week or so, these should contain the regular saver account number, which you can then use to fund the account using the sort code/account numbers in any MBS passbook.

Moreover I'd expect that this time round they may not be as busy as last year given that they've imposed a hard cut off date for eligibility and they're only offering the one regular saver (with a reduced rate from last year, albeit with a higher maximum monthly deposit).

I'd agree on your point about being patient with MBS though, I'd imagine they'll still be rather busy at the moment and pestering them will only cause delays. I've applied for mine so I'm just going to let them get on with it till I hear more from them.4 -

I've finally got my email off the Principality. It mentions my ISA and my Triple Access Regular, but no mention is made of my Learner Earner (Issue 1)Bridlington1 said:

Another typo I'm afraid, it seems standards are starting to slip these days. Now updated, apologies for the misinformation.fabsaver said:

According to their website the Saffron BS 12 Month Members Regular Saver is reducing from 5.25% to 5.00% on 30 August 2024.Bridlington1 said:

As advertised below is a list of the variable rate regular savers I'm aware of that have announced rate reductions or that they're holding their rates since the BOE base rate reduction from 5.25% to 5% on 1/8/24.Bridlington1 said:

For ease of reference I'll add a list of which regular savers have announced rate decreases/rate holds since the last BOE base rate reduction to the Archived List of Regular Savers thread later this evening, I've been maintaining a list of them on my spreadsheet anyway so it'll just be a copy/paste job with todays additions thrown in.

There may be some accounts missing, if there are any please let me know.

Note I haven't listed accounts that are yet to declare.

Upcoming Regular Saver Rate Decreases:Account Old rate New rate Date Aldermore Regular Saver Account Issue 1 5.25% NO CHANGE 03/09/24 Buckinghamshire BS Regular Saver 4.00% 3.75% 01/09/24 Buckinghamshire BS Regular Saver Locals 4.40% 4.15% 01/09/24 Coventry BS Children's Regular Saver 4.65% 4.40% 02/09/24 Coventry BS Colleague Regular Saver 5.50% 5.25% 02/09/24 Coventry BS First Home Saver 5.60% 5.35% 02/09/24 Coventry BS First Home Saver 5.60% 5.35% 02/09/24 Coventry BS First Home Saver (2) 5.05% 4.80% 02/09/24 Coventry BS Loyalty Regular Saver 7.00% 6.75% 02/09/24 Coventry BS Loyalty Regular Saver (2) 6.75% 6.50% 02/09/24 Coventry BS Regular Saver 5.05% 4.80% 02/09/24 Coventry BS Regular Saver (5) 5.50% 5.25% 02/09/24 Coventry BS Regular Saver (6) 5.00% 4.75% 02/09/24 Coventry BS Regular Saver ISA 5.05% 4.80% 02/09/24 Darlington BS 12 Month RS 5.10% 5.10% 01/09/24 Darlington BS Green Regular Saver 4.20% 3.95% 01/09/24 Darlington BS High Days & Holidays Saver 4.15% 3.80% 01/09/24 Darlington BS regular esaver 4.20% 3.95% 01/09/24 Darlington BS regular saver 4.20% 3.95% 01/09/24 Darlington BS Special Occasion Saver 4.20% 3.95% 01/09/24 Hanley Economic Online Regular Saver 5.50% NO CHANGE 01/09/24 HRBS Regular Saver 30 Day Notice 5.25% 5.00% 24/08/24 HRBS Regular Saver 30 Day Notice 5.25% 5.00% 24/08/24 HRBS Regular Saver 30 Day Notice Issue 2 5.10% 4.85% 24/08/24 HRBS Regular Saver 30 Day Notice Issue 2 5.10% 4.85% 24/08/24 Leek BS Homebuyers Regular Savings 3.80% 3.55% 02/09/24 Leek BS Regular Saver Account Issue 1 & 2 3.80% 3.55% 02/09/24 Leek BS Regular Saver Account Issue 3 5.25% 5.00% 02/09/24 Mansfield BS Bonus Regular Savings Issue 8 6.10% 5.85% 01/09/24 Mansfield BS Kick Start Regular Savings Issue 7 (after 1Y only, before 1Y fixed a4 6.1%) 4.25% 4.00% 01/09/24 Mansfield BS Regular Savings (2nd issue) 4.25% 4.00% 01/09/24 Mansfield BS Regular Savings (3rd- 6th issues, including 150th anniversary issue) 4.25% 4.00% 01/09/24 Mansfield BS Regular Savings 30 (1st issue) 4.50% 4.25% 01/09/24 Mansfield BS Young Regular Saver (1st and 2nd issue) 4.75% 4.50% 01/09/24 Mansfield BS Young Regular Saver (3rd issue) 4.75% 4.50% 01/09/24 Market Harborough BS Member Monthly Saver 3.75% NO CHANGE 01/09/24 Natwest Digital Regular Saver (headline only) 6.17% 6.17% 29/08/24 Newbury Home Saver 4.25% 4.00% 12/09/24 Principality BS 1 Year Triple Access Regular Saver 6.00% 5.75% 12/09/24 Principality BS First Home Steps Account Issue 4 5.25% 5.00% 12/09/24 Principality BS First Home Steps Online Issue 3 5.25% 5.00% 12/09/24 RBS Digital Regular Saver (headline only) 6.17% 6.17% 29/08/24 Saffron BS 12 Month Members Regular Saver 5.50% 5.25% 30/08/24 Saffron BS Small Saver 5.75% 5.50% 30/08/24 Skipton Home Deposit Saver Issue 1 5.06% NO CHANGE 02/09/24 Stafford Railway BS Regular Saver 5.15% NO CHANGE 01/09/24 Suffolk BS Online 1 Year Variable Rate Regular Saver (30.09.2025) 5.15% NO CHANGE 02/09/24 Suffolk BS Variable Rate Regular Saver (31.05.2026) 5.00% NO CHANGE 02/09/24 Suffolk BS Variable Rate Regular Saver (31.12.2025) 5.00% NO CHANGE 02/09/24 Vernon Online Regular Saver 6.50% NO CHANGE 01/09/24 West Brom Access Regular Saver 3.60% 3.35% 16/09/24 YBS Christmas 2024 Regular Saver/eSaver 6.00% NO CHANGE 06/09/24 YBS First Home Saver/eSaver 5.00% 4.90% 06/09/24 YBS Loyalty 2023 Regular Saver/eSaver 7.00% NO CHANGE 06/09/24 YBS Loyalty Regular eSaver 5.75% NO CHANGE 06/09/24 YBS Loyalty Regular Saver 5.75% 5.65% 06/09/24 YBS Regular Saver/eSaver 5.25% 5.05% 06/09/24

https://www.saffronbs.co.uk/savings/regular-savers/12-month-members-regular-saver

You currently have it listed as reducing from 5.50% to 5.25%. Is it the same account or an earlier version?

I've updated my post to include a screenshot of the email I received which states this. I was typing that one with around a minute to go until the end of my break at work (info was delayed due to Principality phone line issues that repeatedly put me through to mortgages) so I'm afraid I didn't have chance to work out how to add screenshots onto the forum directly from my phone (will experiment later on for future reference).DJDools said:

For variable rate accounts only. I only have one variable rate with Principality so I guess I'll be getting an email soon about that one.Bridlington1 said:I've spoken to Principality.They had no info on their NLA accounts but have since sent me an email saying all accounts will reduce by 0.25%

Additionally I've now added the Principality rate reductions to the list. These are as follows (unless I've missed any off or made typos):Account Old rate New rate Date Principality BS 1 Year Triple Access Regular Saver 6.00% 5.75% 12/09/24 Principality BS Dylan Young Saver 4.00% 3.75% 12/09/24 Principality BS First Home Steps Account 5.25% 5.00% 12/09/24 Principality BS First Home Steps Account Issue 2 5.25% 5.00% 12/09/24 Principality BS First Home Steps Account Issue 3 5.25% 5.00% 12/09/24 Principality BS First Home Steps Account Issue 4 5.25% 5.00% 12/09/24 Principality BS First Home Steps Online 5.25% 5.00% 12/09/24 Principality BS First Home Steps Online Issue 2 5.25% 5.00% 12/09/24 Principality BS First Home Steps Online Issue 3 5.25% 5.00% 12/09/24 Principality BS Gift Saver 4.60% 4.35% 12/09/24 Principality BS Learner Earner (Issue 1 & 2) 5.75% 5.50% 12/09/24 Principality BS Learner Earner Issue 3 4.70% 4.45% 12/09/24 Principality BS NHS Thank You Online Saver 4.20% 3.95% 12/09/24 Principality BS NHS Thank You Saver 4.20% 3.95% 12/09/24 Principality BS School Staff Saver 4.45% 4.20% 12/09/24 Principality BS Thank You Online Saver (Issues 1 to 4) 4.45% 4.20% 12/09/24 Principality BS Thank You Saver (Issues 1 to 4) 4.45% 4.20% 12/09/24 I consider myself to be a male feminist. Is that allowed?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards