We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Regular Savings Accounts: The Best Currently Available List!

Comments

-

States on the product page:jameseonline said:

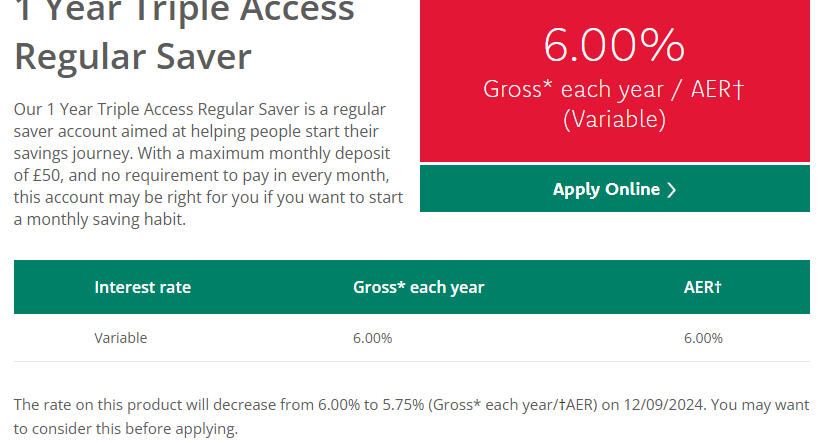

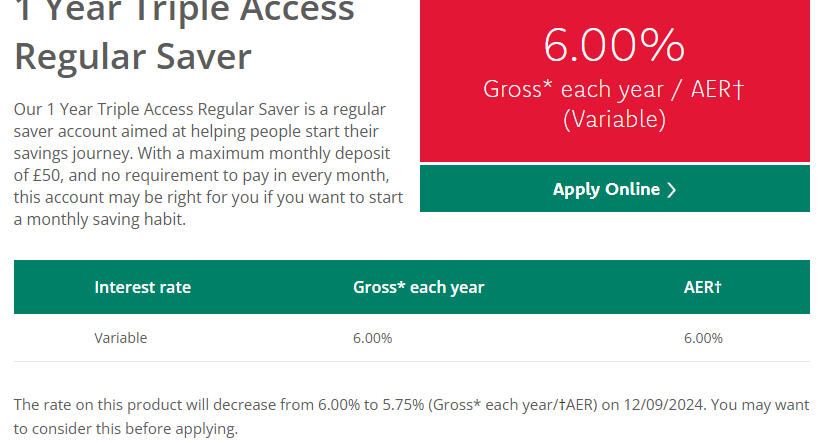

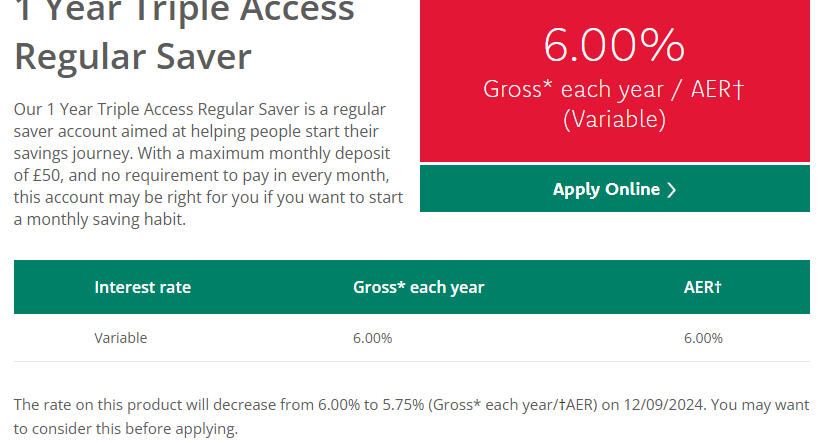

Did you get an email or is this like a new issue or something?t1redmonkey said:Principality 1 year Triple Access Regular Saver reducing from 6% to 5.75% from 12th September.

2 -

Of the 5 different Principality BS Regular Savers which I currently have, this is the only one which doesn't have a fixed rate.t1redmonkey said:Principality 1 year Triple Access Regular Saver reducing from 6% to 5.75% from 12th September.4 -

For those raising complaints with Mon BS as a matter of principle to get them to stick to their own rules, are they also going to complain to Lloyds to get them to stick to their rules too? Thought not.flaneurs_lobster said:

It does. However the consideration might be what to do with the money removed from the (say) Lloyds Club RS currently earning 6.25%.easyasonetwothree said:

For Lloyds at least they say you can't open another regular Saver until the 12 month anniversary anyway. So I don't think the renew trick works with them?twadds123 said:Lloyds, BOS, Halifax regular savers.I have all these due to end in a few months time, just wondering if any one feels it is worth using the "renew" trick to start them again now to lock in the interest rate for another 12 months?With the base rate coming down just wondering if they will drop their rates in the coming months?Northern Ireland club member No 382 :j2 -

Fair enough, I just would have thought they would have emailed about it around the same time as changing it on their site.Bridlington1 said:

States on the product page:jameseonline said:

Did you get an email or is this like a new issue or something?t1redmonkey said:Principality 1 year Triple Access Regular Saver reducing from 6% to 5.75% from 12th September.

Now wondering if any others will change.1 -

5?, so you have 2 different issues of their 5.5% then or am I missing something?Hattie627 said:

Of the 5 different Principality BS Regular Savers which I currently have, this is the only one which doesn't have a fixed rate.t1redmonkey said:Principality 1 year Triple Access Regular Saver reducing from 6% to 5.75% from 12th September.0 -

The First Home Steps Account pages also state those accounts will fall to 5%jameseonline said:

Fair enough, I just would have thought they would have emailed about it around the same time as changing it on their site.Bridlington1 said:

States on the product page:jameseonline said:

Did you get an email or is this like a new issue or something?t1redmonkey said:Principality 1 year Triple Access Regular Saver reducing from 6% to 5.75% from 12th September.

Now wondering if any others will change.

I'm sure Principality will be announcing these changes more widely over the next few days2 -

I also have 5, if that helps:jameseonline said:

5?, so you have 2 different issues of their 5.5% then or am I missing something?Hattie627 said:

Of the 5 different Principality BS Regular Savers which I currently have, this is the only one which doesn't have a fixed rate.t1redmonkey said:Principality 1 year Triple Access Regular Saver reducing from 6% to 5.75% from 12th September.Principality Maturity Winter Regular Saver Bond

Principality 1 Year Regular Saver Bond (Issue 34)

Principality 2 Year Healthy Habits Saver Bond

Principality Triple Access Regular Saver

Principality 6 Month Regular Saver

3 -

I've notched up 8. All of the ones you mention plus Issue 33 of their 1Y Regular Saver Bond and the FHS Online Issues 2 and 3.DJDools said:

I also have 5, if that helps:jameseonline said:

5?, so you have 2 different issues of their 5.5% then or am I missing something?Hattie627 said:

Of the 5 different Principality BS Regular Savers which I currently have, this is the only one which doesn't have a fixed rate.t1redmonkey said:Principality 1 year Triple Access Regular Saver reducing from 6% to 5.75% from 12th September.Principality Maturity Winter Regular Saver Bond

Principality 1 Year Regular Saver Bond (Issue 34)

Principality 2 Year Healthy Habits Saver Bond

Principality Triple Access Regular Saver

Principality 6 Month Regular Saver

3 -

These are the 5 I have. All are fixed rate, except the Triple Access Saver, which is only £50 per month.DJDools said:

I also have 5, if that helps:jameseonline said:

5?, so you have 2 different issues of their 5.5% then or am I missing something?Hattie627 said:

Of the 5 different Principality BS Regular Savers which I currently have, this is the only one which doesn't have a fixed rate.t1redmonkey said:Principality 1 year Triple Access Regular Saver reducing from 6% to 5.75% from 12th September.Principality Maturity Winter Regular Saver Bond

Principality 1 Year Regular Saver Bond (Issue 34)

Principality 2 Year Healthy Habits Saver Bond

Principality Triple Access Regular Saver

Principality 6 Month Regular Saver

4 -

Just had an email for Nat West advising that they are reducing the rate on their Regular Saver from 29th August.Good news for those with up to £5000 in it, is that it is remaining at 6.17% AER.

Bad news for those that are daft enough to have over £5000 in it, is that the rate is reducing from 1.75% to 1.60%2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards