We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Good point. Like most people on here, I am a careful saver and usually check T and Cs carefully before doing something slightly unusual, like making a 13th RS payment. I checked by posting on here well before 1 August whether 13th payments were allowed for the two MonBS RS's. Somebody gave me the link to the archived T and Cs which I checked carefully before making the 13th payments. Having taken the trouble to do this as a customer, I expect a deposit-taking institution to take as much care in applying their own T and Cs. My two 13th payments, sent by SO early on 1 August, are not showing yet so presumably will be returned. This will result in a loss of interest, plus a certain degree of inconvenience. I will certainly be raising this as an issue with Monmouthshire.dcs34 said:

I'd like them to operate their accounts in accordance with their own T&Cs.flaneurs_lobster said:

Are you hoping to squeeze some compo out of MonBS?dcs34 said:

Monmouthshire: 8% Exclusive Regular Saver & 7% Regular Saver Issue 2fabsaver said:Monmouthshire: 8% Exclusive Regular Saver & 7% Regular Saver Issue 2

My 1st August 13th deposits haven't been credited yet to either account. I've checked the terms for both these accounts and they definitely do not state anything about a £3,600 maximum balance (their earlier Coronation Regular Saver did have such a term).

If my deposits get returned I'll be complaining and quoting their own terms at them. If anyone didn't save a copy then archived copies of the summary box and terms are linked in this helpful post by @Bridlington1

I have pre-empted by sending them a secure message asking why the deposits have not been received or returned. Hopefully this will get them to state what they think the T&Cs say / should be, so I can respond with what they actually do say (or, in this case, don't say).6 -

You'd hope people wouldn't but I bet there's a few that do.Stargunner said:

Surely, no one is daft enough to keep over £5k in any of those accounts, so it wont have any relevance.ForumUser7 said:NatWest and RBS Digital Regular Savers

Rate above 5k drops to 1.60% from 1.75% effective 29th August. Headline rate of 6.17% up to and including 5k remains

Idiot tax 🤣0 -

A few more than a few me thinksjameseonline said:

You'd hope people wouldn't but I bet there's a few that do.Stargunner said:

Surely, no one is daft enough to keep over £5k in any of those accounts, so it wont have any relevance.ForumUser7 said:NatWest and RBS Digital Regular Savers

Rate above 5k drops to 1.60% from 1.75% effective 29th August. Headline rate of 6.17% up to and including 5k remains

Idiot tax 🤣I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.1 -

Monmouthshire: 8% Exclusive Regular Saver & 7% Regular Saver Issue 2flaneurs_lobster said:

Are you hoping to squeeze some compo out of MonBS?dcs34 said:

Monmouthshire: 8% Exclusive Regular Saver & 7% Regular Saver Issue 2fabsaver said:Monmouthshire: 8% Exclusive Regular Saver & 7% Regular Saver Issue 2

My 1st August 13th deposits haven't been credited yet to either account. I've checked the terms for both these accounts and they definitely do not state anything about a £3,600 maximum balance (their earlier Coronation Regular Saver did have such a term).

If my deposits get returned I'll be complaining and quoting their own terms at them. If anyone didn't save a copy then archived copies of the summary box and terms are linked in this helpful post by @Bridlington1

I have pre-empted by sending them a secure message asking why the deposits have not been received or returned. Hopefully this will get them to state what they think the T&Cs say / should be, so I can respond with what they actually do say (or, in this case, don't say).

It is worth complaining, especially if a financial loss is suffered. I did. T's&C's for their Coronation Reg stated interest to be paid 31st March. In practice they paid at maturity May 5th. The effect of this was to move £100 of interest from one tax year (covered by PSA) to the following tax year where I would already be incurring higher rate tax. I showed them the T's&C's that I signed up to and they offered some paltry amount as compensation. I rejected that offer and they then asked how much I wanted. I said they should sit down with a calculator and work out my loss. They then offered and I accepted £50. Ditto for the OH.0 -

Saffron BS Interest rate reductions from 30/8/24:

Small Saver from 5.75% to 5.5%

12 Month Members RS from 5.25% to 5%

17 -

I'd expect that CS would initially quote the two following points in the T&Cs in their mitigation without fully understanding the meaning of them.Hattie627 said:

Good point. Like most people on here, I am a careful saver and usually check T and Cs carefully before doing something slightly unusual, like making a 13th RS payment. I checked by posting on here well before 1 August whether 13th payments were allowed for the two MonBS RS's. Somebody gave me the link to the archived T and Cs which I checked carefully before making the 13th payments. Having taken the trouble to do this as a customer, I expect a deposit-taking institution to take as much care in applying their own T and Cs. My two 13th payments, sent by SO early on 1 August, are not showing yet so presumably will be returned. This will result in a loss of interest, plus a certain degree of inconvenience. I will certainly be raising this as an issue with Monmouthshire.dcs34 said:

I'd like them to operate their accounts in accordance with their own T&Cs.flaneurs_lobster said:

Are you hoping to squeeze some compo out of MonBS?dcs34 said:

Monmouthshire: 8% Exclusive Regular Saver & 7% Regular Saver Issue 2fabsaver said:Monmouthshire: 8% Exclusive Regular Saver & 7% Regular Saver Issue 2

My 1st August 13th deposits haven't been credited yet to either account. I've checked the terms for both these accounts and they definitely do not state anything about a £3,600 maximum balance (their earlier Coronation Regular Saver did have such a term).

If my deposits get returned I'll be complaining and quoting their own terms at them. If anyone didn't save a copy then archived copies of the summary box and terms are linked in this helpful post by @Bridlington1

I have pre-empted by sending them a secure message asking why the deposits have not been received or returned. Hopefully this will get them to state what they think the T&Cs say / should be, so I can respond with what they actually do say (or, in this case, don't say).- Interest is calculated daily and paid at the end of the 12 month term - As we all know 12 months = 12 or 13 payments, but it needs to be clearly stipulated, something they have done in the past by stating a maximum balance, but NOT this time.

- Based on £300 being paid into the account each month for 12 months - However this is just an example of possible interest earnings which is stated due to legal requirements and is not a declaration of what will/can be earnt.

If they take a week to return the £600 for both accounts it's potentially an 80p loss based upon that £600 otherwise being in a 5% feeder a/c.

Individuals will have to decide is it worth the complaint on principal of adherence though. If the boot was on the other foot I'm sure the terms would be rigidly applied.

2 -

Thanks @bridlington1 - where were the new rates advertised please? Found the bit saying they'll decrease on their site, but not what to. I have some other accounts with them as well, but not been emailedBridlington1 said:Saffron BS Interest rate reductions from 30/8/24:

Small Saver from 5.75% to 5.5%

12 Month Members RS from 5.25% to 5% If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2 -

See my previous post....Wheres_My_Cashback said:

I'd expect that CS would initially quote the two following points in the T&Cs in their mitigation without fully understanding the meaning of them.Hattie627 said:

Good point. Like most people on here, I am a careful saver and usually check T and Cs carefully before doing something slightly unusual, like making a 13th RS payment. I checked by posting on here well before 1 August whether 13th payments were allowed for the two MonBS RS's. Somebody gave me the link to the archived T and Cs which I checked carefully before making the 13th payments. Having taken the trouble to do this as a customer, I expect a deposit-taking institution to take as much care in applying their own T and Cs. My two 13th payments, sent by SO early on 1 August, are not showing yet so presumably will be returned. This will result in a loss of interest, plus a certain degree of inconvenience. I will certainly be raising this as an issue with Monmouthshire.dcs34 said:

I'd like them to operate their accounts in accordance with their own T&Cs.flaneurs_lobster said:

Are you hoping to squeeze some compo out of MonBS?dcs34 said:

Monmouthshire: 8% Exclusive Regular Saver & 7% Regular Saver Issue 2fabsaver said:Monmouthshire: 8% Exclusive Regular Saver & 7% Regular Saver Issue 2

My 1st August 13th deposits haven't been credited yet to either account. I've checked the terms for both these accounts and they definitely do not state anything about a £3,600 maximum balance (their earlier Coronation Regular Saver did have such a term).

If my deposits get returned I'll be complaining and quoting their own terms at them. If anyone didn't save a copy then archived copies of the summary box and terms are linked in this helpful post by @Bridlington1

I have pre-empted by sending them a secure message asking why the deposits have not been received or returned. Hopefully this will get them to state what they think the T&Cs say / should be, so I can respond with what they actually do say (or, in this case, don't say).- Interest is calculated daily and paid at the end of the 12 month term - As we all know 12 months = 12 or 13 payments, but it needs to be clearly stipulated, something they have done in the past by stating a maximum balance, but NOT this time.

- Based on £300 being paid into the account each month for 12 months - However this is just an example of possible interest earnings which is stated due to legal requirements and is not a declaration of what will/can be earnt.

If they take a week to return the £600 for both accounts it's potentially an 80p loss based upon that £600 otherwise being in a 5% feeder a/c.

Individuals will have to decide is it worth the complaint on principal of adherence though. If the boot was on the other foot I'm sure the terms would be rigidly applied.

Monmouthshire: 8% Exclusive Regular Saver & 7% Regular Saver Issue 2

It is worth complaining, especially if a financial loss is suffered. I did. T's&C's for their Coronation Reg stated interest to be paid 31st March. In practice they paid at maturity May 5th. The effect of this was to move £100 of interest from one tax year (covered by PSA) to the following tax year where I would already be incurring higher rate tax. I showed them the T's&C's that I signed up to and they offered some paltry amount as compensation. I rejected that offer and they then asked how much I wanted. I said they should sit down with a calculator and work out my loss. They then offered and I accepted £50. Ditto for the OH.

They expect and will enforce us to adhere to their rules and we should expect they also adhere to them.0 -

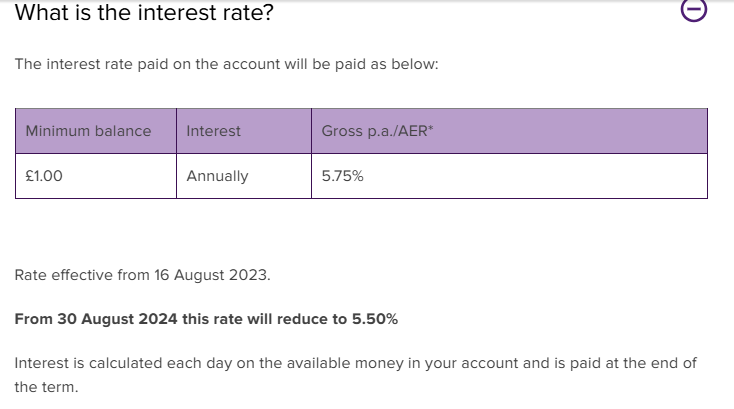

I haven't been emailed either, the new rates are listed in the summary boxes for the individual accounts. E.g. for the small saver:ForumUser7 said:

Thanks @bridlington1 - where were the new rates advertised please? Found the bit saying they'll decrease on their site, but not what to. I have some other accounts with them as well, but not been emailedBridlington1 said:Saffron BS Interest rate reductions from 30/8/24:

Small Saver from 5.75% to 5.5%

12 Month Members RS from 5.25% to 5%

7 -

Is it possible to have more than one regular saver with Saffron? I have the members month loyalty RS but not either of those. Thanks!Bridlington1 said:Saffron BS Interest rate reductions from 30/8/24:

Small Saver from 5.75% to 5.5%

12 Month Members RS from 5.25% to 5%0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards