We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

I fund mine manually. The previous Regular Saver I had with TSB set up two standing orders, and TSB blamed me when one failed even though it was their computer systems that caused itBestSeagull said:My TSB regular saver has matured and I'm thinking about opening a new one. I seem to remember some of you saying you had managed to fund yours manually even though the terms and conditions dictate that it needs to be funded by standing order. I'd much prefer to do it manually if possible.

Can anyone confirm?I consider myself to be a male feminist. Is that allowed?1 -

With mine I can just do an internal transfer. But then TSB computer systems are weird. I have three current accounts with them - two are viewable in the app, but one isn't.Descrabled said:TSB RSI can confirm that, notwithstanding T&C, you can and I do fund this account manually from a TSB account, but you need to set up a new payee in the TSB current account. Additionally, you can fund the RS from an external current account by faster payments and/or standing order.I consider myself to be a male feminist. Is that allowed?1 -

A tactic I might switch to myself, if Skipton repeat their latest glitch next month!surreysaver said:

I fund mine manually. The previous Regular Saver I had with TSB set up two standing orders, and TSB blamed me when one failed even though it was their computer systems that caused itBestSeagull said:My TSB regular saver has matured and I'm thinking about opening a new one. I seem to remember some of you saying you had managed to fund yours manually even though the terms and conditions dictate that it needs to be funded by standing order. I'd much prefer to do it manually if possible.

Can anyone confirm?Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

Yes - I’ve had emails and letters in the post confirming the account details so both are technically open, but have left them unfunded for now as I’m unable to register for online banking. I’m a new customer but my accounts are locked before I’ve even chosen a password for some reason, and an hour and a quarter on the phone for co-op CS to attempt to rectify was a complete waste of time.ChewyyBacca said:Has anybody opened a Co-Op Cashminder account and then successfully opened the 7% Regular saver with Co-op?

T&Cs of RS on the website says Cashminder current account is acceptable, but someone on the forum got rejected for RS, saying Cashminder acct is not acceptable.

Anyone else has got a different experience?1 -

Co-op RS@PloughmansLunch said:

Yes - I’ve had emails and letters in the post confirming the account details so both are technically open, but have left them unfunded for now as I’m unable to register for online banking. I’m a new customer but my accounts are locked before I’ve even chosen a password for some reason, and an hour and a quarter on the phone for co-op CS to attempt to rectify was a complete waste of time.ChewyyBacca said:Has anybody opened a Co-Op Cashminder account and then successfully opened the 7% Regular saver with Co-op?

T&Cs of RS on the website says Cashminder current account is acceptable, but someone on the forum got rejected for RS, saying Cashminder acct is not acceptable.

Anyone else has got a different experience?

Hi Ploughmans ... What actually happens when you try to register? I must have tried about a dozen times before it actually worked.0 -

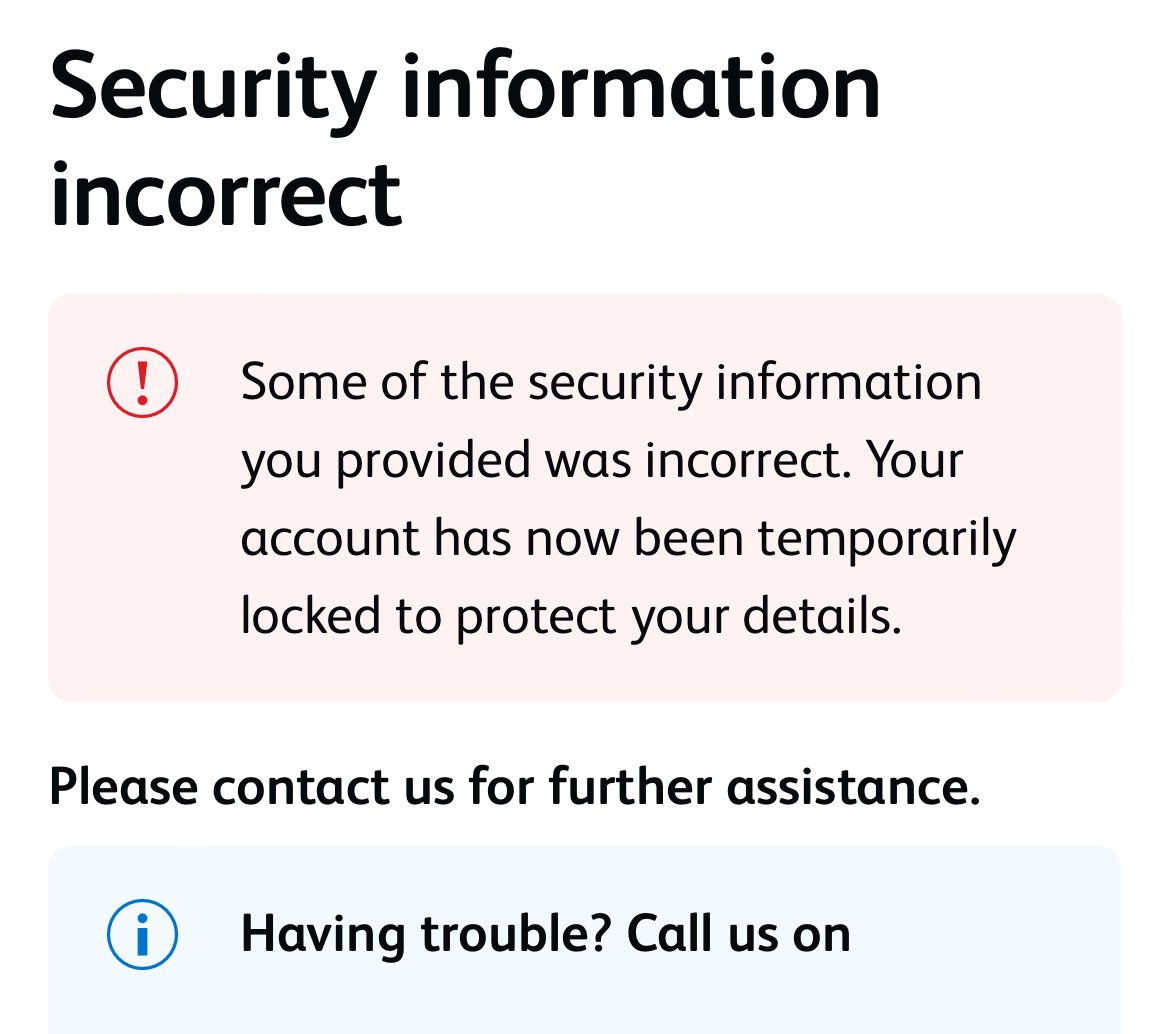

I get his message below, and I can’t face a hour+ of that hold music again. Unless my name or date of birth has changed without my knowledge I’m stumped, as the only other details needed are right there in front of me on the card. It doesn’t work if I use the RS details eitherdealyboy said:

Co-op RS@PloughmansLunch said:

Yes - I’ve had emails and letters in the post confirming the account details so both are technically open, but have left them unfunded for now as I’m unable to register for online banking. I’m a new customer but my accounts are locked before I’ve even chosen a password for some reason, and an hour and a quarter on the phone for co-op CS to attempt to rectify was a complete waste of time.ChewyyBacca said:Has anybody opened a Co-Op Cashminder account and then successfully opened the 7% Regular saver with Co-op?

T&Cs of RS on the website says Cashminder current account is acceptable, but someone on the forum got rejected for RS, saying Cashminder acct is not acceptable.

Anyone else has got a different experience?

Hi Ploughmans ... What actually happens when you try to register? I must have tried about a dozen times before it actually worked.

1 -

For those with the NLA Tipton & Coseley regular savers that were available last year. The terms state that if you miss 3 deposits the account will convert into an EA maturity saver. Just a heads up on the timescales involved:

I missed the deposits for December, January and February. The regular savers converted into easy access maturity savers in line with he Ts&Cs on Friday afternoon (1/3/24), the change of account type didn't result in them paying the accrued interest upon account conversion.

I've found you can't make withdrawals/closure using the transfers section in the app despite them saying it should be possible and they won't let you make withdrawals/closure over the phone so I had to send them a message in the app to get the funds out of the account. I sent them a message yesterday morning requesting that one account is closed and the balance on the other is withdrawn to £100, they actioned this later that day, with the funds arriving in my nominated account earlier today.7 -

Good to know as I'm doing the same, missed Jan, Feb and March. You say they didn't pay accrued interest when account changed to easy access but was it paid when you reduced balance to £100 and closed the other?Bridlington1 said:For those with the NLA Tipton & Coseley regular savers that were available last year. The terms state that if you miss 3 deposits the account will convert into an EA maturity saver. Just a heads up on the timescales involved:

I missed the deposits for December, January and February. The regular savers converted into easy access maturity savers in line with he Ts&Cs on Friday afternoon (1/3/24), the change of account type didn't result in them paying the accrued interest upon account conversion.

I've found you can't make withdrawals/closure using the transfers section in the app despite them saying it should be possible and they won't let you make withdrawals/closure over the phone so I had to send them a message in the app to get the funds out of the account. I sent them a message yesterday morning requesting that one account is closed and the balance on the other is withdrawn to £100, they actioned this later that day, with the funds arriving in my nominated account earlier today.1 -

They paid interest on the account that I closed upon closure. They haven't paid the interest on the one that I just reduced to £100 though so if you wanted to unlock the interest you'd need to close the account.SFindlay said:

Good to know as I'm doing the same, missed Jan, Feb and March. You say they didn't pay accrued interest when account changed to easy access but was it paid when you reduced balance to £100 and closed the other?Bridlington1 said:For those with the NLA Tipton & Coseley regular savers that were available last year. The terms state that if you miss 3 deposits the account will convert into an EA maturity saver. Just a heads up on the timescales involved:

I missed the deposits for December, January and February. The regular savers converted into easy access maturity savers in line with he Ts&Cs on Friday afternoon (1/3/24), the change of account type didn't result in them paying the accrued interest upon account conversion.

I've found you can't make withdrawals/closure using the transfers section in the app despite them saying it should be possible and they won't let you make withdrawals/closure over the phone so I had to send them a message in the app to get the funds out of the account. I sent them a message yesterday morning requesting that one account is closed and the balance on the other is withdrawn to £100, they actioned this later that day, with the funds arriving in my nominated account earlier today.3 -

Co-op RS@PloughmansLunch said:

I get his message below, and I can’t face a hour+ of that hold music again. Unless my name or date of birth has changed without my knowledge I’m stumped, as the only other details needed are right there in front of me on the card. It doesn’t work if I use the RS details eitherdealyboy said:

Co-op RS@PloughmansLunch said:

Yes - I’ve had emails and letters in the post confirming the account details so both are technically open, but have left them unfunded for now as I’m unable to register for online banking. I’m a new customer but my accounts are locked before I’ve even chosen a password for some reason, and an hour and a quarter on the phone for co-op CS to attempt to rectify was a complete waste of time.ChewyyBacca said:Has anybody opened a Co-Op Cashminder account and then successfully opened the 7% Regular saver with Co-op?

T&Cs of RS on the website says Cashminder current account is acceptable, but someone on the forum got rejected for RS, saying Cashminder acct is not acceptable.

Anyone else has got a different experience?

Hi Ploughmans ... What actually happens when you try to register? I must have tried about a dozen times before it actually worked.

<image above>

Indeed, I see. The problem I had was that it kept ending up asking me to login (before I'd created the login details), I think it was confused by a previous failed attempt, but eventually I was sent an OTP and tried again and it worked.

Did you get the three credit file multiple choice questions? I presume you wouldn't have forgotten your name or DOB (hehe), but I had to let the question relating to which month and year I opened a current account pass.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards