We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Regular Savings Accounts: The Best Currently Available List!

Comments

-

No help to you unfortunately but it's advice often repeated here that it's best to maintain relationships with institutions, even if that's just a quid in an easy access account at not much APR, just in case of loyalty offers or later account take-ups.t1redmonkey said:Bit annoying that PBS delete your online account so quickly. I had an account with them earlier this year which I closed in June I believe, but have to go through the whole account creation/activation again since they've already deleted my account.2 -

Yep I do that 99% of the time. Unfortunately with the PBS account I had (one of their previous regular saver issues), it was also an 'all or nothing' withdrawal approach, so I couldn't leave a residual amount in there like I would do if I had the option.flaneurs_lobster said:

No help to you unfortunately but it's advice often repeated here that it's best to maintain relationships with institutions, even if that's just a quid in an easy access account at not much APR, just in case of loyalty offers or later account take-ups.t1redmonkey said:Bit annoying that PBS delete your online account so quickly. I had an account with them earlier this year which I closed in June I believe, but have to go through the whole account creation/activation again since they've already deleted my account.0 -

Open an easy access and stick a quid in it before closing the other accountt1redmonkey said:

Yep I do that 99% of the time. Unfortunately with the PBS account I had (one of their previous regular saver issues), it was also an 'all or nothing' withdrawal approach, so I couldn't leave a residual amount in there like I would do if I had the option.flaneurs_lobster said:

No help to you unfortunately but it's advice often repeated here that it's best to maintain relationships with institutions, even if that's just a quid in an easy access account at not much APR, just in case of loyalty offers or later account take-ups.t1redmonkey said:Bit annoying that PBS delete your online account so quickly. I had an account with them earlier this year which I closed in June I believe, but have to go through the whole account creation/activation again since they've already deleted my account.I consider myself to be a male feminist. Is that allowed?3 -

Do you have the T&C's for the Winter Regular Saver by any chance? Particularly interested if you can withdraw or get access to cash by early closure?Bridlington1 said:

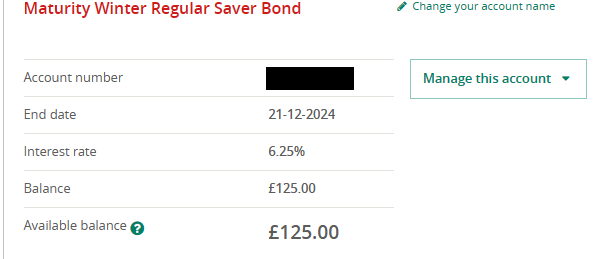

Account open and funded. Also I've just managed to open and fund the Maturity Winter Regular Saver Bond at 6.25% whilst I was at it despite having closed the Christmas Regular Saver in August so not being eligible. The application link can be found below:flaneurs_lobster said:

Now up on websiteBridlington1 said:Principality will be launching a 2 Year Healthy Habits Saver Bond at 6% (£50 max per month, early closure permitted)

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/Healthy-Habits-regular-saver-bond

https://online.principality.co.uk/Originations/launchpage.aspx?productType=RegularSaver&productCode=6090#!

Opened the Healthy Habits Saver Bond but without activation they don't let you open any other accounts. As said before, you could apply as new customer, get a separate ID and hope for their systems to merge but could also end up in a laborious process.

0 -

Maturity Winter Regular Saver Bond (principality.co.uk)pecunianonolet said:

Do you have the T&C's for the Winter Regular Saver by any chance? Particularly interested if you can withdraw or get access to cash by early closure?Bridlington1 said:

Account open and funded. Also I've just managed to open and fund the Maturity Winter Regular Saver Bond at 6.25% whilst I was at it despite having closed the Christmas Regular Saver in August so not being eligible. The application link can be found below:flaneurs_lobster said:

Now up on websiteBridlington1 said:Principality will be launching a 2 Year Healthy Habits Saver Bond at 6% (£50 max per month, early closure permitted)

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/Healthy-Habits-regular-saver-bond

https://online.principality.co.uk/Originations/launchpage.aspx?productType=RegularSaver&productCode=6090#!

Opened the Healthy Habits Saver Bond but without activation they don't let you open any other accounts. As said before, you could apply as new customer, get a separate ID and hope for their systems to merge but could also end up in a laborious process.

4 -

Also for future reference I've archived the Ts&Cs for the Maturity Winter Regular Saver Bond as well as those for the 2 Year Healthy Habits Saver Bond on the wayback machine. The links are listed in this thread.Speculator said:

Maturity Winter Regular Saver Bond (principality.co.uk)pecunianonolet said:

Do you have the T&C's for the Winter Regular Saver by any chance? Particularly interested if you can withdraw or get access to cash by early closure?Bridlington1 said:

Account open and funded. Also I've just managed to open and fund the Maturity Winter Regular Saver Bond at 6.25% whilst I was at it despite having closed the Christmas Regular Saver in August so not being eligible. The application link can be found below:flaneurs_lobster said:

Now up on websiteBridlington1 said:Principality will be launching a 2 Year Healthy Habits Saver Bond at 6% (£50 max per month, early closure permitted)

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/Healthy-Habits-regular-saver-bond

https://online.principality.co.uk/Originations/launchpage.aspx?productType=RegularSaver&productCode=6090#!

Opened the Healthy Habits Saver Bond but without activation they don't let you open any other accounts. As said before, you could apply as new customer, get a separate ID and hope for their systems to merge but could also end up in a laborious process.

https://forums.moneysavingexpert.com/discussion/comment/80268174/#Comment_80268174

9 -

Thanks for the links.Bridlington1 said:

Also for future reference I've archived the Ts&Cs for the Maturity Winter Regular Saver Bond as well as those for the 2 Year Healthy Habits Saver Bond on the wayback machine. The links are listed in this thread.Speculator said:

Maturity Winter Regular Saver Bond (principality.co.uk)pecunianonolet said:

Do you have the T&C's for the Winter Regular Saver by any chance? Particularly interested if you can withdraw or get access to cash by early closure?Bridlington1 said:

Account open and funded. Also I've just managed to open and fund the Maturity Winter Regular Saver Bond at 6.25% whilst I was at it despite having closed the Christmas Regular Saver in August so not being eligible. The application link can be found below:flaneurs_lobster said:

Now up on websiteBridlington1 said:Principality will be launching a 2 Year Healthy Habits Saver Bond at 6% (£50 max per month, early closure permitted)

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/Healthy-Habits-regular-saver-bond

https://online.principality.co.uk/Originations/launchpage.aspx?productType=RegularSaver&productCode=6090#!

Opened the Healthy Habits Saver Bond but without activation they don't let you open any other accounts. As said before, you could apply as new customer, get a separate ID and hope for their systems to merge but could also end up in a laborious process.

https://forums.moneysavingexpert.com/discussion/comment/80268174/#Comment_80268174

I also closed my Christmas Regular Saver before it reached maturity in August. Wonder if Principality will close our accounts and return our money.1 -

I'll keep you all updated with any developments but for now it is looking optimistic:Speculator said:

Thanks for the links.Bridlington1 said:

Also for future reference I've archived the Ts&Cs for the Maturity Winter Regular Saver Bond as well as those for the 2 Year Healthy Habits Saver Bond on the wayback machine. The links are listed in this thread.Speculator said:

Maturity Winter Regular Saver Bond (principality.co.uk)pecunianonolet said:

Do you have the T&C's for the Winter Regular Saver by any chance? Particularly interested if you can withdraw or get access to cash by early closure?Bridlington1 said:

Account open and funded. Also I've just managed to open and fund the Maturity Winter Regular Saver Bond at 6.25% whilst I was at it despite having closed the Christmas Regular Saver in August so not being eligible. The application link can be found below:flaneurs_lobster said:

Now up on websiteBridlington1 said:Principality will be launching a 2 Year Healthy Habits Saver Bond at 6% (£50 max per month, early closure permitted)

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/Healthy-Habits-regular-saver-bond

https://online.principality.co.uk/Originations/launchpage.aspx?productType=RegularSaver&productCode=6090#!

Opened the Healthy Habits Saver Bond but without activation they don't let you open any other accounts. As said before, you could apply as new customer, get a separate ID and hope for their systems to merge but could also end up in a laborious process.

https://forums.moneysavingexpert.com/discussion/comment/80268174/#Comment_80268174

I also closed my Christmas Regular Saver before it reached maturity in August. Wonder if Principality will close our accounts and return our money.

3 -

the terms of the Winter RS Bond PDF do say....Speculator said:

Thanks for the links.Bridlington1 said:

Also for future reference I've archived the Ts&Cs for the Maturity Winter Regular Saver Bond as well as those for the 2 Year Healthy Habits Saver Bond on the wayback machine. The links are listed in this thread.Speculator said:

Maturity Winter Regular Saver Bond (principality.co.uk)pecunianonolet said:

Do you have the T&C's for the Winter Regular Saver by any chance? Particularly interested if you can withdraw or get access to cash by early closure?Bridlington1 said:

Account open and funded. Also I've just managed to open and fund the Maturity Winter Regular Saver Bond at 6.25% whilst I was at it despite having closed the Christmas Regular Saver in August so not being eligible. The application link can be found below:flaneurs_lobster said:

Now up on websiteBridlington1 said:Principality will be launching a 2 Year Healthy Habits Saver Bond at 6% (£50 max per month, early closure permitted)

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/Healthy-Habits-regular-saver-bond

https://online.principality.co.uk/Originations/launchpage.aspx?productType=RegularSaver&productCode=6090#!

Opened the Healthy Habits Saver Bond but without activation they don't let you open any other accounts. As said before, you could apply as new customer, get a separate ID and hope for their systems to merge but could also end up in a laborious process.

https://forums.moneysavingexpert.com/discussion/comment/80268174/#Comment_80268174

I also closed my Christmas Regular Saver before it reached maturity in August. Wonder if Principality will close our accounts and return our money.This savings account is a maturity account.I closed my RS early in September, so I wouldn't qualify for this... yes I could go online and open one of these, but I would expect PBS to close it at some point before the end of the month.

This means you can only open this account if your application is received within 14 days of your previous regular savings account maturing (it has come to the end of its fixed term).

0 -

Also some info that may be useful to some on the 6% West Brom account who are like me and only had a Websave account. I phoned them this morning and asked some questions so this info is what they told me:

- Customers with Websave accounts are classed as existing West Brom BS customers for the purposes of opening the 6% RS

- Where it asks you to enter the existing account number during the online application process for the RS, you take the 7 numbers (not the letters, just the numbers) from your Websave account, and put a 0 in front of them to make up the 8 digit minimum that's required for this field.

- They will then allow you to have the product as an existing customer since apparently they just check your name and postcode, and as long as it matches your Websave account then that will be your eligibility proven.6

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards