We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Regular Savings Accounts: The Best Currently Available List!

Comments

-

With the Hanley, you often have to consult their general savings account T&Cs document for information like that as it'll be common to all their accounts...chris_the_bee said:

When do they credit interest from?refluxer said:RE: Hanley Eco BS deposits - most of the faster payments I made into their Branch Saver showed in online banking the following working day, but one did take two working days so I would recommend only making payments into the Regular Saver from Monday to Thursday and the earlier in the day you can make them, the better.

Date of actual receipt of funds or when shown online?8.2 On our accounts we generally:- Calculate interest on a sum paid into your account in cash or by Electronic Payment, including Internal Transfers, from the day we receive it and credit it to your account. Any sums received by us after 3pm on a Working Day or on a non-Working Day, will be treated as having been received and will be credited to your account and start earning interest at the start of the next Working Day (subject to our Normal Business Hours)

- Calculate interest on a sum deposited by cheque from the second Working Day after we receive it

I think the important thing to note is that faster payments (even those sent before 3pm on a working day) aren't actually received and processed by them until the following working day at the earliest... at least that's the way it works for the Branch Saver - it's possible the Online Regular Saver might be quicker, with it being a true online account.0 -

Is a faster payment not what Hanley refer to as a "Electronic Payment" and therefore credited same day (prior to 3pm)?refluxer said:8.2 On our accounts we generally:- Calculate interest on a sum paid into your account in cash or by Electronic Payment, including Internal Transfers, from the day we receive it and credit it to your account. Any sums received by us after 3pm on a Working Day or on a non-Working Day, will be treated as having been received and will be credited to your account and start earning interest at the start of the next Working Day (subject to our Normal Business Hours)

- Calculate interest on a sum deposited by cheque from the second Working Day after we receive it

I think the important thing to note is that faster payments (even those sent before 3pm on a working day) aren't actually received and processed by them until the following working day at the earliest... at least that's the way it works for the Branch Saver - it's possible the Online Regular Saver might be quicker, with it being a true online account.0 -

Yes but they don't credit it until the following day.

"from the day we receive it and credit it to your account"

0 -

refluxer said:

With the Hanley, you often have to consult their general savings account T&Cs document for information like that as it'll be common to all their accounts...chris_the_bee said:

When do they credit interest from?refluxer said:RE: Hanley Eco BS deposits - most of the faster payments I made into their Branch Saver showed in online banking the following working day, but one did take two working days so I would recommend only making payments into the Regular Saver from Monday to Thursday and the earlier in the day you can make them, the better.

Date of actual receipt of funds or when shown online?8.2 On our accounts we generally:- Calculate interest on a sum paid into your account in cash or by Electronic Payment, including Internal Transfers, from the day we receive it and credit it to your account. Any sums received by us after 3pm on a Working Day or on a non-Working Day, will be treated as having been received and will be credited to your account and start earning interest at the start of the next Working Day (subject to our Normal Business Hours)

- Calculate interest on a sum deposited by cheque from the second Working Day after we receive it

I think the important thing to note is that faster payments (even those sent before 3pm on a working day) aren't actually received and processed by them until the following working day at the earliest... at least that's the way it works for the Branch Saver - it's possible the Online Regular Saver might be quicker, with it being a true online account.

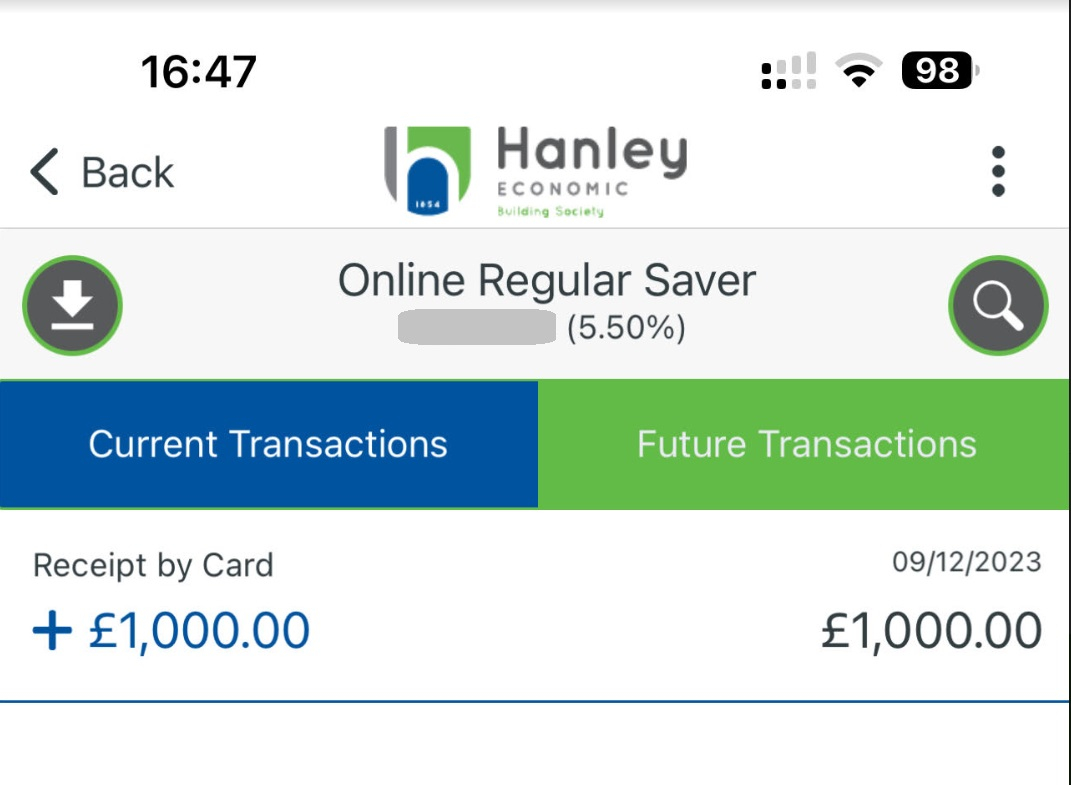

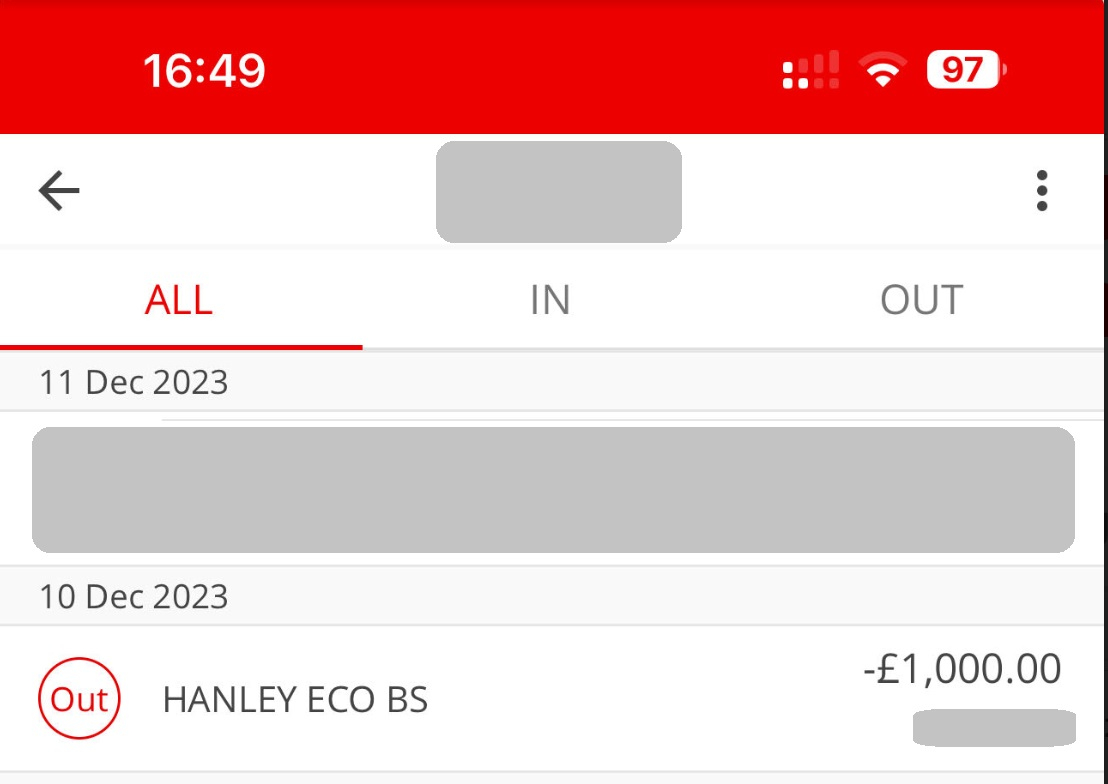

The systems don't always act in the way the T&Cs are written ...... HEBS looking like another example of that.On Saturday December 9 I deposited £1,000 by debit card into my new HEBS Branch Saver. The time I made the deposit isn't shown but I think I did it on Saturday morning. It shows as credited to my HEBS BS on the same day. It wasn't debited from my Santander current account until Sunday, December 10. Whether I will actually get interest from December 9, or only from December 11, I can't yet tell - but tbh, the max 30p interest I would have 'lost' if interest doesn't start until the 11th won't break my bank

0

0 -

From the looks of their general T&Cs, payments to all Hanley Eco BS savings accounts are made to their own account and then distributed to individual accounts via the payment reference and I get the impression that they're either processed manually or possibly queued and processed in batches, as some banks and buildings societies like to do. Either way, this means that (as happybagger eluded to above) even though they might be received the same day, they don't always get processed and credited immediately, like they would be with larger building societies where this is automated and immediate (eg. Nationwide).flaneurs_lobster said:Is a faster payment not what Hanley refer to as a "Electronic Payment" and therefore credited same day (prior to 3pm)?

My observations were just based on my experience of making a number of faster payments into their Branch Account on weekday mornings which weren't credited until the morning of the following working day so I guess I was just trying to set expectations...

1 -

Emily_Joy said:allegro120 said:Emily_Joy said:

Gatehouse - they say the RS account pays profit, not interest. For the purpose of tax reduction does it still count towards personal saving allowance?..

For tax purposes 'profit' counts the same as 'interest'.

Now I am getting concerned. Back in summer Gatehouse paid profit from my ISA into Barclays easy access ISA, but Barclays transferred that almost instantly into my current account. I was expecting the "profit" from ISA to be tax free. Is the latter transfer likely to cause an issue?

No. The profit/interest earned from an ISA is tax-free savings income, even if it's paid to an external account.

Emily_Joy said:It was not me who has made the payment. Gatehouse bank asked for a nominated bank account details as a part of ISA opening process. I gave my easy access Barclays ISA account. The funds were automatically sent there by Gatehouse without me doing anything. I just woke up one morning to an email from Barclays telling me that the funds have been transferred to my current account and this was the first time I heard about the issue.

ISAs generally aren't suitable to function as nominated accounts, even if they're easy access, due to the additional restrictions placed upon them (e.g. declarations, contribution limits, treatment of transfers in and out). The accounts best suited for this purpose are transactional accounts with a sort code and account number, able to directly send and receive Bacs and Faster Payments without restrictions (other than those generally applicable to all accounts).

You should have simply nominated your Barclays current account instead; the profit/interest paid out from an ISA to a nominated current account is still tax-free.

0 -

In my Branch Saver account, I sent a 5 figure sum. It wasn't until three days later when three transactions appeared. The day I sent it showed a credit transaction for that date as "funds received - not allocated", it then showed as a debit straight after, "Funds allocated", then a credit again 2 days later as "Receipt by bank transfer"refluxer said:

From the looks of their general T&Cs, payments to all Hanley Eco BS savings accounts are made to their own account and then distributed to individual accounts via the payment reference and I get the impression that they're either processed manually or possibly queued and processed in batches, as some banks and buildings societies like to do. Either way, this means that (as happybagger eluded to above) even though they might be received the same day, they don't always get processed and credited immediately, like they would be with larger building societies where this is automated and immediate (eg. Nationwide).flaneurs_lobster said:Is a faster payment not what Hanley refer to as a "Electronic Payment" and therefore credited same day (prior to 3pm)?

My observations were just based on my experience of making a number of faster payments into their Branch Account on weekday mornings which weren't credited until the morning of the following working day so I guess I was just trying to set expectations...

Can't say anything about the RS account as I haven't opened it.0 -

Surely, in this case the profit/interest would have left the ISA wrapper, which I wanted to avoid...AmityNeon said:Emily_Joy said:It was not me who has made the payment. Gatehouse bank asked for a nominated bank account details as a part of ISA opening process. I gave my easy access Barclays ISA account. The funds were automatically sent there by Gatehouse without me doing anything. I just woke up one morning to an email from Barclays telling me that the funds have been transferred to my current account and this was the first time I heard about the issue

You should have simply nominated your Barclays current account instead; the profit/interest paid out from an ISA to a nominated current account is still tax-free.

0 -

Emily_Joy said:AmityNeon said:Emily_Joy said:

It was not me who has made the payment. Gatehouse bank asked for a nominated bank account details as a part of ISA opening process. I gave my easy access Barclays ISA account. The funds were automatically sent there by Gatehouse without me doing anything. I just woke up one morning to an email from Barclays telling me that the funds have been transferred to my current account and this was the first time I heard about the issue

You should have simply nominated your Barclays current account instead; the profit/interest paid out from an ISA to a nominated current account is still tax-free.

Surely, in this case the profit/interest would have left the ISA wrapper, which I wanted to avoid...

To be clear, choosing for interest to be paid away to any external account results in said interest leaving the ISA wrapper immediately; the problem was not that Barclays moved the funds to your current account. You cannot just nominate your Barclays ISA to receive the interest earned from your Gatehouse ISA and expect that interest to remain wrapped (i.e. excluded from contribution limits).

9

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards