We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Reading the terms can be useful... you canDescrabled said:Coventry LRSNote that payments into this account must be new money to Coventry. No transfers from existing savings in Coventry easy access accounts as I sometimes do with First Home Saver 1.- Transfer money from another Coventry account

5 -

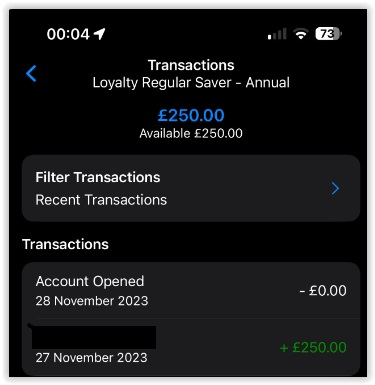

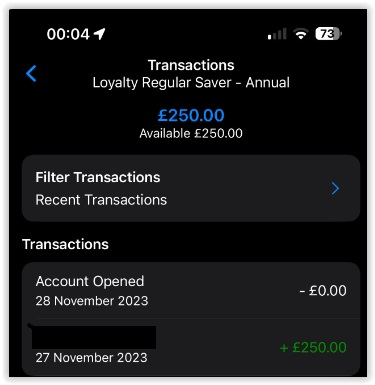

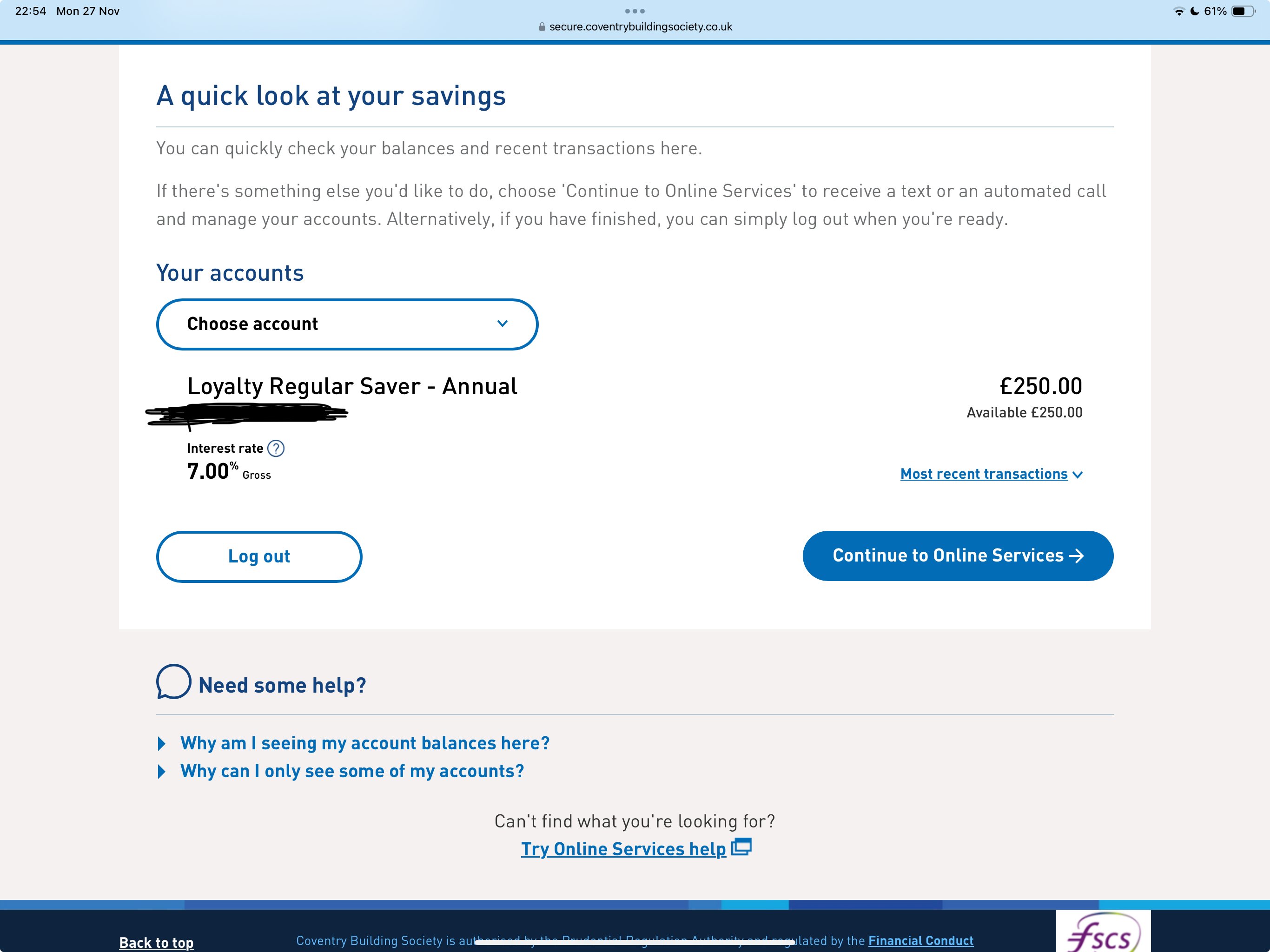

Coventry account opened yesterday and deposited my first £250. What date do I set my SO to - 27th or 28th? I have done 28th, in order not to get my next SO returned

0 -

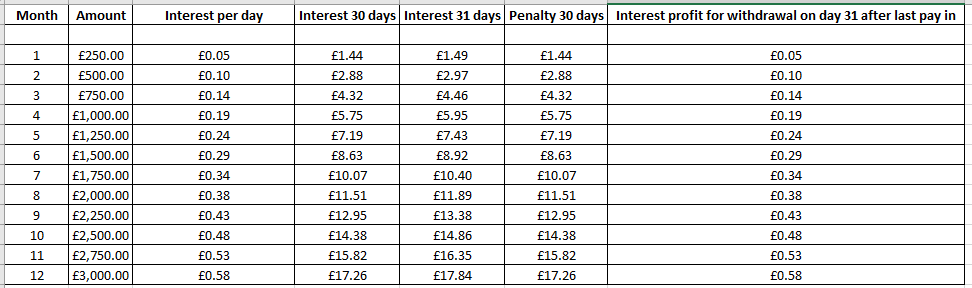

Am I right in my thinking that if I have to withdraw money/close the account, I will not be at loss if I withdraw/close on the 32nd day after my last pay in?

Day 1 pay in and end of day balance used for interest calculation

Day 2 : 31 interest calculated

Day 32 withdrawal

= 31 days interest accrual

Assuming I withdraw the total amount and always pay in the full £250 exactly on the first day of the account month and Cov BS crediting regardless of the weekday. A pay in date falling on a bank holiday might change the picture so take below with a pinch of salt. Interest is variable so a change during the term will change the picture again. Should rates be lowered during the term the profit rate should be higher.

*Numbers rounded by Excel

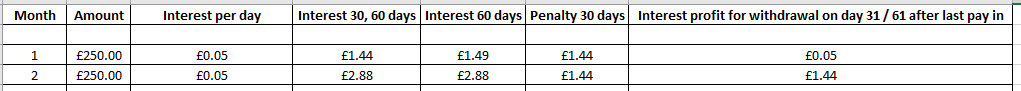

If you pay in on the day of account opening £250 and leave it without any further addition and take out the full £250 on day 61 the profit would be ~ £1.44

Anyone able to confirm if my thinking is right or if it can be disregarded as bs?0 -

Same date as account opening or after has to be a calendar month between or money returned.friolento said:Coventry account opened yesterday and deposited my first £250. What date do I set my SO to - 27th or 28th? I have done 28th, in order not to get my next SO returned

This account is hidden from view when you visit the Coventry site you have to log on and it still does not come up on the savings page untill you hit other products

Update 28-11-23 the account is now visible1 -

There is no point in paying the interest away as the account matures on the same day and you would be likely to pay all of it away or be reinvesting if there was a suitable accountSickGroove said:

Can I ask if it shows your name or your bank's name in the named bank account section under account holder(s)?Bigwheels1111 said:All looking good on my end.

Also, have you opted to have your interest at maturity added to this account or paid away to your nominated bank account?3 -

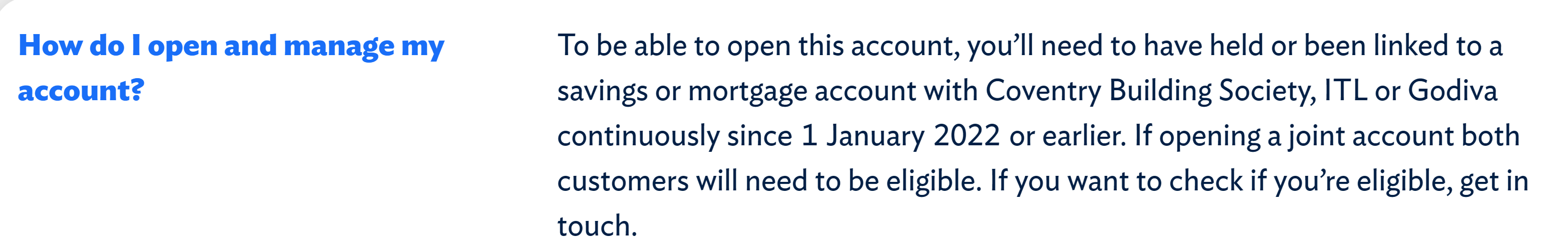

Coventry BS Loyalty Regular Saver now live on their website. See

https://www.coventrybuildingsociety.co.uk/member/product/savings/regular_saver/loyalty-regular-saver.html

10 -

https://aibni.co.uk/our-products/savings-and-deposits/regular-saverAIB (NI) now offering 6% on their Regular Saver, depositing up to £500 each month.Eligibility and full details above.Digital Payback

The National Lottery : A tax on those who aren’t good at maths.2 -

Agreed @Section62. These things often don’t go live until 9am so thanks to @Bridlington1 for alerting people before 9am.

A bit more about the Coventry account - they’re making a donation for every account opened (not just this RS) between 1 Nov and 21 Dec to Centrepoint, subject to a minimum of £100 being in the relevant account as at 31 Dec.10 -

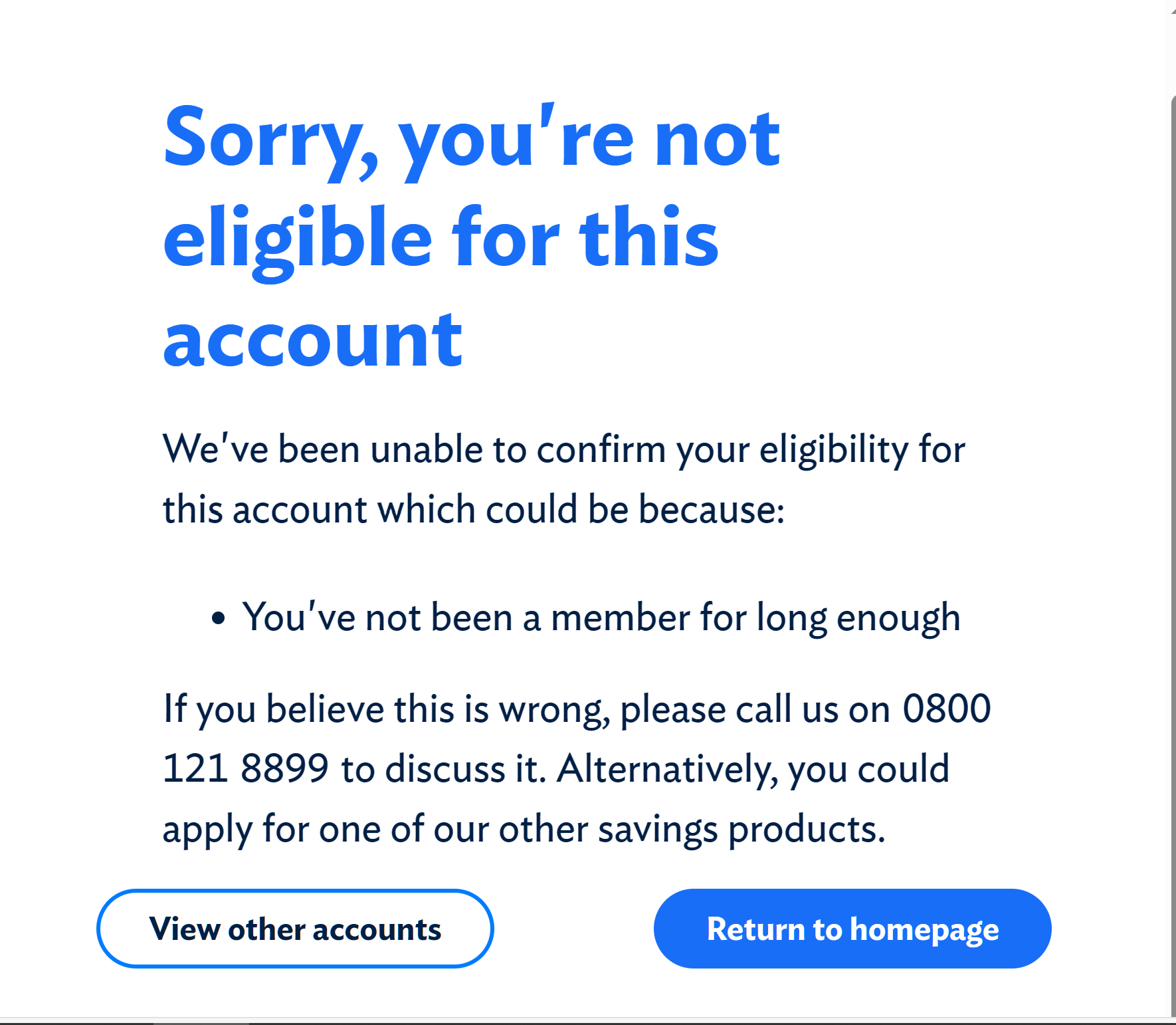

Re Coventry BS - Looks like my Coventry first home saver 5.9% (1st addition opened Dec 2022) is not classed as a savings account because i get this -

And no, i won't ring them...lol.0

And no, i won't ring them...lol.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards