We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Wheres_My_Cashback said:

If they've tightened up their checks that is?allegro120 said:

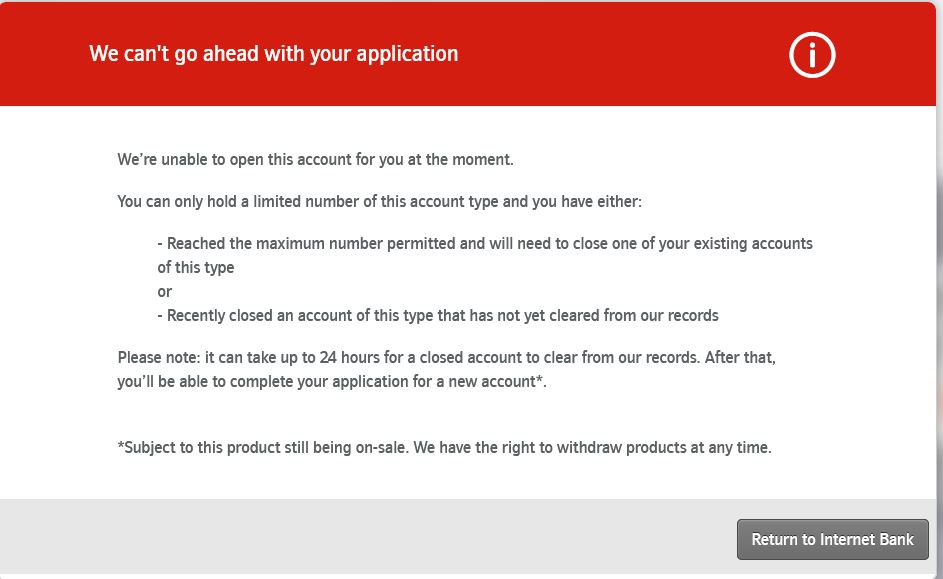

You are only allowed one of these. If one manages to open two they will close one of them.adindas said:What method other people use to get the second Nationwide Flex RS 8%?I tried it today this is what I get ...

I remember not too far back of having 5 Flex direct current accounts paying 5%? for a year when only 1 was permitted. It was quite common amongst MSE readers to have a few ;-)

It only took them 10 months to notice before notifying of closure of 4 so I was quite happy with my extra 40 months of interest.HSBC, First Direct, precise ...TSB still ...

0 -

@Bridlington1 I notice you have Stafford Railway at 5.15% in your list, but I thought it was only 4.9%. I can't see anything else mentioned either on the front page of this thread or on SRBS's website?

0 -

SRBS currently only pays 4.9% but it was reported on this forum a few weeks ago that it will rise to 5.15% from 1/10/23, I can't remember off the top of my head who first mentioned it but if my memory serves me well they were told of the upcoming increase over the phone. Therefore my October provisional list shows the upcoming 5.15% rate.gwapenut said:@Bridlington1 I notice you have Stafford Railway at 5.15% in your list, but I thought it was only 4.9%. I can't see anything else mentioned either on the front page of this thread or on SRBS's website?2 -

it's 5.15% from 01 Oct.gwapenut said:@Bridlington1 I notice you have Stafford Railway at 5.15% in your list, but I thought it was only 4.9%. I can't see anything else mentioned either on the front page of this thread or on SRBS's website?2 -

Yes, 8.30pm.tg99 said:Does Nationwide have a cut off for payments in to start receiving interest same day? Just funded £200 into the new Reg Sav and it has been credited with a date of 23 Sep.3 -

It rises to 5.15% from 4.9% WEF 1st October 2023gwapenut said:@Bridlington1 I notice you have Stafford Railway at 5.15% in your list, but I thought it was only 4.9%. I can't see anything else mentioned either on the front page of this thread or on SRBS's website?1 -

I have closed my SRBS account. Even at 5.15% it doesn’t any longer cut the mustard for me. I was also not attracted by their £12k deposit offer. I put money into the 6.1% NS&I GGB and into the 5.2% Santander instant access instead.chris_the_bee said:

It rises to 5.15% from 4.9% WEF 1st October 2023gwapenut said:@Bridlington1 I notice you have Stafford Railway at 5.15% in your list, but I thought it was only 4.9%. I can't see anything else mentioned either on the front page of this thread or on SRBS's website?1 -

all these years and i still don't know if its possible to search buzz words within a thread.

NW Reg Saver @ 8%. can i open/fund last day of month A, then add funds on day 1 of month B? then day 1 from there on? would i fund 12 or 13 times?

thank you.0 -

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards