We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

lol I always thought 'The internet bank' was a stupid phrase too. Especially coming from (or possibly because its coming from?), the least technical bank of them all, that still uses a card reader.1

-

I like my card reader, as someone who gets a lousy mobile signal at home it makes my life easier.Zaul22 said:lol I always thought 'The internet bank' was a stupid phrase too. Especially coming from (or possibly because its coming from?), the least technical bank of them all, that still uses a card reader.

It's also more secure than sending OTP via text message.8 -

kaMelo said:

I like my card reader, as someone who gets a lousy mobile signal at home it makes my life easier.Zaul22 said:lol I always thought 'The internet bank' was a stupid phrase too. Especially coming from (or possibly because its coming from?), the least technical bank of them all, that still uses a card reader.

It's also more secure than sending OTP via text message.Nationwide is also far from being the 'least technical bank' for several reasons other than the card reader.E.g. Post Office Savings website makes Nationwide's seem like a technological masterpiece of functionality and reliability, and Nottingham Building Society's online banking (not Beehive) simply doesn't exist.Having different options for people - like card readers and cheque books - is a good thing, it helps meet different people's needs. I don't understand why some people regard the continuation of useful (in some cases essential) services to be a negative attribute, except where the cost of providing the service is disproportionate to the benefit gained by members/customers.11 -

Indeed @Section62 - I have cheque books on my current accounts (they're an option you have to request though) and have older family members that don't have smart phones or computers and are close to being left behind by many organisations. In one case we've got around that by me being an Attorney for them and registering with their bank and if she needs something doing she just rings and asks me to sort it out. Even renewing a blue badge or ordering a green garden waste bin needs on-line access now.

Embracing technology for efficiency is all good for most customers, but there are still many for whom it isn't appropriate. Even my grandmother who was blind could write a cheque, as she had a braille guide with holes into which to write the details.10 -

kaMelo said:

I like my card reader, as someone who gets a lousy mobile signal at home it makes my life easier.Zaul22 said:lol I always thought 'The internet bank' was a stupid phrase too. Especially coming from (or possibly because its coming from?), the least technical bank of them all, that still uses a card reader.

It's also more secure than sending OTP via text message.I also like the card reader: two device authentication (three if you include the card) rather than OTP sent to the same device you're logging in with.*Just a personal opinion.

2 -

Card reader to add a new payee ? Perfect. Well done NWide.0

-

RBS (and NatWest ?) have gone for a hybrid model whereby you need a card reader or access to the app to set up new payees online but you can opt to use a second biometric (eg moving face recognition) if using their app.1

-

Barclays make you mess around with a card reader too, for online. In the app, they want the 3 digits off the back of the card.flaneurs_lobster said:RBS (and NatWest ?) have gone for a hybrid model whereby you need a card reader or access to the app to set up new payees online but you can opt to use a second biometric (eg moving face recognition) if using their app.

Why? It's a tacit admission that they don't think a fingerprint and PIN is secure enough. Nonsense.

HSBC make you enter a code (via a very awkward to use code generator) to add the payee, then another one to make the payment, even in the same online session. So stupid.

I think it's pointless, as most fraud is done by convincing the account holder to make a payment. This won't stop that scenario - it just makes a bit more hassle for everyone.

Also totally off-topic, sorry...3 -

Well actually the language we gave them was in the main the one they still use. It is us who have changed things. Ask Susie Dent!!!!!!MiserlyMartin said:

Yet again, its the Americans. We gave them a perfectly good language and they stuffed it up. My company uses this term all the time.UncleK said:

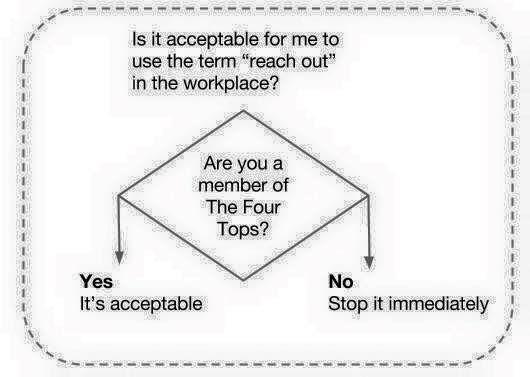

We had this discussion at work....happybagger said:Is it just me that wants to throw up with the phrase "reaching out"?

Is "contacting us" not correct enough? 3

3 -

Yes quite, and thankfully you can opt to remove the blasted thing, installed it twice and removed it both times, personally I found it frustrating and infuriating.flaneurs_lobster said:RBS (and NatWest ?) have gone for a hybrid model whereby you need a card reader or access to the app to set up new payees online but you can opt to use a second biometric (eg moving face recognition) if using their app.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards