We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Easy Access Savings Discussion Area

Comments

-

It's not as simple as investing a fixed amount. If you had £2400 that you did not want to fix because you required easy access, it doesn't make sense to just keep that amount in one standard account because there are regular savers with higher rates.BooJewels said:I did use the calculator you linked to check my thinking before posting. Apologies if I'm misunderstanding.

Working on the fact that many regular savers limit how much you can pay in each month, I worked on £200 per month, resulting in £2400 saved in a year, giving rise to interest of £65 @ 5%. Drip feeding it from an EA account gave £66 interest and putting £2400 into a 1 year fix @ 4.3% gave £103.20 interest.Month 2.5% 5% 1 2200 200 2 2000 400 3 1800 600 4 1600 800

...is better than just keeping everything at 2.5%.2 -

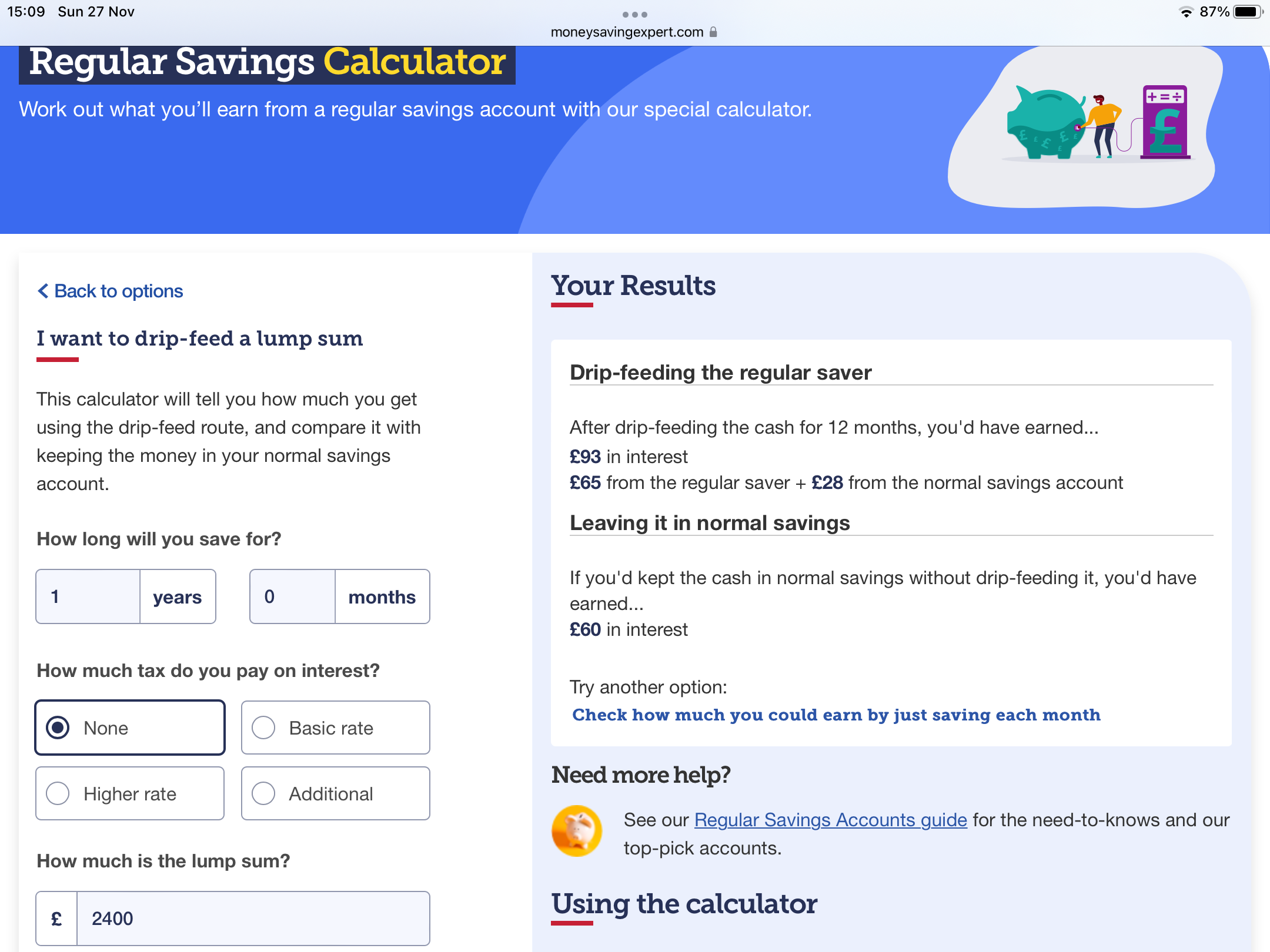

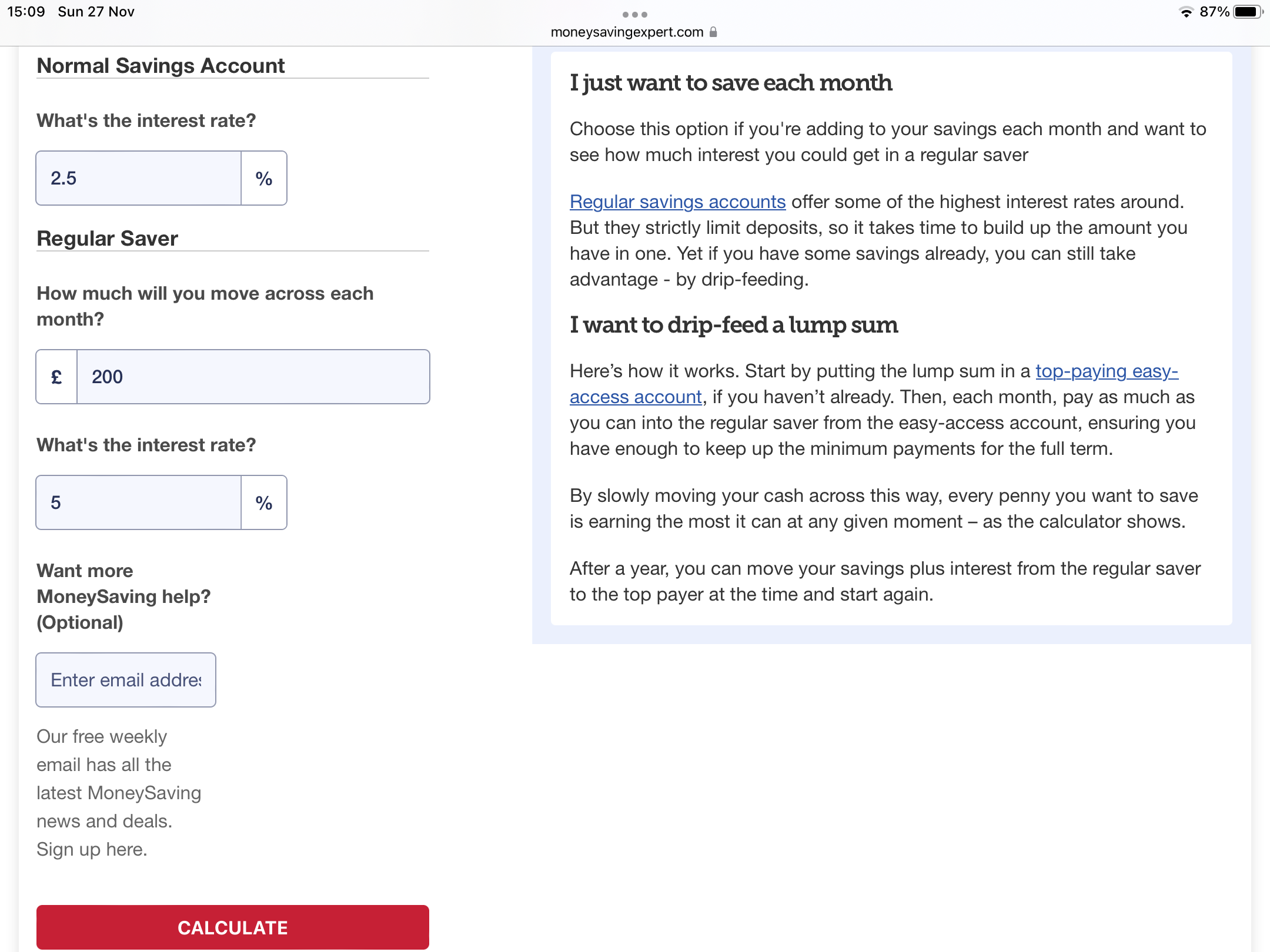

Try the calculator again. Drip feeding £2,400 at £200 per month from a 2.5% easy access to a 5% regular saver will earn you £65 + £28 = £93.BooJewels said:I did use the calculator you linked to check my thinking before posting. Apologies if I'm misunderstanding.

Working on the fact that many regular savers limit how much you can pay in each month, I worked on £200 per month, resulting in £2400 saved in a year, giving rise to interest of £65 @ 5%. Drip feeding it from an EA account gave £66 interest and putting £2400 into a 1 year fix @ 4.3% gave £103.20 interest.

1 -

We were talking about deciding between keeping the funds in an instant access account or putting them into a fixed term account, where you don't have access until maturity.BooJewels said:I did use the calculator you linked to check my thinking before posting. Apologies if I'm misunderstanding.

Working on the fact that many regular savers limit how much you can pay in each month, I worked on £200 per month, resulting in £2400 saved in a year, giving rise to interest of £65 @ 5%. Drip feeding it from an EA account gave £66 interest and putting £2400 into a 1 year fix @ 4.3% gave £103.20 interest.

So the first comparison is between access and no access, not between interest rates.

@chris_the_bee suggested there is a half-way house by using Regular Savers which allow withdrawals and/or early closure. Provided the Regular Saver rate is higher than that of the easy access account, that half-way house approach wins any day on rate. It clearly also wins as far as accessibility is concerned.

2 -

Thanks all - the calculator definitely gave me £66 - I was expecting a bit more than that, so did it again. But the derision I encountered from my post made me grab a calculator and work it out myself - and I got £92.45 = £27.46 from EA and £64.99 from the regular saver. So an additional £32.45 over leaving the same £2,400 in an easy access @ 2.5%.

1 -

You get the £66 if you use the RS only, making deposits from an account which pays no interest.BooJewels said:Thanks all - the calculator definitely gave me £66 - I was expecting a bit more than that, so did it again. But the derision I encountered from my post made me grab a calculator and work it out myself - and I got £92.45 = £27.46 from EA and £64.99 from the regular saver. So an additional £32.45 over leaving the same £2,400 in an easy access @ 2.5%.

If you use the drip feed from a savings account, the calculator gives you much the same amount you worked out for yourself 👍0 -

MSE Regular savings calculator result £93.

1 -

The calculator results in £66 if you set the normal interest rate between 0.05% and 0.13% inclusive.BooJewels said:Thanks all - the calculator definitely gave me £66 - I was expecting a bit more than that, so did it again. But the derision I encountered from my post made me grab a calculator and work it out myself - and I got £92.45 = £27.46 from EA and £64.99 from the regular saver. So an additional £32.45 over leaving the same £2,400 in an easy access @ 2.5%.

Simple formulae:

Regular Saver: 6.5 x Monthly Amount x Rate- 6.5 x 200 x 5% = £65

- 5.5 x M x R

- 5.5 x 200 x 2.5% = £27.50

2 -

I get it, I'm not sure why you're all putting so much effort into correcting me, I already admitted I got something wrong and corrected myself.

I used the calculator on my tablet and the form must be truncated on the smaller screen (it certainly doesn't look like @RG2015 posted above) - now on my computer, I see the box to put the EA interest in and it won't proceed without it - yet somehow it did on my tablet.

I won't trouble you any further.2 -

Bear in mind that these posts are viewed by lots of people. The "corrections" are for the benefit of everyone reading the thread.BooJewels said:I get it, I'm not sure why you're all putting so much effort into correcting me, I already admitted I got something wrong and corrected myself.

I used the calculator on my tablet and the form must be truncated on the smaller screen (it certainly doesn't look like @RG2015 posted above) - now on my computer, I see the box to put the EA interest in and it won't proceed without it - yet somehow it did on my tablet.

I won't trouble you any further.

I believe that one function of a helpful forum like this is to clarify and if necessary correct misleading comments.

I am also grateful to you for reminding me that viewing websites on different devices often gives different views, and functions that do not work in the same way.9 -

Remember when you put your money in a year fix the interest rate will remain the same and you are locked in. EA are variable interest rate accounts and a lot of RS accounts are also variable interest rate accounts. So any comparison over a year is going to change. Over the last year, interest rate have been on an upward trend and there has been many a MSE poster rueing the fact that they locked money in a 1year fix at what at the time seemed a good rate only to see better rates become available. However I do realise this upward trend may be plateauing out.

1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards