We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Easy Access Savings Discussion Area

Comments

-

TSB had a 5% account a few years back, albeit on a limited amount of money. I remember opening an account with them to use it

3

3 -

I seem to recall that TSB's monthly saver paid 2% in January this year, which at the time was pretty good given that the top easy access rates paid less than 1%.soulsaver said:

In ToTP (see signature) at No.10 TSB Tri Access 2.5% (18/11) Save Well Limited Access Account | Savings | TSB Bank thnx @Bridlington1Bridlington1 said:TSB save well limited access saver now pays 2.5% for any month you don't make a withdrawal and 0.25% in any month you do make a withdrawal. Pretty similar to HSBC bonus saver in many ways but paying 0.5% less.

I shalln't bother with this one myself but I thought it worth a mention anyway.

I can't remember any TSB presence in the ToTP before. Nor for a decent reg saver.

Add a switching incentive and there appears to be a change of policy?1 -

Could be worse. Have you seen Hanley Economic Building Society?

I finally gave up with them last year (ex-bagger)

This is what they offer. Where's the 'mutual dividend' here?4 -

Y I had the 2% RS and it was only a couple of months ago I w/d the balance. Still, 3% RS now, the Triple access 2.5% AND an easy switching incentive..Bridlington1 said:

I seem to recall that TSB's monthly saver paid 2% in January this year, which at the time was pretty good given that the top easy access rates paid less than 1%.soulsaver said:

In ToTP (see signature) at No.10 TSB Tri Access 2.5% (18/11) Save Well Limited Access Account | Savings | TSB Bank thnx @Bridlington1Bridlington1 said:TSB save well limited access saver now pays 2.5% for any month you don't make a withdrawal and 0.25% in any month you do make a withdrawal. Pretty similar to HSBC bonus saver in many ways but paying 0.5% less.

I shalln't bother with this one myself but I thought it worth a mention anyway.

I can't remember any TSB presence in the ToTP before. Nor for a decent reg saver.

Add a switching incentive and there appears to be a change of policy?0 -

Nationwide, Britain's biggest building society reported a 13.5% rise in pre-tax profit to £969 million for the six months to the end of September.

Apart from the silly adverts, where are the profits going, can`t be shareholders, definitely not members, so that leaves director`s overblown salaries and bonuses.

https://www.thisismoney.co.uk/money/markets/article-11443101/Nationwide-BS-profits-jumps-thanks-higher-rates.html?ico=mol_desktop_money-newtab&molReferrerUrl=https://www.dailymail.co.uk/money/index.html

5 -

If they could just find my £200 switch bung out of that 969 million I'll be happy.0

-

t1redmonkey said:TSB had a 5% account a few years back, albeit on a limited amount of money. I remember opening an account with them to use it

Aye, wasn't that on up to 2500 in your current account? Used to pay my monthly broadband did that.

0 -

Profits retained to mitigate increased risk of mortgage defaults..2010 said:Nationwide, Britain's biggest building society reported a 13.5% rise in pre-tax profit to £969 million for the six months to the end of September.

Apart from the silly adverts, where are the profits going, can`t be shareholders, definitely not members, so that leaves director`s overblown salaries and bonuses.

https://www.thisismoney.co.uk/money/markets/article-11443101/Nationwide-BS-profits-jumps-thanks-higher-rates.html?ico=mol_desktop_money-newtab&molReferrerUrl=https://www.dailymail.co.uk/money/index.html4 -

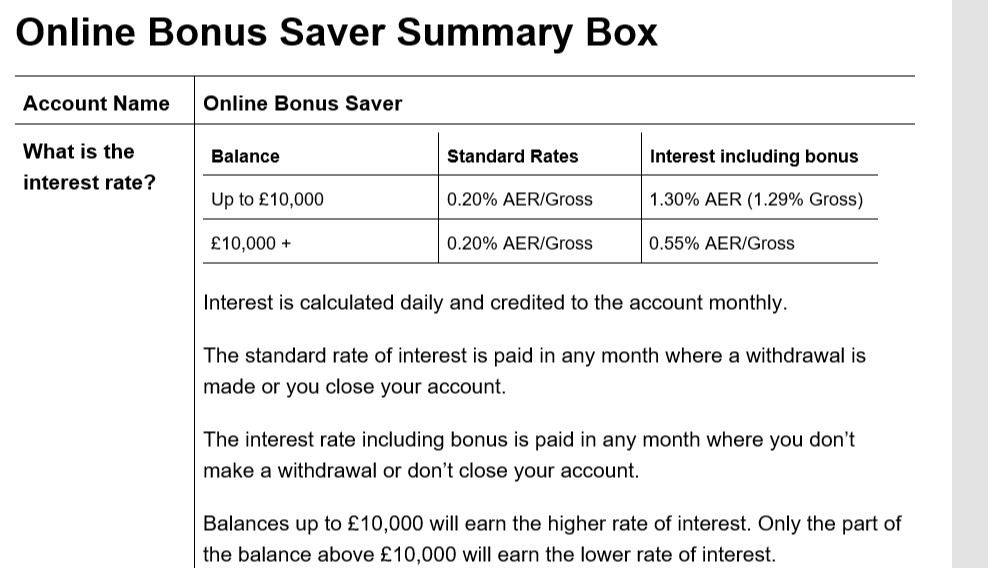

I opened the HSBC on line bonus savings account last week, and have just received an email saying the interest rate is 1.30 up to £10K? Can I find out when the interest rate was dropped from 3%?

£216 saved 24 October 20141

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards