We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Top Easy Access Savings Discussion Area

Comments

-

I haven't had much success with my Al Rayan account. They sent me a nice email and a nice pack of info welcoming me to the bank with everything but sadly not an account number. Tried to phone them three times but couldn't wait on the phone long enough for them to answer. Fourth time, I got through to a person, he put me on hold and then cut the call. To be fair he phoned back, said it was a known issue and he'd pass it through to their technical department. He gave me an incident number. This was about two weeks ago and I've heard nothing since. So, even if I get an account number now, I don't think I'll bother.0

-

Looks like Charter have just launched their Easy Access issue 30 which interestingly is only paying 2.35%. All previous releases being increased to 2.75% from tomorrow. Definitely a stall on all sorts of new accounts at the moment.1

-

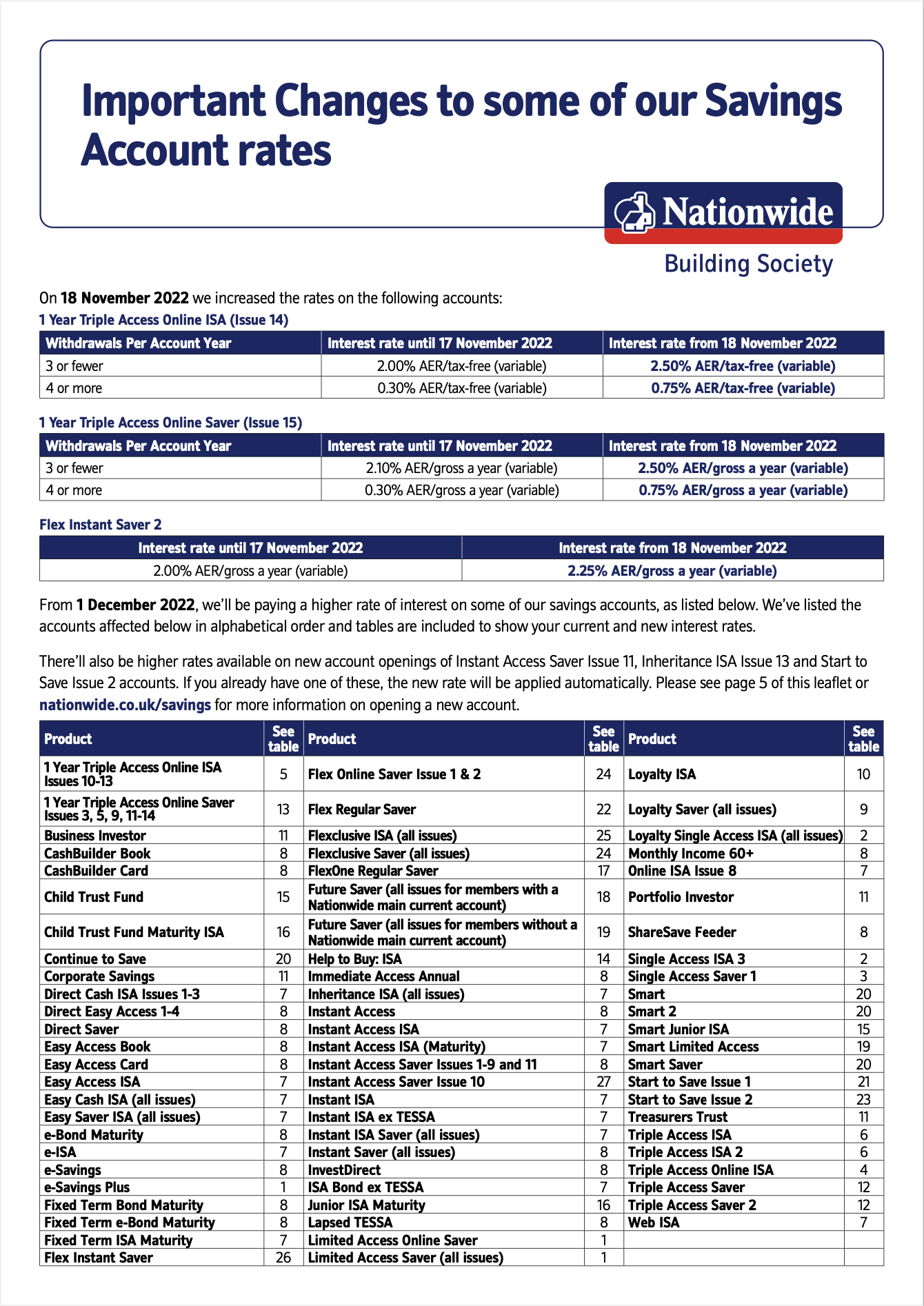

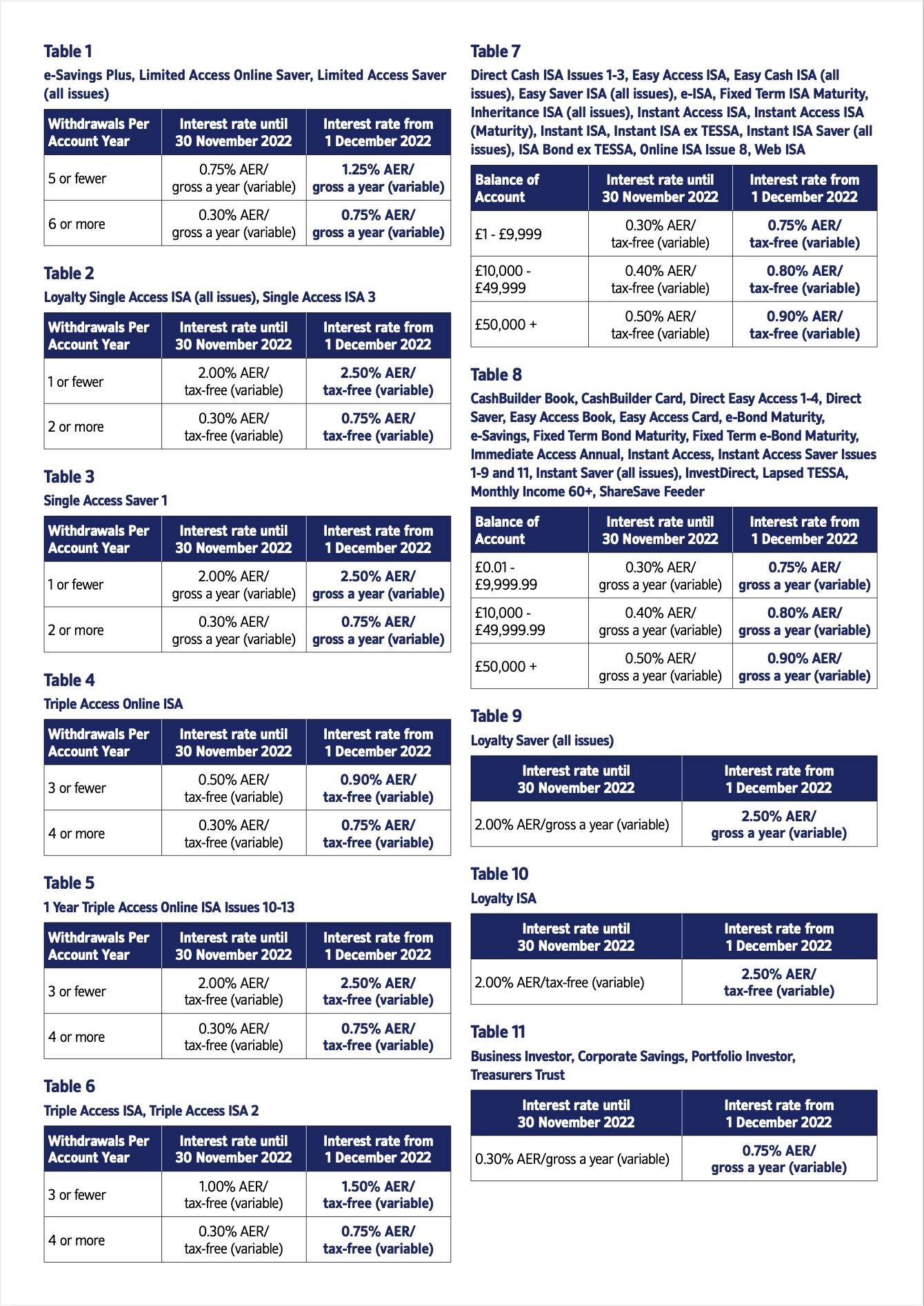

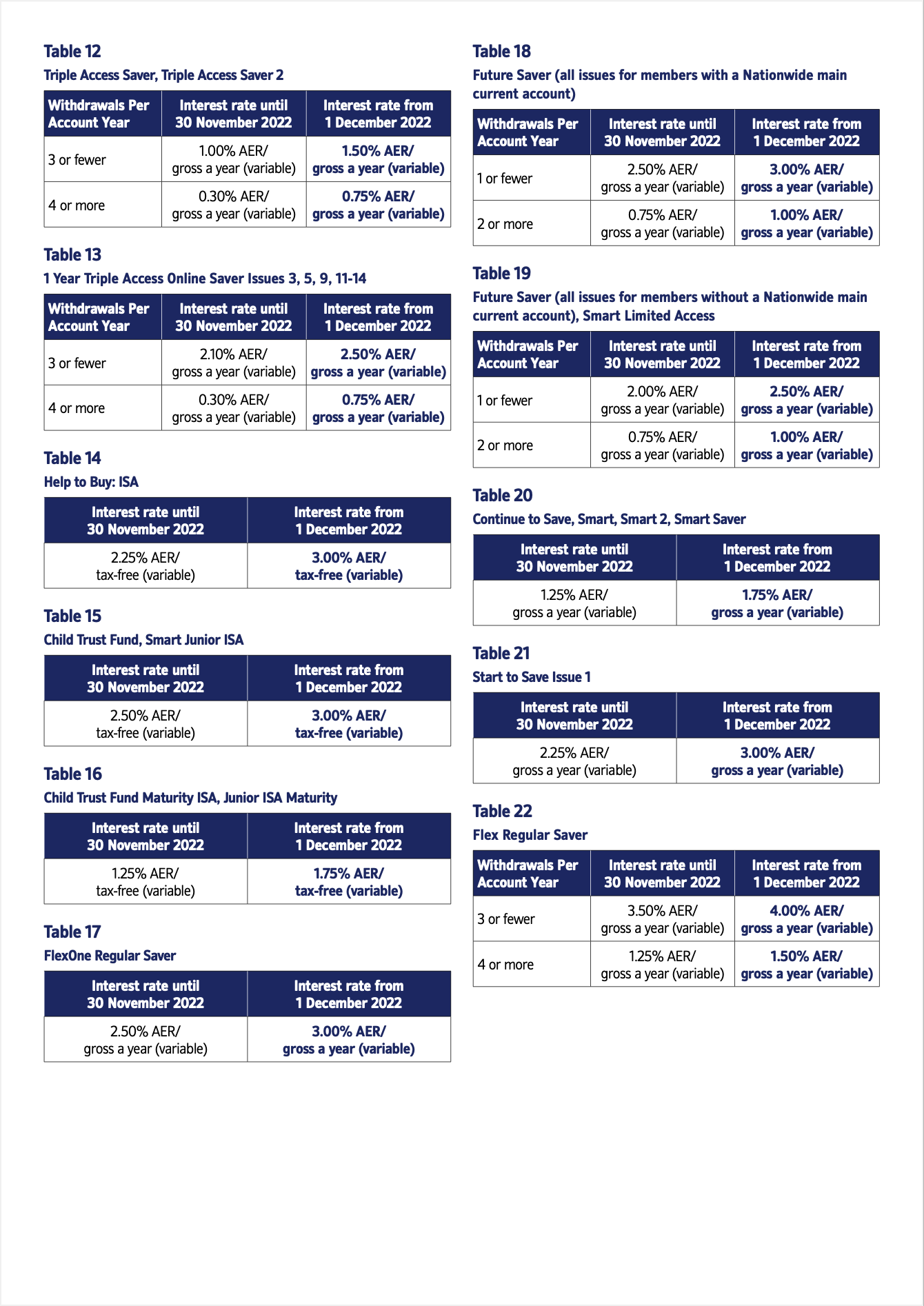

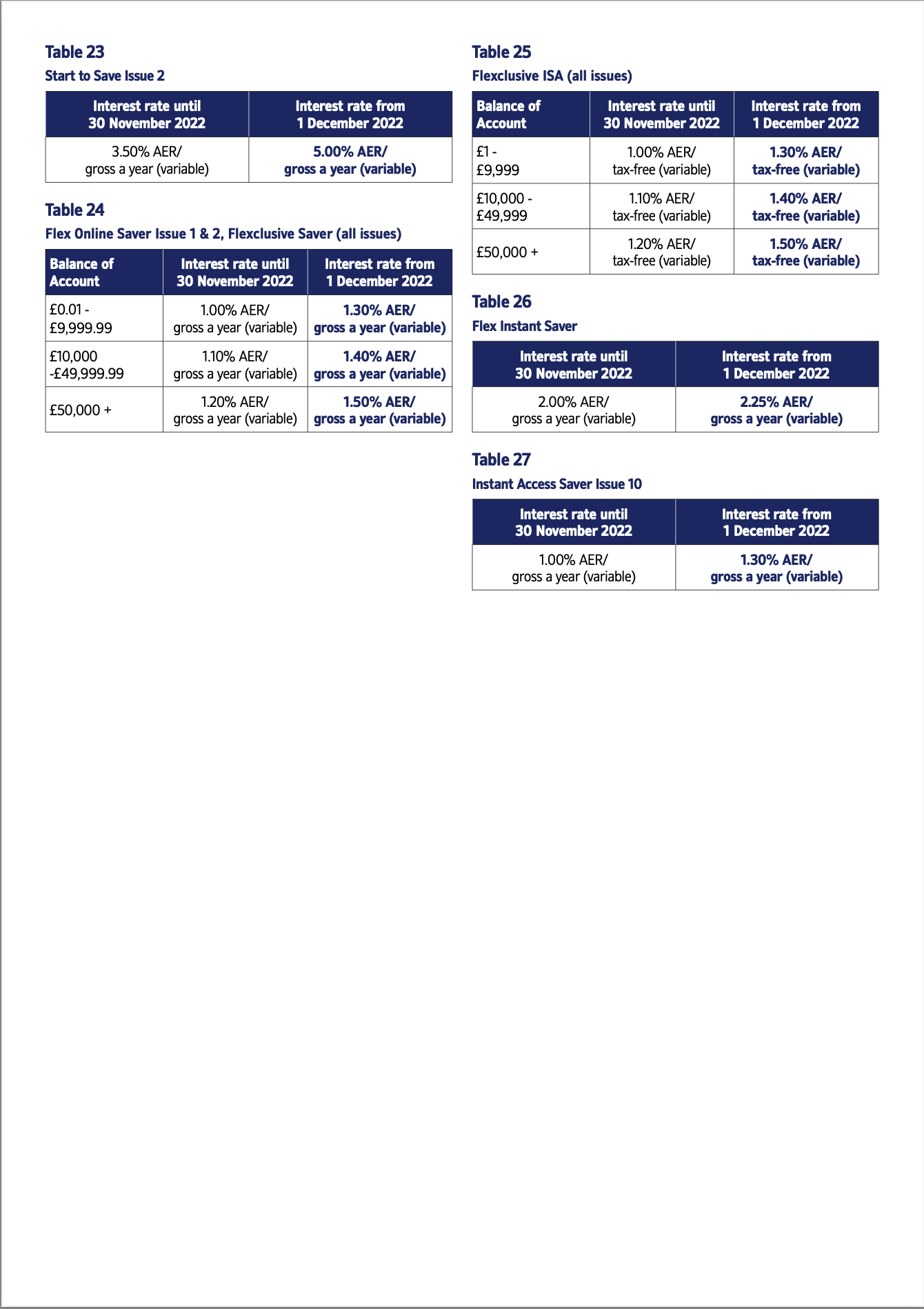

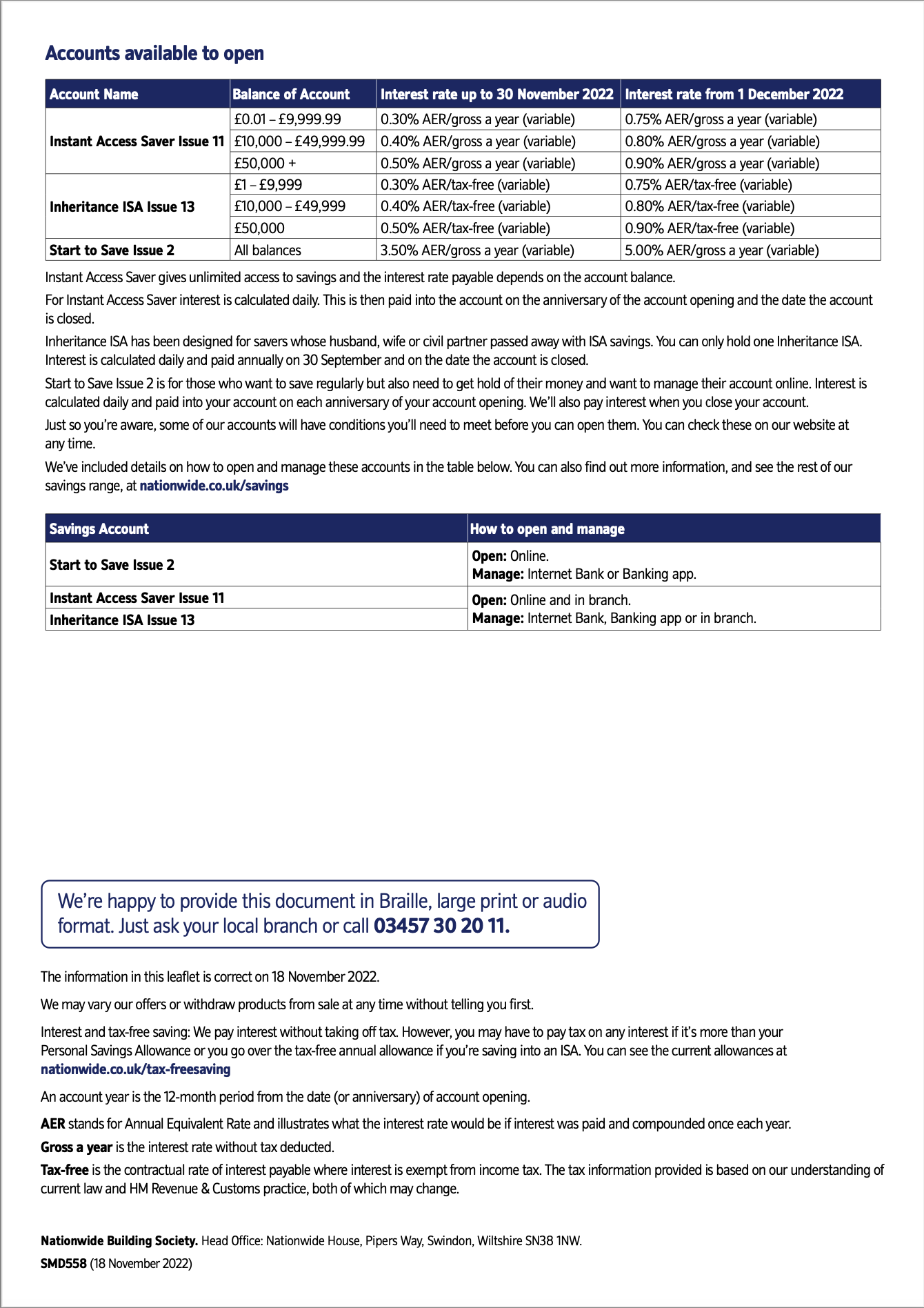

Nationwide Savings Account Rate Changes (Effective 1st December):

On 18 November, we increased the interest rates on some of our savings accounts:

- 1 Year Triple Access Online Saver

- 1 Year Triple Access Online ISA

- Flex Instant Saver.

On 1 December, we’ll be increasing the interest rates on some of our other savings accounts.

Find out how your savings account's interest rate will change: https://www.nationwide.co.uk/-/assets/nationwidecouk/documents/savings/smd558-important-changes.pdf?rev=5d58bb4757754e84bce2f70bd75b6409

@soulsaver Their 1 Year Triple Access Online Saver at 2.50% is TOTP just now, same rate as Principality but allows an additional annual withdrawal.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.10 -

Increase from 1st Dec. a month behind the last BoE increase.

Next BoE 15th Dec.

Pathetic.5 -

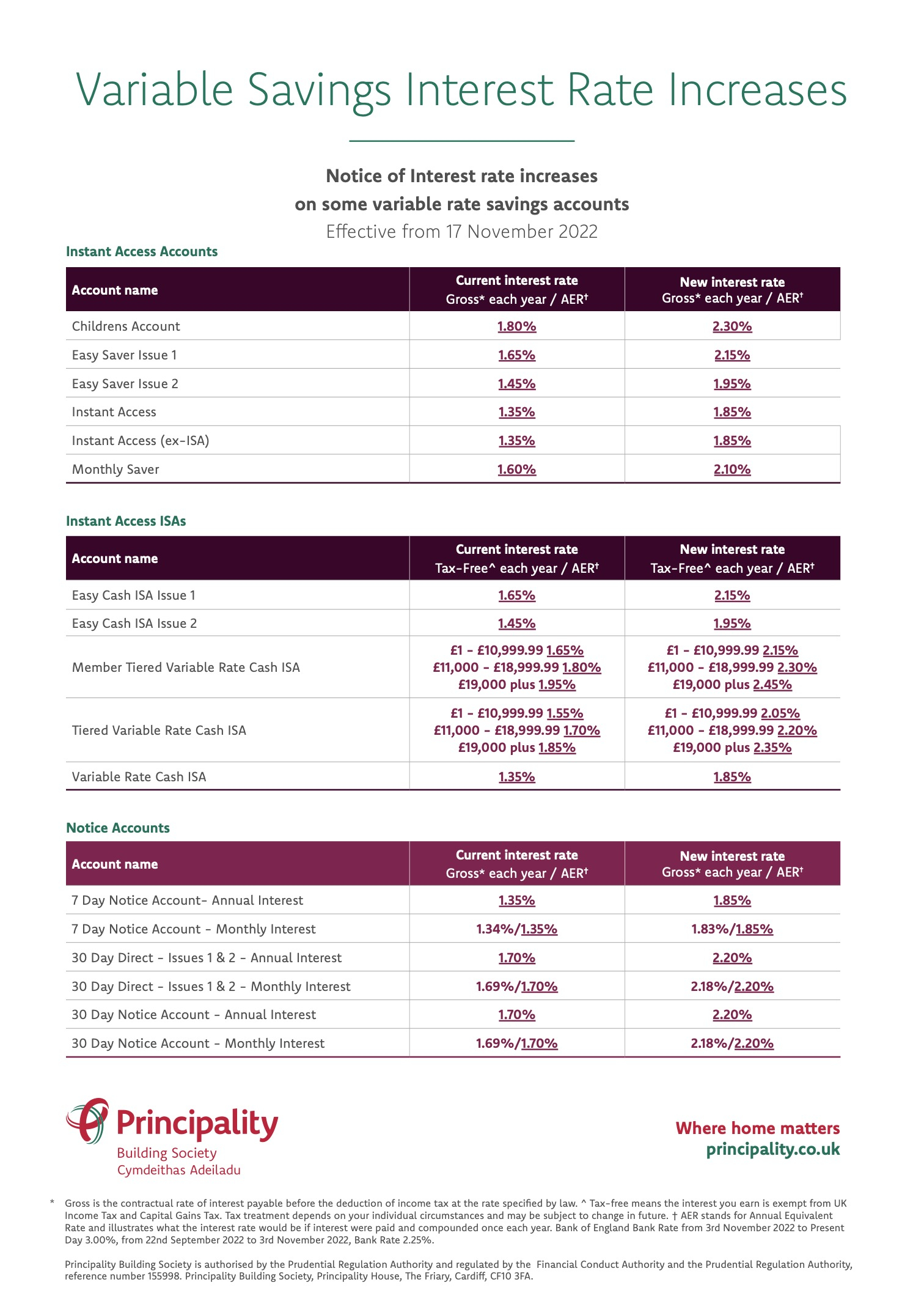

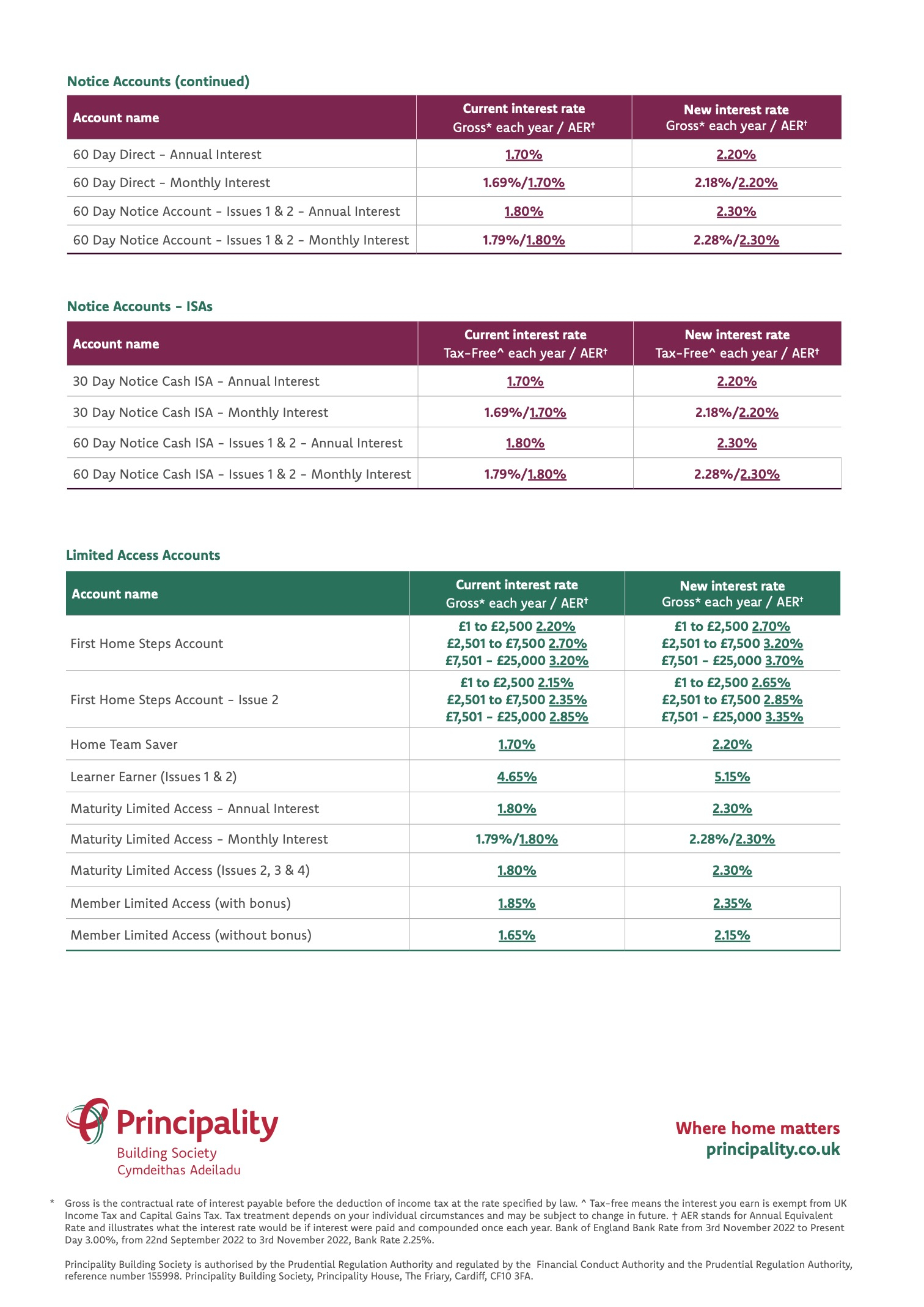

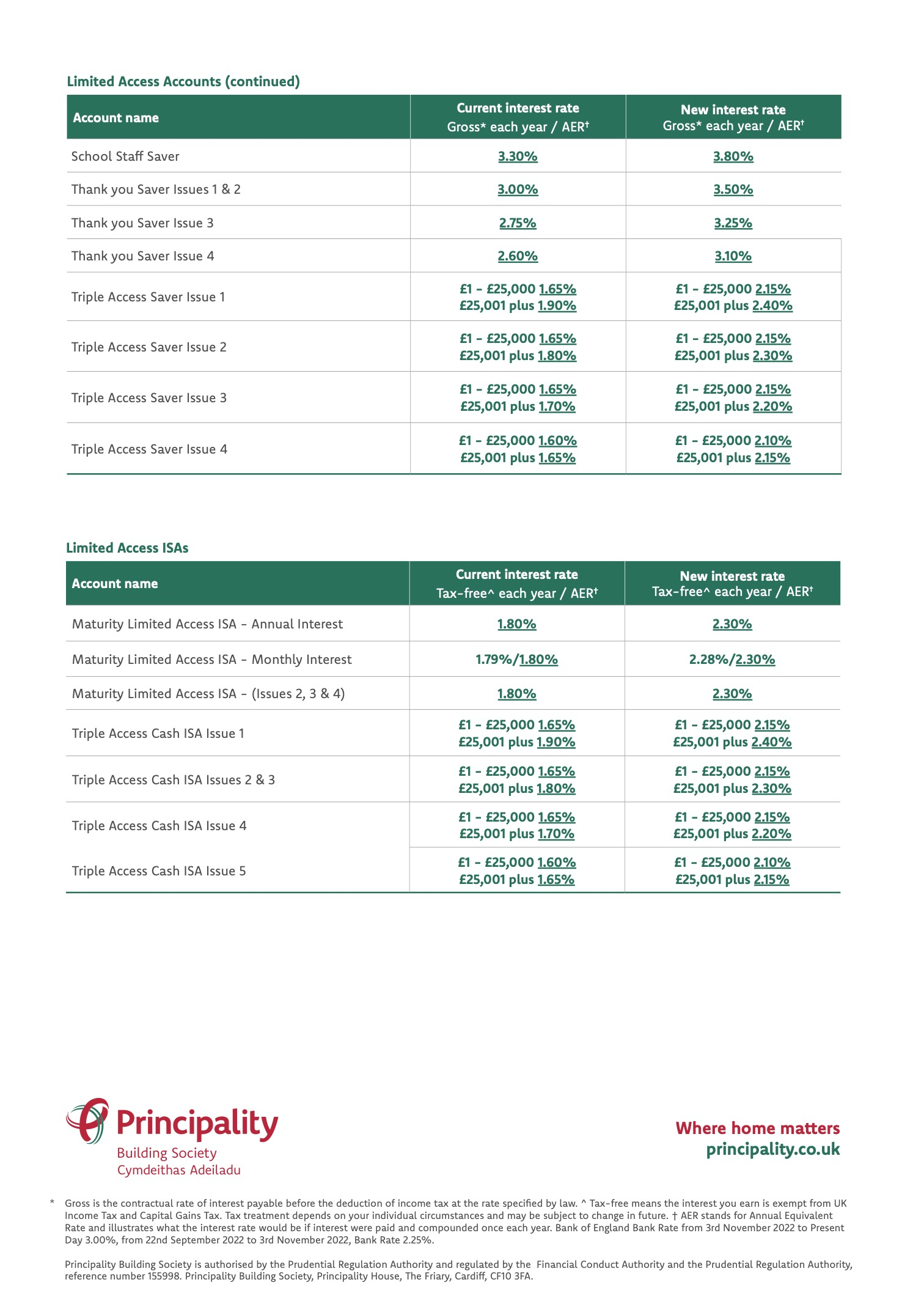

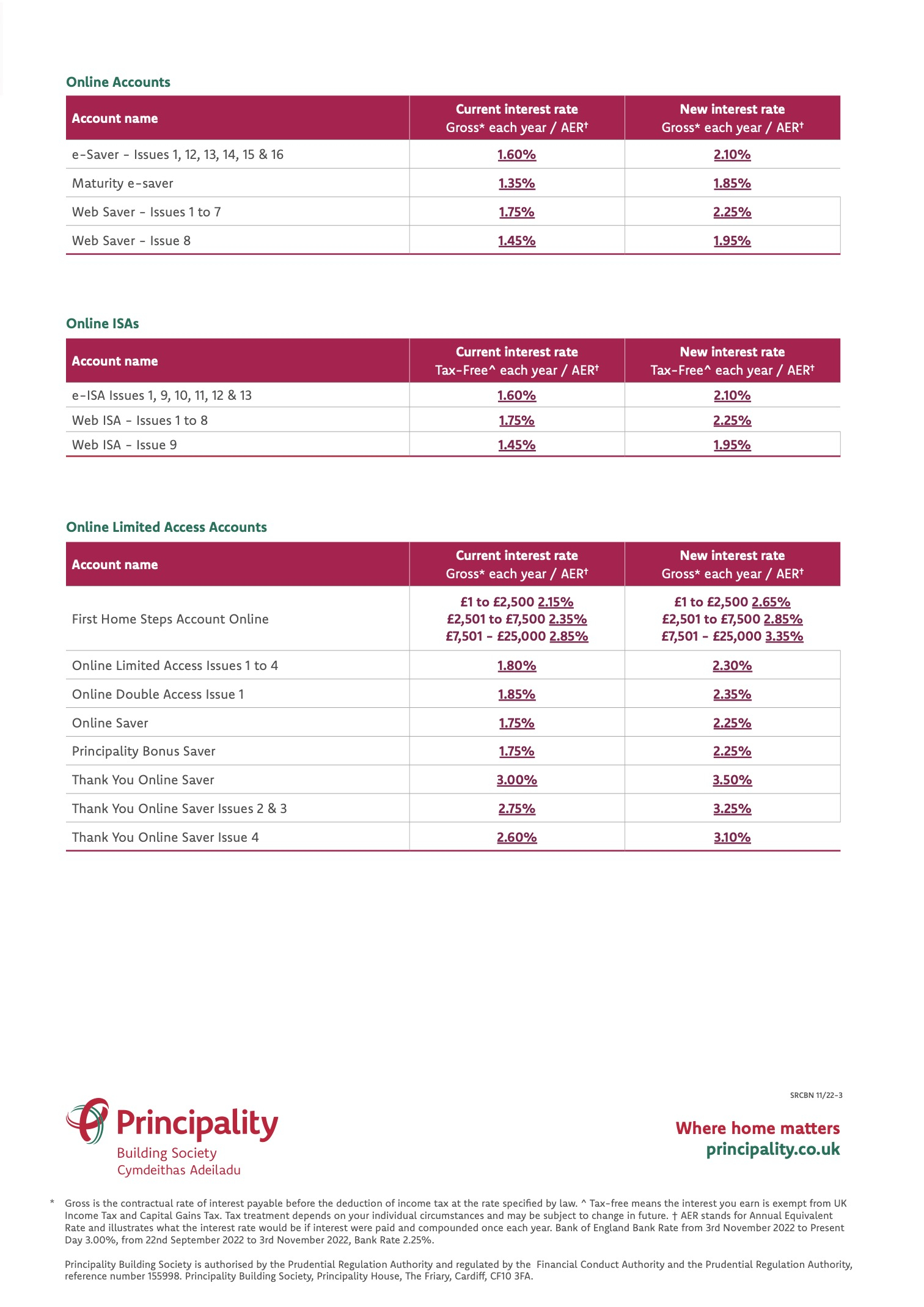

UPDATE FROM PRINCIPALITY REGARDING SOME INCORRECT RATES ON THEIR RATE SHEET EFFECTIVE 17TH NOVEMBER:

@soulsaver @Bridlington1 @refluxer @Band7 @flaneurs_lobster @dekkard

"Hi ForumUser7, thank you for picking up on this.

We want to apologise for this oversight on our end and any confusion caused, and please be assured that the document is being amended as quickly as possible.

The following accounts were not included in the rate change on 17th November and should not be on the list:- Learner Earner Issue 3

- First Home Steps Issue 3

- First Home Steps Online Issue 2

- NHS Thank You Saver

- NHS Thank You Online Saver

The rates displayed on the product pages on the website are the correct ones for these, and we did not reduce the rates on them.

Hope this helps."

I don't know what others think, but it does not seem particularly fair to put accounts on that list as if they were receiving increases, make mistakes with the rates, and then say they were not meant to be included anyway - hopefully they increase them at some stage to remain competitive.

New Rates Sheet Below (and they renamed it to Branch Notice November)

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.4 -

TSB save well limited access saver now pays 2.5% for any month you don't make a withdrawal and 0.25% in any month you do make a withdrawal. Pretty similar to HSBC bonus saver in many ways but paying 0.5% less.

I shalln't bother with this one myself but I thought it worth a mention anyway.5 -

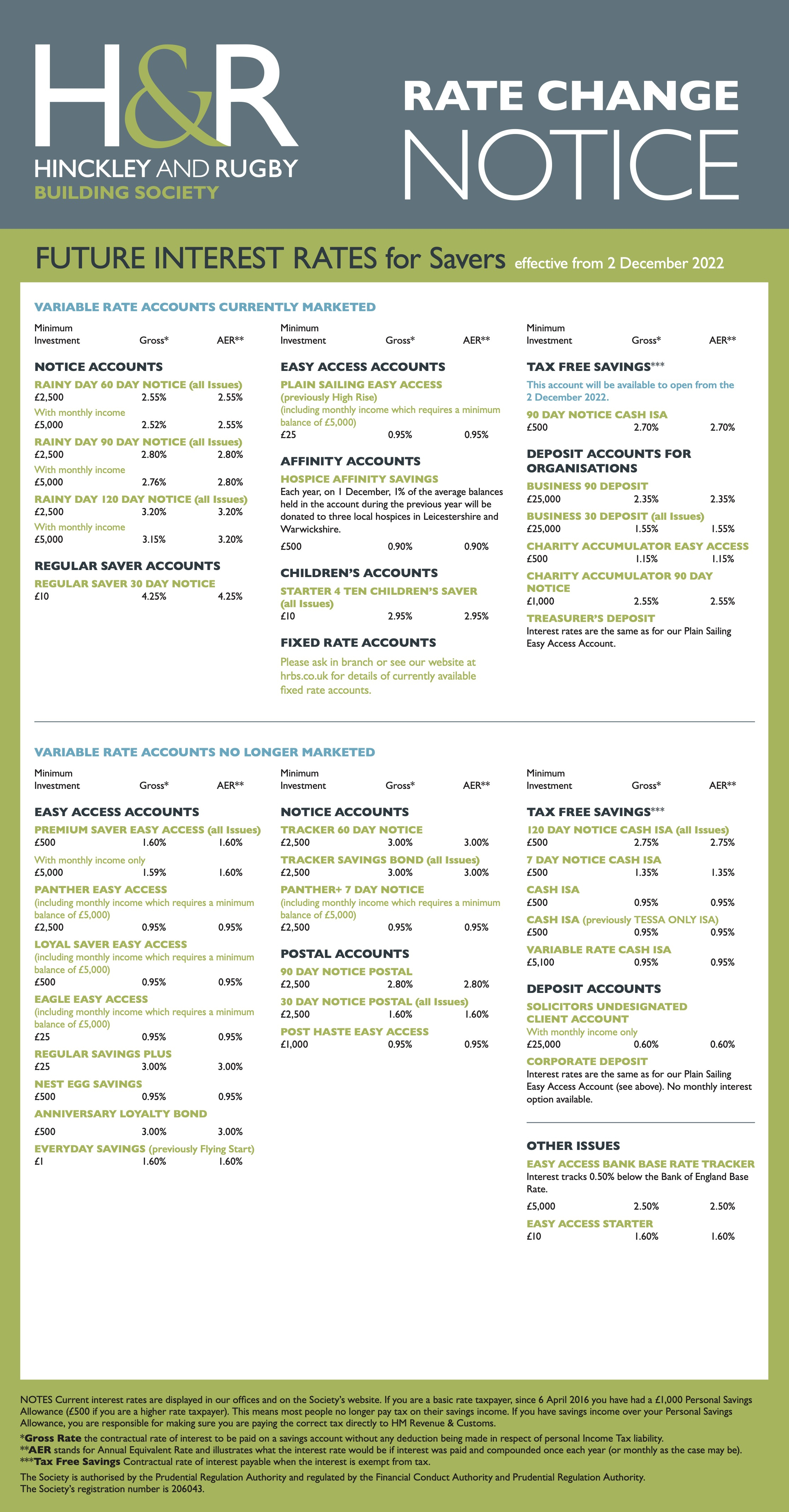

Hinckley and Rugby Building Society Savings Account Rate Changes (Effective 2nd December):

https://www.hrbs.co.uk/saving-info/savings-rates/

*IMPORTANT NOTE*: Although some of their accounts like the Regular Saver 30 Day Notice and 90 Day Notice Cash ISA offer good rates, they are 'not looking at online transactions at present' so 'withdrawals would need to be sent in the post or brought into one of our branch/agency offices'. I don't have a comprehensive list for which accounts they provide stationary for, but for the Regular Saver at least, 'prepaid envelopes are not provided for this account type'. This means if we want to make withdrawals, we either have to live near a branch, or give 30 days notice and pay for postage. These conditions may be fine for some people, but it may put others off - imo, if I lived near a branch I would open it, but I don't so until online withdrawals are possible, or prepaid envelopes are provided it is one I won't be opening, even at the rate it will be from 2nd December.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.3 -

In ToTP (see signature) at No.10 TSB Tri Access 2.5% (18/11) Save Well Limited Access Account | Savings | TSB Bank thnx @Bridlington1Bridlington1 said:TSB save well limited access saver now pays 2.5% for any month you don't make a withdrawal and 0.25% in any month you do make a withdrawal. Pretty similar to HSBC bonus saver in many ways but paying 0.5% less.

I shalln't bother with this one myself but I thought it worth a mention anyway.

I can't remember any TSB presence in the ToTP before. Nor for a decent reg saver.

Add a switching incentive and there appears to be a change of policy?3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards