We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

Post code restricted for the normal work around, too.gwapenut said:Newbury update their rates tomorrow. Not bad rates for a small building society, but not top-end, with the exception of their usually-excellent Existing Members Account which increases 0.45 % to 2.30%. You can only put £2k per tax year in there though.

https://newburytest-live-f3d63f7f4dcc44ad8831e6-4e875e3.divio-media.com/filer_public/bb/41/bb41bd59-1372-4f07-a7d0-26233fd01aaf/9019_-_interest_rate_change_table.pdf0 -

Romesh said:

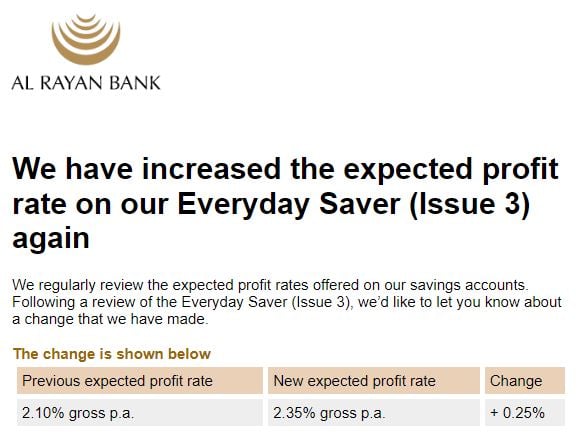

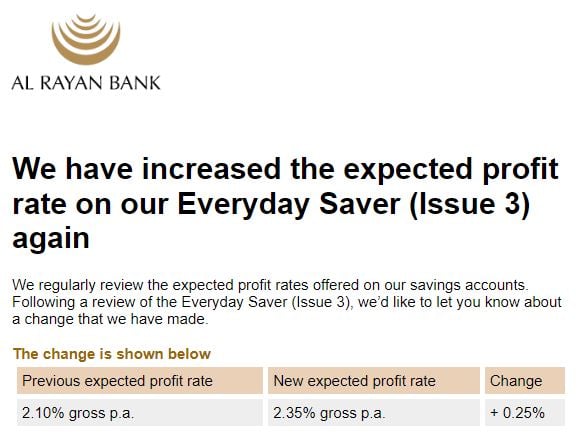

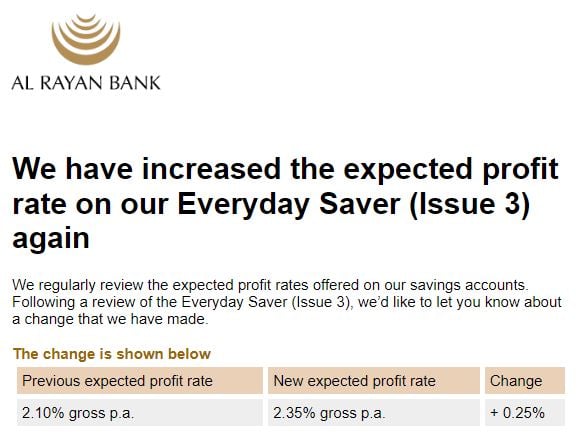

Yes, Al Rayan recently increased their expected profit rate to 2.35% - the best buy tables haven't been updated yetwiseonesomeofthetime said:

I thought 2.35% was higher than 2.25%, as offered by Al Rayan.Silverbird65 said:Latest best acct is Charter Savings 2.25 with opening balance 5000 as many withdrawals as you like👍

EXPECTED profit.... how often do these banks hit their expected return?

0 -

99% of the time and they have to give you advance notice if they are reducing the expected rate. Just like variable interest rates that go up and down.MiserlyMartin said:Romesh said:

Yes, Al Rayan recently increased their expected profit rate to 2.35% - the best buy tables haven't been updated yetwiseonesomeofthetime said:

I thought 2.35% was higher than 2.25%, as offered by Al Rayan.Silverbird65 said:Latest best acct is Charter Savings 2.25 with opening balance 5000 as many withdrawals as you like👍

EXPECTED profit.... how often do these banks hit their expected return?

They just call it "expected profit" to get around specific religious dogma.2 -

This extract is from the Raisin web site: "The expected profit rate (EPR) is different from interest because the bank does not guarantee it. If the bank makes less profit than expected, the EPR on your savings account may change. In these instances, the bank will usually inform the account holder and give you the option to either continue with the new rate or cancel the account early and receive any profit earned up to that point. This very rarely happens, but isn’t impossible."alternate said:

99% of the time and they have to give you advance notice if they are reducing the expected rate. Just like variable interest rates that go up and down.MiserlyMartin said:Romesh said:

Yes, Al Rayan recently increased their expected profit rate to 2.35% - the best buy tables haven't been updated yetwiseonesomeofthetime said:

I thought 2.35% was higher than 2.25%, as offered by Al Rayan.Silverbird65 said:Latest best acct is Charter Savings 2.25 with opening balance 5000 as many withdrawals as you like👍

EXPECTED profit.... how often do these banks hit their expected return?

They just call it "expected profit" to get around specific religious dogma.0 -

I have held various ISA and non-ISA accounts with Al Rayan for several years. They have always paid what they promised / expected - though similar to any other bank, they give plenty of notice in any drop of expected rates (variable only) and you can then move your money to a better paying account, should you be able to find one. The predecessor to their current Everyday Saver was for many months paying above 1% when all the others barely scraped 0.5%. This account wasn't much discussed on here as it wasn't open to new applications.MiserlyMartin said:

EXPECTED profit.... how often do these banks hit their expected return?1 -

1) Okay, seeing as you can fully trust your husband, yes putting all your joint savings into solo savings accounts in his name does make sense because he can earn up to £13570 in savings interest without paying any tax at all. That means you can have up to about £270000 in his savings accounts (assuming an average interest rate of c 5%). However, you should ensure that the total amount in any one account (leaving room for interest) does not exceed the FSCS limit of £85000 though!mortgagewannabe_2 said:mortgagewannabe_2 said:Hi. We currently have a large amount of savings in our Virgin Money M Plus Saver Joint account. My partner only earns a £5k salary per year, hence he has approx £6-7k free personal tax allowance. My question is, whether it's worth moving the savings to his solo account for tax purposes and whether Zopa is good enough? We don't mind a short notice account.

Thanks ever so much for your replies everyone to my above post, found on page 792. Apologies, but I can't reply to everyone individually.- Does it matter if the savings account is currently in joint names and does this have an affect on the amount of tax free allowance/savings interest?

- Does it change anything that I work and earn over £25k pa?

- We chose Virgin Money joint account because at time of application, they had the best interest rate an online website to login and android App access, making it more convenient, but is it worth moving the money into a better interest rate account and if so, which one do you recommend?

2) In this situation that means that you are a basic rate taxpayer and you can earn up to £1000 in savings interest on any savings in your name only before tax will be payable. £1000 is your personal savings allowance as a basic rate taxpayer.

3) With up to £26000 of savings in your husband’s name, £1000 could be placed in a solo Virgin Money M Plus current account currently earning 2.00% monthly interest with the other £25000 placed in the solo Virgin Money M Plus saver, currently paying 2.00% interest quarterly, that would automatically be opened along with the current account. Up to £5000 of savings can be deposited in Yorkshire Building Society’s Rainy Day account and earn 2.50% annual interest rate currently. It’s also worth considering Nationwide’s triple access saver (up to 3 withdrawals per year) which currently pays 2.10% annual interest for any money you’re both not likely to need to draw on very often. Also Al Rayan currently have a savings account with a minimum £5000 deposit that pays 2.35% expected profit rate monthly (in accordance with Sharia requirements.) All the accounts I’ve mentioned here have a variable interest (or expected profit) rate which is likely to go up along with many other savings accounts whilst the Bank of England base interest rate continues to rise.1 -

Santander have launched a limited edition esaver paying 2.75% on balances between £1-£250,00045

-

Wow they've blown everyone else out of the water with this one

1

1 -

I applied and account was open within minutes. Very good rate - going to need to open a cash ISA now.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards