We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

cosh25 said:

Moneyfacts. As advised, the account won’t be available until tomorrow so won’t appear on their website.Ghostcrawler said:source please? on their website highest i see as 0.70% to 1.01% on eSaver Issue 16

thanks for the update, I was in middle of opening saver 16 and saw your post, what a timing. I will hold off for now

1 -

I see its available now.Ghostcrawler said:cosh25 said:

Moneyfacts. As advised, the account won’t be available until tomorrow so won’t appear on their website.Ghostcrawler said:source please? on their website highest i see as 0.70% to 1.01% on eSaver Issue 16

thanks for the update, I was in middle of opening saver 16 and saw your post, what a timing. I will hold off for now

Whats a saver 16?

My existing Marcus is still at 1.05%

Would I change to Skipton? Um No

Gain is 0.15% for a year then close it - that's £1.50 per £1000 per year then I have to set it up and move my money twice within 1 year - in and out. All that for £15. if you have £10,000 in Marcus.0 -

murphydavid said:

I see its available now.Ghostcrawler said:cosh25 said:

Moneyfacts. As advised, the account won’t be available until tomorrow so won’t appear on their website.Ghostcrawler said:source please? on their website highest i see as 0.70% to 1.01% on eSaver Issue 16

thanks for the update, I was in middle of opening saver 16 and saw your post, what a timing. I will hold off for now

Whats a saver 16?

My existing Marcus is still at 1.05%

Would I change to Skipton? Um No

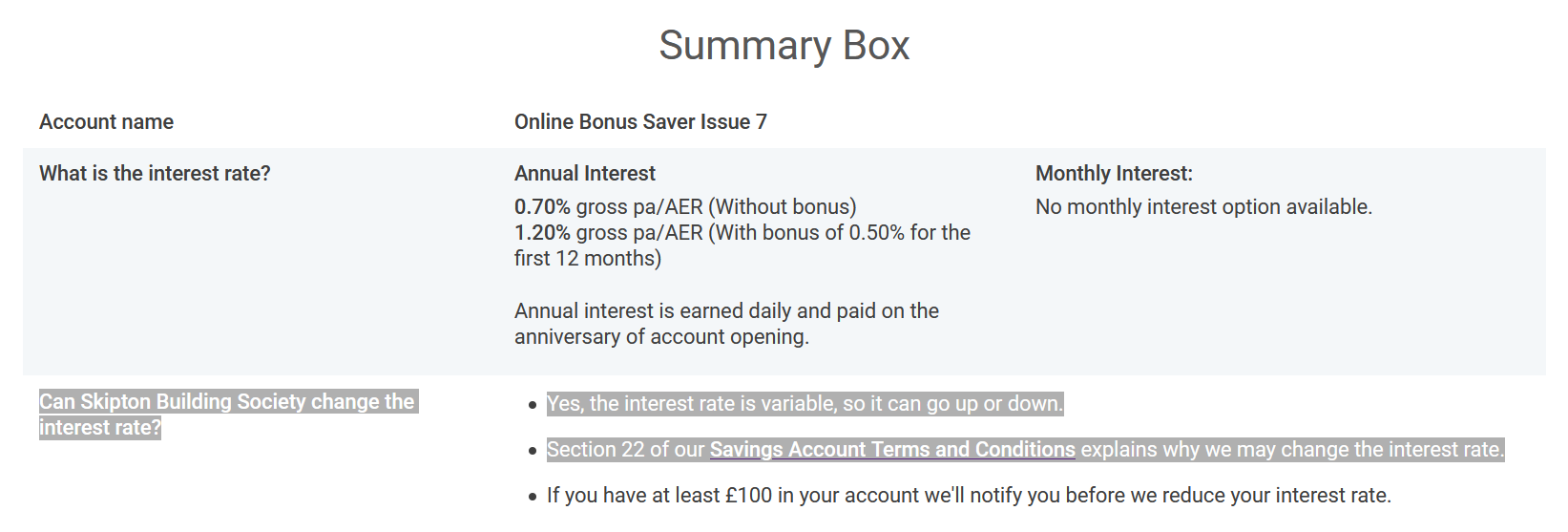

Gain is 0.15% for a year then close it - that's £1.50 per £1000 per year then I have to set it up and move my money twice within 1 year - in and out. All that for £15. if you have £10,000 in Marcus.eSaver issue 16 - https://www.skipton.co.uk/savings/easy-access/e-saver0.70% for balance of £1 - £24,999So rather openeing eSaver 16 issue I will open a new "Online Bonus Saver Issue 7". May be this is not a best choice for you but atleast to me as I do not have Marcus savings account.

0 -

Thats presuming Marcus remains at 1.05%!!!murphydavid said:

I see its available now.Ghostcrawler said:cosh25 said:

Moneyfacts. As advised, the account won’t be available until tomorrow so won’t appear on their website.Ghostcrawler said:source please? on their website highest i see as 0.70% to 1.01% on eSaver Issue 16

thanks for the update, I was in middle of opening saver 16 and saw your post, what a timing. I will hold off for now

Whats a saver 16?

My existing Marcus is still at 1.05%

Would I change to Skipton? Um No

Gain is 0.15% for a year then close it - that's £1.50 per £1000 per year then I have to set it up and move my money twice within 1 year - in and out. All that for £15. if you have £10,000 in Marcus.

I've opened it as no telling how long it will be available now its top of the table. If we have another lockdown and all the rates plummet at least you've got the bonus guaranteed for the year which is better than nothing, if they don't so what I've got a tenner in it to keep it open so its a no brainer to at least give yourself the option down the road!!0 -

SFindlay said:

Thats presuming Marcus remains at 1.05%!!!murphydavid said:

I see its available now.Ghostcrawler said:cosh25 said:

Moneyfacts. As advised, the account won’t be available until tomorrow so won’t appear on their website.Ghostcrawler said:source please? on their website highest i see as 0.70% to 1.01% on eSaver Issue 16

thanks for the update, I was in middle of opening saver 16 and saw your post, what a timing. I will hold off for now

Whats a saver 16?

My existing Marcus is still at 1.05%

Would I change to Skipton? Um No

Gain is 0.15% for a year then close it - that's £1.50 per £1000 per year then I have to set it up and move my money twice within 1 year - in and out. All that for £15. if you have £10,000 in Marcus.

I've opened it as no telling how long it will be available now its top of the table. If we have another lockdown and all the rates plummet at least you've got the bonus guaranteed for the year which is better than nothing, if they don't so what I've got a tenner in it to keep it open so its a no brainer to at least give yourself the option down the road!!Also presuming Skipton remains the same. The only guarantee is 0.50% bonus for first 12 months. 0

0 -

Yes; I agree; its a good choice at the moment for anyone wanting to start a new account.Ghostcrawler said:murphydavid said:

I see its available now.Ghostcrawler said:cosh25 said:

Moneyfacts. As advised, the account won’t be available until tomorrow so won’t appear on their website.Ghostcrawler said:source please? on their website highest i see as 0.70% to 1.01% on eSaver Issue 16

thanks for the update, I was in middle of opening saver 16 and saw your post, what a timing. I will hold off for now

Whats a saver 16?

My existing Marcus is still at 1.05%

Would I change to Skipton? Um No

Gain is 0.15% for a year then close it - that's £1.50 per £1000 per year then I have to set it up and move my money twice within 1 year - in and out. All that for £15. if you have £10,000 in Marcus.eSaver issue 16 - https://www.skipton.co.uk/savings/easy-access/e-saver0.70% for balance of £1 - £24,999So rather openeing eSaver 16 issue I will open a new "Online Bonus Saver Issue 7". May be this is not a best choice for you but atleast to me as I do not have Marcus savings account.

Prior to this release: why were you not considering MSE's best buy of NS&I at 1% (or 1.16% if you have £500)? Even now its a good choice as it has the advantage of possibly saving you work in a years time by not having an expiring bonus. (The government needing low interest loans probably for some time)1 -

murphydavid said:

Yes; I agree; its a good choice at the moment for anyone wanting to start a new account.Ghostcrawler said:murphydavid said:

I see its available now.Ghostcrawler said:cosh25 said:

Moneyfacts. As advised, the account won’t be available until tomorrow so won’t appear on their website.Ghostcrawler said:source please? on their website highest i see as 0.70% to 1.01% on eSaver Issue 16

thanks for the update, I was in middle of opening saver 16 and saw your post, what a timing. I will hold off for now

Whats a saver 16?

My existing Marcus is still at 1.05%

Would I change to Skipton? Um No

Gain is 0.15% for a year then close it - that's £1.50 per £1000 per year then I have to set it up and move my money twice within 1 year - in and out. All that for £15. if you have £10,000 in Marcus.eSaver issue 16 - https://www.skipton.co.uk/savings/easy-access/e-saver0.70% for balance of £1 - £24,999So rather openeing eSaver 16 issue I will open a new "Online Bonus Saver Issue 7". May be this is not a best choice for you but atleast to me as I do not have Marcus savings account.

Prior to this release: why were you not considering MSE's best buy of NS&I at 1% (or 1.16% if you have £500)? Even now its a good choice as it has the advantage of possibly saving you work in a years time by not having an expiring bonus. (The government needing low interest loans probably for some time)

I already have that. I was considering eSaver issue 16 for my TSB debit card 30 transactions which I need to make to get £5 cashback from TSB. I try to keep seperate for each of my bank accounts which require debit card transactions. I am not after interest rates but after monthly cashbacks/rewards for which i need to make xx DC transactions.

1 -

So, you can pay into your own Skipton account by debit card... and get a good rate. I think that may be an attraction for some.

1

1 -

Yes, should be OK for the TSB situation. Not sure about other scenarios though as will be recognised as a financial institution.soulsaver said:So, you can pay into your own Skipton account by debit card... and get a good rate. I think that may be an attraction for some. 0

0 -

soulsaver said:So, you can pay into your own Skipton account by debit card... and get a good rate. I think that may be an attraction for some.

sure it isBigBlueSky said:

Yes, should be OK for the TSB situation. Not sure about other scenarios though as will be recognised as a financial institution.soulsaver said:So, you can pay into your own Skipton account by debit card... and get a good rate. I think that may be an attraction for some.

for Halifax also it works fine

2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards