We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

The Top Easy Access Savings Discussion Area

Comments

-

allegro120 said:It's either open one of Chorley's low paying (£1 minimum to operate) accounts or withdraw leaving £500 there at 5.1%. So far I'm inclined to do the latter. I have more than enough in 5.2%+ EAs to fund all my RSs up to their maturities and on the larger scale the difference from 5.1% and 5.2% on £500 is negligible.Bear in mind that interest won't be paid until 31 Dec if you don't close the account before then. So for someone who has had a very large sum in the account, it might be better to close when the rate drops in order to receive and compound the interest early (or possibly on 6 April if that helps their tax numbers).Then again, the rates on the alternative homes for their money may soon fall still further. Some calculations and good guesses needed.

0 -

Yes - issues 35 and 36 of their easy access savings account paid the top rate for a number of months last year (on and off) and even when it was beaten sporadically, it still remained close to the top right up until the likes of Santander and Metro set the bar higher still at >5.20%.auser99 said:Shawbrook are often quite high up / top the rates don't they? That's where I first came to notice them.

Shawbrook's ISA and non-ISA fixed rate accounts have also regularly made the top 5, although not so much in recent months as they were quick to drop their fixed rates fairly sharply once interest rates stopped rising.0 -

Mainly good guesses for me because most of my money is in variable rate accounts. I have a large collection of accounts paying above 5.1%, but there is no guarantee that any of them will keep their rates for long, so keeping this Chrorley account could be useful. £500 is the minimum to operate and that's what I intend to leave there after withdrawal. In the unrealistic scenario if all rates stay as they are for another 12 months, putting this £500 in Metro instead will earn me an extra 60p a year which for me is not worth loosing NLA account.Rollinghome said:allegro120 said:It's either open one of Chorley's low paying (£1 minimum to operate) accounts or withdraw leaving £500 there at 5.1%. So far I'm inclined to do the latter. I have more than enough in 5.2%+ EAs to fund all my RSs up to their maturities and on the larger scale the difference from 5.1% and 5.2% on £500 is negligible.Bear in mind that interest won't be paid until 31 Dec if you don't close the account before then. So for someone who has had a very large sum in the account, it might be better to close when the rate drops in order to receive and compound the interest early (or possibly on 6 April if that helps their tax numbers).Then again, the rates on the alternative homes for their money may soon fall still further. Some calculations and good guesses needed.0 -

The release notes for the Tandem app sayWe get it. Every second counts in your busy life. That's why we're gifting you those precious extra seconds back.But it's not clear how to set a passcode in the app.

No need to fumble with login codes sent to your phone any longer. Simply set a passcode and bask in the glory of getting to your savings quicker.

0 -

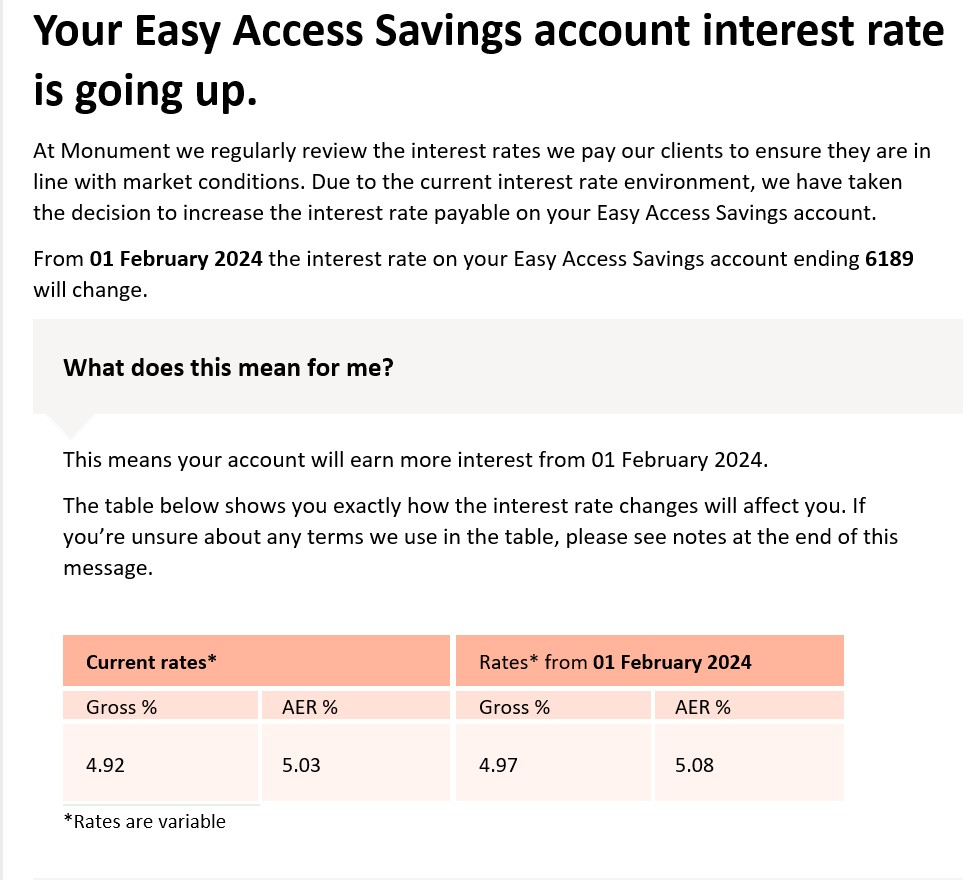

Monumnent is going up!!

1 -

Good to see another account increasing rates. Hopefully keeping others competitive.3

-

rather niche though (unless having £25k is "mainstream")1

-

I've just been through every option in the Tandem app and there doesn't appear to be an option to set one, so I guess the app might get updated at some point.jak22 said:The release notes for the Tandem app sayWe get it. Every second counts in your busy life. That's why we're gifting you those precious extra seconds back.But it's not clear how to set a passcode in the app.

No need to fumble with login codes sent to your phone any longer. Simply set a passcode and bask in the glory of getting to your savings quicker.

Interestingly - on a related note, I was able to open the app today without needing a fingerprint, despite not having accessed it for many weeks. The phone gets turned off every night, too. While I appreciate that withdrawals are limited to linked accounts (an aspect which has been discussed in the past), the sporadic and seemingly random way that log-in security is applied to the app is questionable, IMO. Security for any banking app shouldn't rely on the phone's own OS security measures alone - I don't have any other banking apps where some form of authentication (fingerprint, face scan, passcode etc) isn't required.0 -

Tandem Instant Saver

Received an email today to state that my Top-Up has been renewed, until 2 Feb 2025.

I never requested this, so must be an automated process.1 -

So now Tandem are going backwards and re-adding the passcode they recently removed... Maybe one day they will get it right.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards